MEDIUM TERM FISCAL POLICY CUM FISCAL POLICY STRATEGY STATEMENT

MEDIUM TERM FISCAL POLICY CUM FISCAL POLICY STRATEGY STATEMENT

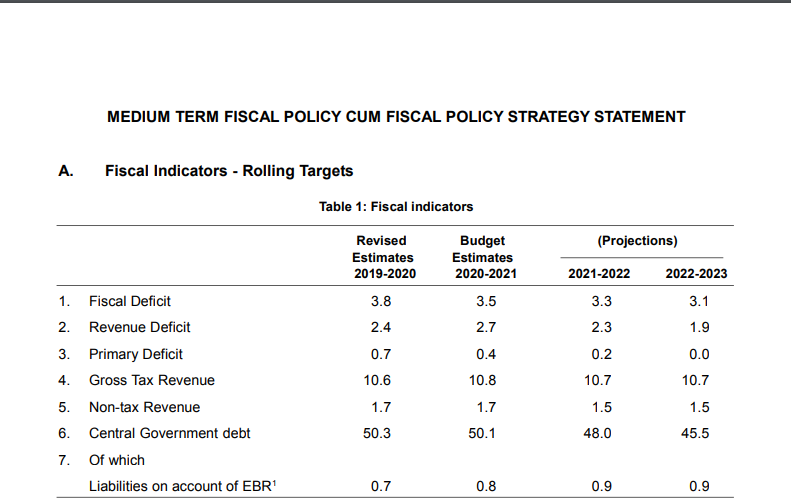

A. Fiscal Indicators – Rolling Targets

1. 2019-20 has witnessed a moderation in growth rates as mentioned in the Macroeconomic Framework Statement. The Government, faced with the task of implementing counter-cyclical policies while walking the fiscal tight rope has focused on maintaining the quality of expenditure. The details of the composition of expenditure are given in the later section of the Statement.

2. The government has initiated structural reforms both on the supply and the demand side. Some of the measures taken have been mentioned in the Framework statement. These have fiscal implications and are important tools to boost economic performance. The impact of these measures initiated is anticipated to have a spill-over effect in the next financial year. In short, the measures initiated by the Government to cement the economic recovery are anticipated to have effects in the next FY as well. In the changed scenario, the government has revised its fiscal roadmap in the near term.

3. It is anticipated that there will be a variation in the fiscal deficit of 0.5 percent of GDP in 2019-20 and 2020-21 to provide adequate space for countercyclical fiscal measures taken for boosting investments. The target for 2019-20 has been revised to 3.8 percent of GDP. The fiscal deficit target for 2020-21 has been revised to 3.5 percent of GDP The objectives of the FRBM Act are a guide to the Government’s fiscal operations and the fiscal deficit target is anticipated to be achieved in the medium – term. The fiscal deficit is expected to decrease to 3.1 percent of GDP by 2022-23.

4. In addition, a stimulus of nearly ` 1 lakh crore (0.5 percent of GDP) has been provided by way of lowering of Corporation Tax rates ensuring that adequate surpluses are available for private investment. A fine balance has been kept in BE 2020-21 by providing adequate resources for meeting revenue expenditure and boosting Capex while keeping the fiscal deficit at 3.8 percent and 3.5 percent for the years 2019-20 and 2020-21 respectively.

Medium-Term prospects about Revenue Receipts

5. The Gross Tax Revenue is anticipated to grow at the rate of 12.3 percent in 2021-22 and 12.6 percent in 2022-23 over previous years. The growth in direct taxes has slowed in 2019-20 due to the cut in corporation tax. While the growth indirect taxes are expected to be 13.6 percent and 13.8 percent, the growth rate in indirect taxes are expected to be slightly muted at 10.7 percent and 11.1 percent in the years 2021-22 and 2022-23 respectively.

Fiscal Outlook for RE 2019-20

6. The target of fiscal deficit is 3.8 percent of GDP 1 in RE 2019-20 compared to the budgeted level of 3.3 percent of GDP. There has been a decrease in Gross Tax Revenue estimates mainly on account of lesser than an anticipated collection of GST and a reduction in Corporation Tax rates. Receipts anticipated from indirect taxes have been revised to reflect a growth of 5.3 percent over the 2018-19 Provisional Actuals, whereas RE 2019-20 for Direct tax reflects a growth of 2.9 percent over the previous year. Corporate tax where a decrease of ` 1,55,500 crore over BE level. NonTax Revenue Receipts are estimated to increase by ` 32,334 crores over BE level.

