Significant Beneficial Ownership (SBO) Under Companies Act 2013

The following is the data of 5 major countries contributing maximum FDI into India in the f/y 2020-21

| Country | FDI (in billion US $) in India | GDP of the country

(in billion US $) |

| Singapore | 17.41 | 340 |

| USA | 13.82 | 20936 |

| Mauritius | 5.64 | 11.4 |

| UAE | 4.2 | 354.28 |

| Cayman Islands | 2.79 | 5.3 |

Related Topic:

Table of Contents

- As per the Department for Promotion of Industry and Internal Trade (DPIIT)

- (1) Beneficial interest

- (2) Sec 89 of the Companies Act ( Declaration in Respect of Beneficial Interest in any Share) read with Rule 9 of Chapter VII, The Companies (Management and Administration) Rules, 2014

- Sec 90 as per Companies act

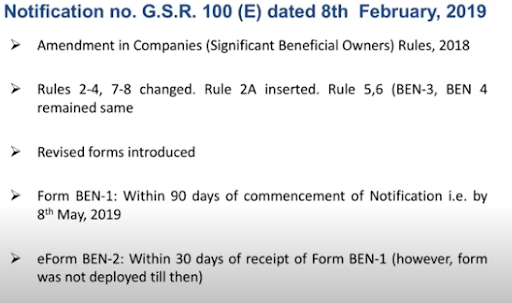

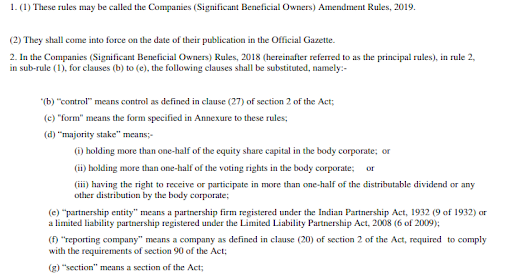

- Amended Rules

- Amended SBO Rules,2019

- (6) Some Illustrations regarding the determination of an SBO

- (7) Some points to remember

- (8) Difference between beneficial Interest and Significant Beneficial ownership

- (9) Summary of relevant Forms

- Conclusion

As per the Department for Promotion of Industry and Internal Trade (DPIIT)

(1) As you can see, Mauritius and Cayman islands are contributing more than 50 % of their GDP as FDI to India. They both are considered to be tax-havens. Whose funds are these?

(2) In the case of the 2G scam all the companies which had made FDI into India had their offices in the same locked room, on a secluded floor in a remote building on a listless road in Mauritius. There was a time when the capital gains on the shares bought from the Mauritius and Singapore route were not taxed in both countries. It was called, ”Double Non-Taxation”.

(3) In the 2G case, the telecom license provided by the government to the companies was non – transferable. But the promoters of these companies transferred the shares of these companies, effectively transferring the control and license with it.

(4) In the case of Aircel- Maxis, T. Ananth Krishnan owned company, “Maxis” bought 74% shares of Aircel ( owned by Sivasankaran) and reported to the registrars in its own country (Malaysia) that it owned 99.3% of the shares in Aircel. The remaining shares it owned through a wholly-owned subsidiary, Global Communications Services Holdings Ltd. It was a flagrant violation of the rules in force at that time.

(5) Most of the FIIs prefer to invest in the Indian stock market through Participatory notes. There are many reasons, but the main ones are Anonymity and easy convertibility into the currency of their choice.

(6) A new term has been coined for the HDFC bank whose around 71% shareholding is outside India, “ Foreign-owned, Indian Controlled”.

Related Topic:

(7) The curious case of the taxability status of Tata trusts. Are these trusts a commercial entity or a charitable trust?

- The three Tata trusts collectively hold about 66% in Tata Sons, which is a Pvt Ltd company. Tata Sons are the holding company of all the Tata group companies. The ITAT ruled that the said trusts were not doing any business. Their total shareholding in Tata sons was only an investment.

- ITAT said none of the trustees of the trusts had any substantial interest in Tata Sons and the investment in Tata Sons by the trust is not “for the purpose of investment in shares”, but “undisputedly for the purpose of sharing the fruits of the success, of the Tata Group, for the benefit of the general public at large”.

- Since the investments by the trusts are in the nature of corpus, it will not make them ineligible for I-T exemption.

- The payments made by Tata Sons to trustees of these trusts were for their roles as its former directors and employees and had nothing to do with the benefits given to them, it said.

- This judgment saved them lakhs of rupees as tax and also their tax exemption status.

(8) The son of a prominent politician transferred all his shareholding in his companies to one of his lackeys who in turn willed those shares to his daughter out of love and affection.

(9) I am not ascribing any notions or casting any aspersions, just telling you the facts which you yourself can verify by 5 minutes of research on the internet. All these issues are directly or indirectly related to the question that who is the ultimate beneficiary of the income being generated and distributed according to the shareholding. Furthermore, who has provided the funds for the purpose of such income generation and for acquiring such shareholding?

(10) Our main topic for today is “Significant Beneficial ownership”. Before understanding that, we have to understand what is “beneficial interest”. It is somewhat similar to the concept of “Lifting of the Corporate Veil”. Except, in this case, the veil is lifted from the registered member of the reporting company.

Related Topic:

(1) Beneficial interest

The concept of ‘Beneficial Interest’ has been discussed in section 89 of the Companies Act. It is an inclusive concept not exhaustive. This definition is applicable for both sections 89 and 90 both. The beneficial interest can be of two types. Direct or indirect.

As per Section 89(10) – For the purposes of this section and section 90, beneficial interest in a share includes, directly or indirectly, through any contract, arrangement, or otherwise, the right or entitlement of a person alone or together with any other person to— (i) exercise or cause to be exercised any or all of the rights attached to such share; or (ii) receive or participate in any dividend or other distribution in respect of such share.”

