How to login at the GST portal and use it

Table of Contents

What is GST Portal?

GST portal is the portal adopted for GST compliances. If you are a taxpayer in GST you need to use this portal. It has the following functionalities.

- Registration of a new taxpayer

- Return filing

- Checking the GSTIN of other parties

- Refund application

- Voluntary payment of tax

- Appeal to the authorities

- Cancellation of registration

- Payment of tax

Related Topic:

GSTN portal to show the details of bill of entry

Step by step process for registration at GST portal

The first step is to take registration. You can complete the entire registration process in four simple steps.

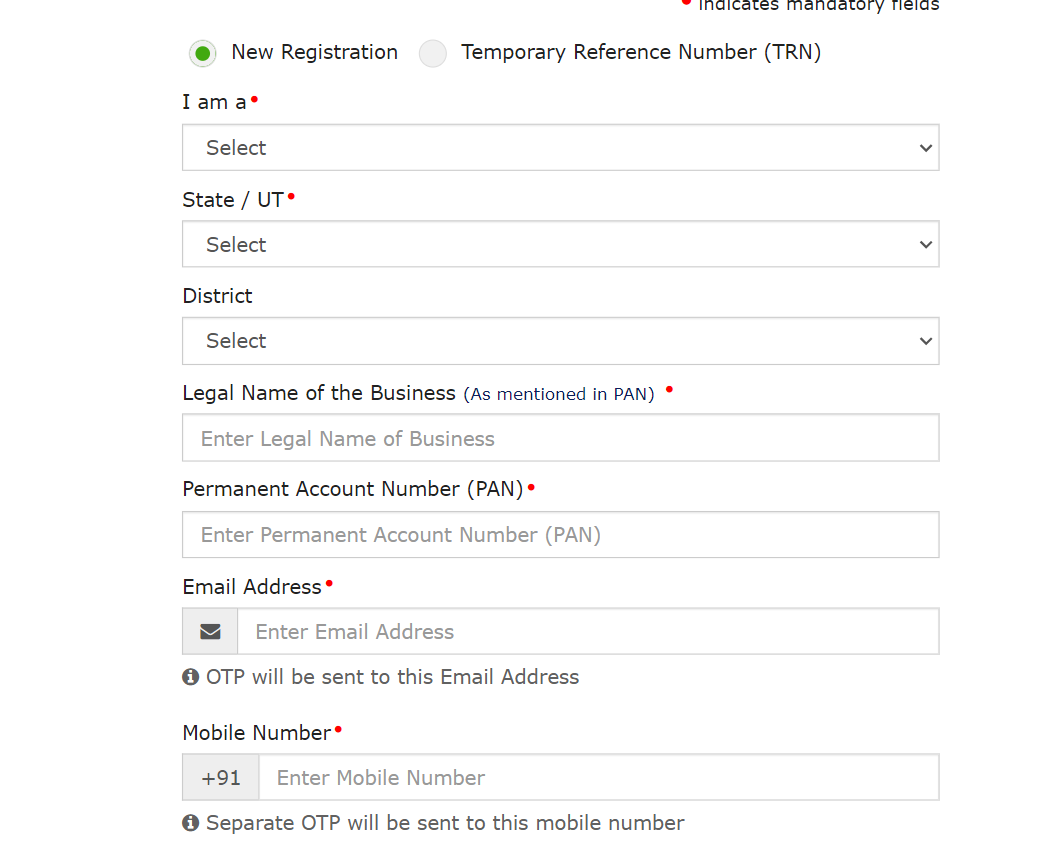

Step 1: Register with basic details

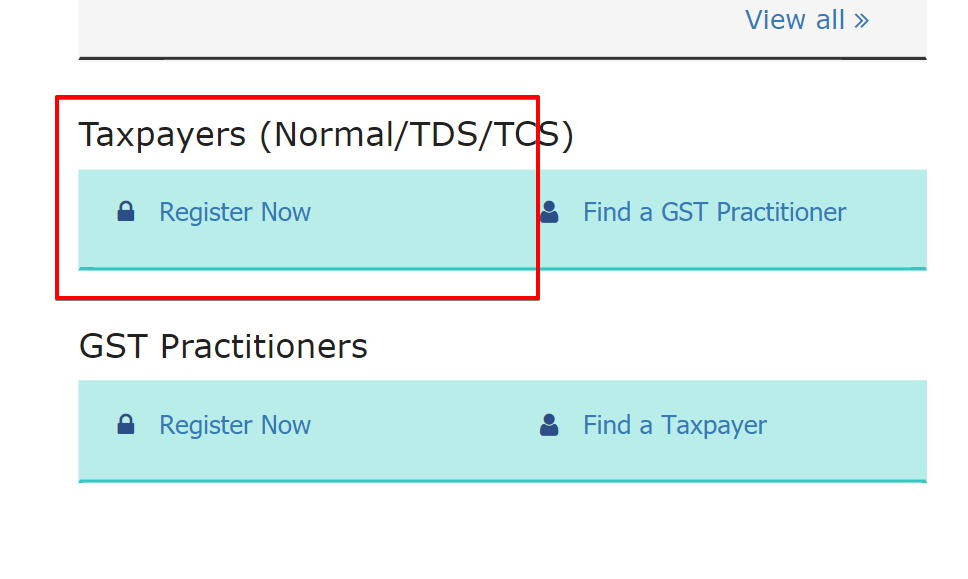

Click on register at GST.gov(dot) in. Click on the register (Normal taxpayer) as shown in the image below.

Step 2- Create TRN

Once you enter these details verify your mobile number and email id via OTP. A TRN will generate. You can use it to log in temporarily till you complete the registration.

Step 3: Fill in all details using TRN

Log on to the GST portal using your TRN and fill in all required details. You need to enter your business details and documents based on your type of entity.

Related Topic:

GST Return Filing System (version 3.0) From 01-01-2021

Important things to do just after your registration on the GST portal

- Select the option to file quarterly/Monthly returns

- Place a signboard at your office

- Get your invoice book printed with the necessary information or map it online in invoicing software.

- Display your address and GST number at your registered office.

Related Topic:

GST compliances for Goods transport agency

How to log in to the GST portal?

Only a registered person can log in to the GST portal. Go to the GST website and then click on login. Enter your login id and password. Now you can go to your dashboard and use the various features provided by the GST portal.

How to log in first time at the GST portal?

- When you have submitted all the details and documents during the registration process, an acknowledgment number is allotted.

- After due verification by the GST authorities, the registration process is completed by allocation of a GST Identification Number (GSTIN).

- In the process, you will also get a username and can set a password for GST. gov.in login.

