Section wise analysis of CGST Amendment Act 2018

- Section wise analysis of CGST Amendment Act 2018

- 1. Definition of adjudicating authority to exclude National Anti-Profiteering authority

- 2. Modification in the clause relating to race club in the definition of Business.

- 3. in the definition of Cost Accountant.

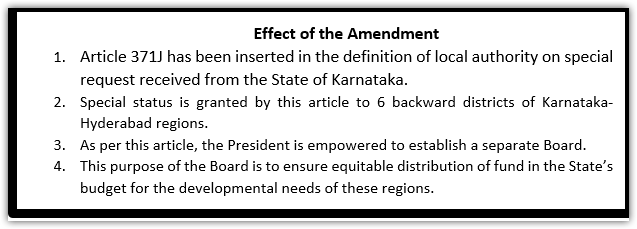

- 4. Insertion of Article 371 J in the definition of local authority

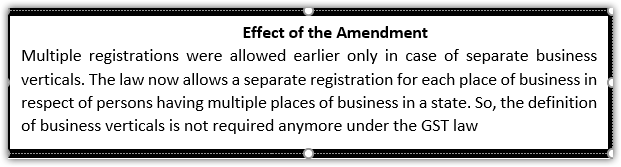

- 5. Omission of the definition of business vertical

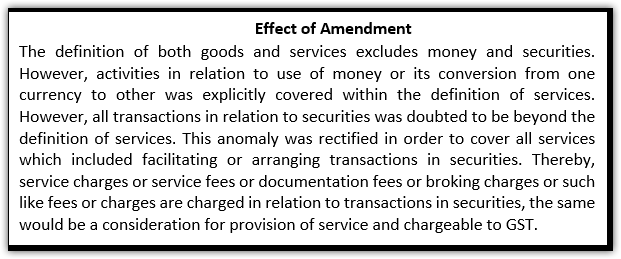

- 6. Definition of services modified to cover facilitation or arranging transactions and securities

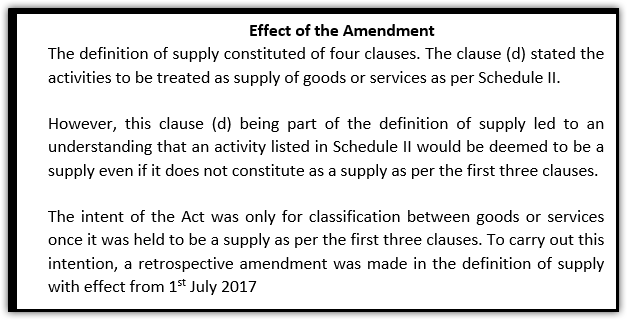

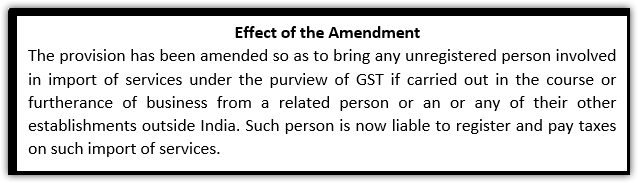

- 7. Retrospective amendment in the definition of supply as regards Schedule II

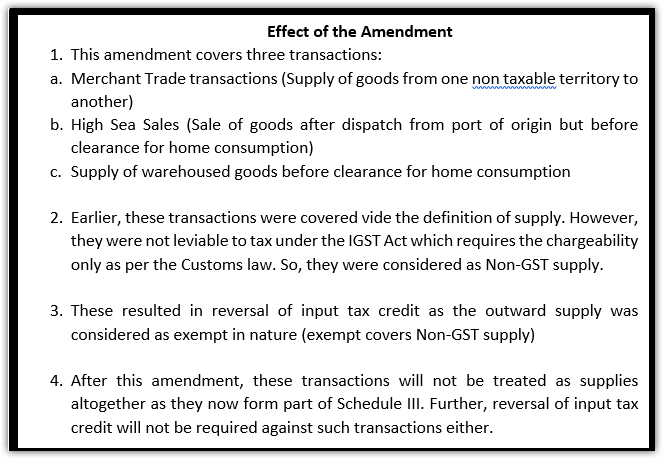

- 8. Entities not registered under GST are liable to pay tax on Import of services

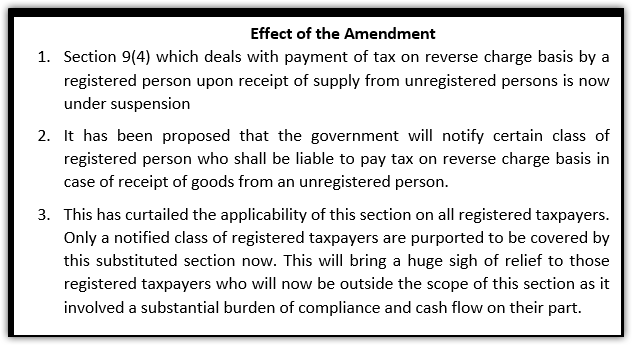

- 9. Merchant trade transactions, high sea sales and supply of warehoused goods before clearance for home consumptions not to be treated as supplies

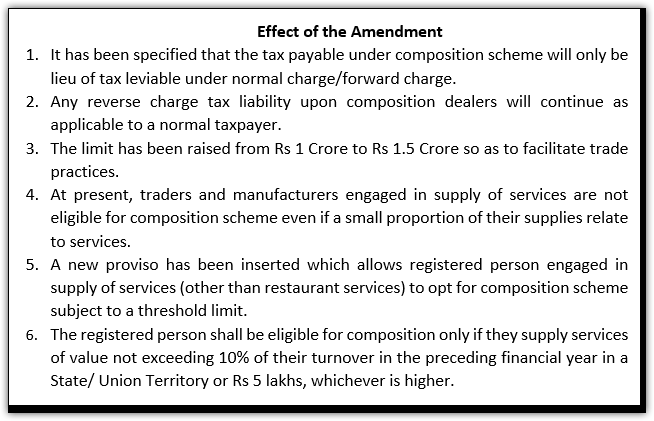

- 10. Restrictive applicability of Section 9 (4)

- 11. Increase in composition threshold limit, rationalization of reverse charge provisions and allowance of provision of services for composition dealers

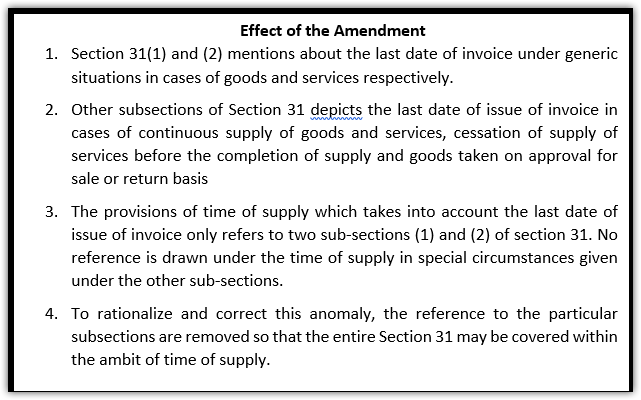

- 12. Rationalization of time of supply provisions for goods and services

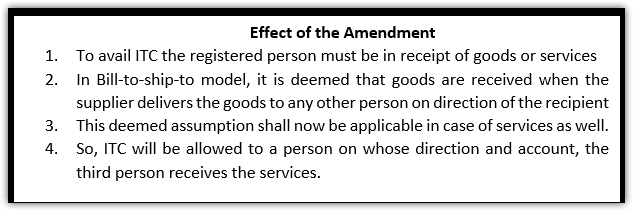

- 13. ITC on services provided to any person on direction of / on account of another person

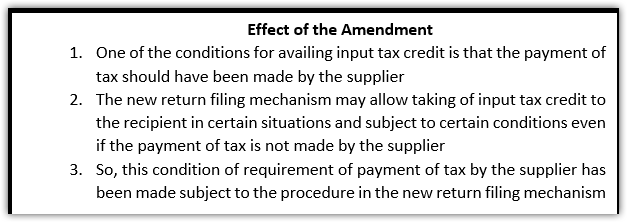

- 14. Entitlement of ITC upon payment by the supplier subject to the new return filing procedure

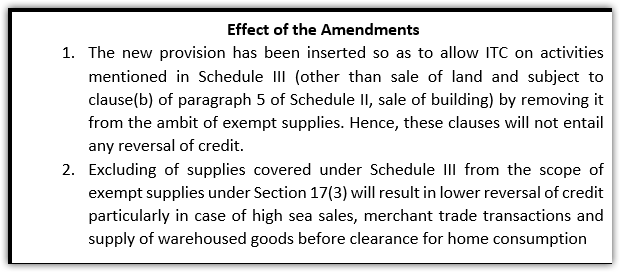

- 15. ITC availability on Schedule III items.

