Knowing the Taxability of Accommodation Benefits and Perks under Income Tax

Knowing the Taxability of Accommodation Benefits and Perks under Income Tax:

Knowing the Taxability of Accommodation Benefits and Perks under Income Tax Jyoti Jain

The accommodation may be a rental property or personal residence or company aided accommodation i.e. property on lease taken by employer, property owned by employer and hotel. In order to know the taxability of all such accommodations, let’s walk through the each type of accommodation and related income tax provisions

1. Rental Property

|

These days, employers are ready to reach the right talent whether available in another city or another country. They also provide various incentives and allowances to such employees including relocation expenses and accommodation facilities. In the new city, mostly, the |

|

employee identifies the house of his/her choice and the employer agrees to pick up the cost of the house rent by providing house rent allowance (HRA). The maximum amount of HRA exempted from tax under section 10(13A) is taken as the least of the following and any excess will be taxed: c) Excess of rent paid annually over 10 percent of annual salary. On the other hand, entrepreneurs and self-employed persons are the new age heroes of the country. Many entrepreneurs and self-employed persons are also moving out for exploring new fields. In this effort, they also look out other cities and move accordingly. They also opt for rental property for residential purposes in early stages. In such cases, there is no employer to provide HRA but section 80GG of the Income Tax Act allows self-employed individuals to claim deduction of rent from gross total income by filing declaration in Form 10BA. The minimum of the following can be taken as deduction under section 80GG: a) Rent paid in excess of 10 % of the total Income or; However, the deduction under section 80GG is not available, if: |

|

performs duties of his/her office or employment; or |

2. Personal Residence

If an employee owns a house in which he/she is living throughout the year and it is not let out or used for any other purpose, the property is called as ‘Self Occupied Property’ and the computation of income from such property is made under section 23 of Income Tax Act after claiming deduction under section 24 of the Act. The annual value of such property is taken as NIL. The interest on home loan, if any up to INR 2 Lakh is allowed as deduction subject to certain conditions.

The House Rent Allowance provided by employer in such cases is fully taxable.

However, if an employee owns a house in a city other than city of employment where he/she resides in a rented house, he/she can claim HRA exemption for rented house. Further, the house owned by employee but not occupied can be treated as self-occupied property in case the same is not let out at any time during the year and is not taxed under the head ‘income from house property’. HRA exemption is also possible in same city where an employee is owning a house but living in rented house. In such case, house owned by employee is treated as ‘let out property’ even if it remains vacant and accordingly, income from such property will be taxed.

In contrast, many entrepreneurs/founders start their journey from home and they use a portion of residential property for business. In such cases, only the portion which is being used for residential purposes is treated as self-occupied property and not taxed under the head ‘income from house property’.

