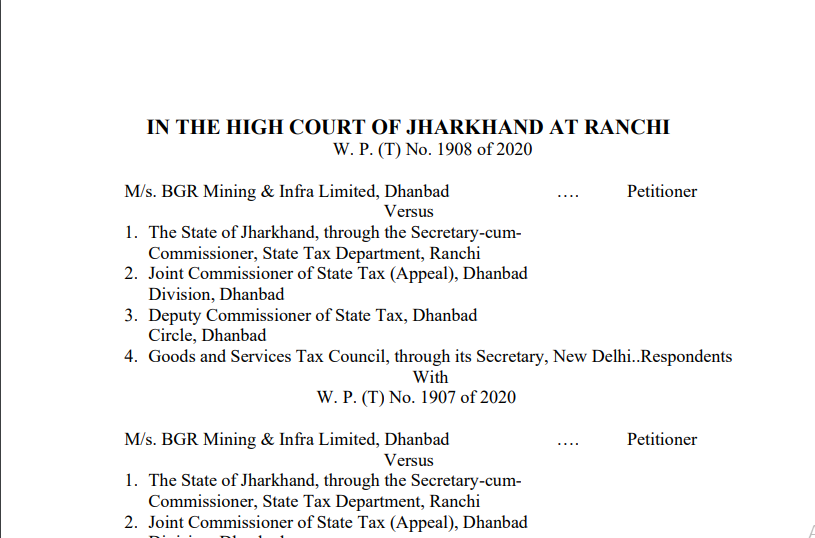

Jharkhand HC in the case of M/s. BGR Mining & Infra Limited Versus The State of Jharkhand

Case Covered:

M/s. BGR Mining & Infra Limited

Versus

The State of Jharkhand

Facts of the Case:

Heard learned counsel for the petitioner and learned counsel for the respondents.

In all these writ petitions, common appellate order dated 20th March 2020 bearing Memo No. 4263 passed by the respondent, Joint Commissioner of State Tax (Appeal), Dhanbad Division, Dhanbad in Appeal Case Nos. DH/GST-02/2019-20 (W. P (T) No. 1914 of 2020); DH/GST-03/2019-20 (W. P (T) No. 1909 of 2020); DH/GST-04/2019-20 (W. P (T) No. 1910 of 2020); DH/GST-05/2019-20 (W. P (T) No. 1913 of 2020); DH/GST-06/2019-20 (W. P (T) No. 1911 of 2020); DH/GST-07/2019-20 (W. P (T) No. 1907 of 2020); DH/GST-08/2019-20 (W. P (T) No. 1915 of 2020); DH/GST-09/2019-20 (W. P (T) No. 1921 of 2020); DH/GST-10/2019-20 (W. P (T) No. 1912 of 2020); DH/GST-11/2019-20 (W. P (T) No. 1908 of 2020) are under challenge relating to different periods from April, 2018 to January, 2019, whereby the appeal filed by the petitioner against the adjudication order levying interest upon the petitioner under Section 50 of Goods and Services Tax Act, 2017 on Gross Tax Liability has been dismissed. The total interest liability imposed by the adjudication order as upheld in appeal and furnished in the form of a chart in the impugned order for the period April 2018 to January 2019 amounts to Rs. 1,10,02,192/-. Petitioner has made a categorical statement in the respective writ petitions that he has discharged its interest liability on net tax liability i.e., interest on tax paid through an electronic tax ledger.

Related Topic:

Jharkhand HC in the case of Shree Nanak Ferro Alloys Pvt. Ltd. Versus The Union of India

Observations & Decision:

We have considered the submission of learned counsel for the parties in respect of the issue of levy of interest under Section 50 of the Act on the gross tax liability as upheld in appeal by the Respondent Joint Commissioner of State Sales Tax (Appeal), Dhanbad Division. We have also taken note of the CBIC circular dated 18th September 2020 quoted hereinabove. The Respondent-State by way of supplementary counter affidavit has made a categorical statement that after issuance of the above Administrative Instructions by CBIC, the State authorities are also imposing interest on Net Tax Liability. Having regard to the categorical stand of the respondent State, for the present, it appears to us that there is no purpose in keeping the writ petitions pending for decision on the challenge to the appellate order made herein on the grounds urged. However, liberty is reserved with the petitioner to approach the Court in case the respondent State chooses to realize interest on the gross tax liability for the subject period covered under the appellate order.

Accordingly, the writ petitions are disposed of in the aforesaid term.

Pending I.As seeking exemption from filing certified copies are closed.

Read & Download the full Decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.