(VAT) GST Vs IBC : Tale of two judgments

Table of Contents

- Brief Background of IBC before we understand GST Vs IBC

- Ultra Tech Nathdwara Cement Ltd., (formerly known as Binani Cements Ltd.):

- Electrosteel Steels Limited vs. the State of Jharkhand:

- Tax authorities are not operational creditors in this case:

- Amendment in section 31 of IBC will be effective prospectively and not retrospectively.

- Main differences between these two cases:

- Conclusion:

Brief Background of IBC before we understand GST Vs IBC

Recovery after completion of insolvency proceedings. Is it tenable under the law? A long battle of GST Vs IBC is there in courts. It will go further. tax authorities will keep sending the notices. Can they do so once the resolution plan is approved? Two cases contradicting each other. Let me start with the provisions of IBC itself. IBC code provides for the resolution of units making consistent losses. Who are unable to pay off their debts. Any one of the following can go for an insolvency application. Although both of these cases were for VAT collection. Actually the transitional provisions provide that any recovery for the past dues shall be made in GST. But in these cases, this issue was not raised by any side. Section 83 of the CGST Act, provides the first charge on assets for GST dues, except the IBC. Read the text here

“82. Notwithstanding anything to the contrary contained in any law for the time being in force, save as otherwise provided in the Insolvency and Bankruptcy Code, 2016, any amount payable by a taxable person or any other person on account of tax, interest or penalty which he is liable to pay to the Government shall be a first charge on the property of such taxable person or such person.”

- Financial creditor: One who lent money to a company for interest

- Operational Creditor: One who is a creditor in business dealing with the company. e.g. the vendors, tax authorities, employees

- Corporate Debtor: The company itself can also go for its own liquidation.

Section “238 of IBC provides for its overriding nature on any other law for the time being in force. It will provide immunity from any proceeding in any Law.

“The provisions of this Code shall have effect, notwithstanding anything inconsistent therewith contained in any other law for the time being in force or any instrument having effect by virtue of any such law. ”

Ultra Tech Nathdwara Cement Ltd., (formerly known as Binani Cements Ltd.):

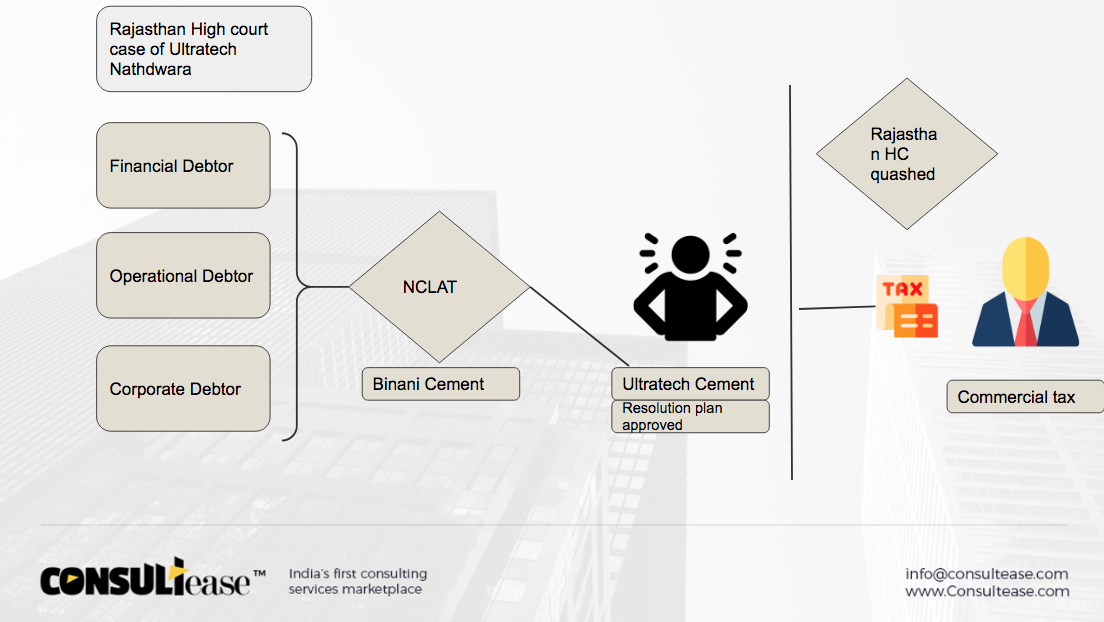

In this case, notices were issued for the dues of Binani Cement. The demand was made after taking over of Binani Cement by Ultratech. Binani Cement suffered huge losses and their financial creditor Bank of Baroda preferred an insolvency application. After the due process of insolvency, NCLAT approved the proposal of Ultratech, to take over Binani Cement. Later on, the department issued notices due to tax. The appellant filed an appeal under Article 226 of the constitution of India. Once the resolution plan is approved, there can be no further demand. Applicant request to quashed the notices and bar any further issuance of notices.

