Section 194I – TDS on Rent under income Tax

- What is TDS on Rent u/s 194I?

- Why is Section 194I a part of the Income Tax Act?

- What Payment is Covered u/s 194I?

- i. Income from letting out of factory building

- ii. Rent includes service charges

- iii. TDS requirement where building and furniture, etc., let out by separate persons

- iv. TDS requirement where rent not payable on a monthly basis

- v. Charges regarding cold storage facility

- vi. Hall rent paid by an association for use of its members

- vii. Payments to hotels for holding seminars including lunch

- Who shall pay TDS u/s 194I?

- Meaning of Rent under TDS Section 194I:

- What is the Point of Deduction of TDS?

- What is the rate of TDS u/s 194I?

- What is the time of deduction under TDS Section 194I?

- What is the exemption limit for TDS on rent under Section 194-I?

- Consequences of non-deduction/non-deposit of TDS on rent

- Download the copy:

What is TDS on Rent u/s 194I?

- This section is applicable to any person who is responsible for the payment of rent. He is liable to deduct and deposit the TDS on Rent. However, an individual or a HUF who is not liable for audit us 44AB is exempted.

- This provision is applicable only to the rent payable to a resident.

- As per the Budget 2017, an Individual or HUF (not liable for Tax Audit) paying rent to a resident exceeding an amount of Rs. 50,000 per month is also liable to deduct TDS @ 5%. This amendment will be effective from 01.06.2017

- In case the aggregate of the amount of rent credited or paid or likely to be credited or paid during the financial year exceeds Rs.1,80,000/-.

- The TDS threshold for deduction of tax on rent is increased from Rs. 1,80,000 to Rs. 2,40,000 for FY 2019-20 onwards.

- There is no surcharge unless the amount is more than Rs.1 crore.

- Rent paid to a government body/agency, is exempt from TDS.

|

Year |

Threshold Limit |

|

F.Y. 18-19 |

> 1,80,000 |

|

F.Y. 19-20 |

> 2,40,000 |

|

F.Y. 20-21 |

>2,40,000 |

Why is Section 194I a part of the Income Tax Act?

Letting out the property is a normal source of generating revenue. Earlies landlords were used to collecting the rent in cash and skip the tax liability on it. But tenant may be claiming those expenses in their P&L. TDS on rent is inserted into income tax ACt to plug this loophole. Now a recipient cant claims any benefit. He will deduct and deposit TDS. The landlord will have to include it in their total income.

What Payment is Covered u/s 194I?

i. Income from letting out of factory building

- Where a factory building is let out, the rent received generally is income from business in the hands of the lessor or the owner of the factory. Only in a few cases, it is income from property in the lessor’s hands.

- But such payment also, which is business income in the hands of the lessor and for which he will necessarily be paying advance tax and finally be returning the rental income, will be subject to tax deduction at source or TDS.

- This is an unnecessary burden on both taxpayers and the tax administrator because the collection of tax will take place as TDS from the lessor without much delay.

ii. Rent includes service charges

- Service charges payable to business centers are covered under the definition of rent, as they cover payments by whatever named called.

iii. TDS requirement where building and furniture, etc., let out by separate persons

- In the case where a building is let out by one person and furniture and fixtures are let out by another person, then the payee is required to deduct tax under Sec. 194I only from the rent paid/credited for the hire of building.

iv. TDS requirement where rent not payable on a monthly basis

- Sec. 194I does not mandate that the tax deduction should be made on a month-to-month basis.

- Therefore, if the crediting of the rent is done on a quarterly basis, the deduction at source will have to be made on a quarterly basis only. Where the rent is paid on a yearly basis, deduction also will have to be made once a year on the basis of the actual payment or credit.

v. Charges regarding cold storage facility

- Rent paid for cold storage is not covered here. Cold storage is a plant and rent is paid for the use of plants. It is not paid for the use of the building. But in the case of another warehouse, it is applicable.

vi. Hall rent paid by an association for use of its members

- Since the association is assessed as an association of persons and not as an individual or HUF, the obligation of tax deduction will be there, provided payment for the use of hall exceeds Rs.2,40,000 from FY 2019-20 onwards (earlier it was Rs.1,80,000).

vii. Payments to hotels for holding seminars including lunch

- Where hotels do not charge for use of premises but charge for catering/meal only, the provisions of Sec. 194I would not apply. However, Sec.194C would apply for the catering part.

