FAQ’s on Udyog Aadhar, MSME benefits and registration

- What is a Udyog Aadhar?

- Udyog Aadhar Eligibility Criteria: –

- Read the Notification:

- Computation of Investment limit in plants & machineries or in equipment’s for the purpose of MSMED Act, 2006: –

- What is excluded from the investment?

- Is Aadhar card is necessary for registration under Udyog Aadhar?

- What are the benefits of Udyog Aadhar?

- What are the MSME schemes 2020 provided by the Government of India?

- Documents required for Udyog Aadhaar new registration: –

- Udyog Aadhar free registration process:-

- How to Edit Udyog Aadhar Details?

- What are the activities specifically excluded from coverage under MSME?

- What is the validity of the certificate?

- How to apply for Mudra loan in 59 minutes?

- FAQ’s on Practical issues:

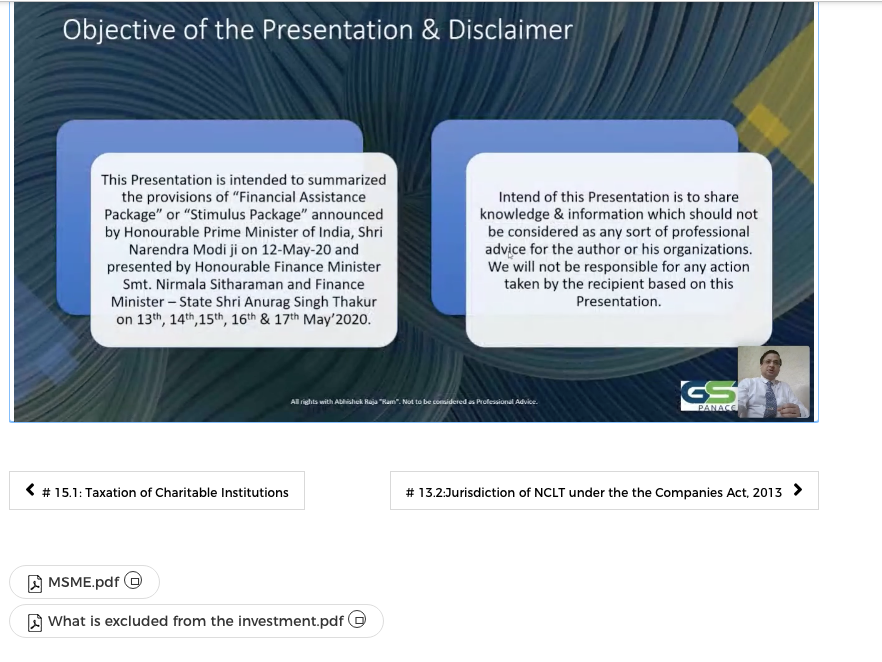

- Watch this video for a detailed discussion

What is a Udyog Aadhar?

Udyog Adhar is the registration number under MSME. In the last couple of weeks, many benefits are offered for MSME. You need to register under Udyog Aadhar. Only then you will be eligible for those benefits. It is free and you can register yourself easily on their portal. So first check whether you are covered by the definition of MSME or not. Then go for registration. Now apply for load at a subsidized rate. You are eligible for other benefits also. The provisions of Udyog Aadhar are covered by MSME Act 2006. The following can register for Udyog Aadhar to get MSME benefits

- Manufacturers

- Service providers

Traders are not eligible for MSME benefits They cant register under the Udyog Aadhar.

Read important questions on Udyog Aadhar answered by the ministry of MSME.

Udyog Aadhar Eligibility Criteria: –

Business entities that are classified basis their investment in plant and machinery (as per the table below) are eligible to apply for a Udyog Aadhar card.

| Erstwhile MSME Classification | ||

| Investment in Plant & Machinery or Equipment | ||

| Classification | Manufacturing Sector | Service Sector |

| Micro Enterprise | Upto Rs. 25 lakhs investment in plant & machinery | Upto Rs. 10 lakhs investment in equipment |

| Small Enterprise | Upto Rs.5 crore investment in plant & machinery | Upto Rs.2 crores investment in equipment |

| Medium Enterprise | Upto Rs.10 crore investment in plant & machinery | Upto Rs.5 crores investment in equipment

|

MSME criteria revised from May 2020 by FM

Earlier the limit for service provider and manufacturer was different. In the revised limit, it is clubbed together. Now investment and turnover both are required to meet MSME criteria.