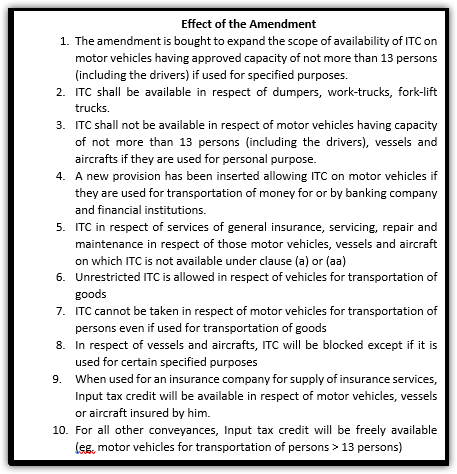

- 16. Expansion of Scope of availability of ITC on motor vehicles

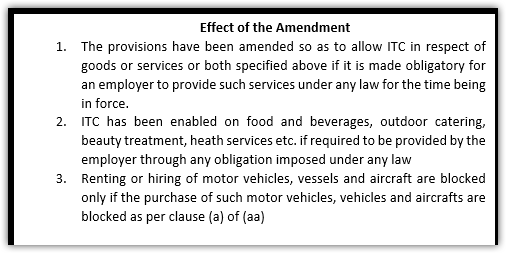

- 17. Expansion of Scope of ITC for Section 17(5) clause(b)

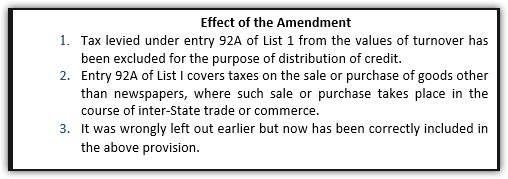

- 18. Insertion of Entry 92A in the exclusions from turnover for distribution of credit

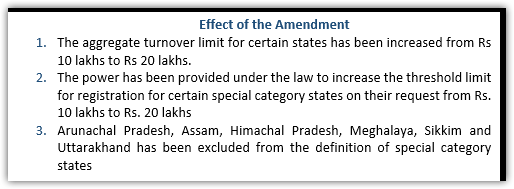

- 19. Threshold exemption limit for registration increased for certain states

- Source

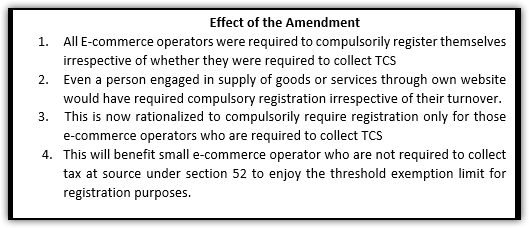

- 20. Compulsory registration only for e-commerce operator required to collect TCS

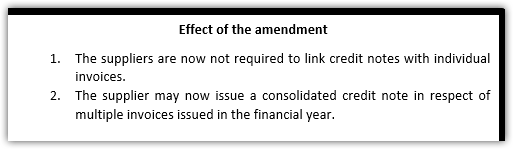

- Source

- Effective Date

- Affected Provision

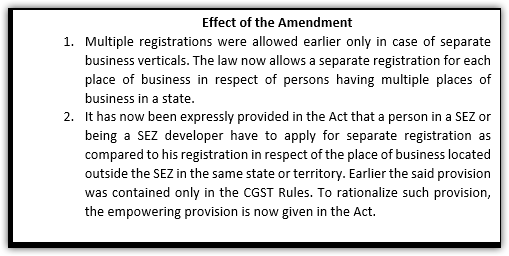

- 21. Multiple registrations for each place of business and separate registration for SEZ

- Source

- Affected Provision

- Amendment

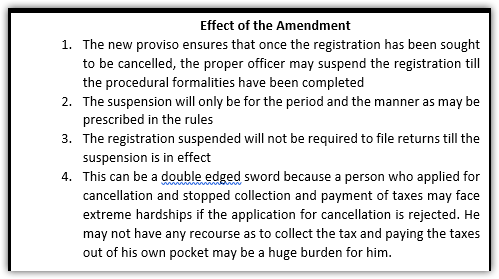

- 22. Suspension allowed upon cancellation of registration

- 23. Issue of consolidated credit note in a financial year.

- Affected Provision

- Provision before amendment

- Provision after amendment

- Amendment

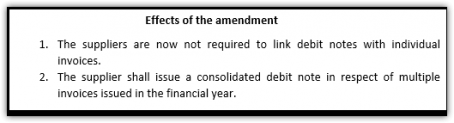

- 24. Issue of consolidated debit note in a financial year.

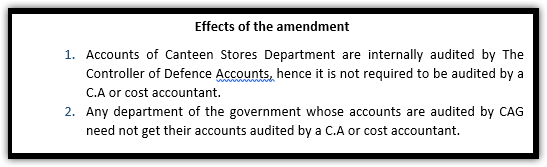

- 25. Accounts to be audited for specified class of registered person.

- Source

- Affected Provision

- Amendment:

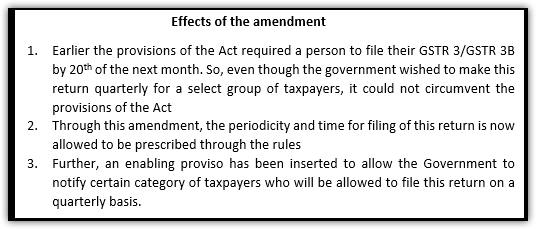

- 26. Empowerment of time limit and periodicity for filing of return through rules

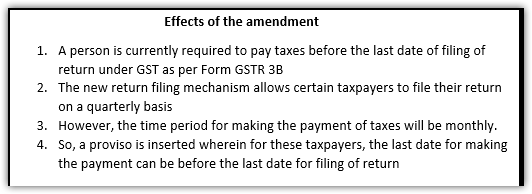

- 27. Payment of tax on a monthly frequency for quarterly taxpayers

- Source

- Effective Date

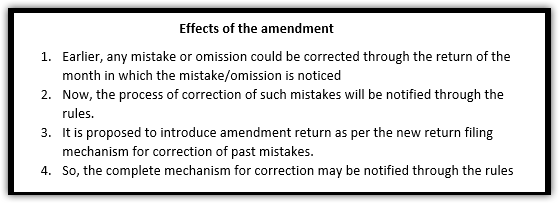

- 28. Correction of mistake through an alternate mechanism including amendment return

- Source

- Effective Date

- Affected Provision

- Provision before amendment

- Provision after amendment

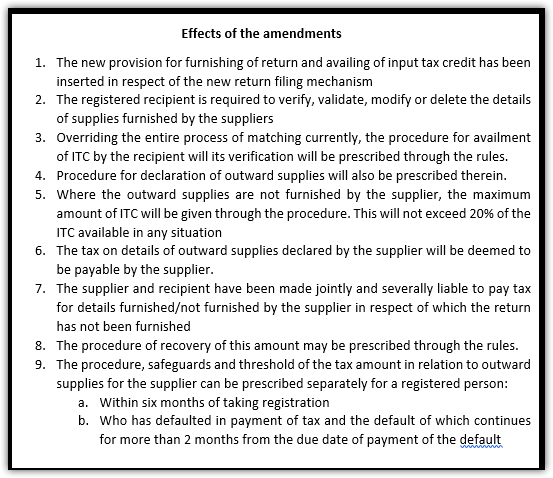

- 29. Procedure for furnishing return and availing ITC in the new return filing mechanism

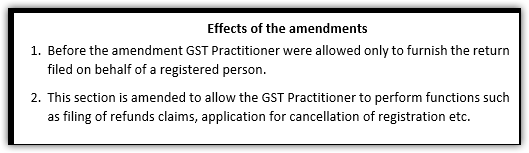

- 30. Expanding the working area of GST Practitioner

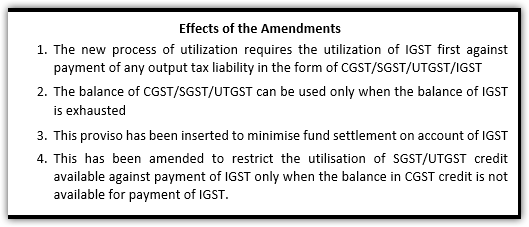

- 31. Utilization of IGST first against payment of any tax

- Source

- Amendment

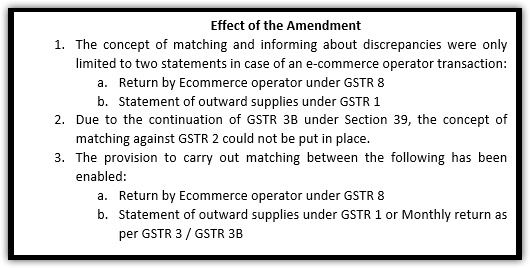

- 32. Concept of matching extended to GSTR 3B for e-com transactions (not just GSTR 1)

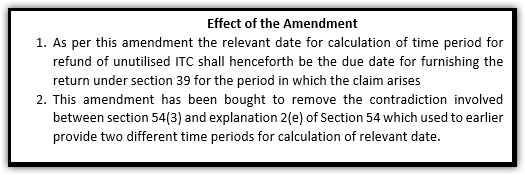

- 33. Modification of relevant date in case of refund of unutilised credit

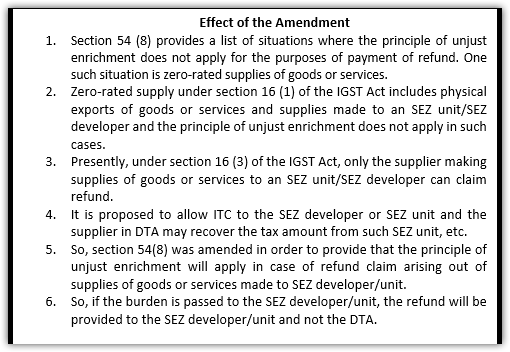

- 34. Unjust enrichment applicable in case of refund on supplies to SEZ developer/unit

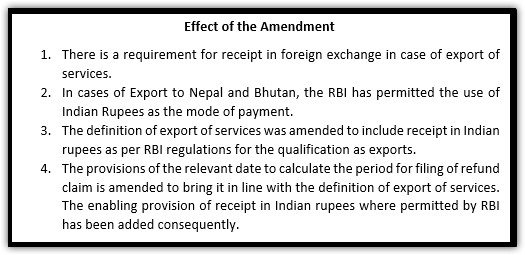

- 35. Relevant date for Export of services to include cases where payment received in INR if permitted by RBI

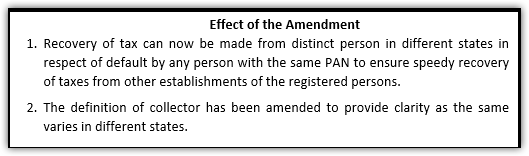

- 36. Person to include distinct person for recovery and definition of collector specified

- Affected Provision

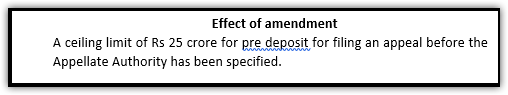

- 37. Ceiling limit for pre deposit for filing appeal before Appellate Authority.