- Now go to GST. gov.in

- Press the Login link given in the top right-hand corner of the GST Home page

- Do not fill in the username and password. Instead, click on the here link in the instruction at the bottom of the page just below ‘Forget Password’. It says “First time login: If you are logging in for the first time, click here to login”.

- Enter the provisional ID/GSTIN/UIN and password received by you at your e-mail address. Enter the given captcha and then click on “Login”.

- A new page is displayed for entering your new credentials. Here you have to enter your new ‘ Username ‘ and new ‘Password ’of your choice. Enter the password again to validate it and press the ‘Submit’ button.

- A success message will appear once the username and password have been created. Please be careful in entering your password again. Both the passwords entered by you must be identical. You can now log in to the GST Portal using these credentials.

- When you log in for the first time on the GST Portal, you will be prompted to file a non-core amendment application to submit your bank accounts details. Click on the “FILE AMENDMENT” button.

- The application form for editing is displayed and non-core fields are available in the editable form. Edit the details in the bank accounts tab by clicking the “ADD NEW” button and submit the application.

Related Topic:

GST Login – Step by Step Guide on How to Login to Government GST Portal India

Features of GST portal we can use

We are giving a list of some of the services available on the GST Portal which can be used by the users;

- Application for Registration for Normal Taxpayer, ISD, Casual Dealer

- Application for GST Practitioner

- Opting for Composition Scheme (GST CMP-02)

- Stock intimation for Composition Dealers (GST CMP-03)

- Opting out of Composition Scheme (GST CMP-04)

- Filing GST Returns

- Payment of GST

- Filing Table 6A of GSTR-1 (Export Refund)

- Claim Refund of excess GST paid (RFD-01)

- Furnish Letter of Undertaking(LUT)(RFD-11)

- Transition Forms (TRAN-1, TRAN-2, TRAN-3)

- Viewing E-Ledgers

- Filing of GSTR-9 -Annual Return

- Filing of GSTR-9C -Reconciliation Statement

- Other than the above services changing core and non-core fields, browsing notices received, filing ITC Forms, Engage/ Disengage GST Practitioner are some of the other services provided on the GST Portal/ GSTN

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.