Explanation 1:

Any person (alone or together) who acquires by any means, whatsoever, right or entitlement to the benefits arising out of certain shares (dividend, or capital appreciation, etc.) along with ;

(i) exercise, or ability to get them exercised, any, or all the rights attached to such share, (eg. voting rights, right to attend meetings, and receive financial statements, etc)

(ii) receive or participate in any dividend or other distribution in respect of such shares.”

Then such person shall be termed to hold a beneficial interest in those shares.

Explanation 2:

- This section creates four categories of persons.

- One, that holds both the registered membership and the beneficial interest attached to it. That is direct beneficial interest or entitlement.

- Second, who are not on the register of members, but own the Beneficial interest adhered with it. They have made a declaration of their interest to the reporting company in MGT 5. That is also deemed to be a direct beneficial interest or entitlement. Hence for direct entitlement, it means that the reporting company has the information regarding both the actual beneficial interest holder and its registered representative.

- Third, are those Beneficial interest holders who do not hold the shares of the reporting company in their own name, and they have not made a declaration of their interest to the company. They can be construed as Indirect beneficial interest or entitlement holders. Thus if a reporting company does not have information regarding the actual beneficial interest holder of any of its shares then such person will be said to hold indirect beneficial interest or entitlement in those shares. Their respective representatives may or may not have given such information to the company.

- Fourth, those who are only the registered members (titular) and do not enjoy the Beneficial interest coupled with it. They have made a declaration in MGT 4 to the company.

Explanation 3:

- In this definition, the word used is ‘Person’, i.e any separate legal entity. The focus is on any taxable entity. It may be an individual or an organization. Any person holding beneficial interest in the company but not holding the shares in its own name and the company is unaware of such a person then that person will be termed as Indirect Beneficial right or entitlement holder.

- The concept of ‘Direct entitlement’ is explained in Explanation II of clause 2(h) of the rules.

- The concept of ‘Indirect entitlement’ is explained in Explanation III of clause 2(h) of the rules.

- The concept of ‘ alone or together is explained in Explanation V of clause 2(h) of the rules.

Related Topic:

Examples of beneficial interest

(a) Depository- In the case, where a person holds any shares in a company in the dematerialized form then, in the register of members of the company, the name of the depository will be mentioned as the member. The name of the person actually holding the beneficial interest over the share will not be present in the register of members. It shall be mentioned in the register maintained by the depository. Hence that person shall hold a beneficial interest in the company through the strength of those shares, though his name is not mentioned in the register.

(b) Partnership Firm – In the situation where any partnership firm, say ABC & Co. wants to acquire shares in a company. It can do so through its partners. (The partnership firm cannot purchase shares in its own name as it does not have a separate legal entity). It has acquired some shares in D Ltd. in the joint name of all the partners’ A, B, and C. In the register of members, those shares will be registered in the joint name of the partners, but the beneficial interest is held by the partnership firm ABC & Co.

(c) Holding and subsidiary Y Pvt Ltd is the wholly-owned subsidiary of X Ltd. To maintain the requirement of minimum number of members in the Pvt ltd company, 1% shares of Y Pvt Ltd are held by the director of X Ltd., Mr. A. Hence his name will be on the register of members in Y Pvt Ltd, but the beneficial interest with respect to those shares lies with X Ltd.

Related Topic:

(2) Sec 89 of the Companies Act ( Declaration in Respect of Beneficial Interest in any Share) read with Rule 9 of Chapter VII, The Companies (Management and Administration) Rules, 2014

| Section | Registered Member | Beneficial Interest | Need to make a declaration | Is the declaration made to the reporting company | Type of beneficial interest |

| 89(1) | Yes | No | Yes, by the registered member disclosing the name of the person holding the beneficial interest. | yes | NA |

| 89(2) | No | yes | Yes, by the person holding beneficial interest disclosing the name of the person who is the registered member on his behalf | yes | Direct |

| yes | yes | No | No | Direct | |

| No | yes | Yes, by the person holding beneficial interest disclosing the name of the person who is the registered member on his behalf | No | Indirect | |

| Any change in the status | Yes, by the registered member and the beneficial owner both | yes | Direct | ||

| Any change in the status | Yes, by the registered member and the beneficial owner both | No | Indirect | ||

Sec 89 of the Companies Act

Rule 9 of Chapter VII, The Companies (Management and Administration) Rules, 2014

Images sourced from the MCA website

- Therefore you can see that the information provided by both persons will be cross-verified.

- This section is creating a distinction between ‘known to the company’ or ‘not known to the company (anonymous)’.

If a person who is;

| Sec 89(1) | Sec 89(2) |

| Named as a member in the register, even though he has no beneficial interest in those shares | Not named as a member in the register, though he has a beneficial interest in those shares (beneficial owner) |

| Within 30 days of his name being entered on the register, has to make a declaration to the company | Within 30 days of acquiring such beneficial interest, has to make a declaration to the company |

| In form MGT 4 | In form MGT 5 |

| If there is any change in the beneficial interest in such shares, the registered owner and the beneficial interest holder, both shall, within a period of thirty days from the date of such change, make a declaration of such change to the company in their respective forms. | |

| When such information is received by the company, the company shall make a note of such declaration in the register of members and shall file, within a period of thirty days from the date of receipt of declaration by it, a return in Form MGT.6 with the Registrar in respect of such declaration with fee. | |

| A trust which is created, to set up a Mutual Fund or Venture Capital Fund or such other fund as may be approved by the Securities and Exchange Board of India will be exempted from this section and rules. | |

| If the beneficial owner does not make the declaration he was ought to make, then he can not exercise any rights attached with those shares. | |

| In such a case, the company shall not be absolved of its responsibility to pay dividends to its members under this Act and the said obligation shall, on such payment, stand discharged. The dividend shall be received by the registered member. | |

Related Topic:

MCA Relaxes the Additional Fee on Filing of Certain Forms under Co. Act, 2013/LLP Act, 2008

Beneficial owner– According to sec 89 the owner of such beneficial interest in shares, directly or indirectly, alone or together, has been termed as a Beneficial owner.

