It is also a tricky issue since there are so many provisions and also due to the frequent insertion of new provisions. Non Compliance with these provisions leads to payment of interest, Late Filing Fee, Penalties and also punishable with imprisonment. Hence, It is advisable to comply with these provisions within the due dates specified. In this article, we provide you with all the important TDS and TCS provisions in a simple manner.

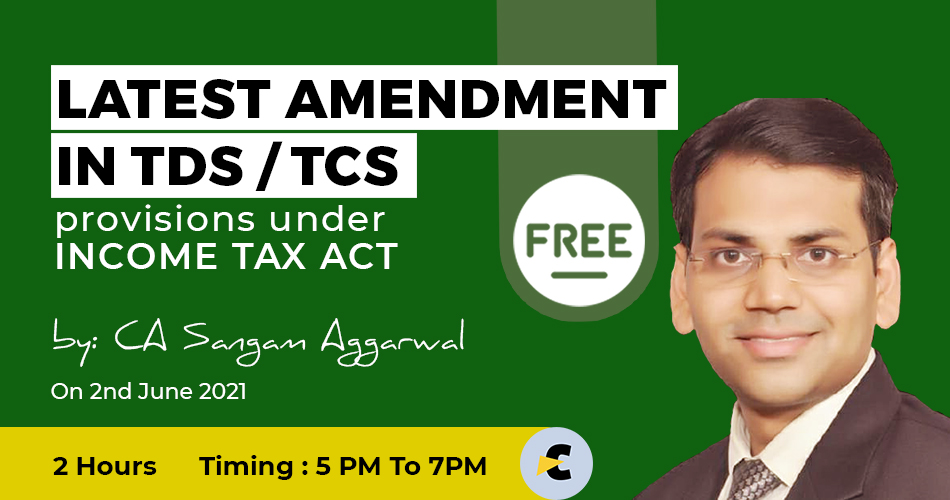

Sangam Aggarwal is a seasoned Tax Practitioner, a Fellow member of ICAI and He has done his LLB in 2014 and has also qualified DISA along with Certificate Course in Concurrent Audit from ICAI. He has also acted as a Co-opted member of the Corporate & Allied Laws and Corporate Governance Committee of NIRC of ICAI (2019-20). He has 12+ years of rich and profound experience in the field of Taxation (Direct & Indirect) and Advisory. He makes Representations for a widely diversified cross-section of industries before Authority for Advance Rulings, CIT (A), ITAT, and other appropriate forums. Sangam Aggarwal has previously worked with IFFCO Tokio General Insurance Co. Ltd. as Manager in Finance & Accounts. He is currently the managing partner of in Chartered Accountants Firm. Sangam Aggarwal is visiting faculty of ICAI and have spoken on different forums of ICAI.

good course for amendments and update with latest knowledge