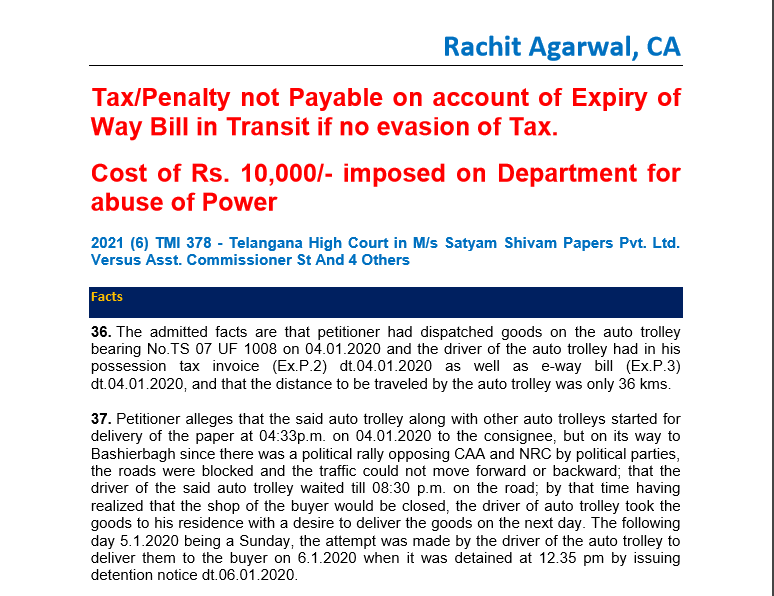

Tax/Penalty not Payable on account of Expiry of Way Bill in Transit if no evasion of Tax.

Cost of Rs. 10,000/- imposed on Department for abuse of Power

2021 (6) TMI 378 – Telangana High Court in M/s Satyam Shivam Papers Pvt. Ltd. Versus Asst. Commissioner St And 4 Others

Facts

- The admitted facts are that the petitioner had dispatched goods on the auto trolley bearing No.TS 07 UF 1008 on 04.01.2020 and the driver of the auto trolley had in his possession tax invoice (Ex.P.2) dt.04.01.2020 as well as an e-way bill (Ex.P.3) dt.04.01.2020, and that the distance to be traveled by the auto trolley was only 36 kms.

- Petitioner alleges that the said auto trolley along with other auto trolleys started for delivery of the paper at 04:33 p.m. on 04.01.2020 to the consignee, but on its way to Bashierbagh since there was a political rally opposing CAA and NRC by political parties, the roads were blocked and the traffic could not move forward or backward; that the driver of the said auto trolley waited till 08:30 p.m. on the road; by that time having realized that the shop of the buyer would be closed, the driver of auto trolley took the goods to his residence with a desire to deliver the goods on the next day. The following day 5.1.2020 being a Sunday, the attempt was made by the driver of the auto trolley to deliver them to the buyer on 6.1.2020 when it was detained at 12.35 pm by issuing detention notice dt.06.01.2020.

Held

It was the duty of 2nd respondent to consider the explanation offered by the petitioner as to why the goods could not have been delivered during the validity of the e-way bill, and instead, he is harping on the fact that the e-way bill is not extended even four (04) hours before the expiry or four (04) hours after the expiry, which is untenable

In our considered opinion, there was no material before the 2nd respondent to come to the conclusion that there was evasion of tax by the petitioner merely on account of lapsing of time mentioned in the e-way bill because even the 2nd respondent does not say that there was any evidence of an attempt to sell the goods to somebody else on 06.01.2020. On account of the non-extension of the validity of the e-way bill by the petitioner or the auto trolley driver, no presumption can be drawn that there was an intention to evade tax.

- In our opinion, there has been a blatant abuse of power by the 2nd respondent

- We deprecate the conduct of 2nd respondent in not even adverting to the response given by the petitioner to the Form GST MOV-07 in Form GST MOV – 09, and his deliberate intention to treat the validity of the expiry on the e-way bill as amounting to evasion of tax without any evidence of such evasion of tax by the petitioner.

The respondents are directed to refund the said amount collected from the petitioner within four (04) weeks with interest@ 6% p.a from 20.1.2020 when the amount was collected from the petitioner till the date of repayment.

The 2nd respondent shall also pay costs of ₹ 10,000 to the petitioner in 4 weeks.

If you already have a premium membership, Sign In.

CA Rachit Agarwal

CA Rachit Agarwal