CBIC justified interest recovery on gross amount

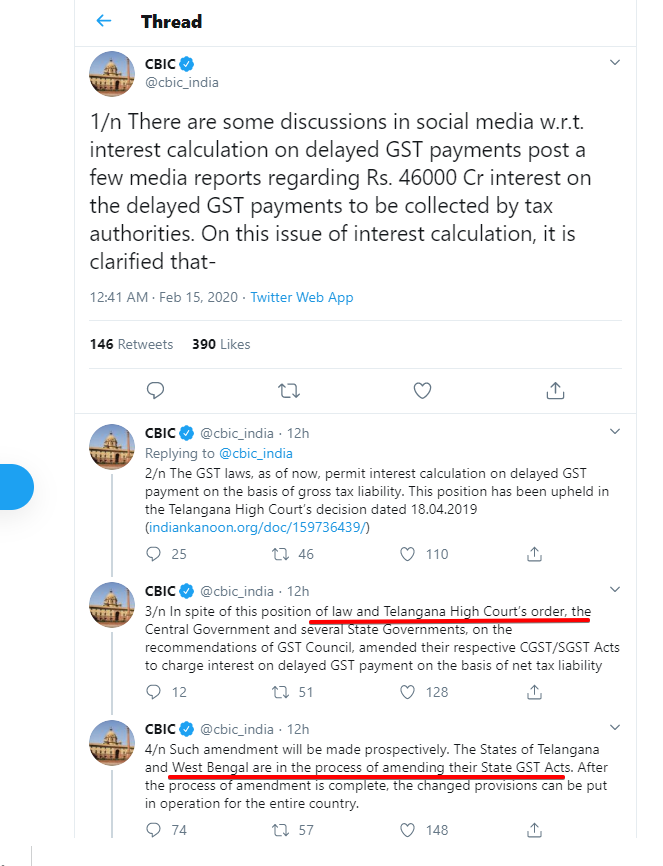

A thread of CBIC tweets for interest recovery on gross amount:

A hue and cry were there in business people and consultants over the collection target of 46k crores of interest by CBIC. Many experts feel that the charge of interest on the gross amount is not fair. GST provisions provide for interest u/s 50 of CGST Act. Also section 16(2) makes it mandatory to file a return to be eligible for ITC. CBIC take a view that in case of late filing of GST return the interest shall be charged on gross liability. They have justified interest recovery on gross amount in their tweets. Let us understand it by an example.

Tax on outward Supply: 10 Cr.

ITC in the ledger : 9.5 Cr.

But the return was filed in next year only. Now Taxpayer feels that interest shall be on Rs. 0.5 Cr but CBIC is of view that it shall be on Rs. 10 Cr. It can cause a huge hardship on taxpayers.

But CBIC justified interest recovery on gross amount via some tweets. I have attached those tweets here.

Famous case of Megha engineering of Telangana high court was also mentioned in this tweet. More action from the side of deptt is expected.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.