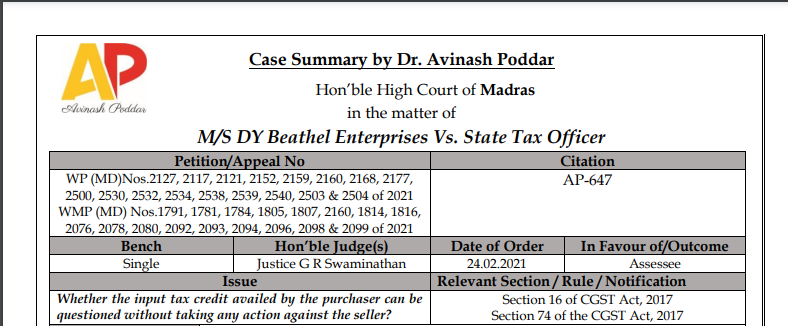

Madras HC Order in the case of M/S DY Beathel Enterprises Vs. State Tax Officer

Case Covered:

M/S DY Beathel Enterprises

Versus

State Tax Officer

Issue:

Whether the input tax credit availed by the purchaser can be questioned without taking any action against the seller?

Brief Facts of the Case:

• The petitioners herein are dealers, registered with Nagercoil Assessment Circle. Though the petitions are 17 in number, the issue raised in all these writ petitions is virtually one and the same. The petitioners are traders in Raw Rubber Sheets. According to them, they had purchased goods from one Charles and his wife Shanthi.

• Based on the returns filed by the sellers, the petitioners herein availed input tax credit. Later, during an inspection by the respondent herein, it came to light that Charles and his wife did not pay any tax to the Government. That necessitated initiation of the impugned proceedings.

• There is no doubt that the respondent had issued show-cause notices to the petitioners herein. The petitioners submitted their replies specifically taking the stand that all the amounts payable by them had been paid to the said Charles and his wife Shanthi and that therefore, those two sellers will have to be necessarily confronted during enquiry. Unfortunately, without involving the said Charles and his wife Shanthi, the impugned orders came to be passed levying the entire liability on the petitioners herein. The said orders are under challenge in these writ petitions.

Related Topic:

Madras HC in the case of M/s. Jayachandran Alloys (P) Ltd.

Brief Arguments by Petitioner/ Appellant:

The specific case of the petitioners is that a substantial portion of the sale consideration was paid only through banking channels. The payments made by the petitioners to the said Charles and his wife included the tax component also. Charles and his wife are also said to be dealers registered with the very same assessment circle.

Based on the returns filed by the sellers, the petitioners herein availed input tax credit. Later, during an inspection by the respondent herein, it came to light that Charles and his wife did not pay any tax to the Government. That necessitated initiation of the impugned proceedings. There is no doubt that the respondent had issued shows cause notices to the petitioners herein. The petitioners submitted their replies specifically taking the stand that all the amounts payable by them had been paid to the said Charles and his wife Shanthi and that therefore, those two sellers will have to be necessarily confronted during the inquiry. Unfortunately, without involving the said Charles and his wife Shanthi, the impugned orders came to be passed levying the entire liability on the petitioners herein. The said orders are under challenge in these writ petitions.

Brief Arguments by Respondents:

The respondent has filed a detailed counter affidavit and contended that the impugned orders, do not warrant any interference.

The learned Government Advocate would point out that the petitioners had availed input tax credit on the premise that tax had already been remitted to the Government, by their sellers. When it turned out that the sellers have not paid any tax and the petitioners could not furnish any proof for the same, the department was entirely justified in proceeding to recover the same from the petitioners herein. The respondent cannot be faulted for having reversed whatever ITC that was already availed by the petitioners herein.

Cases relied upon by:

Petitioner

1. Sri Vinayaga Agencies Vs. The Assistant Commissioner, CT Vadapalani, reported in 2013 60 VST page 283

Respondent

–

Judgement/ Ratio (in brief):

The learned counsel for the petitioners would draw my attention to the decision of the Madras High Court made in Sri Vinayaga Agencies Vs. The Assistant Commissioner, CT Vadapalani, reported in 2013 60 VST page 283. It was held therein that the authority does not have the jurisdiction to reverse the input tax credit already availed by the assesses on the ground that the selling dealer has not paid the tax. I am afraid that this proposition laid down in the context of the previous tax regime may not be straight-away applicable to the current tax regime.

At this stage, the learned counsel brought to my notice that the press release issued by the Central Board of GST council on 4.5.2018. In the said press release, it has been mentioned that there shall not be any automatic reversal of input tax credit from the buyer on nonpayment of tax by the seller. In case of default in payment of tax by the seller, recovery shall be made from the seller. However, reversal of credit from buyer shall also be an option available with the revenue authorities to address exceptional situations like missing dealer, closure of business by the supplier or the supplier not having adequate assets, etc.

It can be seen therefrom that the assessee must have received the goods and the tax charged in respect of its supply, must have been actually paid to the Government either in cash or through the utilization of input tax credit, admissible in respect of the said supply.

If the tax had not reached the kitty of the Government, then the liability may have to be eventually borne by one party, either the seller or the buyer. In the case on hand, the respondent does not appear to have taken any recovery action against the seller / Charles, and his wife Shanthi, on the present transactions.

The learned counsel for the petitioners draws my attention to the order, dated 27.10.2020, finalizing the assessment of the seller by excluding the subject transactions alone. I am unable to appreciate the approach of the authorities. When it has come out that the seller has collected tax from the purchasing dealers, the omission on the part of the seller to remit the tax in question must have been viewed very seriously and strict action ought to have been initiated against him.

According to the respondent, there was no movement of the goods. Hence, examination of Charles and his wife have become all the more necessary and imperative. When the petitioners have insisted on this, I do not understand why the respondent did not ensure the presence of Charles and his wife Shanthi, in the inquiry. Thus, the impugned orders suffer from certain fundamental flaws. It has to be quashed for more reasons than one.

a) Non-examination of Charles in the inquiry

b) Non-initiation of recovery action against Charles in the first place

Therefore, the impugned orders are quashed and the matters are remitted back to the file of the respondent. The stage up to the reception of reply from the petitioners herein will hold good. Inquiry alone will have to be held afresh. In the said inquiry, Charles and his wife Shanthi will have to be examined as witnesses. Parallelly, the respondent will also initiate recovery action against Charles and his wife Shanthi.

With these directions, these writ petitions are allowed. No costs. Consequently, connected miscellaneous petitions are closed.

If you already have a premium membership, Sign In.

Dr. Avinash Poddar

Dr. Avinash Poddar

Ahemdabad, India

Avinash Poddar, currently practicing as a lawyer, as a Law Graduate, a fellow member of Institute of Chartered Accountants of India, Certified Financial Planner, Microsoft Certified Professional and DISA (Diploma in Information Systems Audit) from ICAI. He has also completed various certificate courses of ICAI such as Arbitration, Forensic Accounting and Fraud Detection, Valuation, IFRS, Indirect Taxes. He has also completed post-graduate diploma is Cyber Crime (PGCCL).