Facing Block Credit Under GST Rule 86A & Notices for GSTR 2A & 3B Mismatch

Introduction-

Taxpayers throughout the country are receiving multiple notices which pertain to blocking of input tax credit invoking rule 86(A) of the CGST rules 2017. In many instances notices are also not received by the taxpayers and the fact only comes to notice when one goes to file the return and it is seen that the input tax credits are blocked. Across multiple High courts, this Rule 86(A) and these notices are being contested. The current article will discuss relating to the legal backdrop of rule 86(A) and if a notice is received under rule 86(A), what are the arguments that can be provided in support against such notices and blocked input tax credits as discussed here. Moreover, the defence mechanism in case of a notice for a difference between GSTR-2A and GSTR-3B are also discussed.

GUJ HC: M/s MILI ENTERPRISE Vs UNION OF INDIA

The Hon’ble Gujarat High Court had previously in December 2020, put forward their concerns regarding the vide ambit of Rule 86A. The High Court again in the matter of M/s MILI ENTERPRISE vs UNION OF INDIA issued notices to the Government observing that the department should at least provide the reason for blocking the input tax credit and it should be specified in a notice under rule 86(A). Moreover, the rule itself has a provision stating that the department should have a reason to believe that there is an input tax credit that was availed fraudulently or there is an ineligible input tax credit that has been availed by the taxpayer before taking the step of blocking of an input tax credit. The Hon’ble High Court held that even if the powers are exercised under Rule 86(A) of the CGST Rules, 2017, then also the concerned authority is required to give reasons for blocking the credits in the credit ledger of the petitioner and thereby issue notice.

KAR HC- M/s ARYAN TRADE LINK Vs THE UNION OF INDIA

The Hon’ble High Court of Karnataka in the matter M/s ARYAN TRADE LINK vs THE UNION OF INDIA has quashed a notice and blocking of input tax credit under rule 86A whereby the credit was blocked for more than one year. Rule 86A does not empower the department to block the credit for more than one year and they are bound to unblock it even if the assessment has not taken place or got completed within one year.

CHG: M/s BHARAT ALUMINIUM COMPANY LIMITED Vs UNION OF INDIA AND OTHERS

M/S BHARAT ALUMINIUM COMPANY LIMITED contested blocking of input tax credit due to the mismatch of GSTR 2A and GSTR 3B. It has also been seen that the honourable Madras High Court in the matter of DY BEATHEL ENTERPRISES had directed that the department cannot approach the recipient directly and ask them to reverse the input tax credit. The credit availed in case of GSTR 2A and GSTR 3B match can be reversed only in exceptional circumstances like when the supplier is missing, the supplier has closed down his business or the supplier is found to be non-existent or bankrupt. An extensive video on the same topic is present in our u-tube channel whereby the discussion on the above matter was done critically. The press release of the 27th GST Council Meeting dated 4th May 2018 also proposes the same. Hence, directly the department cannot come to the bona fide recipient to reverse the input tax credit. Notice has been issued by the Honourable High Court of Chhattisgarh in the matter.

Related Topic:

Rule 86A challenged in Gujarat High court

CAL- MRS REALTY PRIVATE LTD & ANR. Vs UNION OF INDIA & ORS

The Calcutta High Court in the matter of MRS REALTY PRIVATE LTD has issued a notice to the Centre as well as The State Government in a writ petition where the vires of Rule 86A was also challenged and it was also prayed to read down section 16(2)(c) of The CGST Act. As per this Section, the input tax credit is disallowed when the tax relating to a transaction is not paid to the government. Keeping the above legal position in mind, in case of a notice under rule 86A is received, it has to be contested on multiple grounds which is discussed as follows