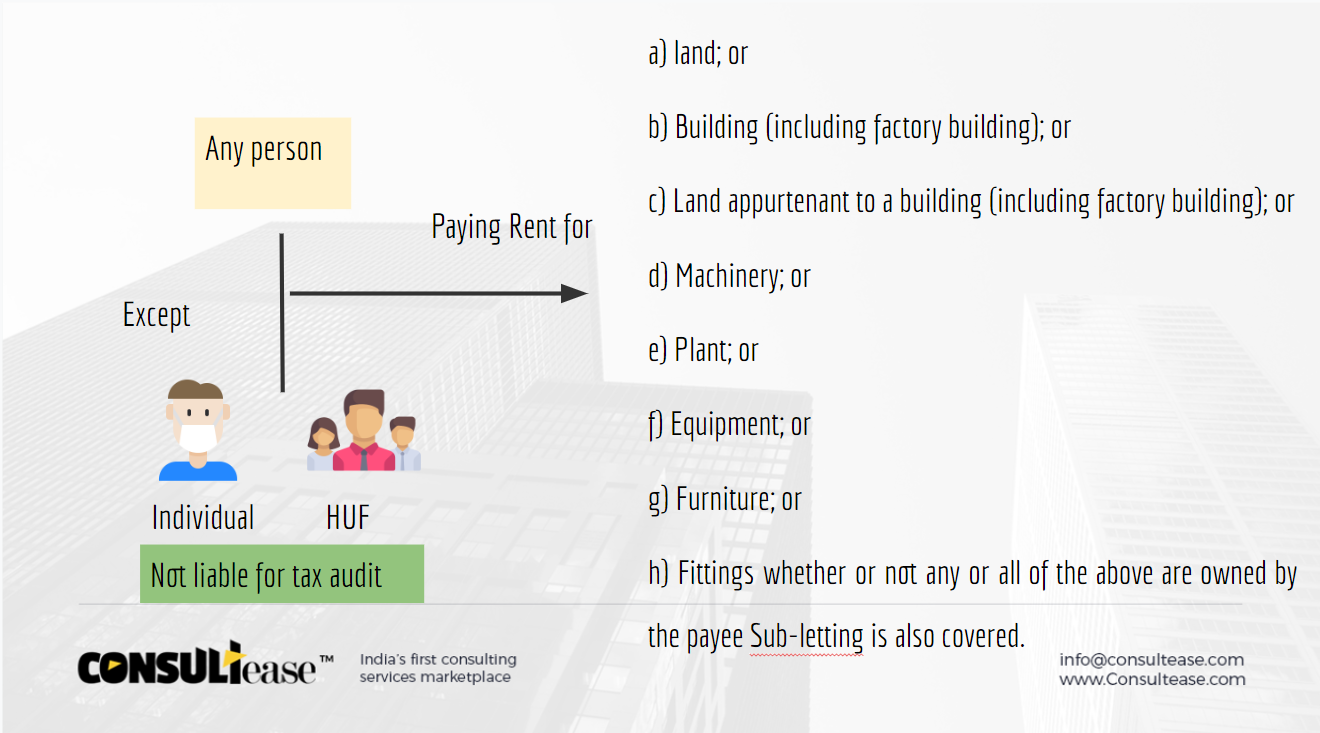

Who shall pay TDS u/s 194I?

- Any person other than an individual or HUF who is liable to pay an income in the form of rent

- To any resident shall deduct TDS under u/s 194I

- At the time of credit or payment whichever is earlier

*Individuals/HUF whose gross receipts/ turnover from any business or profession exceeds Rs 1 crore in case of business and 50 lacs in case of the profession during the immediately preceding FY shall be liable to deduct TDS u/s 194I

Meaning of Rent under TDS Section 194I:

(i) Rent means any payment made for the use of (either separately or together) any –

- land; or

- building (including factory building); or

- land appurtenant to a building (including factory building); or

- machinery; or

- plant; or

- equipment; or

- furniture; or

- fittings,

(ii) under any lease, sub-lease, tenancy or any other agreement or arrangement

(iii) irrespective of the fact that any or all of the above are owned by the payee.

What is the Point of Deduction of TDS?

Tax is required to be deducted at source at the time of credit of ‘income by way of rent’ to the account of the payee or at the time of payment, thereof, in cash or by the issue of a cheque or draft or by any other mode, whichever is earlier.

What is the rate of TDS u/s 194I?

TDS on rent under section 194I shall be deducted at the following rates:

i. 2% in respect of rent paid for the plant, machinery, or equipment

ii. 10% in respect of other rental payments covered under the scope of TDS Section 194I

(i.e., rent for use of any land or building, including factory building, or land appurtenant to a building, including factory building, or furniture or fixtures).

What is the time of deduction under TDS Section 194I?

Under Section 194I TDS is deducted: –

- at the time of credit of such income to the account of the payee or

- at the time of payment in cash/by the issue of cheque/draft or by any other mode

whichever is earlier.

Where any such income is credited to any account, whether called " Suspense account" or by any other name, in the books of account of the person liable to make such payment, such crediting shall be deemed to be the credit of such income to the account of the payee and the provisions of this section will apply accordingly.

What is the exemption limit for TDS on rent under Section 194-I?

The exemption limit under TDS Section 194I is Rs 2,40,000. That is TDS shall not be deducted during the FY if the amount of such income or the aggregate of the amounts of such income credited or paid or likely to be credited or paid to the account of the payee does not exceed Rs 2,40,000.

Example: –

X company Ltd runs its business on a rented building, and monthly rent is 25000 INR. The building owner is an individual MR.A. As per Income tax rule Tax to be deducted on certain kinds of transactions, a certain percentage from the source. In this example, X Company is paying Rent which is the source of Income to MR.A. and it is the duty of Payer to deduct TDS on rent and deposit to the government on behalf of the deductee. Deductee is a person from whom the tax is deducted.

So, The total of Rent paid in our example is 12 x 25000= 300000 Which attract TDS @ 10%.

The deduction can be done at the time of making payment /crediting the income to the lesser account monthly /quarterly/ yearly @ 10 %. The section does not make it compulsory to deduct TDS monthly.

Consequences of non-deduction/non-deposit of TDS on rent

- A taxpayer who is liable to deduct TDS will be liable to pay interest @ 1% per month from the date when tax is deductible till the date when tax is deducted.

- A taxpayer who has deducted tax but not deposited the same to the government is liable to pay interest @ 1.5% per month from the date when tax is deducted to the date of deposit of the TDS.

Download the copy:

If you already have a premium membership, Sign In.