Download Automatic Calculator for Interest on the delayed filling of GSTR – 3B

Table of Contents

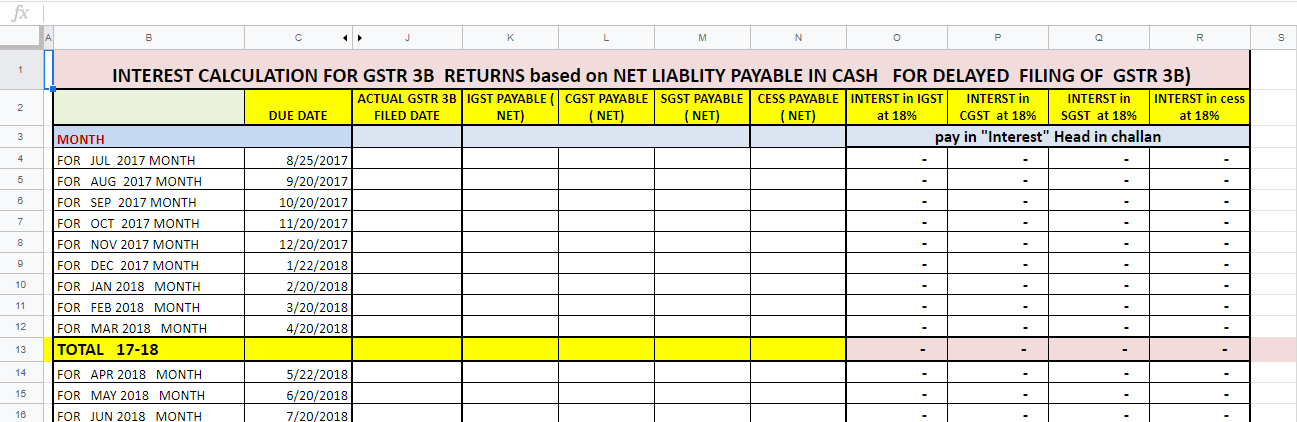

Automatic Calculator for Interest on the delayed filling of GSTR – 3B for FY 17-18, FY 18-19, FY 19-20

This article gives you a brief idea on the topic of Interest under GST & AN AUTOMATIC EXCEL UTILITY for calculation of Interest.

Many taxpayers registered under GST forgot to pay Interest if there was a delay in the Filing of GSTR 3B during FY 17-18 TO FY 19-20. Section 50 of the CGST Act 2017, deals with Interest on delayed payment of GST tax.

Section 50 says that Interest is applicable to the Late Payment of GST Due. Interest has to be paid by every taxpayer who:

- Makes a delayed GST payment i.e. pays GST after the due date. i.e at 18% p.a. ( Sec. 50(1) )

- Claims excess Input Tax Credit i.e at 24% p.a. ( Sec. 50(2) )

How interest will be calculated?:

For a long time, there have been confusions and contradictions on how the Interest shall be calculated.GST Council in its 31st meeting held on 22nd December 2018 recommended that Interest on delayed payment shall be charged on the ‘Net Liability’ of the taxpayer. However, the same was not made effective till date, by way of any circular / notification or amendment. The following proviso has been inserted to Section 50, as per Finance Bill 2019:Provided that the interest on tax payable in respect of supplies made during a tax period and declared in the return for the said period furnished after the due date in accordance with the provisions of section 39, except where such return is furnished after commencement of any proceedings under section 73 or section 74 in respect of the said period, shall be levied on that portion of the tax that is paid by debiting the electronic cash ledger. ( That is on Net Liability basis)

Related Topic:

GST Late Fees and Interest Calculator on Late Filling

Recently, the GST department against Notice demanding interest on Gross GST Liability without giving Input Tax Credit for Late Submission of Form GSTR 3B under Section 50(1) of CGST Act, 2017.

Here we have made an Automatic Calculator which calculates automatically interest under Section 50(1) for any delay in filling. We have tried to make an Excel calculator for delayed GST payment where you have to just enter the date of actual filing of GSTR 3B and NET Liability ( I.e amount being debited in ELECTRONIC CASH LEDGER for Particular month ). Please provide feedback if any mistake or suggestion. Hope you find it helpful.

Related Topic:

Download Free Excel Utility to Calculate GSTR-3B Interest

Note:-

Though the due date has been changed for GSTR 3B of Jan-20, Feb -20, Mar-20 Month in a staggered manner ( i.e 20th or 22nd or 24th ), We kept it 20th Only.