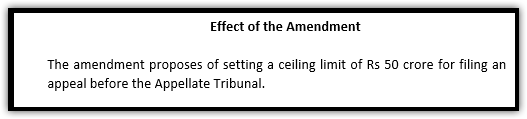

- 38. Ceiling limit for filing appeal before Appellate Tribunal

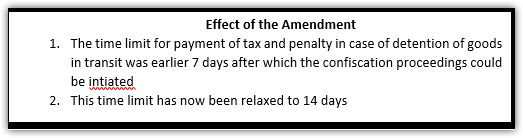

- 39. Time limit for payment of tax or penalty for goods detained or seized increased to 14 days

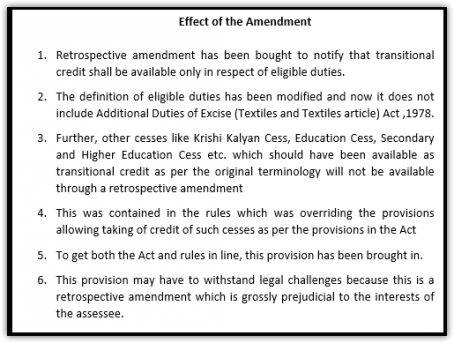

- 40. Retrospective amendment in the transitional credits allowed

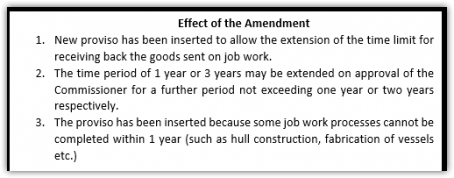

- 41. Time limit for receipt of goods sent on job-work basis extended

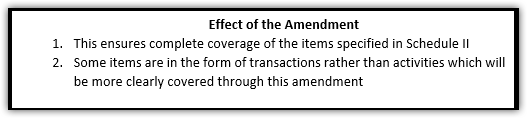

- 42. Retrospective insertion of the term ‘Transactions’ in the heading of Schedule II

- Amendment

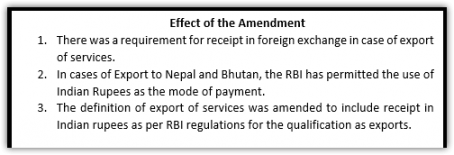

- 43. Definition of export of services to allow receipt in INR if permitted by RBI

- Source

- Effective Date

- Affected Provision

- Amendment

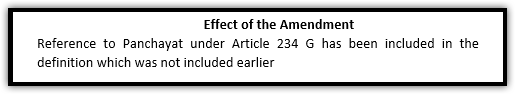

- 44. Modification in the definition of Governmental Authority

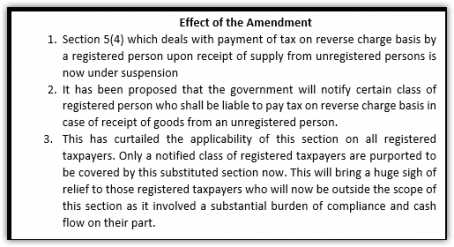

- 45. Restrictive applicability of Section 5(4)

- Source

- Effective Date

- Affected Provision

- Provision before amendment

- Provision after amendment

- Amendment

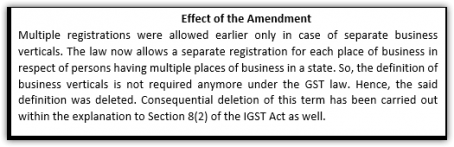

- 46. Omission of term business vertical in the deeming fiction for distinct persons

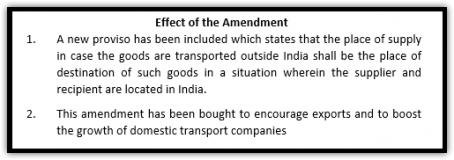

- 47. Place of supply in case of goods transported outside India where the supplier and recipient are in India

- Source

- Effective Date

- Affected Provision

- Amendment

- 48. Place of supply outside India where goods temporarily imported into India & then exported without being put to use after any treatment or process carried out on it

- 49. Apportionment of IGST

- 50. Ceiling limit introduced for filing appeal before Appellate Authority and Appellate Tribunal.

- 51. Modification in the name of CBEC to CBIT

- 52. Distribution of Unutilised Cess in the fund

- 53. Manner and order of utilisation of UTGST credit

Section wise analysis of CGST Amendment Act 2018

| SL NO. | PARTICULARS

|

Reference

Page No |

| 1 | Definition of adjudicating authority to exclude National Anti– Profiteering Authority. | 4 |

| 2 | Modification in the clause relating to race club in the definition of Business | 4 |

| 3 | Modification in the definition of Cost Accountant. | 5 |

| 4 | Insertion of Article 371 J in the definition of local authority | 6 |

| 5 | Omission of the definition of business vertical | 7 |

| 6 | Definition of services modified to cover facilitation or arranging transactions and securities | 7 |

| 7 | Retrospective amendment in the definition of supply as regards Schedule II | 8 |

| 8 | Entities not registered under GST are liable to pay tax on Import of services | 10 |

| 9 | Merchant trade transactions, high sea sales and supply of warehoused goods before clearance for home consumptions not to be treated as supplies | 10 |

| 10 | Restrictive applicability of Section 9 (4) | 11 |

| 11 | Increase in composition threshold limit, rationalization of reverse charge provisions and allowance of provision of services for composition dealers | 12 |

| 12 | Rationalization of time of supply provisions for goods and services | 14 |

| 13 | ITC on services provided to any person on direction of / on account of another person | 15 |

| 14 | Entitlement of ITC upon payment by the supplier subject to the new return filing procedure | 16 |

| 15 | ITC availability on Schedule III items. | 17 |

| 16 | Expansion of Scope of availability of ITC on motor vehicles | 18 |

| 17 | Expansion of Scope of ITC for Section 17(5) clause(b) | 19 |

| 18 | Insertion of Entry 92A in the exclusions from turnover for distribution of credit | 21 |

| 19 | Threshold exemption limit for registration increased for certain states | 22 |

| 20 | Compulsory registration only for e-commerce operator required to collect TCS | 22 |

| 21 | Multiple registrations for each place of business and separate registration for SEZ | 23 |

| 22 | Suspension allowed upon cancellation of registration | 24 |

| 23 | Issue of consolidated credit note in a financial year. | 25 |

| 24 | Issue of consolidated debit note in a financial year. | 26 |

| 25 | Accounts to be audited for specified class of registered person. | 27 |

| 26 | Empowerment of time limit and periodicity for filing of return through rules | 28 |

| 27 | Payment of tax on a monthly frequency for quarterly taxpayers | 29 |

| 28 | Correction of mistake through an alternate mechanism including amendment return | 29 |

| 29 | Procedure for furnishing return and availing ITC in the new return filing mechanism | 30 |

| 30 | Expanding the working area of GST Practitioner | 32 |

| 31 | Utilization of IGST first against payment of any tax | 33 |

| 32 | Concept of matching extended to GSTR 3B for e-com transactions (not just GSTR 1) | 34 |

| 33 | Modification of relevant date in case of refund of unutilised credit | 35 |

| 34 | Unjust enrichment applicable in case of refund on supplies to SEZ developer/unit | 36 |

| 35 | Relevant date for Export of services to include cases where payment received in INR if permitted by RBI | 37 |

| 36 | Person to include distinct person for recovery and definition of collector specified | 38 |

| 37 | Ceiling limit for pre deposit for filing appeal before Appellate Authority. | 39 |

| 38 | Ceiling limit for filing appeal before Appellate Tribunal | 39 |

| 39

|

Time limit for payment of tax or penalty for goods detained or seized increased to 14 days | 40 |

| 40 | Retrospective amendment in the transitional credit. | 41 |

| 41 | Time limit for receipt of goods sent on job-work basis extended | 42 |

| 42 | Retrospective insertion of the term ‘Transactions’ in the heading of Schedule II | 43 |

| 43

|

Definition of export of services to allow receipt in INR if permitted by RBI | 43 |

| 44 | Modification in the definition of Governmental Authority | 44 |

| 45 | Restrictive applicability of Section 5(4) | 45 |

| 46 | Omission of term business vertical in the deeming fiction for distinct persons | 46 |

| 47 | Place of supply in case of goods transported outside India where the supplier and recipient are in India | 47 |

| 48 | Place of supply outside India where goods temporarily imported into India & then exported without being put to use after any treatment or process carried out on it | 47 |

| 49 | Apportionment of IGST | 49 |

| 50 | Ceiling limit introduced for filing appeal before Appellate Authority and Appellate Tribunal. | 49 |

| 51 | Modification in the name of CBEC to CBIT | 50 |

| 52 | Distribution of Unutilised Cess in the fund | 50 |

| 53 | Manner and order of utilisation of UTGST credit | 51 |

1. Definition of adjudicating authority to exclude National Anti-Profiteering authority

Source

Clause 2(a)(ii) of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 2(4) of the CGST Act, 2017.

