Order Now $14,550 (2)

-

4 Logo Drafts, Icon based, modern

312 Sold

-

30 Minutes Call with me

12 Sold

-

Monthly Fee

21 Sold

-

1 year shared hosting

ConsultEase.com Interviewed.

Read Interview-

CA Nikhil M Jhanwar wrote a new post, Key Highlights of 50th GST Council Meeting 1 year, 10 months ago

GTAs can exercise GST under forward charge for a financial year without filing declarations for future years unless they revert to RCM. Such declaration is to be exercised till 31st March of the preceding […]

-

CA Nikhil M Jhanwar wrote a new post, GST Insights – Relief Measures- COVID-19 2.0 4 years ago

In view of the challenges faced by taxpayers in meeting the statutory and regulatory compliances due to the outbreak of the second wave of COVID-19 pandemic, the Government has issued various notifications […]

-

CA Nikhil M Jhanwar wrote a new post, Amended Section 16(4) to de-link ITC on Debit Note with Invoice fails to get stamping of Gujarat AAR 4 years, 1 month ago

The input tax credit is a beneficial piece of legislation but subject to various conditions and limitations prescribed under Section 16 and 17 of CGST Act, 2017. One of the conditions contained in Section […]

-

CA Nikhil M Jhanwar wrote a new post, GST Insights- Compliances before 31st March 21 and Changes w.e.f. 1st April 2021 4 years, 2 months ago

I. Compliances before 31st March 2021

A. File GSTR 9 & 9C for F.Y. 2019-20

The due date file GSTR-9 (for taxpayers having aggregate turnover of more than 2 crs.) and GSTR-9C (for taxpayers having aggregate […]

-

CA Nikhil M Jhanwar wrote a new post, Decoding Indirect tax proposals of Budget 2021 4 years, 3 months ago

Decoding Indirect tax proposals of Budget 2021

Clarifying the applicability of GST on Societies/Clubs/Associations

W.r.e.f. 1st July 2017 post-enactment of Finance Bill, 2021Section

Proposed […]

-

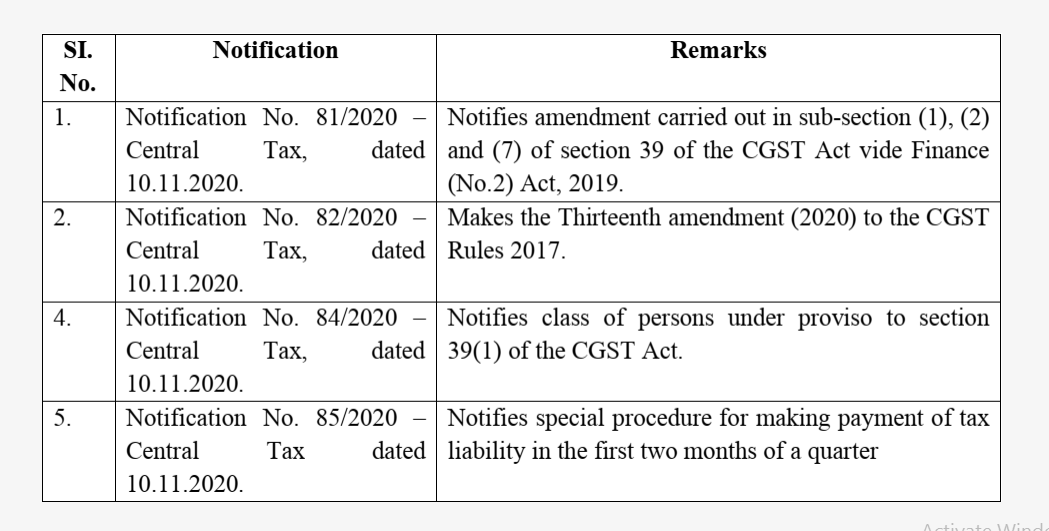

CA Nikhil M Jhanwar wrote a new post, Gist of Quarterly Return Monthly Payment Scheme 4 years, 4 months ago

The gist of Quarterly Return Monthly Payment Scheme

Change in GST Returns Filing System w.e.f. 1st January 2021Existing System

New System from Jan 2021Monthly filing of GSTR-3B for all […]

-

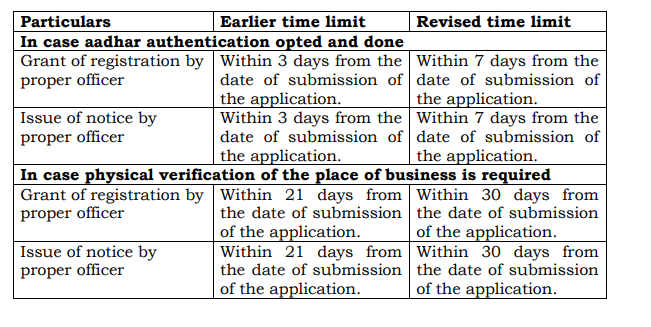

CA Nikhil M Jhanwar wrote a new post, GST Insights – New Year Amendments 4 years, 4 months ago