(3) Significant Beneficial ownership (SBO)

We are giving you some definitions to understand this term better.

Beneficial interest

As per Section 89(10) – For the purposes of this section and section 90, beneficial interest in a share includes, directly or indirectly, through any contract, arrangement, or otherwise, the right or entitlement of a person alone or together with any other person to— (i) exercise or cause to be exercised any or all of the rights attached to such share; or (ii) receive or participate in any dividend or other distribution in respect of such share.”

- This concept is applicable for companies that necessarily have share capital. It is specifically pointing towards rights associated with holding shares. It is an objective term.

- The number of shares can be enumerated.

2 (27) ―control -It shall include the right to appoint a majority of the directors or to control the management or policy decisions exercisable by a person or persons acting individually or in concert, directly or indirectly, including by virtue of their shareholding or management rights or shareholders agreements or voting agreements or in any other manner;

- Control means the right to participate in the decision-making process and even change, or make the policy decision. It implies having veto power or unchallenged power.

Significant influence

As per rules 2(1)(i)

- (i) “significant influence” means the power to participate, directly or indirectly, in the financial and operating policy decisions of the reporting company but is not control or joint control of those policies.

(As Per the Companies act )

- A significant influence– it means control of at least 20 % of total share capital or of business decisions under an agreement.

Explanation

- Significant influence means the right to participate and influence the decision. But it does not give absolute power to make or change the decision.

- Control and Significant Influence are subjective (relative) terms. The reporting company may or may not have share capital. They cannot be enumerated in numbers.

After reading all the above definitions we can form the embodiment of an SBO. This concept has been described in two different ways;

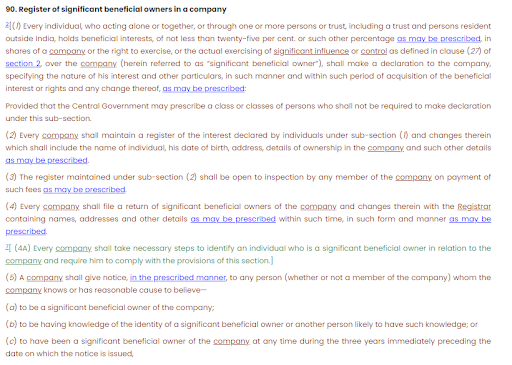

(a) SBO As per section 90(1) of companies act

SBO – Every individual, who is acting alone or together, or through one or more persons or trust, including a trust and persons resident outside India, holds beneficial interests, of not less than twenty-five percent. or such other percentage as may be prescribed [as per SBO rules, 2019, it is 10% ], in shares of a company or the right to exercise, or the actual exercising of significant influence or control as defined in clause (27) of section 2, over the company (herein referred to as “significant beneficial owner”),

(b) SBO As per Companies (Significant Beneficial Owners) Amendment Rules, 2019

(h) “significant beneficial owner” in relation to a reporting company means an individual referred to in subsection (1) of section 90, who acting alone or together, or through one or more persons or trust, possesses one or more of the following rights or entitlements in such reporting company, namely:-

(i) holds indirectly, or together with any direct holdings, not less than ten percent. of the shares;

(ii) holds indirectly, or together with any direct holdings, not less than ten percent. of the voting rights in the shares;

(iii) has the right to receive or participate in not less than ten percent. of the total distributable dividend or any other distribution, in a financial year through indirect holdings alone, or together with any direct holdings;

(iv) has right to exercise, or actually exercises, significant influence or control, in any manner other than through direct holdings alone:

Notes

- For the definition of an SBO, you have to read both definitions. As per the section and the rules. The combined effect will be termed as an SBO.

- The focus is on Individual and on Indirect Beneficial interest or control.

- For being an SBO the first and foremost condition is Indirect right or entitlement (Anonymity, not known to the company). If the individual is only having a direct holding in the Reporting Company (whether less than or more than 10%), he shall not be considered as an SBO. But if the individual is holding indirectly along with direct holding (holding not less than 10%), then he shall be considered as SBO. If the same individual also has a direct interest, then it can be added to declare him as an SBO.

- The soul of this section and the rules lies in the fact that they are trying to find the identity of that individual ( not any person, or organization, as per the IT Act ) who holds such indirect interest in the reporting company. In today’s world which is so intertwined, financial transactions are made to pass through a maze that transcends geographical boundaries, various tax regimes, and different types of organizational structures.

- These transactions and interests are deliberately hidden from the eyes of the law enforcing agencies to avoid tax, or to keep a shroud over the actual beneficiary (individual with whose intent that act was committed, or who enjoys the fruits of his holding such interest) because the transaction may be illegal or emanating from a crime.

- Every organization consists of individuals at the helm of its affairs. The organization per se does not have an intent of its own. But there must be somebody whose word is the last word. That individual’s or the group’s intentions are the driving force behind the actions of that organization. In criminal law, you can give corporal punishment only to individuals, not to organizations. Today Vijay Mallaya is a declared fugitive, not Kingfisher Airlines or United Breweries.

Related Topic:

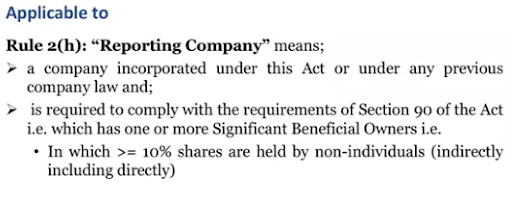

Definition of the reporting company

- The reporting company has only to send a notice to enquire about the individual who is behind the registered member to any person as per the prescribed rules. Therefore only those companies become liable for this section whose non-individual shareholding is more than or equal to 10%. Individual shareholders are deemed to be the direct beneficial interest holders. Though they may be representing an individual who can be defined as an SBO if their holding is also combined with theirs.

- The onus of declaration of their status as an SBO has been laid completely on the said individual or group of individuals.

- Therefore for being declared as an SBO, that member (person), who is representing such SBO individual, must not have declared his indirect interest u/s 89 to the company and such interest must be more or equal to 10%. But after this statute, they have also to declare their SBO status.

