Specific points for GSTR 9 and GSTR 9C for FY 2019-20

Table of Contents

Applicability of GSTR – 9 & GSTR – 9C

It is our last audit! yes, we need to finish it on time as there are remote chances of extension of due dates. We have compiled some quick issues for the GSTR 9 and 9C for FY 2019-20. We hope they are helpful for all filing the GSTR 9 and GSTR 9C for FY 2019-20.

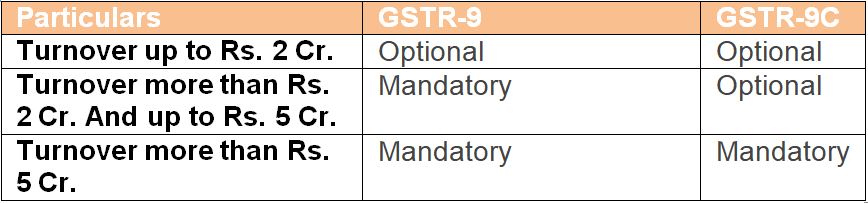

Notification No. 47/2019 and 77/2020 – Central Tax gives the benefit of the optional filing of annual return for registered persons whose aggregate turnover in a financial year does not exceed Rs 2 crore, for F.Y. 2017-18, F.Y. 2018-19, and FY 2019-20 as well.

Related Topic:

Instructions of Form GSTR-9

Notification No. 16/2020- Central tax Revised the threshold limit of aggregate turnover from Rs. 2 crores to Rs. 5 crores for FY 2018-19 & onwards.

Example:-

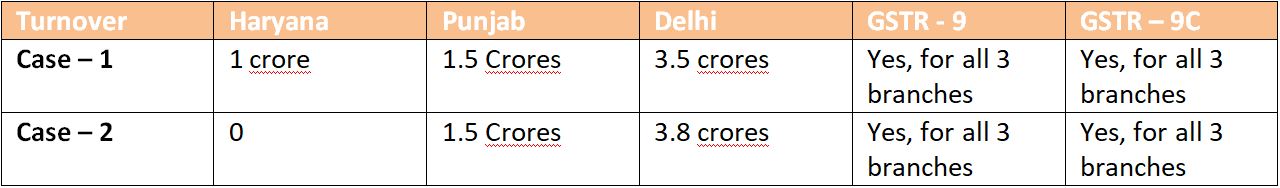

- Turnover of all Branches will be Included in Determining Aggregate turnover.

- GSTR – 9 is optional for taxpayers having aggregate turnover up to 2 crores in FY 2019-20, and it is mandatory for taxpayers having aggregate turnover of more than 2 crores in FY 2019-20.

- GSTR – 9C is mandatory for taxpayers having an aggregate turnover of more than 5 crores in FY 2019-20.

- If the threshold of aggregate turnover is crossed then GSTR – 9,9C will be applicable to all branches irrespective of turnover of such particular Branch.

- Even if the GST is surrendered during the financial year, GSTR – 9 is required to be filed, if the threshold limit is exceeded.

Related Topic:

Relaxations Not Available For FY 2019-20 And Onwards In Filing GSTR 9 And 9C

Related Topic:

