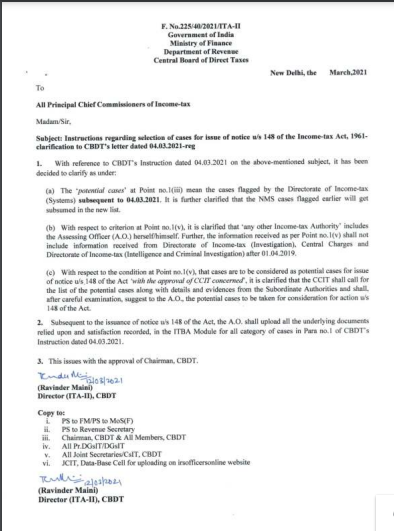

Instruction regarding selection of cases for issue of notice u/s 148 of the Income-tax Act, 1961-Clarification to CBDT’s Letter dated 04.03.2021.

To

All Principal Chief Commissioners of Income-tax

Madam/Sir,

Subject: Instruction regarding the selection of cases for the issue of notice u/s 148 of the Income-tax Act, 1961-Clarification to CBDT’s Letter dated 04.03.2021-reg.

- With reference to CBDT’s Instruction dated 04.03.2021 on the above-mentioned subject, it has been decided to clarify as under:

(a) The ‘potential cases’ at Point no. 1(iii) mean the cases flagged by the Directorate of Income-tax (Systems) subsequent to 04.03.2021. It is further clarified that the NMS cases flagged earlier will get subsumed in the new list.

(b) With respect to criterion at Point no. 1(v), it is clarified that ‘any other Income-tax Authority’ includes the Assessing Officer (A.O.) herself/himself. Further, the information received as per Point no. 1(v) shall not include information received from the Directorate of Income-tax (Investigation), Central Charges, and Directorate of Income-tax (Intelligence and Criminal Investigation) after 01.04.2019.

(c) With respect to the condition at point no. 1(v), that cases are to be considered as potential cases for the issue of notice u/s 148 of the Act ‘with the approval of CCIT concerned’, it is clarified that the CCIT shall call for the list of potential cases along with details and evidence from the Subordinate Authorities and shall, after careful examination, suggest to the A.O., the potential cases to be taken for consideration for action u/s 148 of the Act.

2. Subsequent to the issue of notice u/s 148 of the Act, the A.O. shall upload all the underlying documents relied upon and satisfaction recorded, in the ITBA Module for all categories of cases in Para no. 1 of CBDT’s Instruction dated 04.03.2021.

3. This issue with the approval of Chairman, CBDT.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.