|

Revised Criteria From 15th May 2020 MSME Classification |

|

|

Investment and Annual Turnover |

|

| Classification | Manufacturing & Service Sector |

| Micro-Enterprise | Investment < Rs. 1 Cr. And Turnover< Rs.5Cr. |

| Small Enterprise | Investment < Rs. 10 Cr. And Turnover< Rs.50 Cr. |

| Medium Enterprise | Investment < Rs. 20 Cr. AndTurnover< Rs. 100 Cr. |

Read the Notification:

Computation of Investment limit in plants & machineries or in equipment’s for the purpose of MSMED Act, 2006: –

As per Ministry of Small Scale industries notification dated 5th day of October, 2006, the investment in Plant and Machinery referred to in respective limits is the Original Price, irrespective of whether the plant and machinery are new or second handed, shall be taken into account. In the case of imported machinery, the following shall be included in calculating the value, namely;

- Import duty (excluding miscellaneous expenses such as transportation from the port to the site of the factory, demurrage paid at the port);

- Shipping charges;

- Customs clearance charges; and

- Sales tax or value added tax.

Take care that only physical assets can be considered in investment.

Related Topic:

Udyam Registration – Eligibility, Process, Documents Required, and Certificate

What is excluded from the investment?

The following are excluded while calculating the investment in Plant and Machinery:-

- Equipment such as tools, jigs, dyes, moulds and spare parts for maintenance and the cost of consumables stores;

- Installation of plant and machinery;

- Research and development equipment and pollution controlled equipment

- Power generation set and extra transformer installed by the enterprise as per regulations of the State Electricity Board;

- Bank charges and service charges paid to the National Small Industries Corporation or the State Small Industries Corporation;

- Procurement or installation of cables, wiring, bus bars, electrical control panels (not mounded on individual machines), oil circuit breakers or miniature circuit breakers which are necessary to be used for providing electrical power to the plant and machinery or for safety measures;

- Gas producers plants;

- Transportation charges (excluding sales-tax or value-added tax and excise duty) for indigenous machinery from the place of the manufacture to the site of the enterprise;

- Charges paid for technical know-how for the erection of plant and machinery;

- Such storage tanks which store raw material and finished product and are not linked with the manufacturing process; and

- Fire fighting equipment.

- Further, investment in Land, Building, Vehicles, Furniture and fixtures, Office Equipment etc shall not be considered in determining the threshold limit of plant and machinery or equipment as the case may be.

Is Aadhar card is necessary for registration under Udyog Aadhar?

Yes. For registration under the Udyog Aadhar scheme, Aadhar card is compulsory. In case an applicant is other than the proprietor, the Aadhar card of the partner and the director will be required.

What are the benefits of Udyog Aadhar?

There are few benefits to registering your business for Udyog Aadhaar. They are as follows.

- Easy Bank Loan upto 1 Cr without Collateral/ Mortgage

- Special Preference in Procuring Government Tenders

- 1 percent Exemption on interest rate on Bank Over Draft (OD)

- Concession in Electricity Bills

- Protection against the delay in payment from Buyers

- Tax Rebates

- Special 50 percent discount on Government fees for Trademark and Patent

- Fast Resolution of Disputes

- The business owner will get protection against delay in Payment.

- You can also avail collateral-free loans from the bank.

- Rate of interest from the banks can be reduced.

- Exemption of 1% interest on Overdraft.

- Exemption under direct tax laws.

- Enjoy easy bank mortgage.

- Reimbursement on the payment made for obtaining the ISO certificate.

- Reservation of products for exclusive manufacturing by MSME and SSI.

- The business owner who opts for Udyog Aadhar can get a concession on Electricity bills.

What are the MSME schemes 2020 provided by the Government of India?

Some of the MSME schemes approved by the Government of India that we shall look upon are listed below.

