Changes in Income Tax Returns AY 2019-20

This presentation on Changes in Income Tax Returns AY 2019-20 has been prepared for academic use only for sharing knowledge on the subject.

Change in e-filing mode

Compulsory e-filing

w.e.f. AY 2019-2020, only individuals with age > 80 years can now file paper return in these forms –

ITR – 1 Sahaj

ITR – 4 Sugam

E-filing is now virtually compulsory for everyone now!

Changes in the applicable form

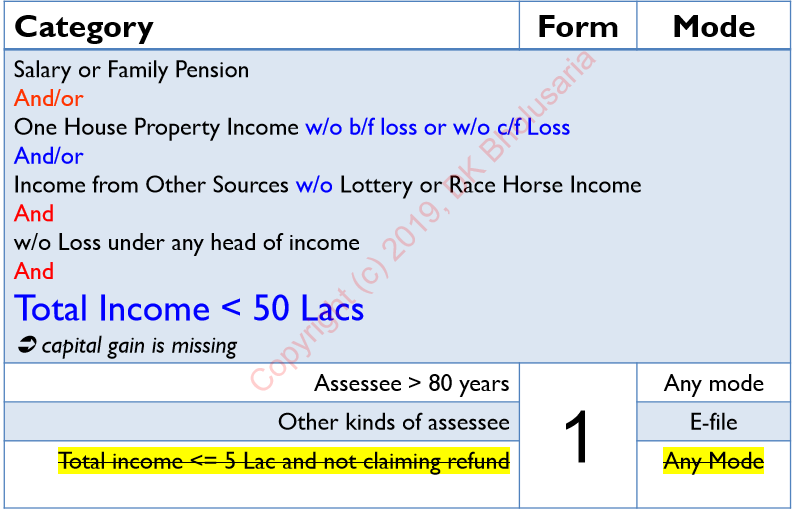

Forms for non-business assessee Individuals (only Ordinary Resident)

Form 1(Sahaj) is the simplest form but with lots of riders

From AY 2019-20, these ordinary residents are not allowed to file ITR-1

- who has claimed deduction under section 57, except for deduction u/s 57 (iia) i.e. family pension

- is a director in any company;

- has held any unlisted equity share at any time during the previous year;

- is assessable for the whole or any part of the income on which tax has been deducted at source in the hands of a person other than the assessee (see rule 37BA)

Following Ordinary residents were not allowed to file ITR-1 (till now)

- has assets (including financial interest in any entity) located outside India;

- has signing authority in any account located outside India;

- has income from any source outside India

- has the income to be apportioned in accordance with provisions of section 5A (i.e. Portuguese Civil Code)

- has claimed any relief of tax under section 90 or 90A or deduction of tax under section 91

- has agricultural income, exceeding five thousand rupees

- has income taxable under section 115BBDA

- has an income of nature referred to in section 115BBE

Forms for non-business assessee Individual and HUFs

|

Category |

Form |

Mode |

|

All Individuals – With no income under head of PGBP (even if it is proprietary business only). – Not eligible to file ITR-1 All HUFs with no business income |

||

|

All kinds of assesses |

2 |

E-File only |

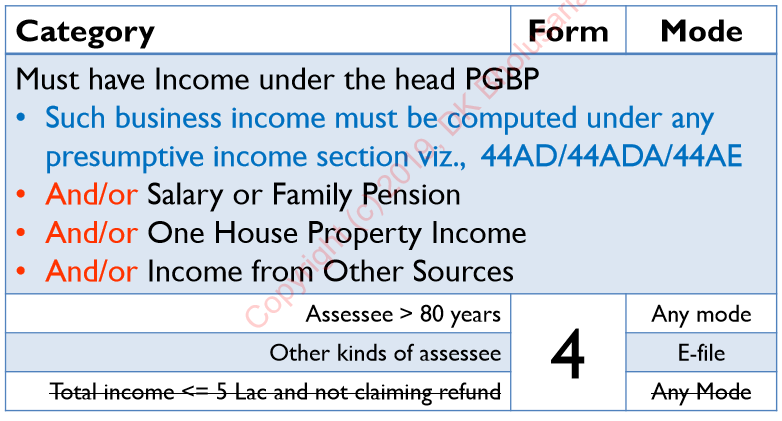

Forms for Business Assessee

Individuals, HUFs & Firms (not LLP)

–Only presumptive business income -Only ordinary residents

From AY 2019-20, following ordinary residents are not allowed to file ITR-4 (similar to ITR-1)

- has claimed deduction under section 57, except for deduction u/s 57 (iia) i.e. family pension

- is a director in any company;

- has held any unlisted equity share at any time during the previous year;

- is assessable for the whole or any part of the income on which tax has been deducted at source in the hands of a person other than the assessee (see rule 37BA)

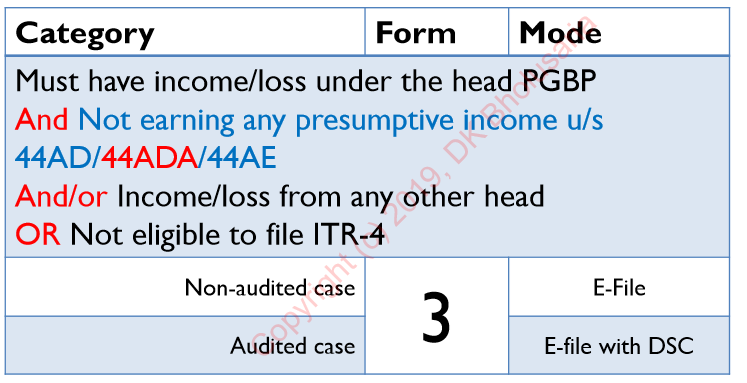

Forms for Business Assessee

Individuals and HUFs

–Non-presumptive business income

Forms for Business Assessee Companies

|

Category |

Form |

Mode |

|

All Companies excluding section 8 company on which section 139(4A~4F) applies |

6 |

E-file With digital signatures only |

Forms for Business Assessee Trusts etc.

