Rule 155 of the CGST Act – Recovery through land revenue authority

Rule 155 of the CGST Act – Recovery through land revenue authority

Rule 155 of the CGST Act-

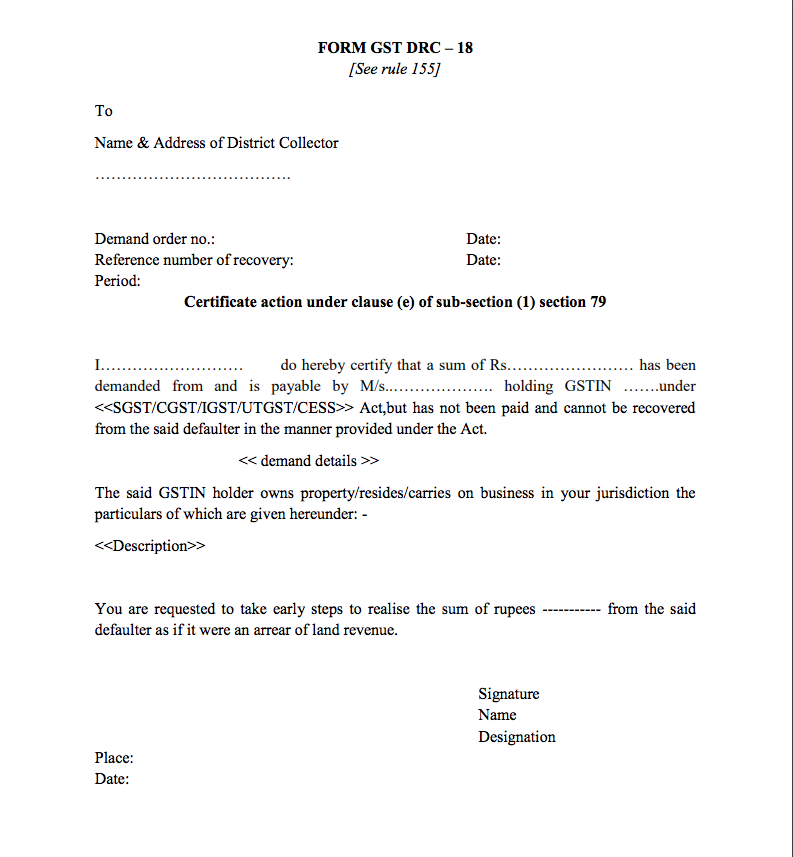

“Where an amount is to be recovered in accordance with the provisions of clause (e) of sub-section (1) of section 79, the proper officer shall send a certificate to the Collector or Deputy Commissioner of the district or any other officer authorised in this behalf in FORM GST DRC-18 to recover from the person concerned, the amount specified in the certificate as if it were an arrear of land revenue.”

Summary of Rule 155 of the CGST Act-

Any dues under section 79(1)(e) are recoverable as land revenue in GST. The officer will send a certificate to Collector or DC or any other authorised officer in Form GST DRC-18. Here is the format of DRC-18.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.