- Udyog Aadhaar Memorandum scheme

- Incubation

- Women Entrepreneurship

- Grievance Monitoring System

- Zero Defect Zero Effect scheme

- Credit Linked Capital Subsidy scheme

- Quality Management Standards and Quality technology tools

-

Udyog Aadhar Memorandum Scheme

This scheme replaces a previous registration process called the SSI registration or MSME registration. The previous process was riddled with a lot of paperwork and submissions, for MSME registration. With this scheme, the registration is done using only two forms: Entrepreneur Memorandum-I and Entrepreneur Memorandum-II replacing the 11 forms of the previous process.

The process is free and completely online. MSME’s registered through this scheme using Aadhaar are entitled to MSME loans, government subsidies, hassle-free bank accounts in the name of the MSME and much more. The scheme as a whole has registered around two lakhs small-scale businesses in the MSME category and makes the sector of these businesses an organized one with holistic and maximum benefits. The MSME scheme for SC/ST entrepreneurs is recognized by the system separately and the MSME schemes benefits are provided for them.

2. Incubation

Under the incubation scheme, the government supports new and innovative ideas such as new designs and new products. The government provides financial assistance to Host Institutions (HI) which are exploring and implementing new ideas in their respective service sectors. The financial assistance pertains to 75-85% of the project cost with a maximum limit to INR 8 lakhs. This scheme actively promotes technological advances and knowledge innovations by financially assisting ingenious ideas. The eligibility for MSME schemes depends on the innovation that a company can come up with.

3. Women Entrepreneurship

Women entrepreneurs are at a lacking figure, with only 14% of all entrepreneurs being women. To promote and cater to the potential of women entrepreneurs, many schemes provide benefits and skill-training to young women who desire to take up entrepreneurship and MSMEs as an option. MSME schemes for enterpreneurs pdf are unmatched in providing help that is specifically available for women.

The scheme takes care of women who may not have adequate educational background for handling entrepreneurship and hence provides training in the field. A prize named ‘Outstanding Women Entrepreneur’ is awarded every year. The prize is given to recognise achievements and innovations of women entrepreneurs, hence it promotes entrepreneurship for women.

There are many other schemes that exist to serve the purpose. One such scheme is Income Generating Scheme, which provides training-cum-income generation through entrepreneurial activities. This scheme aims to make women economically well-founded and independent by financing their ideas and MSMEs. A Government MSME loan is also provided to bright women entrepreneurs.

4. Grievance Monitoring System

This scheme is launched to monitor and cater to all sorts of complaints and suggestions by business and MSME owners. It aims to make the system of grievance handling transparent and fast. Grievance and complaint lodging is simple and easy. It is a completely online process.

Many kinds of complaints and queries are attended by this monitoring system, though certain grievances regarding a Subjudice matter, any personal dispute, a case under RTI proceedings are usually not catered to.

One can track the status of their complaint by clicking on the ‘view status’ button on the website. There is a unique registration number attached to each complaint and the system keeps updating the progress of the complaint on a regular basis.

5. Zero Defect Zero Effect Scheme

The Zero Defect Zero Effect scheme also called the ZED scheme is a call to the manufacturing industry. It calls to manufacture goods that have zero defect, hence better quality products and also calls to manufacture goods in an environment friendly way so that it has ‘zero effect’ environment. This scheme is applicable for all MSMEs and addresses various issues of quality of goods that are manufactured and exported and ecological needs of the country and other countries around the world. The ZED maturity assessment model is established to certify manufactured products on various levels such as safety, performance, environmental responsibility, etc. This MSME schemes for exporters is a great benefit to exporters to foreign countries.

6. Credit Linked Capital Subsidy scheme

This scheme provides a capital subsidy of up to 15% for MSMEs to cater to advancements in technological needs. It aims to provide plants and machinery of MSMEs with state of the art, contemporarily relevant technology. The scheme aims to cater to MSMEs, including those dealing with khadi, coir and village units. The institutional finance availed by these for making a well-established and upgraded technology will be covered under the scheme. MSME Schemes for startups are also available under this scheme and any start-up requiring technological advancement can opt for it through here.

7. Quality Management Standards and Quality Technology Tools

This scheme aims to induce consciousness of quality in the products manufactured by the MSME sectors. This scheme inculcates a sense of good competitiveness among the different entrepreneurial establishments and hence ensures quality production of goods.

