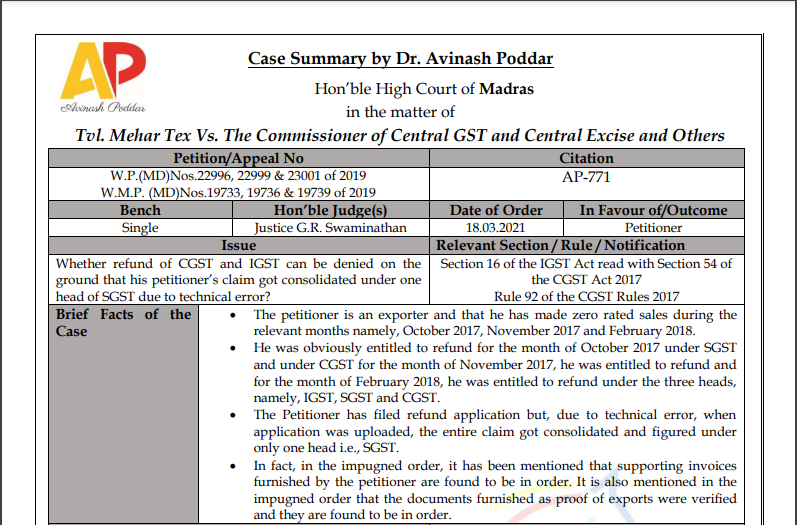

Madras High court in the case of Tvl. Mehar Tex

Case Covered:

Tvl. Mehar Tex

Versus

The Commissioner of Central GST and Central Excise

Issue:

Whether refund of CGST and IGST can be denied on the ground that his petitioner’s claim got consolidated under one head of SGST due to technical error?

Relevant Section / Rule / Notification:

Section 16 of the IGST Act read with Section 54 of the CGST Act 2017, Rule 92 of the CGST Rules 2017

Brief Facts of the Case:

• The petitioner is an exporter and that he has made zero-rated sales during the relevant months namely, October 2017, November 2017, and February 2018.

• He was obviously entitled to refund for the month of October 2017 under SGST and under CGST for the month of November 2017, he was entitled to refund and for the month of February 2018, he was entitled to refund under the three heads, namely, IGST, SGST, and CGST.

• The Petitioner has filed a refund application but, due to technical error, when the application was uploaded, the entire claim got consolidated and figured under only one head i.e., SGST.

• In fact, in the impugned order, it has been mentioned that supporting invoices furnished by the petitioner are found to be in order. It is also mentioned in the impugned order that the documents furnished as proof of exports were verified and they are found to be in order.

Brief Arguments by Petitioner/ Appellant:

According to the petitioner, they are entitled to a corresponding refund under all three heads, namely, SGST, CGST, and IGST. However, when the refund applications were uploaded, the entire claim got consolidated and figured under the head of SGST alone. While considering the refund applications, the second respondent restricted the refund claim to the extent of the petitioner’s liability for the respective months only under the head of SGST under Rule 92 of CGST Rules, 2017 and rejected the refund claims made in respect of the other heads. In any event, the petitioner had submitted the refund application manually also. Questioning the same, these writ petitions came to be filed.

Brief Arguments by Respondents:

The stand of the respondents is that the respondents cannot be faulted for having passed the impugned orders. The respondents considered the claim of refund made by the petitioner under the head of SGST and finding that the refund claim was available only to a limited extent and granted relief to that extent. If according to the petitioner, there was some technical error due to technical glitches, it was the responsibility of the petitioner to have brought it to the notice of the concerned authority for taking immediate action. In the case on hand, the petitioner has not done so. Therefore, the learned Standing counsel called upon this Court to sustain the orders impugned in these writ petitions.

Related Topic:

Epiphany by the Madras High Court in TRAN-1 debate

Judgement/ Ratio (in brief):

The petitioner has registered himself with the third respondent and they are also filing monthly returns under the Goods and Service Tax Act. The petitioner’s case is that they had made zero-rated sales during the months October 2017, November 2017, and February 2018.

I carefully considered the rival contentions and went through the materials on record.

The only question is whether the petitioner’s claim for refund on CGST and IGST can be denied on the ground that his claim got consolidated under one head of SGST. The petitioner’s specific case is that due to error and a new system of software in GST, the entire refund liability of ITC got auto-populated under the head of SGST instead of CGST, SGST, and IGST.

Related Topic:

No GST on Notice pay: Madras High Court

If due to an error on the part of any software in GSTN, this had occurred obviously, the petitioner cannot be expected to produce a proof for the same. In any event, the petitioner had submitted the refund applications manually also. If the petitioner was otherwise eligible to refund, on the ground of technical glitches and errors have occurred due to auto-population, the petitioner ought not to be denied relief. Nothing can be more unfair.

Therefore, the orders impugned in these writ petitions are set aside to the extent they reject the refund claim of the petitioner made under CGST and IGST. The matter is remitted to the file of the second respondent. The second respondent will verify if the petitioner is otherwise eligible for a refund. If the second respondent is satisfied, a refund will be made to the petitioner herein. This exercise shall be done within a period of eight weeks from the date of receipt of a copy of this order.

These writ petitions stand allowed accordingly. No costs. Consequently, connected miscellaneous petitions are closed

Head Note/ Judgement in Brief:

Refunds of CGST and IGST can be denied on the ground that his petitioner’s claim got consolidated under one head of SGST due to technical error. NO

Authors View:

In the present matter, the error was committed due to new software and the procedural issue. Therefore, the Hon’ble Court has rightly remanded back the matter to the file of the respondent authority to verify whether the petitioner is entitled for refund legally and if yes then the refund to be made. This exercise to be done within 8 weeks from the date of receipt of the copy of order. A legal right cannot be withheld merely due to some procedural issue and in this matter there was issue at the end of the software.

If you already have a premium membership, Sign In.

Dr. Avinash Poddar

Dr. Avinash Poddar

Ahemdabad, India

Avinash Poddar, currently practicing as a lawyer, as a Law Graduate, a fellow member of Institute of Chartered Accountants of India, Certified Financial Planner, Microsoft Certified Professional and DISA (Diploma in Information Systems Audit) from ICAI. He has also completed various certificate courses of ICAI such as Arbitration, Forensic Accounting and Fraud Detection, Valuation, IFRS, Indirect Taxes. He has also completed post-graduate diploma is Cyber Crime (PGCCL).