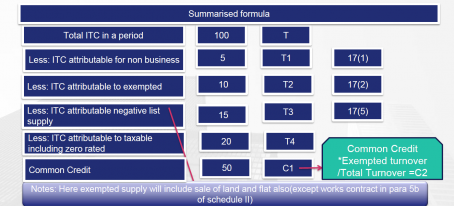

Rule 42: simplified

Rule 42: simplified

Important point to take care

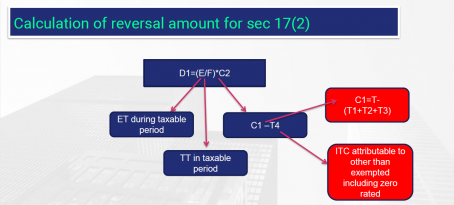

- ITC of non business, exempted, section 17(5) and taxable including zero rated (T1,T2,T3,T4) supply is required to be declare every month while filing GSTR 2. GSTR 2 is pending for indefinite period by CBEC. It is advisable to give this consolidated amount in GSTR 3B.

2.Exp. to rule 43 provide that following shall not be included in exempted supply:

a) Export to Nepal Bhutan (they are covered in exempt supply via notification no.42/2017).

b) Interest earned on deposits or advances.

c) Transportation of goods via vessel from India to outside India.

3.When there is no turnover in any period Turnover of la st period when the figure of turnover is available shall be taken into consideration.

4.Any amount if Duty or tax levied under entry 84 of List I and entry no. 51 and 54 of List II of seventh schedule and shall be excluded from TT or ET.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.