GST on Director’s Remuneration- Whether payable?

Table of Contents

A. Decoding the Advance ruling on director’s remuneration

Imagine you are the whole-time director of your company and drawing remuneration in the form of salary, allowances, and perquisites on a monthly basis. Now, if the GST Department audits books of accounts of your company and asks you to pay GST under the reverse charge mechanism (RCM) on the salary you are drawing from your company. Will you follow this proposition of the Department? That’s what has been promulgated in the recent advance ruling by Rajasthan AAR in the case of M/s Clay Craft India Pvt. Ltd. leaving question again open for a debate on GST applicability on the employment contracts of the directors. Let’s first decode this advance ruling

The brief facts of the case were the following:

- The applicant is a private limited company incorporated under the Companies Act, 1956

- The Board of Directors comprised of 6 directors and all are whole-time directors of the company and have been assigned different business functions under the company.

- The directors are being compensated by the company by way of a regular salary and other allowances as per the company policy and as per their employment contract

- The company is deducting TDS on their salary and PF laws are also applicable to their services

- Salary is paid to their Directors is being booked under “Income from Salary” by the Directors in their Income Tax returns

- The applicant sought for advance ruling due to the doubt created by another advance ruling on similar lines in the case of M/s. Alcon Consulting Engineers (India) Pvt. Ltd.

The question which was raised in AAR was whether GST is payable under the Reverse Charge Mechanism (RCM) on the salary paid to the director of the company who is paid a salary as per contract.

The Hon’ble AAR ruled that GST is applicable to the director’s remuneration under RCM merely based on the reasoning that the director is not an employee of the company and hence, it does not fall under Entry No. 1 of Schedule III of CGST Act, 2017. No attempt was made to evaluate the existence of the employer-employee relationship which was a critical aspect to determine the correct taxability on the director’s remuneration. Further, AAR in its Para 5.10 opines that a distinct identity has been created for directors’ services by way of Notification No. 13/2017-CGST(Rate) 2017 dated 28.06.2017. However, the Hon’ble AAR failed to appreciate that a transaction has to first pass the test of ‘supply’ under Section 7 of the CGST Act, 2017 before applying the RCM Notification. The Notification cannot bypass the legal provisions of the Law. Rather Section 9(3) applies only in respect of those categories of transactions that are ‘supply’ in the first place.

Time and again we have been receiving AARs with pro-revenue perception. Legally, the AARs are binding only on the applicant and do not have any persuasive value but it firmly provides us the insight of the way revenue comprehends the law. Secondly, it creates a conundrum for the taxpayers like the applicant in this AAR who sought AAR after taking a clue from similar AAR on the issue. Being a quasi-judicial authority, the AARs should be passed after an unbiased and critical examination of facts and legal position as it has a rippling effect across the trade and industry looking to the issue involved which has a bearing on all companies.

B. Examining the relevant provisions of the GST and Companies Act

Let’s now legally examine the GST applicability on the director’s remuneration paid to the directors by the companies. To determine the taxability the moot question before us is whether the transaction between director and company falls under Entry No. 1 of Schedule III (transactions which are treated as neither supply of goods nor services as per Section 7(2)(a) of CGST Act, 2017) which reads as under:

Services by an employee to the employer in the course of or in relation to his employment

If the answer is yes, then No GST would be payable as it will be out of the purview of the scope of ‘supply’ itself and there would be no need to even apply of Section 9(3)/5(3) of GST laws as it applies only transactions which are ‘supplies of goods or services or both’.

If the answer is No, then GST under RCM would apply subject to the presence of other elements of ‘supply’ and the company or body corporate will pay the GST if the transaction falls under Sr. No 6 of the Notification 13/2017-Central Tax (Rate), dated 28- 6-2017 which read as under:

6. Services supplied by a director of a company or a body corporate to the said company or the body corporate.

The issue of taxability of the director’s remuneration is not nascent and has its roots falling in the erstwhile service tax regime as well wherein departments consistently took views that directors being ‘malik’ of the company cannot be an employee of the company. To understand the scope of ‘director’ and ‘remuneration’ we should resort to relevant provisions of the Companies Act, 2013.