These tools of Quality Management Standards (QMS) and Quality Technology Tools (QTT) employs a sense of competition and hence competitive prices are also included in the act of manufacturing. The usage of these tools aims to instil a consciousness of using resources efficiently, improving quality of products, reducing rework on already manufactured goods, reducing inventory build-up at the various stages of the manufacturing process. This scheme’s implementation also helps in MSME export entrepreneurship as it inculcates a sense of international quality standards.

The scheme is implemented through awareness drives, workshops, study missions, teacher training projects, etc. This MSME schemes for food processing and food packaging industries is beneficial as it resorts to quality assurance.

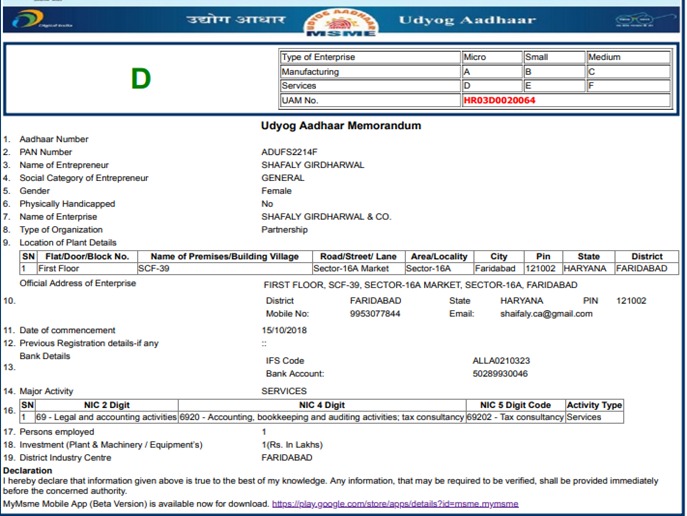

Documents required for Udyog Aadhaar new registration: –

When registering for Aadhaar Udyog, the documents required may include:

- Personal Aadhaar number

- Name of owner

- Category of applicant

- Name of business

- Type of organization

- Bank details

- Key activity

- National Industrial Classification code

- Number of persons employed

- Details of District Industry Centre (DIC)

