Section 50 of GST Act | Interest on ‘Gross’ or ‘Net’ Tax Liability | Telangana High Court

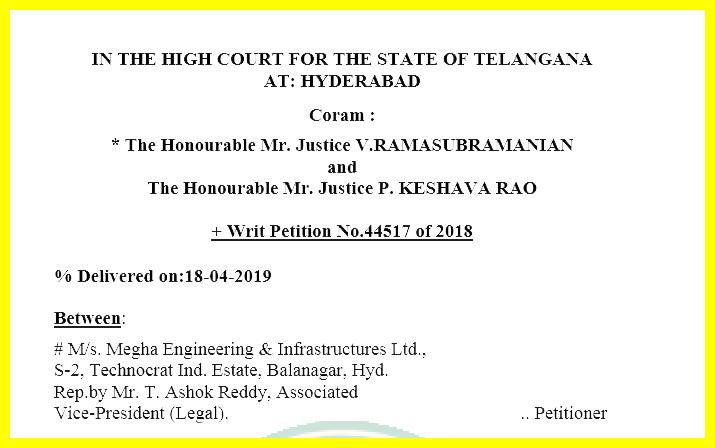

I am sharing with you all a synopsis on the very recent ruling of Hon’ble Telangana High Court on the issue of payment of interest on ‘Gross Tax Liability’ or ‘Net Tax Liability’ under the GST laws. You can download the pdf of ” Section 50 of GST Act | Interest on ‘Gross’ or ‘Net’ Tax Liability | Telangana High Court “ Act pdf by clicking the image below:

In the case of Megha Engineering & Infrastructures Ltd. v. Comm. of Central Tax (WP no. 55517 of 2018), Hon’ble Telangana High Court held that the claim of respondents revenue for interest liability on Input Tax Credit (ITC) portion of the tax liability cannot be found fault with. That is to say, interest for the delayed payment of output tax liability of GST shall also be required to be paid on the liability paid by way of ITC.

Question for ruling before the Hon’ble Court was “Whether the liability to pay interest under Section 50 of the GST Acts, 2017 is confined only to the net tax liability or whether interest is payable on total tax liability including a portion of which is liable to be set-off against ITC”?

The Court first referred to the entire scheme of the provisions dealing with ‘availing of ITC’ and ‘utilization thereof’ viz.- Section 39 (Filing of Returns), Section 16 (Eligibility of ITC), Section 41 (Provisional claim & Acceptance of ITC) and Section 49 (Payment of Tax).

Among these sections, the emphasis was placed on Sub-Section (4) of Section 49 which reads as:

The amount available in the electronic credit ledger may be used for making any payment towards output tax under this Act or under the Integrated Goods and Services Tax Act in such manner and subject to such conditions and within such time as may be prescribed.

Thereafter, Sub-section (1) of Section 50 of was referred. Sub-Section (1) reads as:

Every person who is liable to pay tax in accordance with the provisions of this Act or the rules made thereunder, but fails to pay the tax or any part thereof to the Government within the period prescribed, shall for the period for which the tax or any part thereof remains unpaid, pay, on his own, interest at such rate, not exceeding eighteen per cent., as may be notified by the Government on the recommendations of the Council.

It was observed that, output tax liability can paid by way of Electronic Credit Ledger (ELC) as per Sub-Section (4) of Section 49 (i.e. until the payment liability is not actually settled off (GSTN portal set-off) from ELC, the same cannot be considered to have been paid into the government treasury and interest meter will keep on running). The mere availability of the ITC in ELC would not tantamount to the payment of tax.

Moreover, it was observed that only when the payment is made as per the provisions of Sub-Section (4) of Section 49, the government gets right over the money available in the electronic credit ledger. Since the ownership of such money is with the dealer till the time of actual payment, the government become entitled to interest as per the provisions of Section (1) of Section 50 up to the date of their entitlement to appropriate it.

PS: Arguments that GST council in its 31st meeting has given in principle approval for legislative amendment of GST Acts to ensure that interest is paid only on net tax liability was rejected since the said amendments are only proposed.

If you already have a premium membership, Sign In.

CA Shivashish Karnani

CA Shivashish Karnani