Provision before amendment

2(4) “adjudicating authority” means any authority, appointed or authorised to pass any order or decision under this Act, but does not include the Central Board of Excise and Customs, the Revisional Authority, the Authority for Advance Ruling, the Appellate Authority for Advance Ruling, the Appellate Authority and the Appellate Tribunal;

Related Topic:

Provisions of Clause 6(B) & 6(C) of Section 25 shall not apply to a certain person

Provision after Amendment

“adjudicating authority” means any authority, appointed or authorised to pass any order or decision under this Act, but does not include the Central Board of Indirect Taxes and Customs, the Revisional Authority, the Authority for Advance Ruling, the Appellate Authority for Advance Ruling, the Appellate Authority, the Appellate Tribunal and the Authority referred to in subsection (2) of section 171;

CGST Amendment Act 2018 Effect on definition

2. Modification in the clause relating to race club in the definition of Business.

Source

Clause 2(b) of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Related Topic:

Amended Section 44 of CGST Act: Annual return in GST

Affected Provision

Section 2(17) (h) of the CGST Act, 2017.

Provision before amendment

2 (17) (h) services provided by a race club by way of totalisator or a licence to book maker in such club; and

Related Topic:

Important changes by CGST Amendment Act 2018

Provision after amendment

2 (17) (h) activities of a race club including by way of totalisator or a license to bookmaker or activities of a licensed book maker in such club; and

Amendment

The above provision marked in red has been substituted by provisions marked in green.

CGST Amendment Act 2018 impact on service

3. in the definition of Cost Accountant.

Modification

Source

Clause 2(d) of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 2(35) of the CGST Act, 2017

Provision before amendment

2(35). cost accountant” means a cost accountant as defined in clause (c) of sub-section (1) of section 2 of the Cost and Works Accountants Act, 1959;

Provision after amendment

2(35). cost accountant” means a cost accountant as defined in clause (b) of sub-section (1) of section 2 of the Cost and Works Accountants Act, 1959;

Amendment

The above provision marked in red has been substituted with the provision marked in green.

CGST Amendment Act 2018 impact on definition

4. Insertion of Article 371 J in the definition of local authority

Source

Clause 2(e) of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 2(69) of the CGST Act, 1962

Provision before amendment

2(69) “a local authority “means –

(f) a Development Board constituted under article 371 of the Constitution; or

Provision after amendment

2(69) “a local authority “means –

(f) “a Development Board constituted under article 371 and article 371J of the Constitution; or

Amendment

Article 371J has been included in the definition of local authority.

CGST Amendment Act 2018 371J

5. Omission of the definition of business vertical

Source

Clause 2(c) of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 2(18) of the CGST Act, 2017

Amendment

(18) “business vertical” means a distinguishable component of an enterprise that is engaged in the supply of individual goods or services or a group of related goods or services which is subject to risks and returns that are different from those of the other business verticals.

Explanation––For the purposes of this clause, factors that should be considered in determining whether goods or services are related include––

(a) the nature of the goods or services;

(b) the nature of the production processes;

(c) the type or class of customers for the goods or services;

(d) the methods used to distribute the goods or supply of services; and

(e) the nature of regulatory environment (wherever applicable), including banking, insurance, or public utilities;

CGST Amendment Act 2018 registration

6. Definition of services modified to cover facilitation or arranging transactions and securities

Source

Clause 2(f) of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 2(102) of the CGST Act, 2017

Provision before amendment

2(102) “services” means anything other than goods, money and securities but includes activities relating to the use of money or its conversion by cash or by any other mode, from one form, currency or denomination, to another form, currency or

denomination for which a separate consideration is charged;

Provision after amendment

2(102) “services” means anything other than goods, money and securities but includes activities relating to the use of money or its conversion by cash or by any other mode, from one form, currency or denomination, to another form, currency or

denomination for which a separate consideration is charged;

Explanation-For the removal of doubts, it is hereby clarified that the expression “services” includes facilitating or arranging transactions in securities.

Amendment

The portion marked in green has been inserted.

CGST Amendment Act 2018

7. Retrospective amendment in the definition of supply as regards Schedule II

Source

Clause 3 of the CGST Amendment Act, 2018.

Effective Date

1st July 2017.

Affected Provision

Section 7 of the CGST Act, 2017.

Amendment

The following clause marked in green has been inserted and those marked in red has been omitted;

7 (1) For the purposes of this Act, the expression “supply” includes––

(a) all forms of supply of goods or services or both such as sale, transfer, barter, exchange, licence, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business;

(b) import of services for a consideration whether or not in the course or furtherance of business; and

(c) the activities specified in Schedule I, made or agreed to be made without a consideration; and

(d) the activities to be treated as supply of goods or supply of services as referred to in Schedule II

(1A) Certain activities or transactions, when constituting a supply in accordance with the provisions of sub-section (1), shall be treated either as supply of goods or supply of services as referred to in Schedule II.

(2) Notwithstanding anything contained in sub-section (1), ––

(a) activities or transactions specified in Schedule III; or

(b) such activities or transactions undertaken by the Central Government, a State Government or any local authority in which they are engaged as public authorities, as may be notified by the Government on the recommendations of the Council,

shall be treated neither as a supply of goods nor a supply of services.

(3) Subject to the provisions of sub-sections (1), (1A) and (2), the Government may, on the recommendations of the Council, specify, by notification, the transactions that are to be treated as–

(a) a supply of goods and not as a supply of services; or

(b) a supply of services and not as a supply of goods.

CGST Amendment Act 2018 supply

8. Entities not registered under GST are liable to pay tax on Import of services

Source

Clause 30 of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Schedule I of the CGST Act, 2017

Amendment

Schedule I

- Import of services by a taxable person from a related person or from any of his other establishments outside India, in the course or furtherance of business.

Amendment

The portion marked in red has been omitted.

CGST Amendment Act 2018 import

9. Merchant trade transactions, high sea sales and supply of warehoused goods before clearance for home consumptions not to be treated as supplies

Source

Clause 32 of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Schedule III of the CGST Act, 2017

Amendment

The provision marked in green below has been inserted in Schedule III:

- Supply of goods from a place in the non-taxable territory to another place in the non-taxable territory without such goods entering into the taxable territory.

8 (a) Supply of warehoused goods to any person before clearance for home consumption.

(b) Supply of goods by the consignee to any other person, by endorsement of documents of title to the goods, after the goods have been dispatched from the port of origin located outside India but before clearance for home consumption.

Explanation. – For the purposes of this clause, the expression “warehoused goods” shall have the meaning as assigned to it in the Customs Act, 1962 (52 of 1962)

CGST Amendment Act 2018 high sea sales

10. Restrictive applicability of Section 9 (4)

Source

Clause 4 of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 9(4) of the CGST Act, 2017

Provision before amendment

9(4) The central tax in respect of the supply of taxable goods or services or both by a

supplier, who is not registered, to a registered person shall be paid by such person on

reverse charge basis as the recipient and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

Provision after amendment

9(4) The Government may, on the recommendations of the Council, by notification, specify a class of registered persons who shall, in respect of taxable goods or services or both received from an unregistered supplier, pay the tax on reverse charge basis as the recipient of such goods or services or both, and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

Amendment

The provision marked in red has been substituted by the provisions marked in green.

CGST Amendment Act 2018amendment in 9(4)

11. Increase in composition threshold limit, rationalization of reverse charge provisions and allowance of provision of services for composition dealers

Source

Clause 5 of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 10(1) and (2) of the CGST Act, 2017

Provision before amendment

10(1). Notwithstanding anything to the contrary contained in this Act but subject to the provisions of sub-sections (3) and (4) of section 9, a registered person, whose aggregate turnover in the preceding financial year did not exceed fifty lakh rupees, may opt to pay, in lieu of the tax payable by him, an amount calculated at such rate as may be prescribed, but not exceeding, ––

(a) one per cent. of the turnover in State or turnover in Union territory in case of a manufacturer,

(b) two and a half per cent. of the turnover in State or turnover in Union territory in case of persons engaged in making supplies referred to in clause (b) of paragraph 6 of Schedule II, and

(c) half per cent. of the turnover in State or turnover in Union territory in case of other suppliers, subject to such conditions and restrictions as may be prescribed:

Provided that the Government may, by notification, increase the said limit of fifty lakh rupees to such higher amount, not exceeding one crore rupees as may be recommended by the Council. 10(2) The registered person shall be eligible to opt under sub-section (1), if: —

(a) he is not engaged in the supply of services, other than supplies referred to in clause (b) of paragraph 6 of Schedule II;

Provision after amendment

10(1). Notwithstanding anything to the contrary contained in this Act but subject to the provisions of sub-sections (3) and (4) of section 9, a registered person, whose aggregate turnover in the preceding financial year did not exceed fifty lakh rupees, may opt to pay, in lieu of the tax payable by him under sub-section (1) of Section 9, an amount of tax calculated at such rate as may be prescribed, but not exceeding, ––

(a) one per cent. of the turnover in State or turnover in Union territory in case of a manufacturer,

(b) two and a half per cent. of the turnover in State or turnover in Union territory in case of persons engaged in making supplies referred to in clause (b) of paragraph 6 of Schedule II, and

(c) half per cent. of the turnover in State or turnover in Union territory in case of other suppliers, subject to such conditions and restrictions as may be prescribed:

Provided that the Government may, by notification, increase the said limit of fifty lakh rupees to such higher amount, not exceeding one hundred and fifty lakhs rupees, as may be recommended by the Council.