As per Section Sec.2(34) “Director” means a director appointed to the Board of a company.

As per Section 2(54) “Managing Director” means a director who, by virtue of the articles of a company or an agreement with the company or a resolution passed in its general meeting, or by its Board of Directors, is entrusted with substantial powers of management of the affairs of the company and includes a director occupying the position of the managing director, by whatever name called.

As per Section 2(94) “whole-time director” includes a Director in the whole-time employment of the company;”

As per Rule 2(1)(k) of the Companies (Specification of definitions details) Rules, 2014, “Executive Director” means a whole-time director as defined in clause (94) of section 2 of the Act.

As per Section 2(78), ‘remuneration’ means any money or its equivalent given or passed to any person for services rendered by him and includes perquisites as defined under the Income-tax Act

Under the Companies Act, a General Circular No. 24/2012 dated 09.08.2012 issued by Ministry of Corporate Affairs (MCA) clarifies that “The Non-Whole Time Directors of the company are presently not covered under the exempted list and as such, the sitting fees/commission payable to them is liable to Service Tax. Service tax is payable on the commission/sitting fees payable to Non-Whole Time Directors of the company.”

A perusal of the above provisions reveals that the director whether the whole-time director or managing director can also be an employee of the company. Further, the remuneration is wide enough to cover any monetary, non-monetary, fixed or variable component. The directors are appointed to the Board of Directors of the Company and are also accountable for their actions and performance to the Board. That is, the Board has supervisory control over the functions being performed by the Directors.

C. Establishing an employer-employee relationship

Coming to the scope of terms ‘employee’, the term has not been defined in GST as well as corporate law. As per the Cambridge Dictionary, an employee is: “someone who is paid to work for someone else”

As per Section 2(f) of Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 ‘employee’ is defined to mean ‘Any person who is employed for wages in any kind of work, manual or otherwise, in or in connection with the work of an establishment, and who gets his wages directly or indirectly from the employer, and includes ……..

The existence of the relationship between employer and employee is an essential ingredient to fall under clause (1) of the Schedule III of the CGST Act, 2017. In the case of Ram Prashad vs Commissioner of Income-Tax, 1972 (8) TMI 61 – SUPREME COURT, the Hon’ble SC has observed that there is no doubt that for ascertaining whether a person is a servant or an agent, a rough and ready test is, whether, under the terms of his employment, the employer exercises a supervisory control in respect of the work entrusted to him. Further, the nature of employment of managing director may be determined by the articles of association of a company and/or the agreement, if any, under which a contractual relationship between the director and the company has been brought about, whereunder the director is constituted an employee of the company, if such be the case, his remuneration will be assessable as salary under section 7. The similar view was taken in Regional Director, E.S.I. .. vs Sarathi Lines (P) Ltd. on 29 January 1997 (1998) ILLJ 28 Ker the Hon’ble High Court of Karnataka

The issue also came up in the service tax regime before Tribunals and in the case of M/s Allied Blenders And Distillers Pvt. Ltd. V/s Commissioner of CST, Aurangabad, 2019 (1) TMI 433 – CESTAT Mumbai it was held that it is the agreement between the employer i.e. company and the Director would reveal the exact relationship between them

In the case of M/s Rent Works India Pvt. Ltd. V/s CCE, Mumbai-V 2016 (5) TMI 786 – CESTAT Mumbai, the Hon’ble Tribunal opined that the same department of Government of India cannot take a different stand on the amount paid to the very same person and treat it differently

Hence, in the above judgments and following catena of other judgments, the Tribunals have paid emphasis on the existence of employer and employee relationship while deciding the taxability on the director’s remuneration:

- NRB Industrial Bearings Pvt. Ltd V/s CCE & ST, Aurangabad- 2019 (8) TMI 600 – CESTAT Mumbai