Errors in Generating or Downloading GSTR-9C JSON File and their Resolution

Table wise details required for GSTR – 9 & 9C

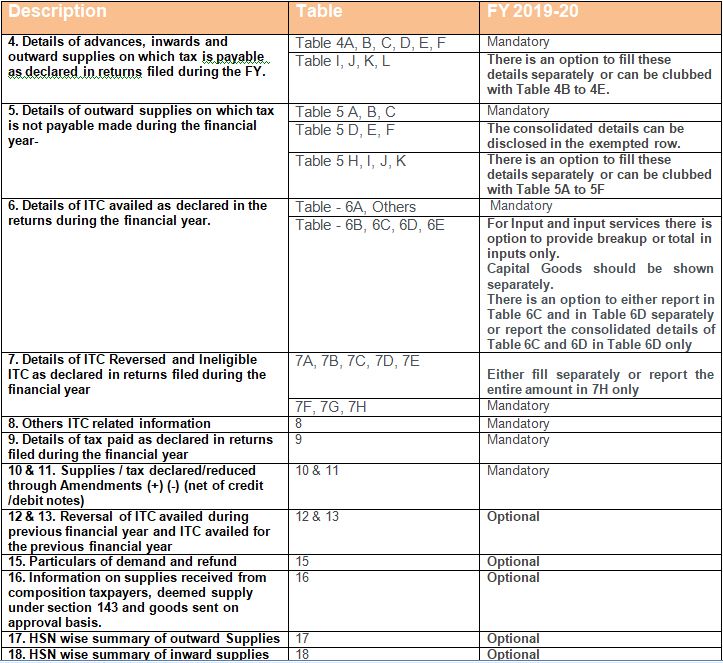

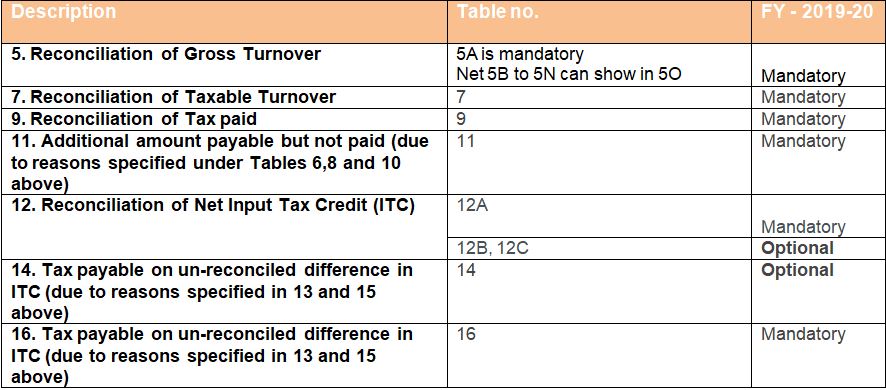

Vide Notification no. 79/2019 Some tables, Clause of the form GSTR – 9 and 9C were made Optional.

GSTR- 9

GSTR -9C

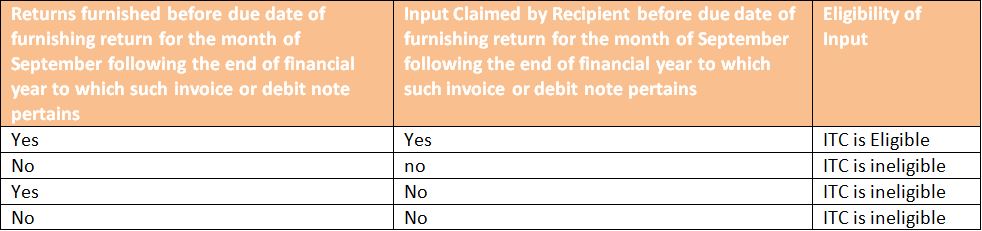

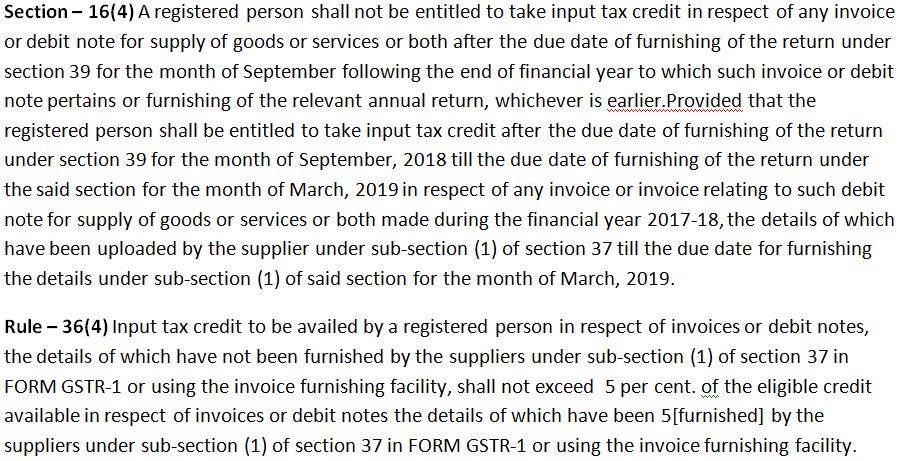

Eligibility of Input tax credit- Interplay of section 16(4) & Rule 36(4)

Related Topic:

GSTR 9 and 9C –FY 2020-21

Reversal of input tax credit in case of non-payment of Consideration

The proviso to section 16(2) provides for the reversal of ITC in some cases. The supplier must have made the payment of the invoice within 180 days from the date of issue of the invoice.

Example 1:- Mehta Enterprises Bought Raw material from Rishi traders worth Rs. 10,00,000 plus 18% IGST 1,80,000. Invoice issued on 1-July-2018.

Related Topic:

GST portal allows downloading table 8A of GSTR 9

Mehta enterprises Claimed 1,80,000 as ITC in their Returns.

But Mehta Enterprises failed to pay the invoice amount within 180 days from the date of invoice. Now Mehta Enterprises will have to reverse the ITC of Rs. 1,80,000.

Related Topic:

GSTR 9 & 9C with FEW SAMPLE DISCLOSURES

Challenges in tracing the default of 180 days payment

An auditor is required to comment upon the compliance of this provision. In some of the recent cases department issued the notices to the auditors. they asked the auditors about their failure to comment upon this default in some taxpayers. Thus for this particular year, we should take care to include a commentary on this provision.

Related Topic:

Detailed Analysis of GSTR 9 and GSTR 9C

It is not an easy task. Especially in the case of large organizations, there is a long list of purchases. Aging is not a normal report for any MIS. It is time-consuming to check the compliance of 180 days payment. The auditor will himself have to do the aging of all creditors. It is not normal compliance under any other law. We can’t assume that this thing is taken care of by the statutory auditor.

Related Topic:

CREATING JSON FOR GSTR 9C

In some cases, it may be impossible to do the aging. The auditors can seek a management representation letter in those cases. Where it is hard to do the aging.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.