- This section is on the borderline of declaring an SBO as a Benami Holder of assets ( financial interest ) in the reporting company.

- This section mandates “lifting of Corporate Veil” (multiple times to go beyond multiple layers) from the registered member till the original individual behind that member is revealed. But the onus is on the individual, not the company because it is his shareholding that is at stake.

- This definition covers both types of companies, with or without share capital.

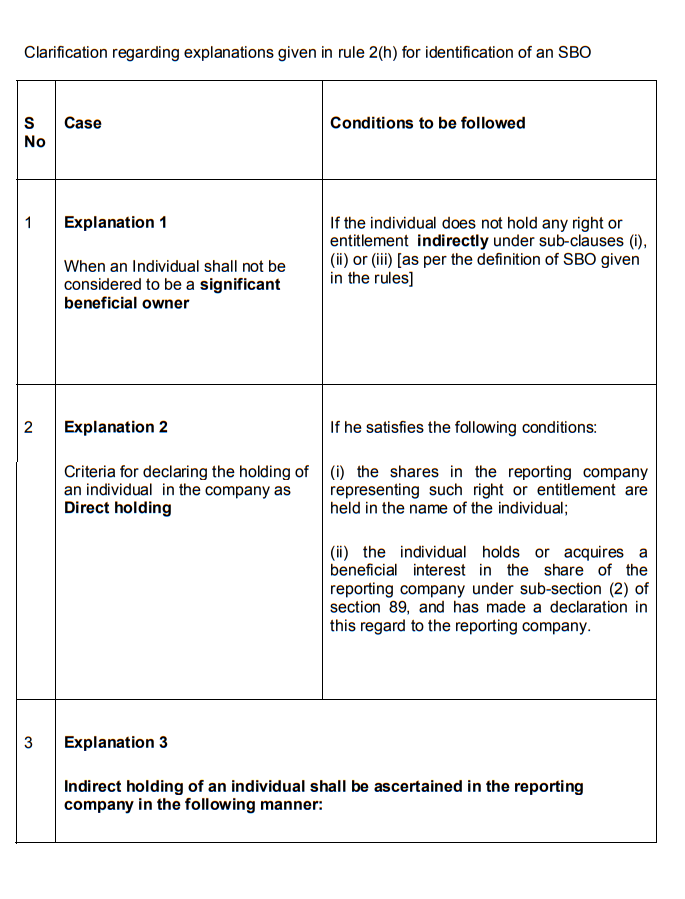

Deliberations and clarifications regarding an SBO as per explanations [as per Rule 2(h)] and definition as per sec 90

Clarifications regarding an SBO according to explanations [as per Rule 2(h)] and definition as per sec 90

| Important points | Deliberations and clarifications |

Related Topic:

Examples

(a) A person Mr. Z holds 12% shares in Max Ltd and all the shares are registered in his own name.

In this case, though Mr. Z holds more than 10% of shares in the company still he will not be considered as an SBO for the reporting company (Max ltd) because his total holdings in the company are direct, he does not hold any indirect beneficial interest.

(b) C Ltd holds 20% shares in H Ltd. J Ltd holds 75% shares in C ltd and K ltd holds 25% shares in C ltd. E holds 60% shares in J Ltd and F holds 70% shares in K Ltd

C Ltd is a member of H Ltd. But J Ltd holds indirectly (75% * 20% = 15%) of shares of H Ltd and is also not a member. E holds 60% shares in J Ltd. Hence E will be an SBO for H ltd. K Ltd indirectly holds ( 25% * 20% = 5%) of H Ltd. Hence no need to see further.

(c) L is a trustee of a charitable trust, which holds 20% shares of D Ltd.

L is the holder of indirect beneficial interest in D Ltd by the virtue of being a trustee of a charitable trust which is the immediate member. Hence L is an SBO for D Ltd.

(d) A person Mr. Z holds 5% of the shares in Min Ltd, which are registered in his own name, and a company B Pvt Ltd holds 20% shares in Min Ltd. Mr. Z holds 60% shares in B Pvt ltd.

Mr. Z will be an SBO for Min Ltd. His total holding will be [60% * 20%= 12%+ 5%=17 %]

Related Topic:

(4) Sec 90 (Register of significant beneficial owners in a company) read with Companies (Significant Beneficial Owners) Rules, 2018 (old rules) and then later amended by Companies (Significant Beneficial Owners) Amendment Rules, 2019 (new rules), notified on 8.2.2019

| A person who is an SBO, (as per the rules and this section) has to make a declaration to the company, specifying the nature of his interest and other particulars, within 30 days of his becoming an SBO |

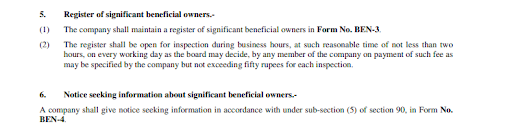

| Every company shall maintain a register of the interest declared by an SBO and changes therein which shall include the name of the individual, his date of birth, address, details of ownership in the company, and such other details as may be prescribed. |

| The register maintained shall be open to inspection by any member of the company on payment of such fees as may be prescribed. |

| Every company shall file a return of significant beneficial owners of the company and changes therein with the Registrar containing names, addresses, and other details as may be prescribed within such time, in such form and manner as may be prescribed. |

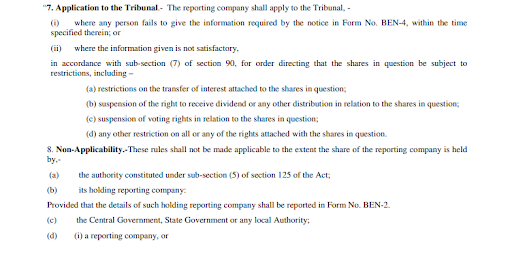

| If an SBO fails to make the requisite declaration or if the information given is not satisfactory, there are two main consequences. |

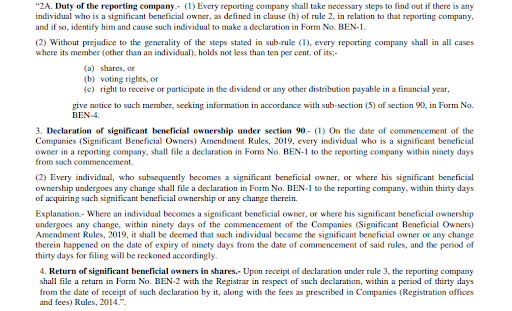

| As per rule 2A. Duty of the reporting company.- (1) Every reporting company shall take necessary steps to find out if there is any individual who is a significant beneficial owner, as defined in clause (h) of rule 2, in relation to that reporting company, and if so, identify him and cause such individual to make a declaration in Form No. BEN-1.