Related Topic:

Information Utility & lodgment of Default under IBC, 2016

SLP filed by the department in Supreme Court was also mentioned.

Then amendment in section 31 of IBC specifically covers the central and state government. The resolution plan once approved will be binding on all financial creditors, operation creditors, central and state governments. This provision was amended. Read the bold and underlined part. It is the change incorporated in section 31 of IBC. Even if is not amended, Tax authorities are fairly covered by the operational creditors. Section

Also, the FM in her speech for this amendment ensured the immunity to the resolution applicant from any dues or liabilities.

Finally, after all these arguments, the honorable Rajasthan high court decided in favor of the applicant. The notices issued by the department were quashed. You can understand n brief from this image.

Electrosteel Steels Limited vs. the State of Jharkhand:

Although in this case also demand was raised by the VAT dept. But it has some differences. In this case, garnishee proceedings were started. The Bank of the insolvent company was asked to pay.

Three important stands taken by the authorities were

Tax authorities are not operational creditors in this case:

The tax authorities claimed that their dues are not an operational debt. they are not covered by the term operational creditors. The rationale behind it was.(Para 23)

This Tax liability can very well be treated as the amount of tax already realized by the petitioner Company from its customers, on behalf of the State Government, and not the direct debt of the petitioner Company towards the State Government, in which case the tax liabilities of the petitioner Company, for realising which the impugned garnishee order has been issued, may not come within the definition of “operational debt”, as defined in the IB Code.

The resolution plan is not binding on state tax authorities.

The adjudicating authority is required to make a public announcement of the initiation of ICRP and invite claimed. This was not done in the present case. Section 13 of the IBC Code provides for this communication immediately. But in the current case, the announcement was made in the area of Kolkata and nit in Jharkhand. Regulation 6 of Insolvency and Bankruptcy Board of India (Insolvency Resolution Process for Corporate Persons) Regulations, 2016, provide for the detailed procedure of this public announcement.

Amendment in section 31 of IBC will be effective prospectively and not retrospectively.

Section 31(1) of the IB Code, 2016 was amended vide IBC (Amendment) Act, 2019, to make the approved resolution plan binding on the Government Authorities in relation to the statutory dues. It is pursuant to this amendment that the rights of the Government Authorities for statutory dues were affected and such right was made subject to the approved resolution plan. The said amendment was made effective from 16.08.2019, which is prospective in nature, and no express retrospective effect was given to the said amendment.

Main differences between these two cases:

The first difference was of a person who is served the notice. In the first case, it was the buyer who acquired the company. In the second one, it was the bank of an insolvent company

Second, In the first case, the department was duly informed by the IRP about the insolvency proceedings. In the second case, there was no information.

Third, In the first case, there was no discussion about the applicability of amendment in section 13 of the IBC Act. In the second one, it was the main argument of the deptt. The amendment is not retrospective. Thus it will not cover their case.

Fourth, In the first case, there is no dispute about the tax department, being an operational creditor. In the second one, Deptt denied that they are operational creditors. They claimed that the amount of tax is not a direct due. it is collected on behalf of the department bt the taxpayer, That money is used in business instead of paying it to the account of the government

Conclusion:

Both cases differ from each other. After a conjoin reading we can say that a resolution plan, once approved properly, will be binding on tax authorities also. In the case of electro steel, the procedure was not properly followed. Although their claim of amendment in section 31 is not retrospective won’t sustain longer. Government dues were already covered in operational debtors. The amendment in section 31 is of clarificatory nature Even if there is no such amendment. Government dues can fairly fall in operational debt. The resolution plan will be binding on them. As clarified by the FM herself while introducing the changes. The intention of the government is to provide immunity to the buyer of an insolvent unit from any future demand or proceeding. In the absence of it, no one will pay for a loss-making unit. The aim is to provide them with a clean slate. If they will have fear of past dues. They will better keep away from such overtake. I hope this GST Vs IBC will be easy to decide in the future. Things are almost settled with these two cases. But there is room for further litigation.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.