Update on Instructions for filling out Form ITR-7

Update on Instructions for filling out Form ITR-7

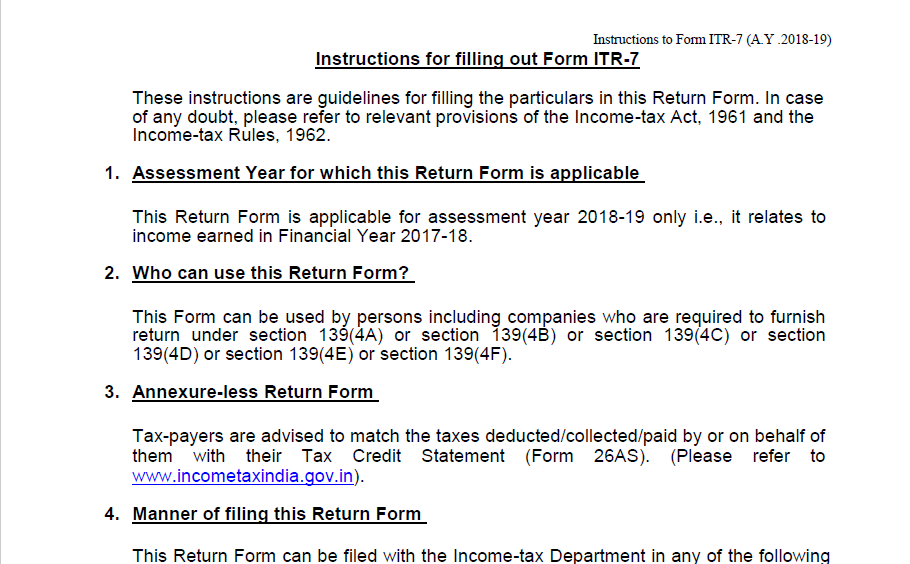

On the 1st September 2018, the e-filing site has updated on Instructions for filling out Form ITR-7. Following are the instructions issued:

These instructions are guidelines for filling the particulars in this Return Form. In case of any doubt, please refer to relevant provisions of the Income-tax Act, 1961 and the Income-tax Rules, 1962.

1. Assessment Year for which this Return Form is applicable

This Return Form is applicable for the assessment year 2018-19 only i.e., it relates to income earned in Financial Year 2017-18.

2. Who can use this Return Form?

This Form can be used by persons including companies who are required to furnish return under section 139(4A) or section 139(4B) or section 139(4C) or section 139(4D) or section 139(4E) or section 139(4F).

3. Annexure-less Return Form

Tax-payers are advised to match the taxes deducted/collected/paid by or on behalf of them with their Tax Credit Statement (Form 26AS). (Please refer to www.incometaxindia.gov.in).

4. The manner of filing this Return Form

This Return Form can be filed with the Income-tax Department in any of the following ways: –

(i) by furnishing the return electronically under digital signature;

(ii) by transmitting the data in the return electronically under electronic verification code;

(iii) by transmitting the data in the return electronically and thereafter submitting the verification of the return in Return Form ITR-V;

However, a political party shall compulsorily furnish the return in the manner mentioned at (i) above.

In case an assessee is required to furnish a report of audit under sections 10(23C)(iv), 10(23C)(v), 10(23C)(vi), 10(23C)(via), 10AA, 12A(1)(b), 44AB, 44DA, 50B, 80-IA, 80-IB, 80-IC, 80-ID, 80JJAA, 80LA, 92E, 115JB or 115JC, he shall file such report electronically on or before the date of filing the return of income.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.