7. Non-Debt Capital receipts are anticipated to reduce by ` 38,224 crores over BE 2019-20, mainly on account of lower disinvestment receipts. Revised estimates for non-debt capital receipts have been kept at `81,604 crores. The absolute value of Fiscal Deficit has been revised to `7,66,848 crore in RE which reflects an increase of `63,087 crores over BE 2019-20.

8. In RE 2019-20, total expenditure has been estimated at `26,98,552 crore which reflects a decrease of `87,797 crores from BE 2019-20. Revenue expenditure in RE 2019-20 is `23,49,645 crore, while Capital expenditure, estimated at `3,48,907 crore in RE, shows an increase of `10,338 crores over BE 2019-20.

Fiscal Outlook for BE 2020-21

9. Fiscal deficit in 2020-21 is expected to be 3.5 percent of GDP. As mentioned earlier, this is on account of the structural reform measures initiated by the Government, The GTR is budgeted at `24,23,020 crore in BE 2020-21 which reflects a growth of `2,59,597 crore (12 percent) over RE 2019-20. Direct taxes are expected to grow at 12.7 percent over the previous year to reach `13,19,000 crore in BE 2020-21. Indirect taxes are budgeted at `10,99,520 crore in BE 2020-21 showing an increase of 11.1 percent over RE 2019-20. Non-Tax Revenue collections in 2020-21 are budgeted at `3,85,017 crore which reflects a growth of 11.4 per cent over RE 2019-20.

10. Non-Debt Capital receipts have been budgeted at `2,24,967 crore in BE 2020-21 indicating an increase of `1,43,363 crore over RE 2019-20. An amount of `90,000 crores has been budgeted in disinvestment receipts from Public Sector Banks and other Financial Institutions. Total net borrowings in 2020-21 are projected at `7,96,337 crore as compared to ` 7,66,848 crore in RE 2019-20.

11. Total expenditure in 2020-21 is pegged at `30,42,230 crore which is an increase of `3,43,678 crore (12.7 percent) over RE 2019-20. Revenue Expenditure is estimated to be `26,30,145 crore in BE 2020-21 reflecting year-on-year growth of 11.9 percent. Capital expenditure is expected to expand to `4,12,085 crore reaching 1.8 percent of GDP in 2020-21 compared to 1.7 percent in 2019-20.

Assumptions underlying the Fiscal Indicators –

Revenue receipts

Tax-Revenue

12. Gross Tax Revenue (GTR) has been pegged at `21,63,423 crore in RE 2019-20 which reflects a decrease of `2,97,772 crore from BE 2019-20. The reasons for this shortfall are the reductions in Corporation tax. For BE 2020-21, GTR is expected to be `24,23,020 crore which works out to be 10.8 percent of GDP. Overall, a year-on-year growth of 4 percent and 12 percent is expected in 2019-20 and 2020-21 respectively. In the medium term, GTR is expected to grow at 12.3 percent in 2021-22 before growth rate picks up to 12.6 percent in 2022-23 respectively over the previous year.

13. The direct tax has also been revised to `13,19,000 crore whereas Indirect tax is budgeted at `10,99,520 crore in BE 2020-21 which, as a percentage of GDP, works out to be 5.9 percent and 4.9 percent respectively. Direct tax collections are anticipated to reach 6 percent of GDP in 2022-23. The projections of direct tax revenues for FY 2021-22 & 2022-23 are computed with the following assumptions:

- Through Taxation Laws (Amendment) Act, 2019, several relief measures including a reduction in rates of corporate tax, roll-back of enhanced surcharge in certain conditions, and reduction in rates of Minimum Alternate Tax (MAT) were provided resulting in an estimated revenue loss of 1.45 lakh crore per annum. The impact of these relief measures have been taken into account in the RE for FY 2019-20

- There is no further change in tax rate or slabs or any of the tax provisions in the Income-tax Act, 1961.

14. Tax devolution to states in 2021-22 and 2022- 23 will be governed by the Fifteenth Finance Commission recommendation which will be brought out in their final report. The devolution formula of the first fifteenth FC report has been used for calculation of the centre’s share of tax revenue in the projection period.

15. Indirect taxes are expected to grow at 11.1 percent in 2020-21, 10.7 percent in 2021-22 and 11.1 percent in 2022-23. These assume no major change in the indirect tax policy during the projection years. For the financial years 2020-21 and 2021-22, Central GST, UTGST, and GST Compensation Cess are expected to have a buoyancy of 1.0 with respect to nominal GDP growth rates of the respective years.

16. Tax buoyancy in respect of Customs Duty has been assumed at 0.9 for each projection year. In the case of Central Excise, due to specific rate structure on MS/HSD, a growth of 6 percent has been applied for CS (POL) revenue projections for FY 2020-21 and 2021-22. This is at par with an average domestic POL consumption growth in the previous five years.

Download the copy:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.