SEZ Online – New Functionalities/Features

SEZ Online – New Functionalities/Features

Functionalities made available on the SEZ Online system are reviewed and enhanced/modified from time to time. New functionalities are added in the system based on the inputs and requirements received from various user groups. These functionalities are developed based on the understanding developed by the NDML team from the study of existing practices and procedures in this regard and efforts are made to provide features on the system that are compliant with the procedural and technical requirements. However, users are requested to refer the relevant legal and authorized documents and formations for reference on legal and authentic aspects of the transactions before filing transactions.

1 Payment of SWS(Customs) and Health Cess

Currently, in case of SEZ to DTA BOE transactions where duty is payable, the duty can be paid using any of the following modes or in a combination of these modes – TR6 Challan, License/Scrip, and Advance Duty Ledger. Accordingly, users are making use of these facilities for payment of duty, and customs can provide approval/verification at the time of assessment / issuing Out of Charge.

Payment of SWS (Customs): As per Customs Circular No. 02/2020, it has been clarified that Social Welfare Surcharge [SWS] cannot be paid using MEIS Scrip available balance and needs to be paid to vide duty payment challan.

Payment of Health Cess: During the Budget declared on 1st February 2020, a new duty component was introduced called “Health Cess” for notified chapter headings. As per the Finance Act 2020, it is notified that Health Cess on Customs cannot be paid using any Export Benefit License/Scrips.

In order to facilitate users, control has now been introduced in the system which guides the user to make payment of Customs duty using MEIS Scrip excluding SWS(Customs), Health Cess. Duty payment excluding Health Cess for other Export benefit schemes viz. Advance Authorization, EPCG, etc.

The system will check the Scrip amount captured for payment of customs duty and if the user captured total duty amount inclusive of SWS(Customs), Health Cess then the system will restrict License/Scrip usage and instruct the user to exclude SWS(Customs), Health Cess while recording Scrip amount. In such cases, SWS(Customs), Health Cess needs to be paid using duty payment challan.

Below important controls are introduced in the system:

The system provides two important options with reference to usage of License/Scrip in Duty Payment

1. Recording facility: where the user applies notification which makes resultant duty payment as zero or less than the original amount. So in this option, though duty amount and payment obligation is already adjusted as per notification claimed and this feature enables recording of relevant License/Scrip being used under the notification claimed. This recording is only for information purposes and does not impact the challan value.

2. Payment facility: When a user has not claimed the applicable notification for use of license/scrip he can use this feature. In this case, as the notification is not claimed, the duty amount calculated is the total actual duty payable. This can be either paid using TR-6 challan, License/Scrip, or Advance Duty Payment facility. In this scenario, the user can use License/Scrip and it can be verified by customs at the time of assessment. Recording of License / Scrip, in this case, reduces the Challan amount to the extent of License / Scrip used.

Below updates are made and controls are introduced in the above two options

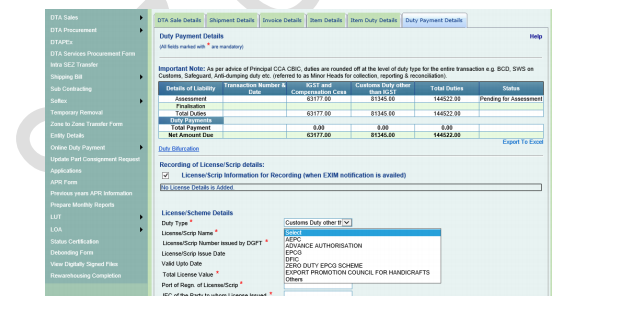

Recording of License/Scrip details section (when EXIM notification i.e. notification pertaining to Export benefit scheme is claimed):

• “MEIS” option from “License/Scrip Name” drop-down list has been removed when the user selects “Duty Type” as “Customs Duty other than IGST”.

The above change is made to introduce a restriction on payment of SWS Customs & Health Cess using the MEIS Scrip. It indicates that when MEIS notification is applied then all duties under Customs (Excluding GST) become zero. In order to pay SWS Customs when MEIS Scrip is to be used, the recording facility is restricted and the user has to capture MEIS Information through Payment using License/Scrip facility. This enables payment of Customs duty (Excluding SWS(Customs) using Scrip and SWS(Customs) using TR-6 challan/advance duty ledger.

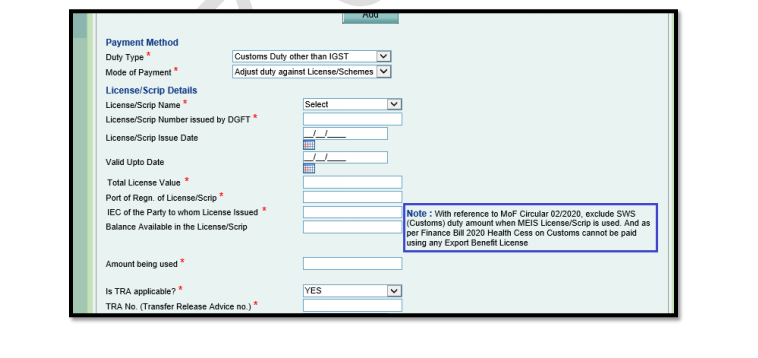

Changes Duty Payment using License / Scrip / Scheme section:

• In case if the license/scheme selected under License/Scrip Name dropdown is MEIS, then the allowed duty payment amount will be Total Customs Duty minus SWS Duty and Health Cess on Customs Duty amounts. i.e. if Total Customs duty amount (other than IGST) is Rs.100 and SWS is Rs.10 & Health Cess is Rs.20 then the system will not allow recording of MEIS Scrip for more than Rs.70.

