CGST (Second amendment rules) 2019

CGST (Second amendment rules) 2019:

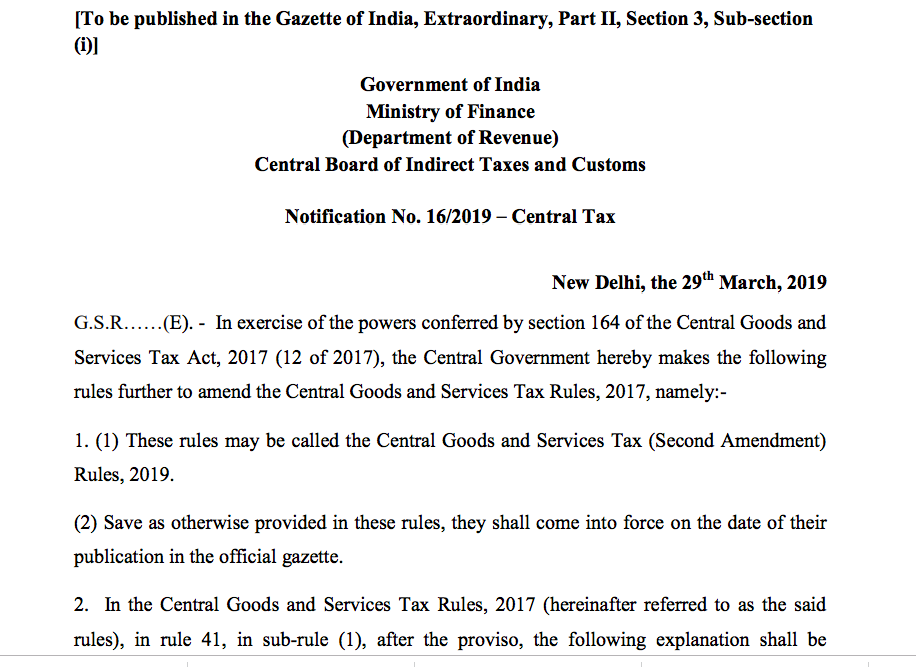

CGST (Second amendment rules) 2019 bring into major changes for taxpayers. They are bring into force via Notification No. 16/2019 – Central Tax dated 29th March 2019. We can divide them into various headings.

- Formulation of new scheme for real estate taxation. As it was decided in last meeting of GST council a new tax scheme is there for real estate. This scheme is laid down in detail by this notification. New tax rates for housing projects were 1% and 5% respectively for affordable housing and other than affordable housing. The value of affordable is upto 45 lac and area is 60SQM in other than metro and 90 SQM in metro cities.

- Relief for ITC adjustment for taxpayers. Now you will be able to adjust your IGST in any order with your CGST or SGST. But important issue is still pending. Can I use it partly for CGST and Partly for SGST. Still it will be a relief because section 49A inserted via CGST amendment Act 2018 has set the adjustment in different manner. It was causing cash flow blockage for taxpayers. here was a huge demand for its removal. Hope it will bring a relief to those people.

You can download the pdf from the following link.

CGST (Second amendment rules) 2019

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.