The reporting company must give notice to any person in form BEN-4 (whether or not a member of the company) whom the company knows or has reasonable cause to believe— (a) to be a significant beneficial owner of the company; (b) to be having knowledge of the identity of a significant beneficial owner or another person likely to have such knowledge; or (c) to have been a significant beneficial owner of the company at any time during the three years immediately preceding the date on which the notice is issued, and who is not registered as a significant beneficial owner with the company as required under this section? |

| The information required by the notice shall be given by the concerned person within a period not exceeding thirty days of the date of the notice. |

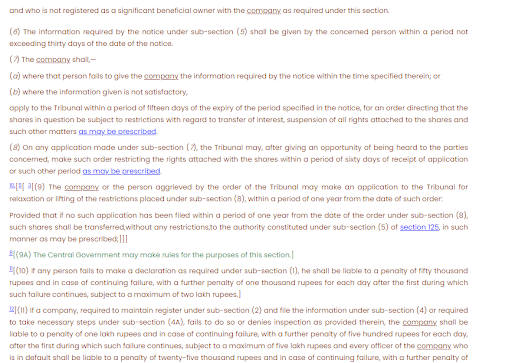

| The company shall,—

(a) where that person fails to give the company the information required by the notice within the time specified therein; or (b) where the information given is not satisfactory, apply to the Tribunal within a period of fifteen days of the expiry of the period specified in the notice, for an order directing that the shares in question be subject to restrictions with regard to the transfer of interest, suspension of all rights attached to the shares and such other matters as may be prescribed. |

| On any application made, the Tribunal may, after giving an opportunity of being heard to the parties concerned, make such an order restricting the rights attached with the shares within a period of sixty days of receipt of an application or such other period as may be prescribed. |

| The company or the person aggrieved by the order of the Tribunal may make an application to the Tribunal for relaxation or lifting of the restrictions placed, within a period of one year from the date of such order: |

| Provided that if no such application has been filed within a period of one year from the date of the order, such shares shall be transferred, without any restrictions, to the authority constituted under sub-section (5) of section 125, in such manner as may be prescribed (Investor’s education and protection fund) |

Related Topic:

Sec 90 as per Companies act

![]()

Amended Rules

Amended SBO Rules,2019

(5) Issues related to “significant beneficial ownership”

(A) Which (10% or 25%) Percentage of shares is to be seen for deciding an SBO?

In section 90, the threshold percentage is given,” not less than 25% or as may be prescribed”. In the rules therein, such percentage has been prescribed as “not less than 10%”. Therefore from the combined reading, it construes that we have to consider 10% as the threshold. But such interpretation is subject to judicial review, though it has not been challenged till now.

(B) Significant influence or control

The definition of determining an individual as an SBO is so wide that it will catch a lot of individuals unawares. If an individual holds 5% affirmative voting rights on matters pertaining to financial and policy decisions, then he may vote as a part of a voting pool, comprising of other individuals which could be termed as exerting significant influence. Thus his ability to vote along with a voting pool may render him the status of an SBO and trigger the requirement to make a disclosure.

(C) Increased compliance burden

It is true that the intention of the government, behind the introduction of the new significant beneficial ownership regime, is to curb the use of multi-layered corporate structures for money laundering and tax evasion purposes by individuals. But they have also increased complexities and compliances in regular and bona fide deal-making. Apart from due diligence, the investors will also have to ensure that requisite filings and disclosures have been made by all the concerned parties to avoid any future claims questioning the capacity and/or authority of the seller to transfer the shares. Since the law also has subjective interpretations, therefore, percentage of shareholding is not the only criteria to be declared as an SBO.

(D) All the rights associated with the share have to be relooked

After the notification of the ‘SBO’ definition under section 90 and the rules therein, every share now needs to be looked at as a bundle of rights (right to vote, right to receive dividends, etc.) and each right attached to a share is capable of being assigned to another person. Therefore, one share can have multiple beneficial owners. This may require investors to revisit all their existing shareholder agreements, voting agreements, etc. to evaluate whether the rights created under those agreements have triggered filing requirements under sec 89, or sec 90 of the Act.

(E) Pooled Investment Vehicles

Where the member of the reporting company is a pooled investment vehicle or an entity controlled by the pooled investment vehicle, based in a jurisdiction that is not a member of the FATF or, if it’s a regulator of the securities market, who is not a member of the International Organisation of Securities Commissions, then in such cases, the SBO provisions are unclear as to how to determine the SBO.

(F) Rules are insufficient in the case of different types of entities in a multilayered chain

The rules are clear for determining the SBO for the entities which are the immediate members of the reporting company. They are also sufficient if the subsequent layer is of the same type of entity as the first layer. There is ambiguity in determining the SBO when the constitutions of the entities in the subsequent layers of the same chain are different. Moreover, there are some unique types of trusts also, where the determination of SBO is very complex.

(G) Where dematerialized shares are held by pledgee and it is invoked

Suppose an SBO has pledged his shares for obtaining any finances, or any other asset. The lender has invoked the pledge of such shares held in a dematerialized form and is now holding the shares in its own account as an investment. SBO Rules are silent on who should be filing the declaration in this case, the SBO or that lender. This is because of the conflict between the provisions of the Depositories Act, 1996 and Regulation 58 of the SEBI (Depositories and Participants) Regulations, 1996 and Section 176 of the Indian Contract Act, 1872.