Provided further that a person who opts to pay tax under clause (a), clause (b) or clause (c) may supply services of value not exceeding ten percent of turnover in the preceding financial year in a State or Union territory or five lakh rupees, whichever is higher.

10(2) The registered person shall be eligible to opt under sub-section (1), if: —

(a) he is not engaged in the supply of services, other than supplies referred to in clause (b) of paragraph 6 of Schedule II; save as provided in sub-section (1);

Amendment

- The upper limit for registration has been increased from one crore to one hundred and fifty lakhs

The provisions marked in green has been inserted newly in place of the provision struck through in red

CGST Amendment Act 2018 Composition scheme

12. Rationalization of time of supply provisions for goods and services

Source

Clause 6 and Clause 7 of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

- Section 12(2) clause(a) of the CGST Act, 2017

- Section 13(2)(a) and (b) of the CGST Act, 2017

Amendment

The portion marked in red has been omitted:

12(2) The time of supply of goods shall be the earlier of the following dates, namely:—

(a) the date of issue of invoice by the supplier or the last date on which he is required, under sub-section (1) of section 31, to issue the invoice with respect to the supply; or 13(2) The time of supply of services shall be the earliest of the following dates, namely:—

(a) the date of issue of invoice by the supplier, if the invoice is issued within the period prescribed under sub-section (2) of section 31 or the date of receipt of payment, whichever is earlier; or

(b) the date of provision of service, if the invoice is not issued within the period prescribed under sub-section (2) of section 31 or the date of receipt of payment, whichever is earlier;

CGST Amendment Act 2018 Section 31

13. ITC on services provided to any person on direction of / on account of another person

Source

Clause 8(a) of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 16(2) clause (b) of the CGST Act, 2017

Amendment

The portion marked in green has been inserted newly

16(2) Notwithstanding anything contained in this section, no registered person shall be entitled to the credit of any input tax in respect of any supply of goods or services or both to him unless, ––

(a) he is in possession of a tax invoice or debit note issued by a supplier registered under this Act, or such other tax paying documents as may be prescribed;

(b) he has received the goods or services or both.

Explanation— For the purposes of this clause, it shall be deemed that the registered person has received the goods or, as the case may be, services

- where the goods are delivered by the supplier to a recipient or any other person on the direction of such registered person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to goods or otherwise;

- where the services are provided by the supplier to any person on the direction of and on account of such registered person;

-

CGST Amendment Act 2018 ITC

-

14. Entitlement of ITC upon payment by the supplier subject to the new return filing procedure

-

Source

Clause 8(b) of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 16(2)(c) Second Proviso of the CGST Act, 2017

Amendment

The potion marked in red has been omitted:

(c) subject to the provisions of section 41 or 43A, the tax charged in respect of such supply has been actually paid to the Government, either in cash or through utilisation

of input tax credit admissible in respect of the said supply; and

-

CGST Amendment Act 2018 ITC

15. ITC availability on Schedule III items.

Source

Clause 9(a) of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 17(3) of the CGST Act,2017

Amendment

The following provision marked in green has been inserted:

17 (3) The value of exempt supply under sub-section (2) shall be such as may be prescribed, and shall include supplies on which the recipient is liable to pay tax on reverse charge basis, transactions in securities, sale of land and, subject to clause (b) of paragraph 5 of Schedule II, sale of building but shall not include the value of activities or transactions (other than sale of land and, subject to clause (b) of paragraph 5 of Schedule II, sale of building) specified in Schedule III.

-

CGST Amendment Act 2018 Schedule III

16. Expansion of Scope of availability of ITC on motor vehicles

Source

Clause 9(b) of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 17(5) clause (a) of the Customs Act, 1962

Provision before amendment

Notwithstanding anything contained in sub-section (1) of section 16 and subsection (1) of section 18, input tax credit shall not be available in respect of the following, namely: —

(a) motor vehicles and other conveyances except when they are used––

(i) for making the following taxable supplies, namely: —

(A) further supply of such vehicles or conveyances; or

(B) transportation of passengers; or

(C) imparting training on driving, flying, navigating such vehicles or conveyances;

(ii)for transportation of goods;

Provision after amendment

Notwithstanding anything contained in sub-section (1) of section 16 and subsection (1) of section 18, input tax credit shall not be available in respect of the following, namely: —

(a) motor vehicles for transportation of persons having approved seating capacity of not more than thirteen persons (including the driver) except when they are used––

(i) for making the following taxable supplies, namely: —

(A) further supply of such vehicles or

(B) transportation of passengers; or

(C) imparting training on driving, flying, navigating such vehicles;

(aa) vessels and aircraft except when they are used––

(i) for making the following taxable supplies, namely:—

(A) further supply of such vessels or aircraft; or

(B) transportation of passengers; or

(C) imparting training on navigating such vessels; or

(D) imparting training on flying such aircraft;

(ii) for transportation of goods;

(ab) services of general insurance, servicing, repair and maintenance in so far as they relate to motor vehicles, vessels and aircraft for which the credit is not available in accordance with the provisions of clause (a) or clause (aa);

Provided that the input tax credit in respect of such services shall be available—

(i) where the motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa) are used for the purposes specified therein;

(ii) where received by a taxable person engaged—

(I) in the manufacture of such motor vehicles, vessels or aircraft; or

(II) in the supply of general insurance services in respect of such motor vehicles, vessels or aircraft insured by him;

-

CGST Amendment Act 2018 ITC OF MOTOR VEHICLE

-

-

17. Expansion of Scope of ITC for Section 17(5) clause(b)

- Source Clause 9(b) of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 17(5) clause (b) of the CGST Act, 2017

Provision before amendment

17(5) (b) the following supply of goods or services or both—

(i) food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery except where an inward supply of goods or services or both of a particular category is used by a registered person for making an outward taxable supply of the same category of goods or services or both or as an element of a taxable composite or mixed supply;

(ii) membership of a club, health and fitness centre;

(iii) rent-a-cab, life insurance and health insurance except where––

(iv) travel benefits extended to employees on vacation such as leave or home travel concession;

Provision after amendment

17(5) (b) the following supply of goods or services or both—

(i) food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery, leasing, renting or hiring of motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa) except when used for the purposes specified therein, life insurance and health insurance:

Provided that the input tax credit in respect of such goods or services or both shall be available where an inward supply of such goods or services or both is used by a registered person for making an outward taxable supply of the same category of goods or services or both or as an element of a taxable composite or mixed supply;

(ii) membership of a club, health and fitness centre; and

(iii) travel benefits extended to employees on vacation such as leave or home travel concession;

Provided that the input tax credit in respect of such goods or services or both shall be available, where the provision of such goods or services or both is obligatory for an employer to provide to its employees under any law for the time being in force.

the Government notifies the services which are obligatory for an employer to provide to its employees under any law for the time being in force; or such inward supply of goods or services or both of a particular category is used by a registered person for making an outward taxable supply of the same category of goods or services or both or as part of a taxable composite or mixed supply; and

-

CGST Amendment Act 2018 ITC

18. Insertion of Entry 92A in the exclusions from turnover for distribution of credit

Source

- Clause 10 of the CGST Amendment Act, 2018.Effective DateDate to be notified by the government.

Affected Provision

Section 20- Explanation clause (c) of the CGST Act, 2017

Amendment

The following portion marked in green has been inserted after clause b of Section 28E

Clause (c) of Explanation to section 20: the term ‘turnover’, in relation to any registered person engaged in the supply of taxable goods as well as goods not taxable under this Act, means the value of turnover, reduced by the amount of any duty or tax levied under entries 84 and 92A of List I of the Seventh Schedule to the Constitution and entries 51 and 54 of List II of the said Schedule.

-

CGST Amendment Act 2018 insertion of 92A

19. Threshold exemption limit for registration increased for certain states

Source

Clause 11 of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Second Proviso to Section 22(1) and Explanation (iii) of the CGST Act, 2017

Amendment

Provided further that the Government may, at the request of a special category State and on the recommendations of the Council, enhance the aggregate turnover referred to in the first proviso from ten lakh rupees to such amount, not exceeding twenty lakh rupees and subject to such conditions and limitations, as may be so notified

Explanation (iii) to section 22 the expression “special category States” shall mean the States as specified in sub-clause (g) of clause (4) of article 279A of the Constitution except the State of Jammu and Kashmir and States of Arunachal Pradesh, Assam, Himachal Pradesh, Meghalaya, Sikkim and Uttarakhand

-

CGST Amendment Act 2018

20. Compulsory registration only for e-commerce operator required to collect TCS

-

Source

Clause 12 of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 24 (x) of the CGST Act, 2017

- AmendmentThe provision marked in green has been inserted.24 (x) every electronic commerce operator who is required to collect tax at source under section 52;

-

CGST Amendment Act 2018

21. Multiple registrations for each place of business and separate registration for SEZ

-

Source

Clause 13 of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 25(1) and (2) of the CGST Act, 2017

Amendment

The provision marked in green has been inserted

25(1). Every person who is liable to be registered under section 22 or section 24 shall apply for registration in every such State or Union territory in which he is so liable within thirty days from the date on which he becomes liable to registration, in such manner and subject to such conditions as may be prescribed:

Provided that a casual taxable person or a non-resident taxable person shall apply for registration at least five days prior to the commencement of business

Provided further that a person having a unit, as defined in the Special Economic Zones Act, 2005, in a Special Economic Zone or being a Special Economic Zone developer shall have to apply for a separate registration, as distinct from his place of business located outside the Special Economic Zone in the same State or Union territory.”;

25(2). A person seeking registration under this Act shall be granted a single registration in a State or Union territory:

Provided that a person having multiple business verticals in a State or Union territory may be granted a separate registration for each business vertical, subject to such conditions as may be prescribed:

-

CGST Amendment Act 2018

22. Suspension allowed upon cancellation of registration

-

Source

Clause 14 of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Proviso after Section 29(1)(c) of the CGST Act 2017

Proviso After Section 29(2) of the CGST Act, 2017

Amendment

The heading Section 29 has been now amended to “Cancellation or Suspension of registration.”

