New changes in CGST Act wef 30th June

New changes in CGST Act:

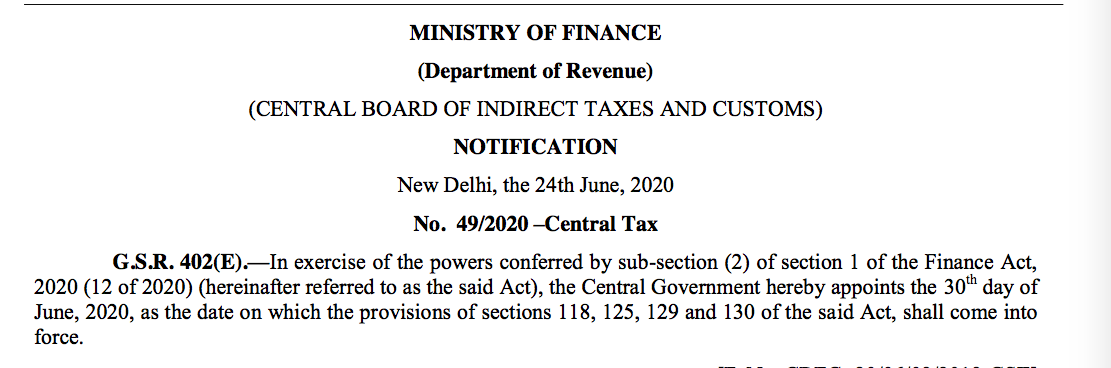

The following changes are introduced in the CGST Act. The date of applicability is 30th June 2020. These new changes in CGST Act were introduced via the Finance Act 2020. It is amended via notification no. 49/2020 central tax.

Related Topic:

Interplay of Section 129 & 130 of CGST Act

| Section of FA 2020 | Section of CGST Act Amended | Details of amendment |

| Section 118 | Section 2(114) | following sub-clauses shall be substituted, namely:—

“(c) Dadra and Nagar Haveli and Daman and Diu; (d) Ladakh;” |

| Section 125 | Section 109(6) | In section 109 of the Central Goods and Services Tax Act, in sub-section (6),(a) the words “except for the State of Jammu and Kashmir” shall be omitted;

(b) the first proviso shall be omitted. |

| Section 129 | Section 168 | In section 168 of the Central Goods and Services Tax Act, in sub-section (2), for the words, brackets and figures “sub-section (5) of section 66, sub-section (1) of section 143”, the words, brackets and figures “sub-section (1) of section 143, except the second proviso thereof” shall be substituted |

| Section 130 | Section 172 | In section 172 of the Central Goods and Services Tax Act, in sub-section (1), in the proviso, for the words “three years”, the words “five years” shall be substituted. |

You can download our amended CGST Act to see the amended provision.

Get unlimited unrestricted access to thousands of insightful content at ConsultEase.

If you already have a premium membership, Sign In.

payu form placeholder

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.