Taxability of Exports of Services Between Establishments of Distinct Person

There was a lot of confusion & doubts in the interpretation of Explanation 1 under Section 8 of the IGST Act 2017 in relation to condition (v) of export of services as mentioned in sub-section (6) of section 2 of the IGST Act 2017.

In India services provided by subsidiaries, branches, agencies, representational offices, etc. of foreign companies not incorporated in India, to any establishment of the said foreign company outside India were considered as an international transaction between distinct persons, Such supply was not treated as Zero-rated supply & were taxed under GST.

Export of service [Section 2(6) of IGST Act]

A transaction is considered as export of service when it fulfills all the following conditions:

![export of service [section 2(6) of igst act]](https://www.consultease.com/wp-content/uploads/2021/09/export-of-service-section-26-of-igst-act.jpg)

Relevance of Distinct persons under Export of services

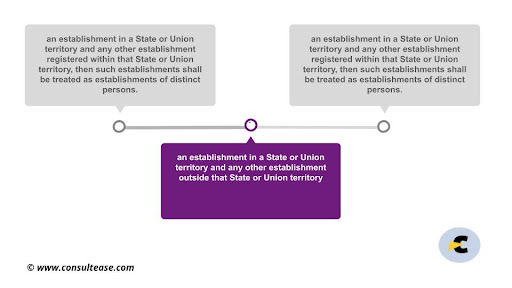

Condition (v) of subsection 6 of Section 2 of The IGST Act ~ the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8

Now as per explanation 1 under Section 8 of The IGST Act 2017, an establishment shall be treated as the establishment of distinct persons when a Person has –

Are foreign companies & their subsidiary companies incorporated in India separate legal Entities?

Explanation 2 to section 8 of the IGST Act suggests that, if a foreign company is conducting business in India through their branch, agency, representational office, etc. then Such business will be treated as the establishment of the said foreign company & if it supplies services to any establishment of the saif foreign company outside India then such transaction was treated as Supply between the establishment of a distinct person.

Similarly, when a Company incorporated in India, is conducting business outside India through their branch, agency, representational office, etc. then Such business will be treated as the establishment of the said Indian Company & any supply of service to its establishment outside India was treated as Supply between the establishment of distinct persons.

Now we will have to check the relevant provisions to determine whether these establishments can be treated as separate legal entities.

Definition of “Person” under GST

In Subsection 84 of Section 2 of the CGST Act 2017,

“person” includes—

-

- an individual;

- a Hindu Undivided Family;

- a company;

-

- a firm;

- a Limited Liability Partnership;

- an association of persons or a body of individuals, whether incorporated or not, in India or outside India;

- any corporation established by or under any Central Act, State Act or Provincial Act or a Government company as defined in clause (45) of section 2 of the Companies Act, 2013;

- anybody corporate incorporated by or under the laws of a country outside India;

- a co-operative society registered under any law relating to co-operative societies;

- a local authority;

- Central Government or a State Government;

- society as defined under the Societies Registration Act, 1860;

- trust; and

- every artificial juridical person, not falling within any of the above

Definition of “Company” under Companies act

As per subsection 20 of section 2 of the companies Act 2013, “company” means a company incorporated under this Act or under any previous company law

Definition of “Foreign Company” under Companies act

As per subsection 20 of section 2 of the companies Act 2013, “foreign company” means any company or body corporate incorporated outside India which—

- has a place of business in India whether by itself or through an agent, physically or through electronic mode; and

- conducts any business activity in India in any other manner.

Let’s analyze all the provisions to determine whether such establishments are separate entities or not with the help of the following examples.

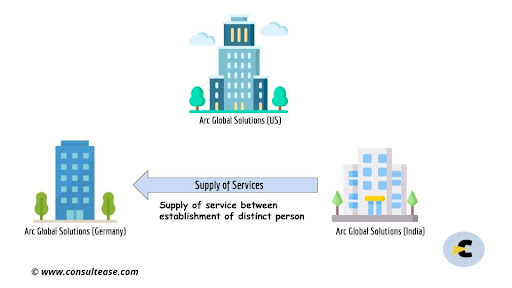

Arc Global solutions, a US-based multinational company. They started their business in India through a Branch, which is a company incorporated in India under the Companies act 2013. Now, the Indian branch supplies services to the German branch of Arc global solutions, Such supply was treated as supply between the establishment of distinct persons & was taxable under GST.

However, going through the relevant provisions above, it is observed that Arc global solutions is a foreign company, incorporated outside India & it falls under the definition of “Person” under the CGST act. Similarly, Its Indian branch which is incorporated in India is an Indian company & it also falls under the definition of “Person” under the CGST Act. It means both are Separate legal entities. Thus, a subsidiary/ sister concern/ group concern of any foreign company which is incorporated in India will be considered as a separate “Person” as well as a separate legal entity from the foreign company under the provisions of the CGST act.

Export of Services to foreign Company Incorporated outside India to be Qualified as Export

The GST Council has Clarified that Foreign companies & their establishment in India are Separate Persons under GST.

Therefore, supply of services by a subsidiary/ sister concern/ group concern, etc. of a foreign company to the establishment of such foreign company which is incorporated under laws of a country outside India will not be considered as Supply of services between mere establishments of a distinct person. Similarly, Supply by an Indian company to Its Establishment located outside India will not be considered as a Supply of services between mere establishments of a distinct person.

Previously, many entities whose refund was denied on services like R&D in software, business process management and IT services Etc. as such services were barred by Condition (V)under sub-section (6) of section 2 of the IGST Act & not considered as Exports.

This Clarification has resulted in major relief as it will ensure availability of export status to Services provided by branch, agency, representational office, etc. to any other establishment outside India.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.