The proviso marked in green has been inserted:

Sec 29(1) …

Provided that during pendency of the proceedings relating to cancellation of registration filed by the registered person, the registration may be suspended for such period and in such manner as may be prescribed.

Sec 29(2) …

Provided further that during pendency of the proceedings relating to cancellation of registration, the proper officer may suspend the registration for such period and in such manner as may be prescribed

CGST Amendment Act 2018

23. Issue of consolidated credit note in a financial year.

- Source Clause 15(a) of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 34(1) of the CGST Act, 2017

Provision before amendment

34(1). Where a tax invoice has been issued for supply of any goods or services or both and the taxable value or tax charged in that tax invoice is found to exceed the taxable value or tax payable in respect of such supply, or where the goods supplied are returned by the recipient, or where goods or services or both supplied are found to be deficient, the registered person, who has supplied such goods or services or both, may issue to the recipient a credit note containing such particulars as may be prescribed.

Provision after amendment

34(1). Where one or more tax invoice have been issued for supply of any goods or services or both and the taxable value or tax charged in that invoice is found to exceed the taxable value or tax payable in respect of such supply, or where the goods supplied are returned by the recipient, or where goods or services or both supplied are found to be deficient, the registered person, who has supplied such goods or services or both, may issue to the recipient one or more credit notes for supplies made in a financial year containing such particulars as may be prescribed.

Amendment

The portion marked in red has been substituted with the portions marked in green.

CGST Amendment Act 2018

24. Issue of consolidated debit note in a financial year.

- Source Clause 15(b) of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 34(3) of the CGST Act, 1962

Provision before amendment

34(3). Where a tax invoice has been issued for supply of any goods or services or both and the taxable value or tax charged in that tax invoice is found to be less than the taxable value or tax payable in respect of such supply, the registered person, who has supplied such goods or services or both, shall issue to the recipient a debit note containing such particulars as may be prescribed

Provision after amendment

34(3). Where one or more tax invoices have been issued for supply of any goods or services or both and the taxable value or tax charged in that tax invoice is found to be less than the taxable value or tax payable in respect of such supply, the registered person, who has supplied such goods or services or both, shall issue to the recipient one or more debit note for supplies made in a financial year containing such particulars as may be prescribed

-

CGST Amendment Act 2018

-

25. Accounts to be audited for specified class of registered person.

-

Source

Clause 16 of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 35(5) of the CGST Act 2017.

Amendment:

The proviso marked in green has been inserted after Section 35(5):

Every registered person whose turnover during a financial year exceeds the prescribed limit shall get his accounts audited by a chartered accountant or a cost accountant and shall submit a copy of the audited annual accounts, the reconciliation statement under sub-section (2) of section 44 and such other documents in such form and manner as may be prescribed.

Provided that nothing contained in this sub-section shall apply to any department of the Central Government or a State Government or a local authority, whose books of accounts are subject to audit by the Comptroller and Auditor-General of India or an auditor appointed for auditing the accounts of local authorities under any law for the time being in force. Provided that where the Appellate Authority is satisfied that the appellant was prevented by sufficient cause from presenting the appeal within the period so specified, it may allow a further period of thirty days for filing such appeal.

-

CGST Amendment Act 2018

26. Empowerment of time limit and periodicity for filing of return through rules

- Source Clause 17(a) of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 39(1) of the CGST Act 2017

Provision before amendment

Every registered person, other than an Input Service Distributor or a non-resident taxable person or a person paying tax under the provisions of section 10 or section 51 or section 52 shall, for every calendar month or part thereof, furnish, in such form and manner as may be prescribed, a return, electronically, of inward and outward supplies of goods or services or both, input tax credit availed, tax payable, tax paid and such other particulars as may be prescribed, on or before the twentieth day of the month succeeding such calendar month or part thereof.

Provision after amendment

Every registered person, other than an Input Service Distributor or a non-resident taxable person or a person paying tax under the provisions of section 10 or section 51 or section 52 shall, for every calendar month or part thereof, furnish, in such form, manner and within such time as may be prescribed, a return, electronically, of inward and outward supplies of goods or services or both, input tax credit availed, tax payable, tax paid and such other particulars as may be prescribed.

Provided that the Government may, on the recommendations of the Council, notify certain classes of registered persons who shall furnish return for every quarter or part thereof, subject to such conditions and safeguards as may be specified therein.”;

-

CGST Amendment Act 2018

27. Payment of tax on a monthly frequency for quarterly taxpayers

-

Source

Clause 17(b) of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

- Affected ProvisionSection 39(7) of the CGST Act 2017

Amendment

The portion marked in green has been newly inserted:

Provided that the Government may, on the recommendations of the Council, notify certain classes of registered persons who shall pay to the government the tax due or part thereof as per the return on or before the last date on which he is required to furnish such return, subject to such conditions and safeguards as may be specified therein.

CGST Amendment Act 2018

28. Correction of mistake through an alternate mechanism including amendment return

Source

Clause 17(c) of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 39(9) of the CGST Act 2017

Provision before amendment

Sec 39(9) – Subject to the provisions of sections 37 and 38, if any registered person after furnishing a return under sub-section (1) or sub-section (2) or sub-section (3) or sub-section (4) or sub-section (5) discovers any omission or incorrect particulars therein, other than as a result of scrutiny, audit, inspection or enforcement activity by the tax authorities, he shall rectify such omission or incorrect particulars in the return to be furnished for the month or quarter during which such omission or incorrect particulars are noticed, subject to payment of interest under this Act:

Provided that no such rectification of any omission or incorrect particulars shall be allowed after the due date for furnishing of return for the month of September or second quarter following the end of the financial year, or the actual date of furnishing of relevant annual return, whichever is earlier.

Provision after amendment

Sec 39(9) – Subject to the provisions of sections 37 and 38, if any registered person after furnishing a return under sub-section (1) or sub-section (2) or sub-section (3) or sub-section (4) or sub-section (5) discovers any omission or incorrect particulars therein, other than as a result of scrutiny, audit, inspection or enforcement activity by the tax authorities, he shall rectify such omission or incorrect particulars in such form and manner as may be prescribed subject to payment of interest under this Act:

Provided that no such rectification of any omission or incorrect particulars shall be allowed after the due date for furnishing of return for the month of September or second quarter following the end of the financial year to which such details pertain, or the actual date of furnishing of relevant annual return, whichever is earlier.

CGST Amendment Act 2018

29. Procedure for furnishing return and availing ITC in the new return filing mechanism

Source

Clause 18 of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government

Affected Provision

Section 43A of the CGST Act, 2017

Provision after amendment

The below mentioned provision has been inserted:

(1) Notwithstanding anything contained in section 37 or section 38, the procedure for furnishing the details of outward supplies by a registered person, other than an Input Service Distributor or a non-resident taxable person or a person paying tax under the provisions of section 10 or section 51 or section 52 (hereafter in this section referred to as the ‘supplier’), and for verifying, validating, modifying or deleting such supplies by the corresponding registered person (hereafter in this section referred to as the ‘recipient’) in connection with the furnishing of return under section 39 shall be such as may be prescribed..

(2) Notwithstanding anything contained in section 41, section 42 or section 43, the procedure for availing of input tax credit by the recipient and verification thereof shall be such as may be prescribed.

(3) The procedure specified under sub-section (1) and sub-section (2) may include the following:-

(i) the procedure for furnishing the details of a tax invoice by the supplier on the common portal for the purposes of availing input tax credit by the recipient in terms of clause (a) of sub-section (2) of section16;

(ii) the amount of tax specified in an invoice for which the details have been furnished by the supplier under clause (i) but the return in respect thereof has not been furnished and tax has not been paid shall be deemed to be tax payable by him under the provisions of this Act;

(iii) the procedure and threshold, not exceeding one thousand rupees, for recovery of the amount of tax payable under clause (ii);

(iv) the procedure and circumstances where the recovery of input tax credit can be made, instead of from the supplier, from the recipient who has availed credit on an invoice for which details have been furnished by the supplier under clause (i) but tax has not been paid by the said supplier;

(v) for the purposes of clause (ii) and (iii), the supplier and the recipient shall be jointly and severally liable to pay tax or to reverse the input tax credit availed against such tax, as the case may be;

(vi) the procedure and threshold for availing input tax credit by the recipient on the basis of invoice for which details have not been furnished by the supplier under clause (i) and recovery thereof; and

(vii) the procedure, safeguards and threshold of tax amounts in the invoices, the details of which can be furnished under clause (i) by a newly registered person or by a registered person who has defaulted in payment of tax liability, exceeding the amount of tax or the period of time specified in the rules.

-

CGST Amendment Act 2018

30. Expanding the working area of GST Practitioner

- Source Clause 19 of the CGST Amendment Act, 2018.Effective Date

Date to be notified by the government.