- M/S. Brahm Alloy Limited V/s Commissioner Of CGST & Central Excise, Durgapur, 2019 (4) TMI 1537 – CESTAT Kolkata

- M/S. Maithan Alloys Ltd. V/s CCE & ST, Bolpur 2019 (4) TMI 1595 – CESTAT Kolkata

Given the above legal and judicial position, the presence of the following factors would entail the existence of employer and employee relationship

- There is an employment contract entered into between Director and the company clearly defining roles and responsibilities, terms of the appointment, terms of the remuneration, terms of the termination, the person to whom director would report

- The Director is paid a salary on a monthly basis. The component of salary can be in monetary as well in non-monetary, can be fixed as well variable pay

- Supervisory aspect is important i.e. MD/WTD is accountable for his performance and will be under the supervisory control of another person i.e. Board of Directors of the Company

- Treatment under Income-tax Act- if treated as Salary, TDS deduction u/s 92 and Form 16 issued and in ITR of Directors, disclosed as Salary Income

- Treatment under other laws like Provident fund, Professional Tax, ESIC etc.- whether declared as an employee or not

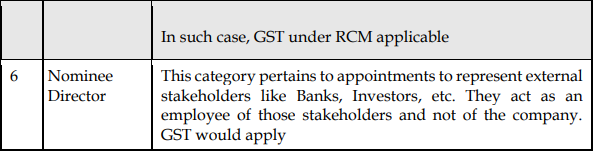

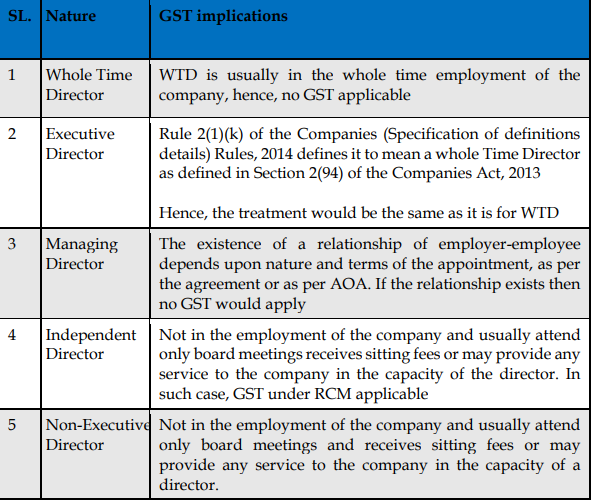

D. Summarizing GST implications on director’s services

Applying the above factors to different categories of directors, the GST implications on amounts paid to the directors can be summarized as below:

Download the copy:

It may be noted that above GST implications pertain to services provided by the Director in the capacity of a director or employee and not as an independent service provider like leasing of office space. In this case, the director as an independent service provider is liable to pay GST under forward charge and not the company.

Before parting…

It is not rocket science to conclude that both AARs did not consider all the relevant aspects of the case and legal position before arriving at the rulings and it is highly likely the current AAR would be contested before the Appellate level. Nevertheless, as audits and assessment would resume after temporary halt due to COVID-19, all businesses should be well prepared to face this issue during, keep the relevant employment contracts and supportings in place and revisit the current structure of directors and its GST implications until the Government comes out with a suitable clarification in this regard.

Disclaimer:

The information in this document is for educational purposes only and nothing conveyed or provided should be considered as legal, accounting or tax advice.

CA Nikhil M Jhanwar

CA Nikhil M Jhanwar

Nikhil M Jhanwar is a practicing Chartered Accountant based in North India having a vast experience of 8 years in taxation advisory/compliances, litigation support, drafting replies to Show Cause Notices, and representing clients before the Department in Indian GST and UAE VAT. He has closely worked on GST implementation in India and UAE VAT implementation in particular impact analysis, regulatory support, implementation support, I.T. support, tax advisory, and compliances. Being a Faculty Member of GST by ICAI, he regularly speaks at forums and seminars on various topics of GST. He is a keen writer and his articles have been published in prominent tax journals and websites.