GST Insights – New Year Amendments

The Central Government has made critical amendments to CGST Rules, 2017 vide Notification No. 94/2020–Central Tax dated 22.12.2020 to make provisions more stringent and harsh f […]

-

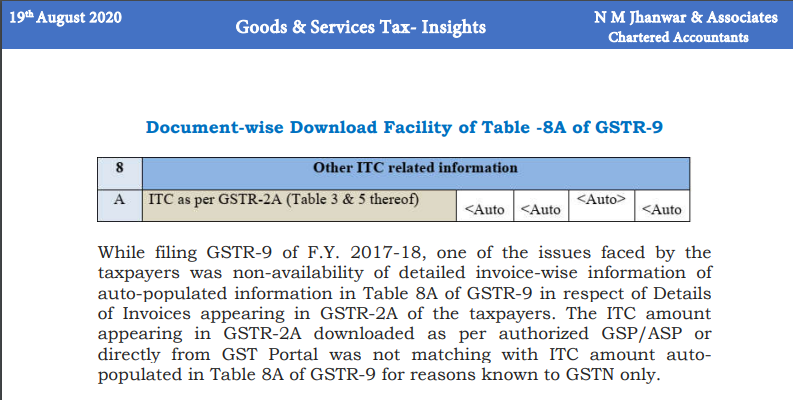

CA Nikhil M Jhanwar wrote a new post, Document-wise Download Facility of Table-8A of GSTR-9 4 years, 9 months ago

Document-wise Download Facility of Table-8A of GSTR-9

8

Other ITC related InformationA

ITC as per GSTR-2A (Table 3 & 5 thereof)

-

CA Nikhil M Jhanwar wrote a new post, GST Insights Judicial Pronouncements 4 years, 12 months ago

GST Insights Judicial Pronouncements

The validity of the Order of Prohibition passed by DC

Best Judgement assessment

The ex-parte assessment order passed during the lockdown period

GST on Whol […]

-

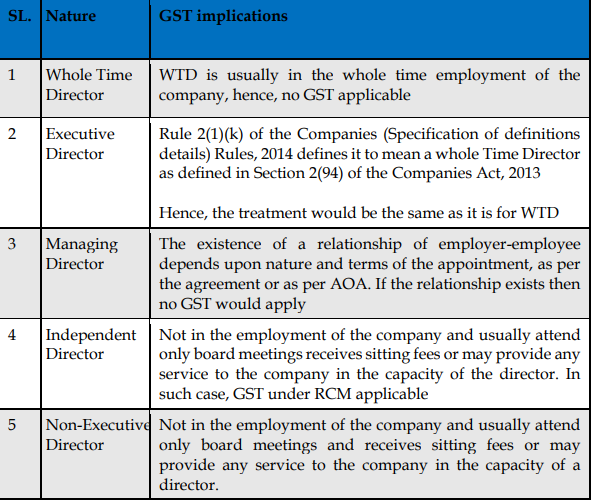

CA Nikhil M Jhanwar wrote a new post, GST on Director’s Remuneration- Whether payable? 5 years, 1 month ago

A. Decoding the Advance ruling on director’s remuneration

Imagine you are the whole-time director of your company and drawing remuneration in the form of salary, allowances, and perquisites on a monthly basis. N […]

-

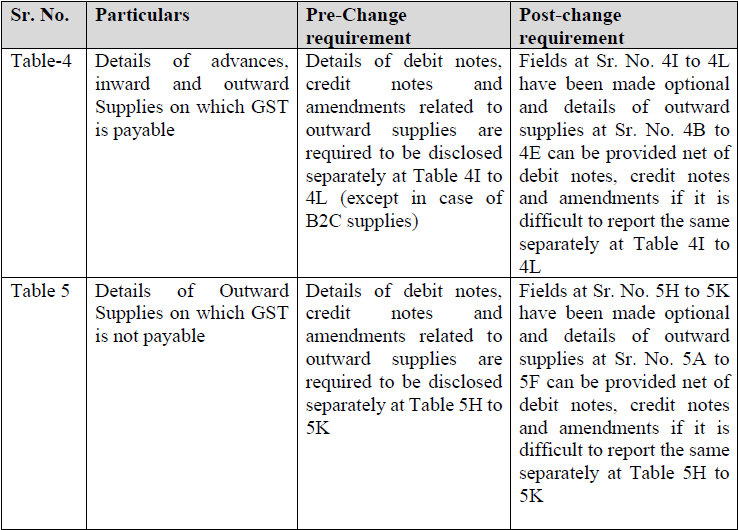

CA Nikhil M Jhanwar wrote a new post, Note on Recent changes in GSTR-9 & 9C 5 years, 6 months ago

In its 4th and probably final round of extension and modification exercise in filing GSTR-9 and 9C, the Government has issued following yesterday:

1. Notification No. 56/2019-CGST dated 14th November 2019 […]

CA Nikhil M Jhanwar

Paid User

@ca-nikhil-m-jhanwar

active 1 year, 4 months ago