In the case of Balkrishna Gupta v. Swadeshi Polytex Limited, the honorable supreme court held that the pledgee does not become the beneficial owner of shares upon invocation of the pledge. In such a situation, there may be confusion as to who should be filing the SBO declaration.

(H) Shares of a Deceased SBO where the Transmission of Shares has not been Completed Due to Disputes

In some cases where the original SBO has deceased and the shares held by him are not legally and beneficially transmitted to his or her legal heirs, due to a dispute with regard to the validity of the will in case of a testamentary succession (according to the conditions of the will), or in the case of intestate succession ( when the will is absent ) where the court has not issued succession certificates or letters of administration.

There may be some occasions, where courts may appoint an administrator pendente lite ( till the judicial proceedings are going on), under Section 247 of the Indian Succession Act, 1925, and such administrator acts as an officer of the court and holds the shares for a temporary period until the dispute regarding the validity of the will is resolved.

(I) Role of the reporting company

In determining the SBO, there is no role of the reporting company. But in cases where the reporting company is a Pvt Ltd Company, where the share transfer is not possible without the consent of the company then the chances of not knowing the transferor and transferee are very remote. It may also be possible that the company itself has allotted the shares in such a manner where the identity of the SBO remains unidentified. Therefore some responsibility of the reporting company should also be imposed in closely held, or unlisted companies where shares are not in dematerialized form.

(J) How to transcend other jurisdictions to reach that individual?

As you can see the SBO can be any individual, Indian or foreign. There are apprehensions regarding knowing the true identity of the foreigner, and the veracity of his claims. There are surreptitious ways where a foreign individual can appoint an Indian national to act on his behalf. Also, these provisions are applicable only in India, not in other jurisdictions. The shares can be transferred at any time before their confiscation or the individual being declared as an SBO. Individuals can also take steps to preclude them from attracting such provisions.

(K) Interplay with other legislation

Since these sections are included very recently, there are no precedents of any share confiscation under this section or judicial pronouncements regarding any significant cases. There are unclear ramifications as to how filing of SBO declarations interplays with other laws and regulations like the Income Tax Act, 1961, the Prohibition of Benami Transactions Act, 1988 and SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018, SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011, Black Money Act, 2015, and Insolvency law, etc.

There is also a concern that if the shares are held through a bankruptcy-remote trust, the bankruptcy remoteness of such holding could get compromised by filing SBO declarations. Such filings can also lead to unnecessary wild goose hunts by the tax sleuths to harass the bonafide individuals. The information regarding an SBO would come into the public domain, which could be detrimental to the physical and financial health of such individuals.

Related Topic:

Change of Definition of Listed Company and Companies not to be considered as Listed Companies