3. Company Aided Accommodation

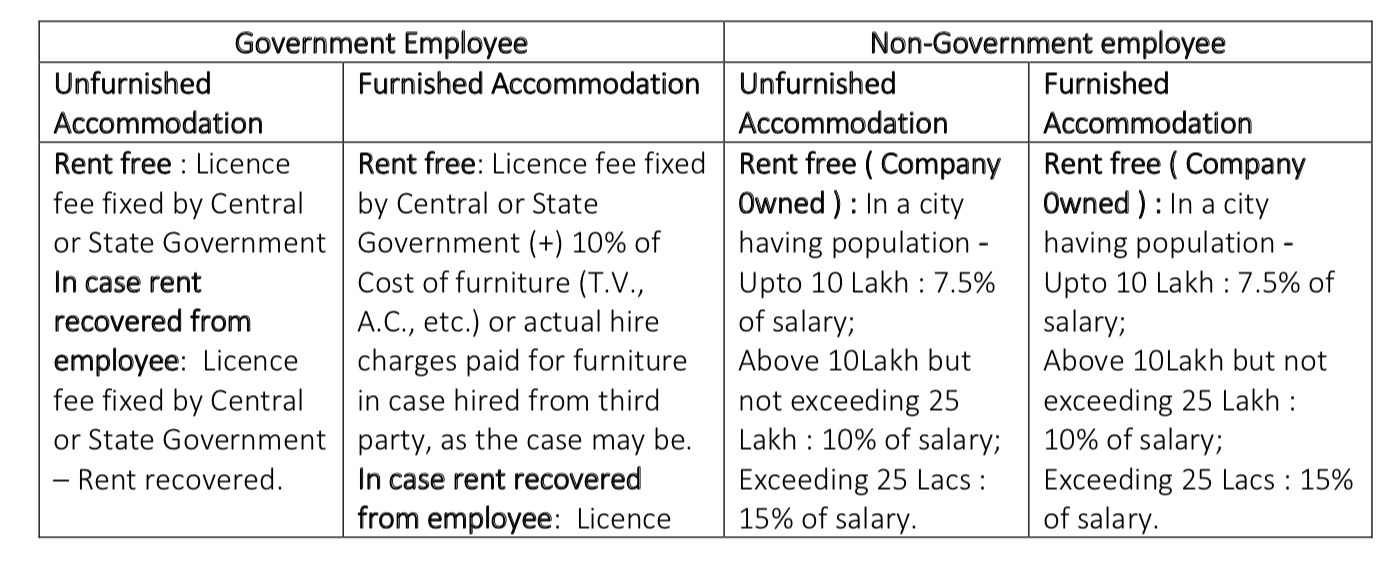

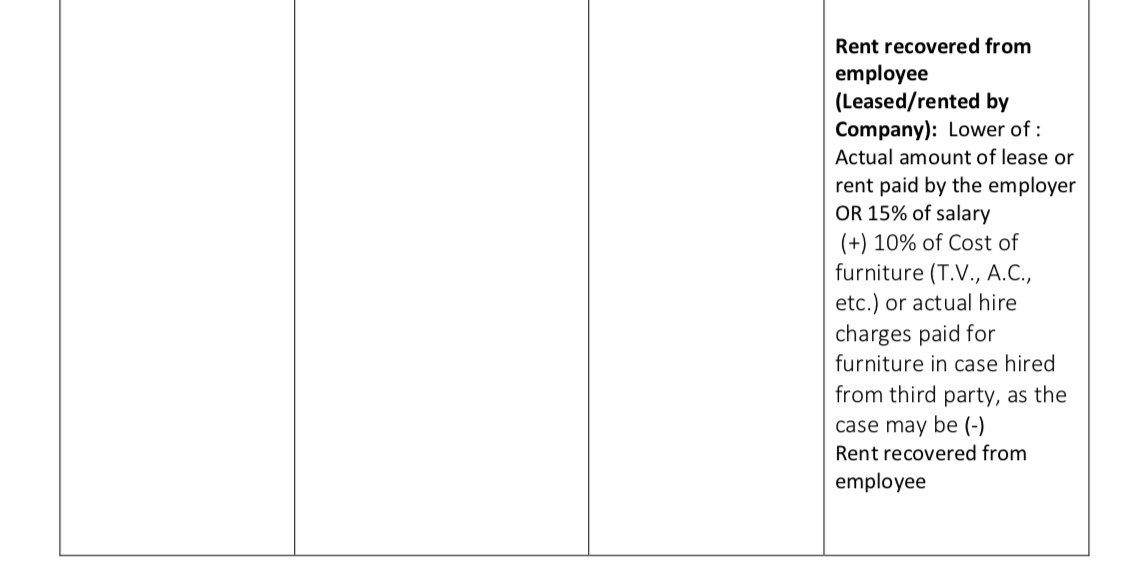

It is common for employers to provide accommodation that is free or at concessional rent to employees. This facility is termed as ‘Perquisite’ under section 17 of Income Tax Act and is taxable in the hands of employees. The valuation of such perquisite is specified under rule 3 of Income Tax Rules. Different treatments are given to accommodations provided by employers depending on type of employee i.e. Government or Non-Government employee. The following table will help in determining the value of furnished or unfurnished accommodations provided to both types of employees.

Knowing the Taxability of Accommodation Benefits and Perks under Income Tax

4. Hotel accommodation

Often, companies provide hotel accommodation to employees for few days when they move to a new city to allow them to settle and find a place to occupy for residential purposes. At several times, employers also arrange hotel accommodation for employees for few months in order to execute projects in different cities. The value of such accommodation is determined as 24% of the salary paid or payable or actual hotel charges paid by the employer, whichever is lower, for the period during, which such accommodation is provided to the employee. It is important to note that in case of transfer of employee from one place to another, if the hotel accommodation is provided for a period not exceeding 15 days, there would be no perquisite value taxable in the hands of employee.