Provisional Attachment under GST Act to Protect Revenue is not an Omnibus Power

Case covered:

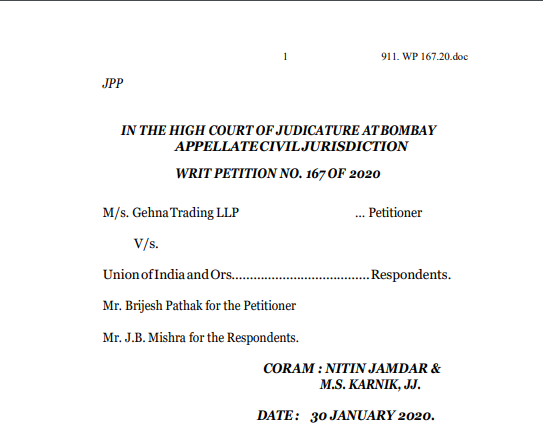

M/s. GehnaTrading LLP

Versus

Union of India and Ors.

Facts of the case:

By this Petition, the Petitioner has challenged the action of the Respondents in provisionally attaching the bank account of the Petitioner.

On 6 December 2019 the Deputy Commissioner, Central Goods and Service Tax (CGST) informed the Branch Manager where the Petitioner holds a bank account that in view of the proceedings filed against one Yusuf Fauzdar Shaikh, proprietor of M/s.FashionCreations, proceedings have been launched against the said taxable person and the Respondents were of the belief that amounts were being transferred to various persons, including the Petitioner. Hence, a direction was issued to the bank not to allow any debit.

Related Topic:

Provisional Attachment of Credit Ledger on account of Nonexistence of Supplier at their Registered Address

Though the order does not refer to any provision of law, the learned Counsel for the Petitioner points out that the power for provisionally attaching the bank account is under Section 83 of the Central Goods and Services Tax (CGST) Act, 2017. The learned Counsel for the Petitioner submitted that there are no proceedings under Sections 62, 63, 64, 67, 73 and74againstthe Petitioner as mentioned under Section 83 of the CGST Act, which is necessary if attachment under Section 83 is to be levied. The learned Counsel for the Petitioner relies upon the decision of this Court dated 17 January 2020 in Writ Petition No. 3145 of 2019 (Kaish Impex Pvt. Ltd. v/s. Union of India & Ors.) wherein this Court has observed thus:-

“13. Primary defense of the Respondents is that even if section 62, 63, 64, 67, 73 and 74 mentioned in section 83 of the Act are not referable to the case of the Petitioner since summons is issuedtothePetitioner in pursuant to the inquiry initiated against M/s. Maps Global under section 67 of the Act, by the issuance of summons the proceedings, get extended to the petitioner also.

Related Topic:

Provisional Attachment of Credit Ledger on account of Nonexistence of Supplier at their Registered Address

Observation of the court:

The Petitioner is entitled to succeed. Accordingly, the writ petition is allowed. The order passed by the Respondent dated 6 December 2019 attaching the bank account of the Petitioner, details of which have been given in the Petition is quashed and set aside.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.