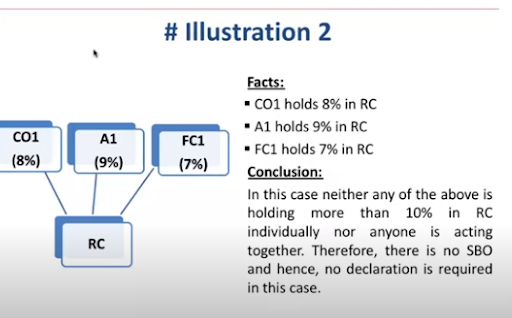

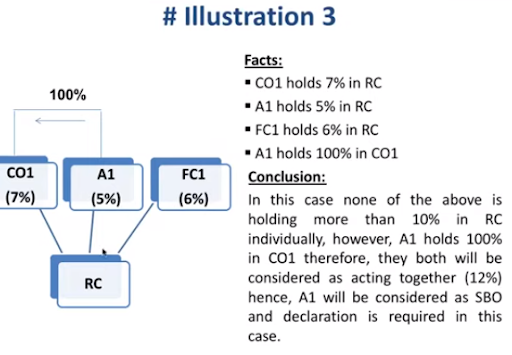

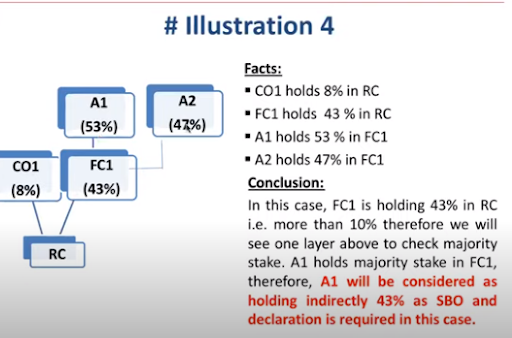

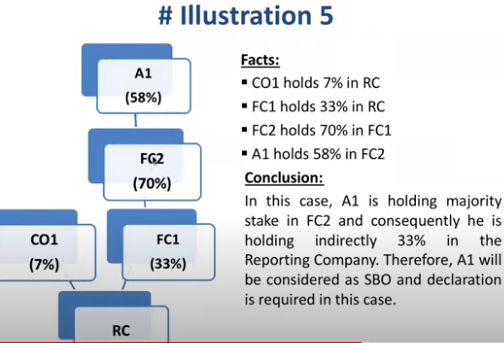

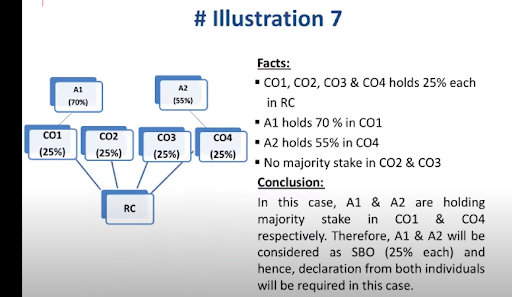

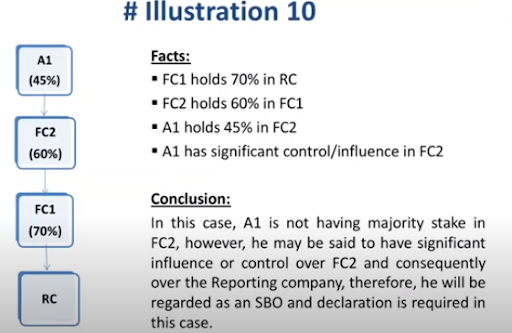

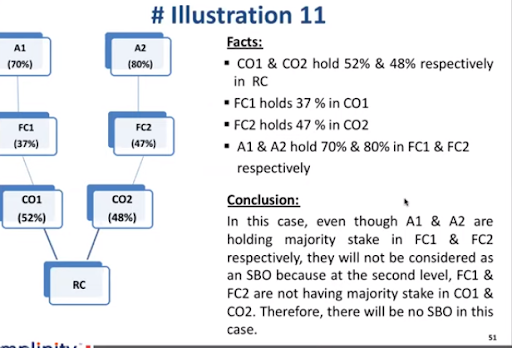

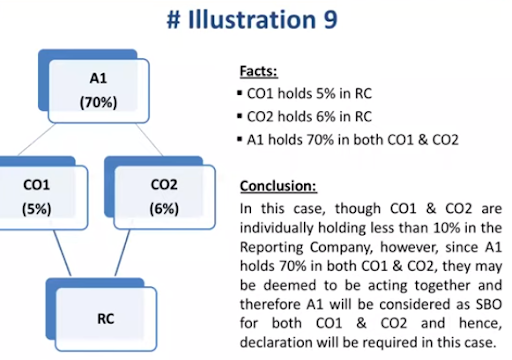

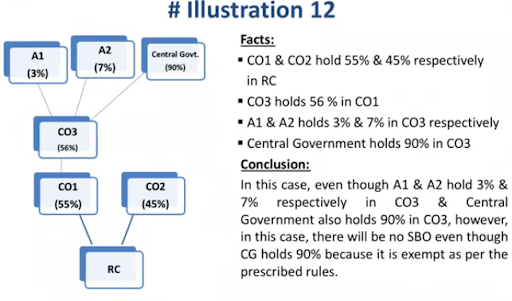

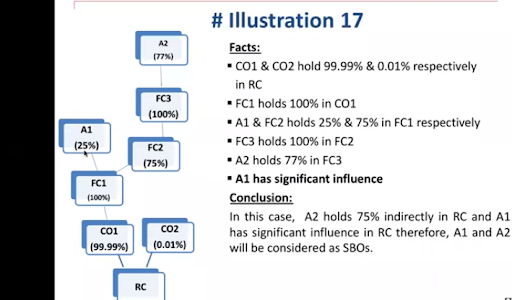

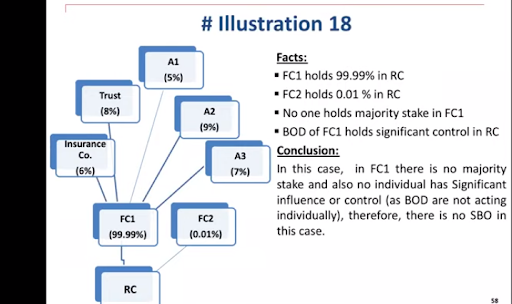

(6) Some Illustrations regarding the determination of an SBO

1.)

2.)

3.)

4.)

5.)

6.)

7.)

8.)

9.)

10.)

11.)

12.)

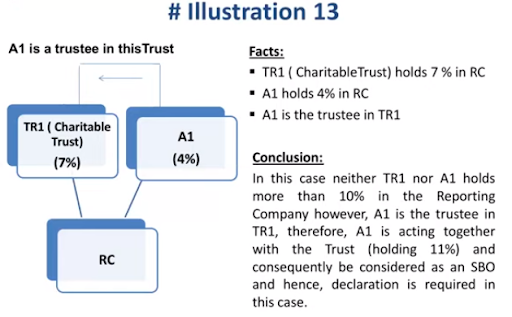

13.)

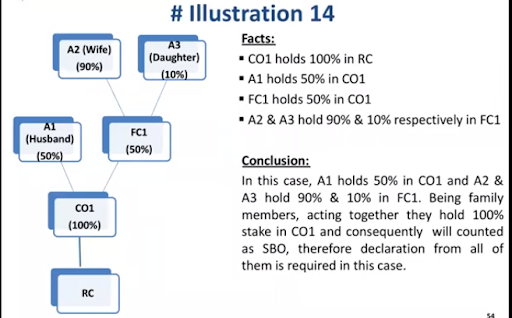

14.)

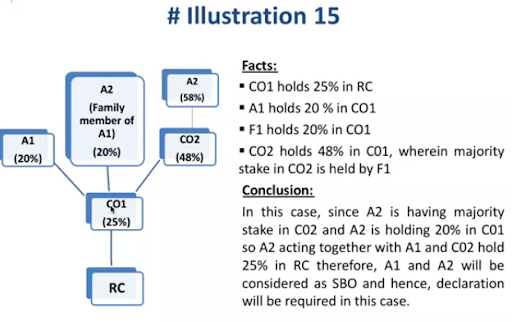

15.)

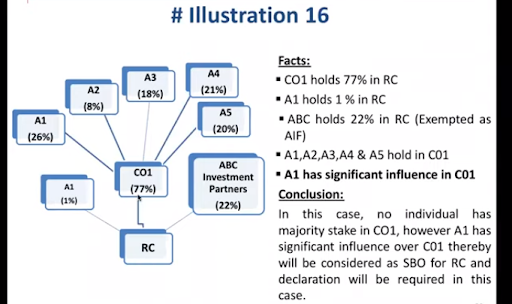

16.)

(7) Some points to remember

(A) Status of preference shares and ESOPs

- As per explanation 6, preference shares are not eligible for calculating the holding threshold limit or for total shares. But if the dividend is not paid on them for continuous 2 years, then as per sec 47 of the Cos Act, they get voting rights and hence will be counted for calculating both, since as per sec 90 voting rights are included in the definition of SBO.