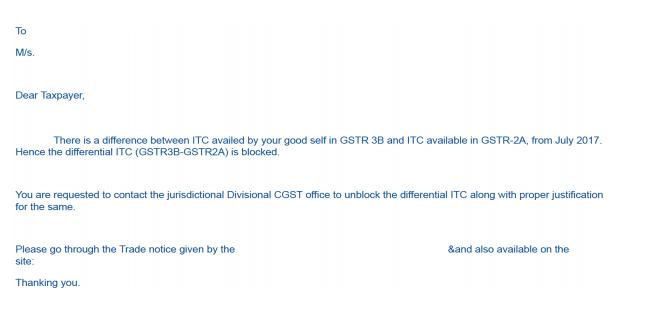

sample Notice Blocking ITC availed

Extract of Rule 86A

(1) The officer … not below the rank of an AC… having reasons to believe on the following grounds that credit of ITC is fraudulently availed or is ineligible may block ITC –

a) ITC has been availed on invoices, etc –

i. issued by a person who has been found non-existent or not .. conducting .. business registered place

ii. without receipt of goods or services or

b) ITC has been availed on the strength of any document, the tax charged on which has not been paid to the Govt; or

c) The supplier is found non-existent or

d) The recipient does not possess the document …

Related Topic:

Multi Disciplinary Partnership Firms allowed from now on. CAs can have partnership with CMAs and CSs.

Defences on a/c of Rule 86A being irregularly implemented-

1. From the email received, where no reason to invoke Rule 86A of CGST Rules 2017 is specified, the same has to be contested. It should be stated that the department should have reason to believe that a fraudulent or end ineligible ITC has been availed. Just due to a prima-facie mismatch in ITC availed in GSTR3B vis-à-vis ITC available in GSTR2A, if ITC has been blocked, the same may also be contested as per the case laws cited above.

2. If the Conditions laid down u/r 86A are not satisfied, the same may be contested in the case.

3. It may be mentioned that in case of any doubt, the same could have been asked by means of a notice under any section for assessment of tax liability rather than blocking ITC which can cause financial hardship to the taxpayer.

4. The ‘Doctrine of impossible performance’ and ‘doctrine of reading down’ as laid down in Arise India Case (Apex Court) may be argued.

In ‘Arise India Limited and other v. Commissioner Of Trade & Taxes, Delhi And others’ – SC held that the expression dealer or class of dealers occurring in Section 9 (2) (g) of the DVAT Act should be interpreted as not including a purchasing dealer who has bona fide entered into purchase transactions with validly registered selling dealers who have issued tax invoices and where there is no mismatch of the transactions in Annexures 2A and 2B. Unless the expression dealer or class of dealers in Section 9 (2) (g) is read down in the above manner, the entire provision would have to be held to be violative of Article 14 of the Constitution.

5. Arguments may be put forward on principles laid down in DY Beathel Enterprises (Mad HC) Case and Press Note dated 4th May 2018

6. Arguments may be put forward on the basis of Sec 42(3) of The CGST Act. The section states that the department has to go to both the recipient and the supplier in case of a mismatch of GSTR 2A and 3B. The word ‘both’ in section 42(3) is relevant and hence the department cannot only come to only the recipient and ask for input tax reversal which was upheld by the order of the Madras High Court whereby the court stated that the suppliers should be interrogated before coming to the recipient.

7. The detailed reason for such differences should be explained and justified in the submission and relief should be prayed.

8. Moreover, the Govt of Kerala wide circular 4/2021 has laid down a standard operating procedure for blocking input tax credit. The important points in the circular with the SOP for blocking of input tax credit are

Related Topic:

Allahabad HC Order in the case of M/s Jindal Pipes Limited Versus The State Of U.P.

1. That the taxpayers should be intimated before blocking the input tax credit and without intimation, the ITC cannot be blocked by the department

2. That in case the taxpayer represents against the blocking of the input tax credit, then within 15 days, such representations have to be disposed of by the department.

3. Lastly, the blocking of input tax credit should be used as an emergency provision only and should not be used as an alternative for issuing show-cause notices and assessing the case.

The blocking of the input tax credit would be contested a long way going forward, as we have first observed around 6 to 7 months back, that vide power given in the hands of the authorities and if the powers are used more frequently than desired, then it might cause real financial hardships to the assesses. Hence let us wait and watch how the litigation for rule 86A goes forward!