• In case if the license/scheme selected under License/Scrip Name dropdown is other than MEIS, then the allowed duty payment amount will be Total Customs Duty minus Health Cess on Customs Duty amount. E.g. When total duty (Customs duty + GST) is Rs. 100 and Health Cess is Rs. 20 then the system will not allow recording of such license/scrip for more than Rs. 80.

| License | Duties allowed for payment |

| MEIS | Total Customs Duty – (SWS + Health Cess Customs) |

| Other than MEIS | Total Customs Duty – Health Cess |

The following note indicating the same has also been added under Duty Payment using the License / Scheme section.

In case if the user has selected any EXIM notification under Item Duty Details, then on the selection of the MEIS option under license/scrip dropdown a message will be popped up stating “You have already used Exim Notification in the Duty details section. If you wish to pay the duty using MEIS License, then please remove the Exim Notification from Customs Duty Section.” And the user will be required to remove such EXIM notification for using the MEIS license for duty payment.

Impact on Existing License added in the BOE/DTA Sale transactions –

• In case of the existing transaction having license details (whether MEIS or any other) added for recording purpose / for duty payment and such transactions are not yet submitted to customs, then such license details will be automatically removed from the system. User will have to add fresh license/Scrip details as per the revised implementation

• In case of the existing transaction having license details (whether MEIS or any other) added for recording purpose / for duty payment and such transactions are already submitted to customs, then such license details will prevail in such submitted transactions as per the old implementation throughout its workflow. This may be examined by Customs or requested by Unit, that MEIS duty scrip amount captured covers SWS, Health Cess too then contact customs for rejection of such Scrip & request customs to raise a query. After the query is raised capture appropriate amount and submit. (However, for already submitted requests, control will not be triggered users will have to manually ensure that correct duty amount is captured using Scrip/License (i.e. Minus SWS Customs / Health Cess)

Enhancement in Duty Presentation:

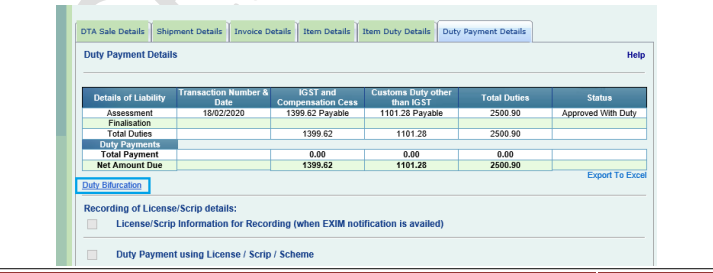

A new link with the name “Duty Bifurcation” has been made available in “Duty Payment Details

Download the copy:

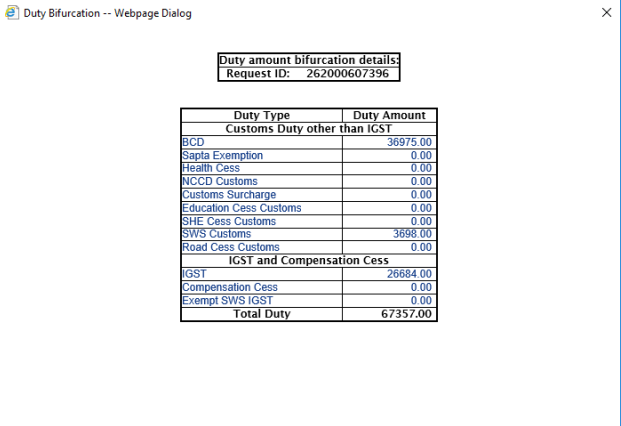

When this link is clicked, the system will facilitate users by presenting each duty component i.e. it will show the name of the duty and corresponding duty amount calculated by the system. Component wise duty will be presented at the Bill of Entry-level.

This feature will facilitate users in determining duty amount to be paid using License / Scrip where SWS(Customs), Health Cess needs to be excluded while paying duty using License/Scrip.

Clicking on this link a new window will get popped up which will have all the applicable duty components in the transaction bifurcated into two main categories – Customs Duty other than IGST and IGST and Compensation Cess.

2 Changes in User Management

User Creation

In order to ensure enhanced control in terms of user identity, Entity Admin users will now have to specify few additional details at the time of the creation of functional users like – Profile Photo, Date Of Birth, Employee ID, Permanent Account Number(PAN), scanned image of PAN, Letter of Authorization Copy (i.e. approval from concerned official to create User ID in SEZ Online System – this is an optional field) It will be applicable while updating the user details for existing users also.

A new field for uploading a screenshot showing DSC details has been introduced in the existing section for assigning the DSC to a functional user. This will ensure that DSC is available and is issued in the name of the user.

Also, the previous checkbox selection for assigning the DSC has been changed to radio option selection for – Assigning a DSC, Updating an existing DSC, or removing the DSC. While updating or removing the DSC, the user is required to provide the reason for such an update/removal of DSC.

A declaration checkbox has also been made available on user creation screen stating “I hereby declare and affirm that the information provided by me is true and correct to the best of my knowledge and belief.” which the corresponding Admin user will be required to select at the time of creating a new user/updating the user details for any existing user.

The above mentioned new details will be applicable for Entity Applicant (New/Existing Entities) users as well. Entity Applicant users (Users created for submission of New Unit Application, New Developer Application) will be additionally required to capture Company Name.

Entity Applicant will also be able to capture the DSC details for himself from now onwards.

PFB screenshots for reference.

New User Registration Form – (The additional fields here are applicable to Existing User Regularization form as well)

If you already have a premium membership, Sign In.

Rama Krishan

Rama Krishan

Faridabad, India