Affected Provision

Section 48(2) of the CGST Act, 2017

Amendment

A registered person may authorise an approved goods and services tax practitioner to furnish the details of outward supplies under section 37, the details of inward supplies under section 38 and the return under section 39 or section 44 or section 45, and to perform such other functions and in such manner as may be prescribed

-

CGST Amendment Act 2018

31. Utilization of IGST first against payment of any tax

-

Source

Clause 20(b) of the CGST Amendment Act, 2018

Clause 21 of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 49(5) clause (c) and (d) of the CGST Act, 2017

Section 49A and 49B of the CGST Act, 2017

Amendment

The provision marked in green has been inserted :

49 (5) The amount of input tax credit available in the electronic credit ledger of the registered person on account of ––

(a) integrated tax shall first be utilised towards payment of integrated tax and the amount remaining, if any, may be utilised towards the payment of central tax and State tax, or as the case may be, Union territory tax, in that order;

(b) the central tax shall first be utilised towards payment of central tax and the amount remaining, if any, may be utilised towards the payment of integrated tax;

(c) the State tax shall first be utilised towards payment of State tax and the amount remaining, if any, may be utilised towards payment of integrated tax

Provided that the input tax credit on account of state tax shall be utilized towards payment of integrated tax only where the balance of the input tax credit on account of central tax is not available for payment of integrated tax;

(d) the Union territory tax shall first be utilised towards payment of Union territory tax and the amount remaining, if any, may be utilised towards payment of integrated tax

Provided that the input tax credit on account of Union territory tax shall be utilized towards payment of integrated tax only when the balance of the input tax credit on account of central tax is not available for payment of integrated tax;

(e) the central tax shall not be utilised towards payment of State tax or Union territory tax; and

(f) the State tax or Union territory tax shall not be utilised towards payment of central tax.

Provided that input tax credit on account of central tax, State tax or Union territory tax shall be utilised towards payment of integrated tax under clause (b), clause (c) or clause (d) only after the input tax credit available on account of integrated tax has been first utilised fully towards such payment.

Section 49A. Notwithstanding anything contained in section 49, the input tax credit on account of central tax, State tax or Union territory tax shall be utilised towards payment of integrated tax, central tax, State tax or Union territory tax, as the case may be, only after the input tax credit available on account of integrated tax has first been utilised fully towards such payment.

Section 49B. Notwithstanding anything contained in this Chapter and subject to the provisions of clause (e) and clause (f) of sub-section (5) of section 49, the Government may, on the recommendations of the Council, prescribe the order and manner of utilisation of the input tax credit on account of integrated tax, central tax, State tax or Union territory tax, as the case may be, towards payment of any such tax.”.

-

CGST Amendment Act 2018

-

32. Concept of matching extended to GSTR 3B for e-com transactions (not just GSTR 1)

- Source Clause 22 of the CGST Amendment Act, 2018Effective Date

Date to be notified by the government.

Affected Provision

Section 52(9) of the CGST Act, 2018.

Amendment

The portion marked in green has been inserted :

52(9). Where the details of outward supplies furnished by the operator under sub-section (4) do not match with the corresponding details furnished by the supplier under section 37 or section 39, the discrepancy shall be communicated to both persons in such manner and within such time as may be prescribed.

-

CGST Amendment Act 2018

33. Modification of relevant date in case of refund of unutilised credit

- Source Clause 23(b)(ii) of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 54(2) Explanation 2 clause (e) , of the CGST Act, 2017

Provision before amendment

Explanation.-For the purposes of this section,-

(2) “relevant date” means-

(e) in the case of refund of unutilised input tax credit under of sub-section (3), the end of the financial year in which such claim for refund arises;

Provision after amendment

Explanation.-For the purposes of this section,-

(2) “relevant date” means-

(e) in the case of refund of unutilised input tax credit under clause (ii) of sub-section (3), the due date for furnishing of return under section 39 for the period in which such claim for refund arises;

-

CGST Amendment Act 2018

34. Unjust enrichment applicable in case of refund on supplies to SEZ developer/unit

- Source Clause 23(a) of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government

Affected Provision

Section 54(8) clause (a) of the CGST Act, 2017

Provision before amendment

54(8) refund of tax paid on zero rated supplies of goods or services or both or on inputs or input services used in making such zero-rated supplies exports;

Provision after amendment

54(8) refund of tax paid on export of goods or services or both or on inputs or input services used in making such exports;

Amendment

The portion marked in red has been substituted by the portion marked in green.

-

CGST Amendment Act 2018

35. Relevant date for Export of services to include cases where payment received in INR if permitted by RBI

- Source Clause 23(b)(i) of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Explanation 2(c)(i) to Section 54 of the CGST Act 2017

Amendment

The portion marked in green has been inserted :

Explanation.-For the purposes of this section,-

(2) “relevant date” means-

(c) in the case of services exported out of India where a refund of tax paid is available in respect of services themselves or, as the case may be, the inputs or input services used in such services, the date of––

(i) receipt of payment in convertible foreign exchange or in Indian Rupees where permitted by the Reserve Bank of India, where the supply of services had been completed prior to the receipt of such payment; or

(ii) issue of invoice, where payment for the services had been received in advance prior to the date of issue of the invoice;

-

CGST Amendment Act 2018

36. Person to include distinct person for recovery and definition of collector specified

-

Source

Clause 24 of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 79 (4) of the CGST Act, 2017

Amendment

The explanation marked in green has been inserted after this section :

(1) For the purposes of this section, the word person shall include “distinct persons” as referred to in sub-section (4) or, as the case may be, sub-section (5) of section 25.

(2) For the purposes of this clause, the term “Collector” means the Collector of a revenue district and includes a Deputy Commissioner or a district magistrate or head of the revenue administration in a revenue district.

-

CGST Amendment Act 2018

37. Ceiling limit for pre deposit for filing appeal before Appellate Authority.

- Source Clause 25 of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 107(6) of the CGST Act 2017

Amendment

The portion marked in green has been inserted:

No appeal shall be filed under sub-section (1), unless the appellant has paid—

(a) in full, such part of the amount of tax, interest, fine, fee and penalty arising from the impugned order, as is admitted by him; and.

(b) a sum equal to ten per cent. of the remaining amount of tax in dispute arising from the said order, subject to a maximum of twenty-five crore rupees, in relation to which the appeal has been filed.

-

CGST Amendment Act 2018

38. Ceiling limit for filing appeal before Appellate Tribunal

- Source Clause 26 of the CGST Amendment Act, 2018

Effective Date

Date to be notified by the government.

Affected Provision

Section 112(8) of the CGST Act, 2017

Amendment

The portion marked in green has been newly inserted:

No appeal shall be filed under sub-section (1), unless the appellant has paid––

(a) in full, such part of the amount of tax, interest, fine, fee and penalty arising from the impugned order, as is admitted by him; and

(b) a sum equal to twenty per cent. of the remaining amount of tax in dispute, in addition to the amount paid under sub-section (6) of section 107, arising from the said order, subject to a maximum of fifty crore rupees, in relation to which the appeal has been filed.

-

CGST Amendment Act 2018

39. Time limit for payment of tax or penalty for goods detained or seized increased to 14 days

- Source Clause 27 of the CGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 129(6) of the CGST Act, 2018.

Provision before Amendment

129(6): Where the person transporting any goods or the owner of the goods fails to pay the amount of tax and penalty as provided in sub-section (1) within seven days of such detention or seizure, further proceedings shall be initiated in accordance with the provisions of section 130:

Provided that where the detained or seized goods are perishable or hazardous in nature or are likely to depreciate in value with passage of time, the said period of seven days may be reduced by the proper officer.

Provision after Amendment

129(6): Where the person transporting any goods or the owner of the goods fails to pay the amount of tax and penalty as provided in sub-section (1) within fourteen days of such detention or seizure, further proceedings shall be initiated in accordance with the provisions of section 130:

Provided that where the detained or seized goods are perishable or hazardous in nature or are likely to depreciate in value with passage of time, the said period of fourteen days may be reduced by the proper officer.

Amendment

The portion marked in red has been substituted by the portion marked in green.

-

CGST Amendment Act 2018

40. Retrospective amendment in the transitional credits allowed

- Source Clause 28 of the CGST Amendment Act, 2018

Effective Date

1st July 2017

Affected Provision

Section 140(1) of the CGST Act, 2017

Explanation 1 (iii) and (iv) of the CGST Act, 2018.

Explanation 2 clause (iii) and (iv) of the CGST Act, 2018.

Amendment

Sec 140(1) – A registered person, other than a person opting to pay tax under section 10, shall be entitled to take, in his electronic credit ledger, the amount of CENVAT credit of eligible duties carried forward in the return relating to the period ending with the day immediately preceding the appointed day, furnished by him under the existing law in such manner as may be prescribed:

Explanation 1 :

Clause (iii) – the additional duty leviable under sub-section (1) and (5) of section 3 of the Customs Tariff Act, 1975;

Clause (iv) – the additional duty of excise leviable under section 3 of the Additional Duties of Excise (Textile and Textile Articles) Act, 1978;

Explanation 2 :

Clause (iii) – the additional duty leviable under sub-section (1) and (5) of section 3 of the Customs Tariff Act, 1975;

Clause (iv) – the additional duty of excise leviable under section 3 of the Additional Duties of Excise (Textile and Textile Articles) Act, 1978;

Explanation 3 – For removal of doubts, it is hereby clarified that the expression “eligible duties and taxes” excludes any cess which has not been specified in Explanation 1 or Explanation 2 and any cess which is collected as additional duty of customs under sub- section (1) of section 3 of the Customs Tariff Act, 1975.

