Mere payment via bank account wont make ITC eligible- Aastha Enterprises (PDF)

Table of Contents

Cases Covered:

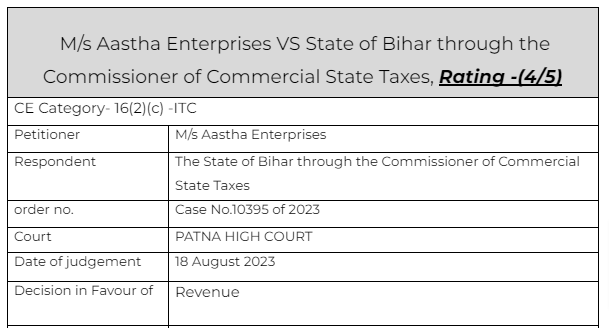

M/s Aastha Enterprises VS State of Bihar through the Commissioner of Commercial State Taxes

Citation:

- Sri Vinayaga Agencies v. The Assistant Commissioner (CT) & Anr.

- M/s D.Y. Beathel Enterprises v. The State Tax Officer

- ALD. Automotive Pvt. Ltd. v. The Commercial Tax Officer & Ors.

- Godrej & Boyce Mfg. Co. Pvt. Ltd. and Others v. Commissioner of Sales Tax and Others;

- The State of Karnataka v. M/s Ecom Gill Coffee Trading Private Limited;

Facts of the case

The dealer purchased the goods from the supplier. The purchase is bona fide. The invoice is there and the payment is made via bank. But in case of default the notice was sent to the recipient. Now the recipient approached the court.

The recipient is of view that the recipient should be eligible for the ITC as he compiled all the requirements. The time for filing an appeal against the notice is already lapsed.But the court admitted the petition because it was related to the ITC.

Observations & Judgement of the court

The mere production of a tax invoice, establishment of the movement of goods and receipt of the same and the consideration having been paid through bank accounts would not enable the Input Tax Credit; unless the credit is available in the ledger account of the purchasing dealer who is an assessee.

It is clear that the literal nomenclature and the statutory language, mandates that there should be credit available in the credit ledger of the purchaser to claim Input Tax and otherwise the claim would be frustrated. On the above reasoning, we have to find that the claim of Input Tax Credit raised by the petitioner cannot be sustained when the supplying/selling dealer has not paid up the amounts to the Government; despite collection of tax from the purchasing dealer.

Read & Download the Full M/s Aastha Enterprises VS State of Bihar through the Commissioner of Commercial State Taxes

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.