- Date of commencement

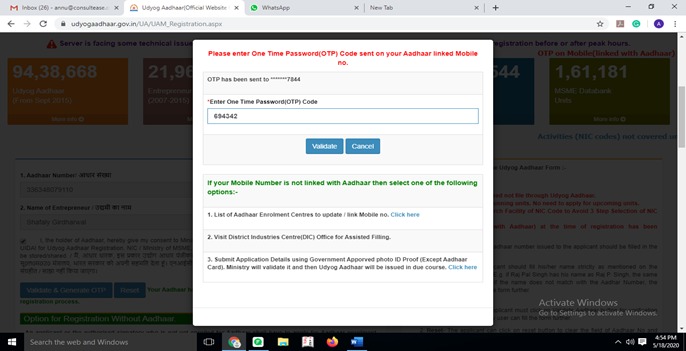

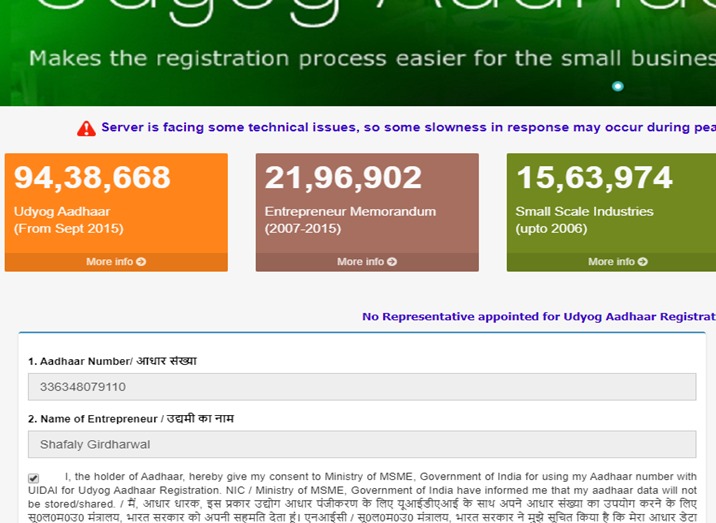

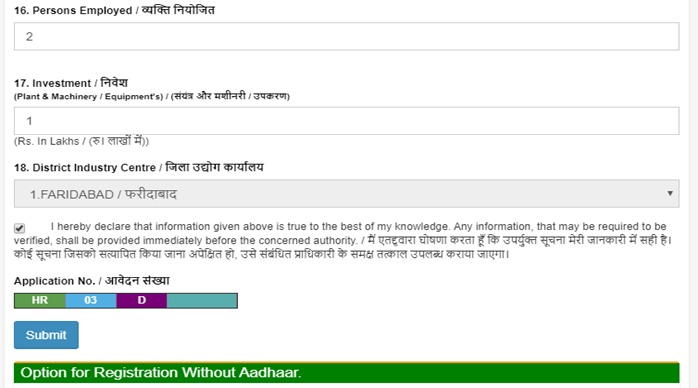

Udyog Aadhar free registration process:-

Go to the official Udyog Aadhar Registration portal where you will find the very first step for getting your business registered online.

- Aadhaar Number – 12 digit Aadhaar number issued to the applicant should be filled in the appropriate field.

- Name of Owner- The applicant should fill his/her name strictly as mentioned on the Aadhaar Card issued by UIDAI. E.g. if Raj Pal Singh has his name as Raj P. Singh, the same should accordingly be entered if the name does not match with the Aadhar Number, the applicant will not be able to fill the form further.

To Validate Aadhar:-

1. Validate Aadhar- The applicant must click on the Validate Aadhaar button for verification of Aadhaar, after that only user can fill the form further.

- Reset- The applicant can click on reset button to clear the field of Aadhaar No and Name of the owner for different Aadhaar.

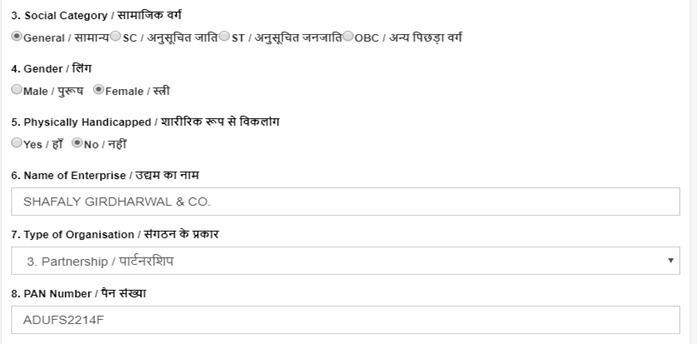

- Social Category- The Applicant may select the Social Category (General, Scheduled Caste, Scheduled Tribe or Other Backward Castes (OBC). The proof of belonging to SC, ST or OBC may be asked by an appropriate authority, if and when required.

- Gender– The Applicant can select the gender of Entrepreneur

- Physically Handicapped- The Applicant can select Physically Handicapped status of Entrepreneur

- Name of Enterprise- The Applicant must fill the name by which his/her Enterprise is known to the customers/public and is a legal entity to conduct business. One applicant can have more than one enterprise doing business and each one can be registered for a separate Udyog Aadhaar and with the same Aadhaar Number as Enterprise 1 and Enterprise 2 etc.

A combination of the same Aadhaar Number and Enterprise Name can be added second times. Only additional details can be added or deleted at the time of editing

7. Type of Organization- The Applicant may select from the given list the appropriate type of the organization for his/her enterprise. The Applicant must ensure that he/she is authorized by the legal entity (i.e. enterprise being registered for Udyog Aadhaar) to fill this online form. Only one Udyog Aadhaar number shall be issued for each enterprise.