|

Category |

Form |

Mode |

|

Trusts and organisations referred to section 139(4A) / (4C) / (4D) / (4E) / (4F) including section 25 company on which section 139(4A~4D) applies |

7 |

E-file |

|

All Political parties – Section 139(4B) |

7 |

E-file With digital signatures only |

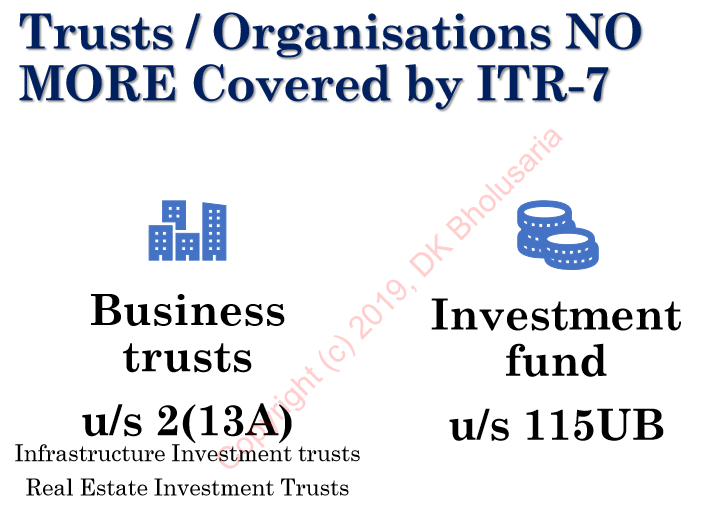

Trusts / Organisations NO MORE Covered by ITR-7

Trusts / Organisations Covered by ITR-7 w.e.f. AY 2019-20

- Charitable or religious trusts u/s 11 or 12

- Political Parties referred to in section 13A

- Research association – Section 10(21)

- News agency – Section 10(22B)

- Association or institution – Section 10(23A)

- A person referred to in Section 10 (23AAA)

- Institutions covered in Section 10 (23B)

- Fund or institution – Section 10(23C)(iv)

- Trust or institution – Section 10(23C)(v)

- University or other educational institutions – Section 10(23C) (iiiab)/(iiiad)/(vi)

- Hospital or other medical institutions – Section 10(23C) (iiiac)/(iiiae)/(via)

- Mutual Fund – Section 10(23D)

- Securitization trust – Section 10(23DA)

- Investor Protection Fund – Section 10 (23EC) or clause (23ED)

- Core Settlement Guarantee Fund – Section 10 (23EE)

- Venture capital company or venture capital fund – Section 10 (23EE)

- Trade union – Section 10(24)(a)/(b)

- Board or Authority – Section 10(29A)

- Infrastructure debt fund – Section 10(47)

- Body or authority or Board or Trust or Commission (by whatever name called) – Section 10(46) 21. University, college or other institution – Section 35(I)(ii)/(iii)

Key changes in forms

Details of No. of days in India

- Individual taxpayers are also required to select the condition based on which the residential status has been determined, i.e as per the number of stay days in India in the relevant tax year and previous years.

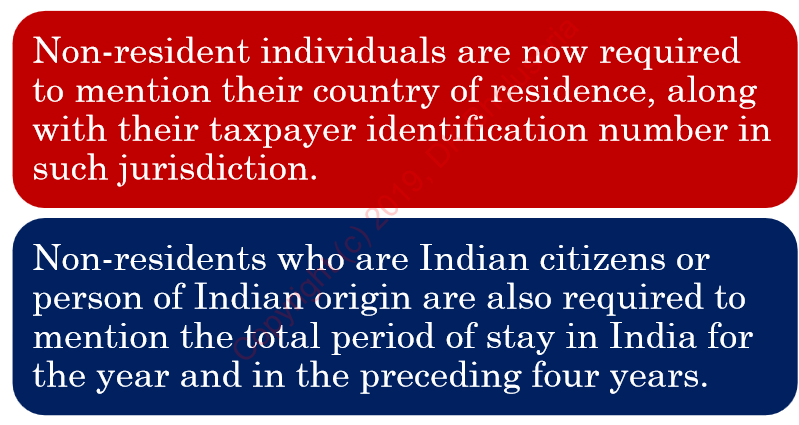

Non-residents individuals

Directorship details (to find out shell companies)

- Name of Company

- PAN of company

- Company is listed or unlisted

- DIN

You can download full ppt of Changes in Income Tax Returns AY 2019-20 by clicking here

If you already have a premium membership, Sign In.

Deepak Bholusaria, CA

Deepak Bholusaria, CA

Quitters do not win, winners do not quit.

Delhi, India

Mr. Deepak Bholusaria is a commerce graduate and fellow member of the Institute of Chartered Accountants of India. He has also completed various certificate courses of ICAI on Indirect taxes, Blockchain, Information Systems Audit, and Valuation. A seasoned professional, author, speaker, public figure and YouTuber with 21 years of experience.