FAQ’s on GST annual return

FAQ’s on GST annual return

Annual return of GST is annual compliance under GST Law. Section 44(1) read with rule 80 of CGST rules covers the provisions of Annual return. There FAQ’s on GST annual return are drafted to address various issues related to annual return.

- Who is required to file GST annual return?

- GST annual is required to be filed by every registered taxpayer. GST annual return is required to be filed even if registration was cancelled during the year. It is required irrespective of turnover. If a person has shifted his registration from composition to normal or vice versa , they are required to file both annual returns.

- Who is not required to file GST annual return?

- As per section 44(2) following persons are not required to file an annual return

- ISD

- CTP

- NRTP

- TDS

- TCS , a separate form is there for TCS deductor.

- As per section 44(2) following persons are not required to file an annual return

- What are the tables in GST annual return?

- Annual return consist of data related to turnover, ITC and taxes paid in GST. It s compilation of all data filed for the year via various returns. Annual return will fetch all data from GSTR 1 or GSTR 3b filed during the previous year.

- What information are required to be provided in GST annual return?

- The data required to be filed in annual return is entire data filed via GST returns. We cant enter correct data here but we need to fill the data already declared. Some of these data will be fetched from GSTR1 as per instruction given in form GSTR 9. But some data will be from GSTR 3B. We need to be careful while filing the annual return.

- Can we revise annul return

-

No, Once filed , the data is annual return cant be edited or changed.

-

-

What will be the use of data we will file via annual return?

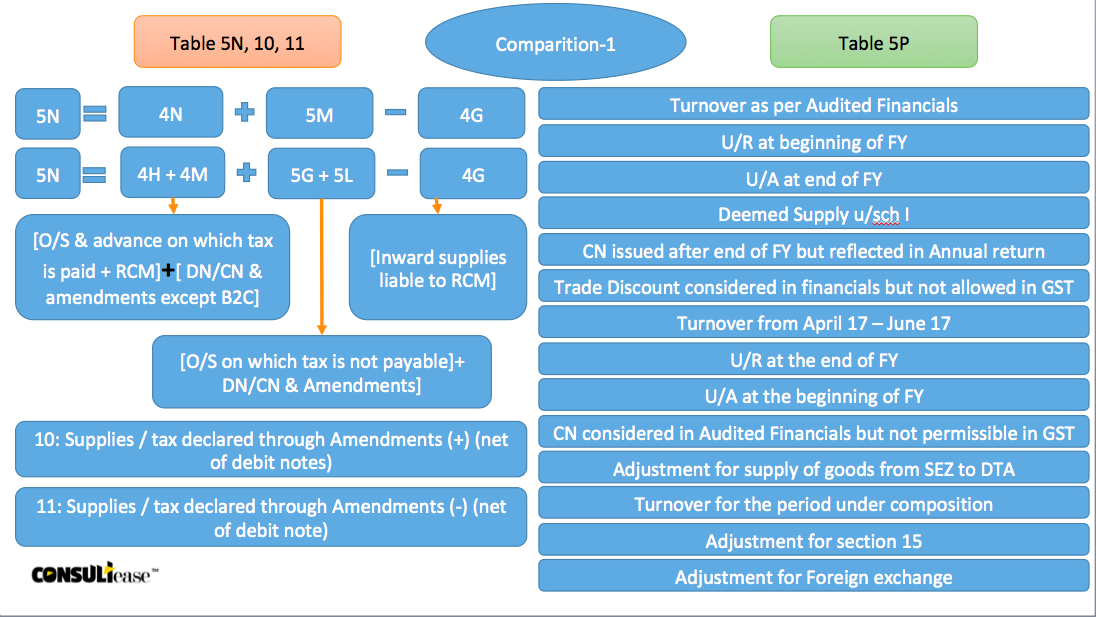

- Some tables of annual return will be auto populated in GSTR 9C and there it will get compared with the data from financials. This comparison will lead to tax liability on taxpayer. Thats the reason, we need to be carefull while filing the data of annual return itself. Once filed we wont be able to correct it or change it. When that wrong data will be compared in GSTR 9C , It will result in wrong reconciliation. For example table 4N will be compared with table 5N will be compared with table 7E of GSTR 9C.

FAQ’s on GST annual return

This is how data will get compared.

- Can we make payment of taxes , which were left in normal returns using annual return?

- Till now the format of annual return have no such functionality. Although it is suggested that taxes can be paid via DRC 03. But any mistake of last year cant be corrected via GST annual return. It is a compilation of data declared via returns.

-

What is the last date to file annual return?

- The last date to file annual return was 31st December but it is extended to 31st March by CBIC.

- When the online filing of annual return will start?

- It is expected that annual return will be live on GST portal by end of January.

- What is penalty for not filing of annual return?

- Late fees for late filing of annual return is Rs. 100 per day per Act. It is restricted to .25% of turnover. Thus we can say that it will be least of the two.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.