- Similarly, till ESOPs are only options, they shall not be included, but after they are exercised, they become equity shares and shall be included in the holding percentage.

- CCPS (compulsorily convertible preference shares) and CCD (compulsory convertible Debentures) are also added to the calculation with their complete dilution numbers.

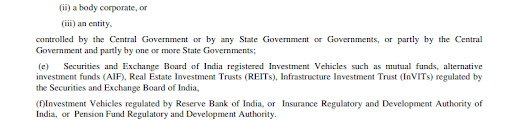

(B) Status of Foreign Corporate Bodies and Foreigners

The reporting company cannot be a foreign company as per the definition of the Reporting company. Since Foreign company is defined separately in the companies act and this section does not provide expressly for them to be included. The foreign company can be a member of the reporting company or become a part of subsequent layers. Hence the reporting company has to be necessarily an Indian company. Since SBO is an individual, he can be an Indian or a foreigner. Therefore these provisions apply to an Indian company and any individual.

(C) When will the reporting company be considered Non-compliant?

- If the declaration from the SBO has been received in form BEN-1 and it is not filed in form BEN-2.

- If the Declaration from SBO is not received in form BEN-1 and the company has not issued a notice in form BEN-4 for making the inquiry.

(D) Will the members of a family of directors on the board of directors will be assumed to be acting together?

- The board of directors is individuals, and they can not be presumed to be acting together. But still, it depends on the facts.

- The relatives may be presumed to be acting together if they have cordial relations amongst them. It is advisable to presume that they are acting together.

(E) Whether acting together will be presumed at the member level or at the subsequent level?

‘Acting together’ can be applied at both levels. First at the member level to determine the holding in the reporting company and then at the subsequent levels to determine the SBO. Since ‘Acting together is in the definition of both, ‘Beneficial interest’ and an ‘SBO’

(F) Who is the SBO in the case of ‘Joint holdings’ and ‘Acting Together

In both cases, all the individuals involved in ‘ Joint holdings’ and ‘Acting together will be deemed to be an SBO and hence all of them have to comply with the provisions. As the rights associated with such holding are enjoyed by all of them.

(G) In both these cases who shall have to fill the form BEN-1?

Anyone person can fill the form BEN-1 declaring the name of other individuals, or alternatively, everyone can file for himself.

(H) If an unregistered firm is a member of a reporting company, will it be considered for an SBO?

Yes, all the partners will be considered for an SBO if they fulfill the conditions.

Related Topic:

Exclusive Jurisdiction of NCLT In All Matters Under Companies Act, 2013.

(8) Difference between beneficial Interest and Significant Beneficial ownership

| S.no | Sec 89 Beneficial interest | Sec90 Significant Beneficial ownership (SBO) |

| 1 | It merely explains what is beneficial interest and contains provisions regarding a person who is holding beneficial interest but who is not a member of the company and a registered member who does not have a beneficial interest. | It gives us the method to determine a significant beneficial owner of a reporting company |

| 2 | It does not give any threshold percentage of holding but describes it in the number of shares. | It provides us with a minimum threshold limit of holding. (>= 10%) |

| 3 | It talks about the beneficial interest which can be direct or indirect | It starts when the beneficial interest is indirect. It calls for disclosure from that person who holds such indirect interest beyond the threshold limit. |

| 4 | It is only restricted to a beneficial interest in terms of shareholding. It is only an objective test i.e. enumerative. | It goes beyond that. It has a much wider import. It talks of beneficial interest, significant influence, and control. It is subjective and objective. |

| 5 | It talks about a person (any organization having a separate legal entity ) as a member of the reporting company | It talks about the individual who is the ultimate beneficiary of benefits arising out of such undisclosed interest in the reporting company. |

| 6 | It is a precursor to sec 90. | It is the culmination of the effect of sec 89 |

| 7 | Here the beneficial interest holder loses his right over such shares, but the registered member continues to receive dividends. | Here the shares whose SBO is unknown are transferred to the Investor education and protection fund |

| 8 | There is no requirement of maintaining any register. | The reporting company has to maintain a register of the individuals who have declared themselves as an SBO |

| 9 | There is no responsibility on the reporting company to enquire about the holder of beneficial interest. It merely has to send the information received from its members and from indirect beneficial interest holders to the registrar. | The reporting company has the responsibility to enquire about such indirect beneficial interest holders. And if the information is not received then make an application to the tribunal. If the company has reasonable cause to believe that the declarations so given are not satisfactory, then, it has to issue a notice in BEN-4 to such persons and follow the provisions contained in this section and as per the SBO rules |

| 10 | The aim of the section is that the company must know the person who owns the beneficial interest in its shares. | The aim of the section is to go beyond the layers of various legal structures and reveal the identity of the individual who has invested in the company and enjoys the benefits of such investment and also to know the various individuals who control or influence the operations of the company. |

(9) Summary of relevant Forms

| Section 90, read with relevant Rules | |

| BEN-1 | Declaration gave by an SBO to the company. |

| BEN-2 | Return of SBO to be filed by the reporting company with the Registrar. |

| BEN-3 | Register of SBO to be maintained by the reporting company. |

| BEN-4 | Notice given by the reporting company to persons (whether they are members or not) seeking details of SBO. |

| Section 89, read with relevant Rules | |

| MGT-4 | Declaration by the member to the company on receipt of shares that he does not hold a beneficial interest in those shares. |

| MGT-5 | Declaration by the beneficial owner of shares to the company on the acquisition of ownership in such shares. |

| MGT-6 | Return of beneficial interest to be filed by the company with the Registrar. |

Related Topic:

Conclusion

The Government has unleashed a very potent Frankenstein, which can haunt many people, rather than the individuals who are really aimed at. Though it is a necessary evil, it has to be equipped with adequate safeguards to preclude bonafide transactions and individuals.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.