8. PAN Number – The Applicant has to enter PAN Number in case of Co-Operative, Private Limited, Public Limited, and Limited Liability Partnership It. Will be optional in the remaining type of Organisation

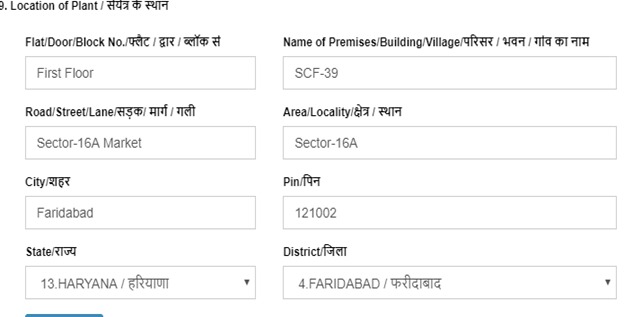

9.Location of Plant- The Applicant may add multiple plant location in one registration by clicking Add Plant button.

9.Location of Plant- The Applicant may add multiple plant location in one registration by clicking Add Plant button.

- Official Address– The Applicant should fill in the appropriate field the complete postal address of the Enterprise including State, District, Pin code, Mobile No and Email.

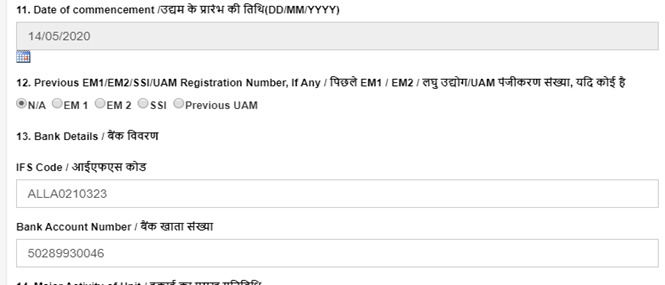

- Date of Commencement- The date in the past on which the business entity commenced its operations may be filled in the appropriate field.

- Previous Registration Details(if any)- If the Applicant’s enterprise, for which the Udyog Aadhaar is being applied, is already issued a valid EM-I/II by the concerned GM (DIC) as per the MSMED Act 2006 or the SSI registration prevailing prior to the said Act, such number may be mentioned in the appropriate place.

- Bank Details- The Applicant must provide his/her bank account number used for running the Enterprise in the appropriate place. The Applicant must also provide the IFS Code of the bank’s branch where his/her mentioned account exists. The IFS code is now a days printed on the Cheque Books issued by the bank. Alternatively, if the Applicant knows the name of the Bank and the branch where his/her account is there, the IFSC code can be found from the website of the respective Bank.

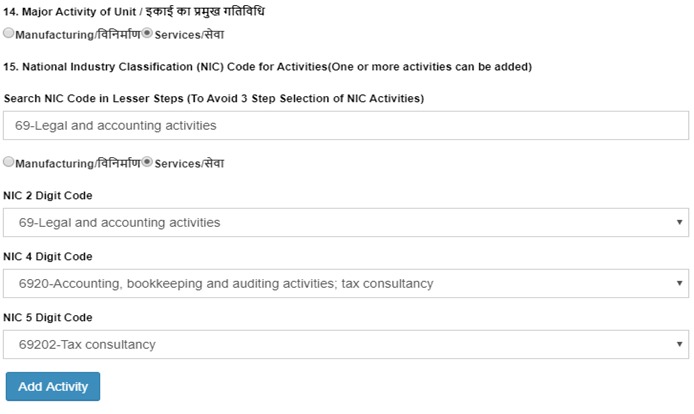

- Major Activity- The major activity i.e. either “Manufacturing” or “Service” may be chosen by the enterprise for Udyog Aadhaar. If your enterprise involves in both type of activities and if major work involves in Manufacturing and a small portion of activity involves in Service sector then select your major activity type as “Manufacturing” and if major work involves in Services and a small portion of activity involves in Manufacturing then select your major activity type as “Services”

- National Industry Classification Code(NIC Code)- The Applicant may choose multiple National Industrial Classification-2008 (NIC) Codes to includes all their activities. Which means the user can select multiple NIC code of Manufacturing and Service sector by clicking the “Add More” button. If you want to add Manufacturing then select the “Manufacturing” radio button and keep on adding by clicking the “Add More” button.

- Person employed- The total number of people who are directly been paid salary/ wages by the enterprise may be mentioned in the appropriate field.

