What is GST input tax credit, ITC in GST

Table of Contents

- What is the input tax credit in GST?

- Who can avail of GST input tax credit?

- Maximum time Limit to avail input tax credit?

- When do we need to reverse GST input tax credit?

- How much credit we can take each month?

- What is 2A? How input tax credit reflects in it?

- What is the list of items when ITC is not available?

- Which industries are not eligible for the input tax credit?

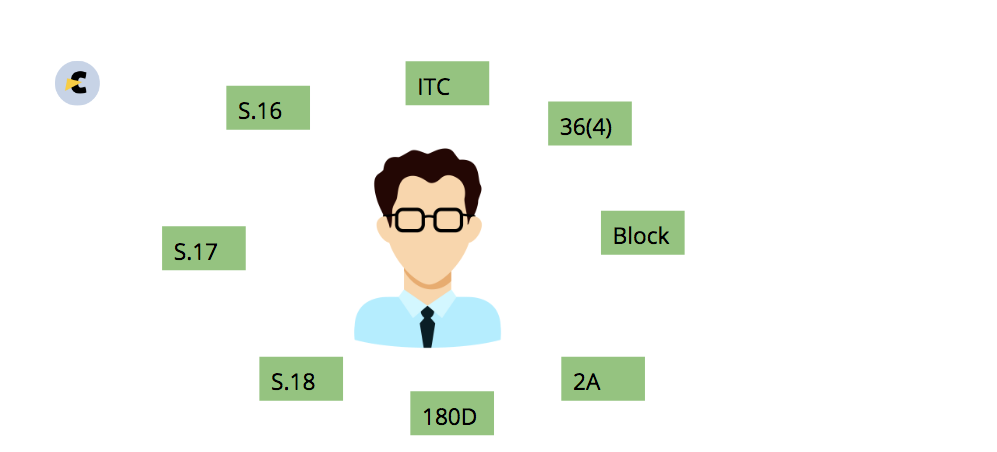

What is the input tax credit in GST?

GST input tax credit is the mechanism to avail of the benefit of tax paid on the purchase. In any value-added tax, every person in the chain pays tax on their value addition.

Related Topic:

Presentation of Input Tax Credit in Annual Return

Who can avail of GST input tax credit?

Every registered person is eligible to take GST input tax credit. A person whose registration is cancelled by the department is also equal to unregistered. Thus he is not eligible for ITC.

What are the conditions to avail input tax credit?

There are many filers for ITC. We need to know all of them. But four basic conditions to avail ITC are:

- The buyer posses the tax invoice or any prescribed document.

- The supplier paid the relevant tax to the government.

- The recipient received the goods or services.

- The recipient has filed the GST return.

Maximum time Limit to avail input tax credit?

As per Section 16(4), Max time limit to Avail ITC of an invoice is

- Before the due date for filing GSTR-3B of September month of the subsequent year

- Before the filing of the annual return for the period to which such an invoice or debit note belongs, whichever is earlier.

In case of Debit notes, with effect from 01-01-2021 the date of issuance of debit note(not the date of underlying invoice) shall be the relevant date to determine the financial year for the purpose of determining the availability of ITC under section 16(4) of the CGST Act 2017.

For Example –

Date of invoice – 28-12-2020

Date of Debit note – 03-04-2021

The invoice pertains to FY 2020-21. However, the relevant financial year for availing of the input tax credit on the said debit note, on or after 01.01.2021, will be FY 2021-22.

Related Topic:

Ineligible ITC in GST for works contract supply

When do we need to reverse GST input tax credit?

In the following cases:

- Recipient fails to pay for supply within 180 days of invoice date. (Proviso to section 16(2))

- The taxpayer is doing both taxable and exempted supply. (Section 17(2))

- The taxpayer use any inward supply for a non-business purpose. (Section 17(3))

- The goods are disposed of as a gift or a free sample.

- The goods are destroyed.

Related Topic:

GST Input Tax Credit availment relaxation due to Covid-19 Outbreak by CA Yashwant Kasar

How much credit we can take each month?

We can take the full amount of ITC reflecting in our 2A. Additional 5% can also be taken. But we need to reduce the amount of ineligible ITC

What is 2A? How input tax credit reflects in it?

GSTR 2A is the auto-populated form of GST. When a supplier his GSTR 1 the data reflects in 2a of a related party. e.g. Mr. A filed the return and entered the invoice of Mr B in his GSTR 1. This reflects in his 2A. He can take the ITC of this amount.

Related Topic:

Updated Provisions of Input Tax Credit under GST

What is the list of items when ITC is not available?

The input tax credit is not available in these cases:

- Purchase of Motor vehicle except for the following cases:

- The capacity is more than 13 people.

- It is used for passenger transportation.

- Used for imparting driving skills

- It is not applicable to trucks, forks, JCB machines, Cranes etc.

- If the taxpayer is doing the business of the same motor vehicle, he can take the credit

- Ships & Planes except when they are used for supply or driving skills.

- Insurance, maintenance & repair of above motor vehicles. But if ITC on the purchase was allowed then it is allowed on repair, insurance & maintenance also.

- Food items, rent a cab and life insurance

- Works contract services for the construction of immovable property except for Plant & machinery.

- Items purchased for construction of immovable property except for plant & machinery.

- Tax paid by a composition dealer.

- Input tax on supply for personal consumption.

- ITC of goods lost or destroyed or written off

- Input tax of Goods given as a gift or free sample

- ITC of purchase to a non resident taxable person is not allowed except imports.

- Input tax of tax paid on demand for fraudulent activity.

Related Topic:

ANALYSIS OF ELIGIBILITY OF INPUT TAX CREDIT ON CAPITAL GOODS

Which industries are not eligible for the input tax credit?

In notification no. 11/2017 tax rates are prescribed. In the case of some businesses, the tax rate is with a condition. It is less than the normal tax rate but the taxpayer is not eligible for the input tax credit.

- Restaurant and eating outlets- Their tax rate is 5% but they are not eligible to take the input tax credit. Thus they need to sell at 5% but a book all the ITC in cost.

- Tour operator services; In this case also tax rate is 5 % with a condition to not to take the input tax credit. But they can take ITC of 5% paid to another tour operator. Thus he can avail ITC of the same industry but not of other items. Because he is not eligible as per 11/2017.

Related Topic:

Input Tax Credit availed by Buyer, Tax not paid by Supplier, Recovery Proceedings quashed against Buyer, Remitted Back to Officer

Hope it was useful. Because ITC is one of the most vital parts.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.