-

CGST Amendment Act 2018

41. Time limit for receipt of goods sent on job-work basis extended

- Source Clause 29 of the CGST Amendment Act, 2018

Effective Date

Date to be notified by the government.

Affected Provision

Section 143(1) of the CGST Act, 2017

Amendment

Proviso marked in green above has been inserted:

Provided that the period of one year or three years, as the case may be, may, on sufficient cause being shown, be extended by the Commissioner for a further period not exceeding one year and two years respectively

-

CGST Amendment Act 2018

42. Retrospective insertion of the term ‘Transactions’ in the heading of Schedule II

-

Source

Clause 31 of the CGST Amendment Act, 2018.

Effective Date

1st July 2017.

- Affected ProvisionSchedule II of the CGST Act, 2017.

Amendment

The portion marked in green has been inserted retrospectively:

ACTIVITIES OR TRANSACTIONS TO BE TREATED AS SUPPLY OF GOODS OR SUPPLY OF SERVICES

-

CGST Amendment Act 2018

43. Definition of export of services to allow receipt in INR if permitted by RBI

-

Source

Clause 2(i) of the IGST Amendment Act, 2018

Effective Date

Date to be notified by the government.

Affected Provision

Section 2 (6) clause (iv) of the IGST Act, 2017

Amendment

Portion marked in green above has been inserted

“export of services” means the supply of any service when, ––

(i) the supplier of service is located in India;

(ii) the recipient of service is located outside India;

(iii) the place of supply of service is outside India;

(iv) the payment for such service has been received by the supplier of service in convertible foreign exchange or in Indian Rupees where permitted by the Reserve Bank of India; and

(v) the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8;.

-

CGST Amendment Act 2018

44. Modification in the definition of Governmental Authority

- Source Clause 2(ii) of the IGST Amendment Act, 2018

Effective Date

Date to be notified by the government.

Affected Provision

Explanation of Section 2(16) of the IGST Act, 2017

Amendment

‘governmental authority’ means “an authority or a board or any other body, –

- set up by an Act of Parliament or a State Legislature; or

- established by any Government, with ninety per cent. or more participation by way of equity or control, to carry out any function entrusted to a Panchayat under article 243G or to a municipality under article 243W of the Constitution”.

-

CGST Amendment Act 2018

45. Restrictive applicability of Section 5(4)

-

-

Source

Clause 3 of the IGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 5(4) of the IGST Act, 2017

Provision before amendment

5(4) The integrated tax in respect of the supply of taxable goods or services or both by

a supplier, who is not registered, to a registered person shall be paid by such person on reverse charge basis as the recipient and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

Provision after amendment

5(4) The Government may, on the recommendations of the Council, by notification, specify a class of registered persons who shall, in respect of supply of specified categories of goods or services or both received from an unregistered supplier, pay the tax on reverse charge basis as the recipient of such supply of goods or services or both, and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to such supply of goods or services or both.

Amendment

The provision marked in red has been substituted by the provisions marked in green

-

CGST Amendment Act 2018

-

46. Omission of term business vertical in the deeming fiction for distinct persons

-

- Source Clause 4 of the IGST Amendment Act, 2018.Effective Date

Date to be notified by the government.

Affected Provision

Section 8(2) – Explanation 1(iii) of the IGST Act, 2017

Amendment

The portion marked in read has been omitted:

Explanation 1(iii) an establishment in a State or Union territory and any other establishment being a business vertical registered within that State or Union territory,

- Source Clause 4 of the IGST Amendment Act, 2018.Effective Date

47. Place of supply in case of goods transported outside India where the supplier and recipient are in India

-

-

Source

Clause 5 of the IGST Amendment Act, 2018

Effective Date

Date to be notified by the government.

Affected Provision

Section 12(8) of the CGST Act 2017

Amendment

12 (8) The place of supply of services by way of transportation of goods, including by mail or courier to,––

(a) a registered person, shall be the location of such person;

(b) a person other than a registered person, shall be the location at which such goods are handed over for their transportation:.

Provided that if the transportation of goods is to a place outside India, the place of supply shall be the place of destination of such goods.

-

CGST Amendment Act 2018

-

48. Place of supply outside India where goods temporarily imported into India & then exported without being put to use after any treatment or process carried out on it

-

- Source Clause 6 of the IGST Amendment Act, 2018

Effective Date

Date to be notified by the government.

Affected Provision

Section 13(3) clause (a) of the IGST Act, 2017

Provision before amendment

13(3) The place of supply of the following services shall be the location where the services are actually performed, namely:—

(a) services supplied in respect of goods which are required to be made physically available by the recipient of services to the supplier of services, or to a person acting on behalf of the supplier of services in order to provide the services:

Provided that when such services are provided from a remote location by way of electronic means, the place of supply shall be the location where goods are situated at the time of supply of services:

Provided further that nothing contained in this clause shall apply in the case of services supplied in respect of goods which are temporarily imported into India for repairs and are exported after repairs without being put to any other use in India, than that which is required for such repairs;

Provision after amendment

13(3) The place of supply of the following services shall be the location where the services are actually performed, namely:—

(a) services supplied in respect of goods which are required to be made physically available by the recipient of services to the supplier of services, or to a person acting on behalf of the supplier of services in order to provide the services:

Provided that when such services are provided from a remote location by way of electronic means, the place of supply shall be the location where goods are situated at the time of supply of services:

Provided further that nothing contained in this clause shall apply in the case of services supplied in respect of goods which are temporarily imported into India for repairs or for any other treatment or process and are exported after repairs or such treatment or process without being put to any other use in India, than that which is required for such repairs;

Amendment

The portion marked in green has been newly inserted

- Source Clause 6 of the IGST Amendment Act, 2018

49. Apportionment of IGST

-

- Source Clause 7 of the IGST Amendment Act, 2018

Effective Date

Date to be notified by the government.

Affected Provision

Section 17(2A) of the IGST Act, 2017

Amendment

New proviso has been inserted after Section 17(2)

17(2A). The amount not apportioned under sub-section (1) and sub-section (2) may, for the time being, on the recommendations of the Council, be apportioned at the rate of fifty per cent. to the Central Government and fifty per cent. to the State Governments or the Union territories, as the case may be, on ad hoc basis and shall be adjusted against the amount apportioned under the said sub-sections

- Source Clause 7 of the IGST Amendment Act, 2018

50. Ceiling limit introduced for filing appeal before Appellate Authority and Appellate Tribunal.

-

- Source Clause 8 of the IGST Amendment Act, 2018.

Effective Date

Date to be notified by the government.

Affected Provision

Section 20 of the IGST Act, 2018.

Amendment

A new proviso has been inserted in Section 20:

Provided also that where the appeal is to be filed before the Appellate Authority or the Appellate Tribunal, the maximum amount payable shall be fifty crore rupees and one hundred crore rupees respectively.

- Source Clause 8 of the IGST Amendment Act, 2018.

51. Modification in the name of CBEC to CBIT

-

- Source Clause 2 of the CGST (Compensation to States) Amendment Act, 2018

Effective Date

Date to be notified by the government.

Affected Provision

Section 7(4) (b) (ii) of the GST (Compensation to States) Act

Provision before Amendment

7(4)(b)(ii) the integrated goods and services tax apportioned to that State, as certified by the Principal Chief Controller of Accounts of the Central Board of Excise and Customs; and

Provision after Amendment

7(4)(b)(ii) the integrated goods and services tax apportioned to that State, as certified by the Principal Chief Controller of Accounts of the Central Board of Indirect Taxes and Customs; and

- Source Clause 2 of the CGST (Compensation to States) Amendment Act, 2018

52. Distribution of Unutilised Cess in the fund

-

- Source Clause 3 of the CGST (Compensation to States) Amendment Act, 2018

Effective Date

Date to be notified by the government.

Affected Provision

Section 10(3) of the GST (Compensation to States) Act

Amendment

New proviso has been inserted after Section 10(3):

10(3A)(Notwithstanding anything contained in sub-section (3), fifty per cent of such amount, as may be recommended by the Council, which remains unutilised in the Fund, at any point of time in any financial year during the transition period shall be transferred to the Consolidated Fund of India as the share of Centre, and the balance fifty per cent. shall be distributed amongst the States in the ratio of their base year revenue determined in accordance with the provisions of section 5:

Provided that in case of shortfall in the amount collected in the Fund against the requirement of compensation to be released under section 7 for any two months’ period, fifty per cent. of the same, but not exceeding the total amount transferred to

the Centre and the States as recommended by the Council, shall be recovered from the Centre and the balance fifty per cent. from the States in the ratio of their base year

revenue determined in accordance with the provisions of section 5.”.

- Source Clause 3 of the CGST (Compensation to States) Amendment Act, 2018

53. Manner and order of utilisation of UTGST credit

-

- SourceClause 4 of the UTGST Amendment Act, 2018

Effective Date

Date to be notified by the government.

Affected Provision

Section 9A and 9B of the UTGST Act, 2017.

- SourceClause 4 of the UTGST Amendment Act, 2018

Amendment

9A. Notwithstanding anything contained in section 9, the input tax credit on account of Union territory tax shall be utilised towards payment of integrated tax or Union territory tax, as the case may be, only after the input tax credit available on account of integrated tax has first been utilised towards such payment.

9B. Notwithstanding anything contained in this Chapter and subject to the provisions of clause (c) of section 9, the Government may, on the recommendations of the Council, prescribe the order and manner of utilisation of the input tax credit on account of integrated tax, Central tax, State tax or Union territory tax, as the case may be, towards payment of any such tax.

If you already have a premium membership, Sign In.

Shubham Khaitan

Shubham Khaitan

Kolkata, India