- lnvestment in Plant & Machinery / Equipment- While computing the total investment , the original investment ( purchase value of items) is to be taken into account excluding tho cost of pollution control, research and development, industrial safety devices, and such other items as may be specified, by notification of RBI. If an enterprise started with a set of plant and machinery purchased in 2008 worth Rs. 70.00 lakh has procured additional plant and machinery in the year 2013 worth Rs. 65.00 lakh, then the total investment in Plant & Machinery may be treated as Rs. 135.00 lakh.

- DIC- The Applicant, based on the location of the Enterprise, has to fill in location of DIC. This Column will be active and show option only when there are more than one DIC in the district. In fact if there is only one DIC in the district system will automatically register you in the same DIC.

- Submit- Click on submit. Enter the OTP and CAPTCHA

How to Edit Udyog Aadhar Details?

- If you have already obtained a Udyog Aadhar number for your enterprise, then you must definitely be relieved.

- However, you should know that there might be some mistakes with your Udyog Aadhar details. In case any error has crept during the registration process, you shouldn’t be disheartened as there is a simple and straightforward way by which you can get rid of the problem.

- The ministry of MSME has recently launched a new provision that allows applicants to edit the Udyog Aadhar Memorandum. You can easily update or edit your information on Udyog Aadhar with a few clicks only.

- Go to Udyog Aadhar login

- Enter your Aadhar number, your name, and the OTP that you receive, and you will be able to edit or update your information.

What are the activities specifically excluded from coverage under MSME?

Ministry of Micro, Small and Medium Enterprises (MSME) has clarified as per notification S.O 2576 (E) dated 18.09.2015 and subsequent notification no S.O 85(E) dated 10.1.2017, activities that would be specifically not included in the manufacturing or production of commodities or rendering of services as per Section 7 of the said Act.

- Forest and Logging

- Fishing and aquaculture

- Wholesale, retail trade and repair of motor vehicle and motorcycles

- Wholesale trade except for motor vehicles and motorcycles.

- Retail Trade Except of Motor Vehicles and motor cycles

- Activities of households as employees for domestic personnel

- Undifferentiated goods and services producing activities of private households for own

- Activities of extraterritorial organisations and bodies

What is the validity of the certificate?

There is no expiry of the Udyog Aadhar Certificate. As long as the entity is ethical and financially healthy there will be no expiry of the certificate.

How to apply for Mudra loan in 59 minutes?

Procedure for applying Mudra Loan Online. This is not a government portal but it was recommended by the government.

The following is the stepwise detail to apply for Mudra loan online:

Step 1: Go to psbloansin59minutes.com/home and Click on “Apply Now”

Step 2: Sign up for the loan application by entering your Name, Mail Id and Mobile and click on Send

OTP button. An OTP will be received on the mobile. Enter the OTP and click on the Proceed button.

You will be prompted to enter a new password for log in. Enter the password and click on “Proceed”

Step 3: Submit your requirement

In the next step you will be asked to submit your requirement i.e. whether you want MSME loan or Business loan under Mudra Scheme.

Select “Mudra Loan” and Click on Proceed

*Step* 4: Filing of Loan application form:

The loan application is of 3 parts:

Provide Your Data in excel format.

Select Banking Partner and the wait for the approval. It is claimed by the government that it takes only 59 minutes.

FAQ’s on Practical issues:

- If I want to start a business in the coming years, Can I apply for a certificate now?

Ans: No, MSME certificate is only for running unit

- If my registration is AADHAR based?

Yes, you can register only with Aadhar

- What if my name at Aadhar is not matching with my real name?

You need to use the name as entered in the Aadhar database. Otherwise registration will not be granted.

- What are the charges for MSME registration

It is free of cost. There are no charges for registration of Udyog Aadhar

- How can I make separate registration for separate units under the same Aadhar?

Yes, you can register separate units under the same Aadhar

- What to fill in the commencement date?

In the case of a company you have a date on commencement of business certificate.

In case of partnership or proprietorship fill an actual date when you started a business.

- Employee detail is mandatory?

Yes it is mandatory

- What amount I should mention in investment. Did I make an investment from time to time?

All investments made from time to time will be accumulated together. We need to fill that complete amount.

- Do we also need to see credit scores while applying for the MSME loan?

No, You don’t need to see the credit score for the MSME loan.

Watch this video for a detailed discussion

If you already have a premium membership, Sign In.