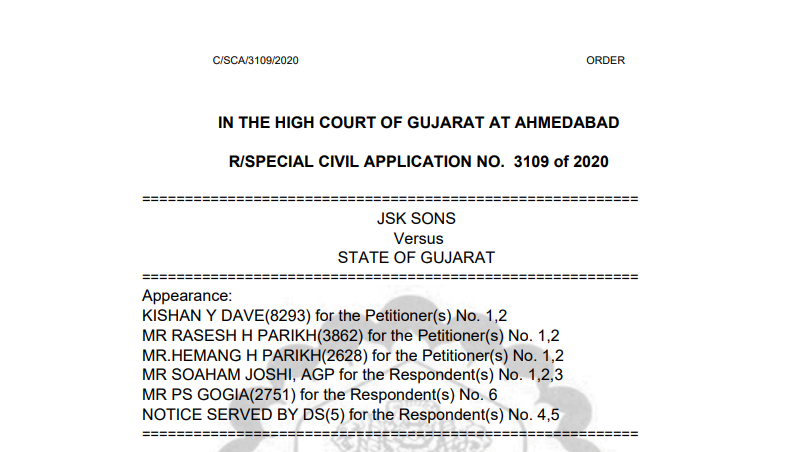

Gujarat HC in the case of JSK Sons Versus State of Gujarat

Case Covered:

JSK Sons

Versus

State of Gujarat

Facts of the Case:

By this petition under Article 226 of the Constitution of India, the petitioners have prayed for the following reliefs :

“(A) Your Lordship may be pleased to admit this petition:

(B) Your Lordship may be pleased issue a writ of mandamus or any other appointment writ, order, and/or directions in the nature of mandamus, quashing and setting aside the provisional order of attachment said to have been issued by Respondent No.2 for attaching the Bank Accounts, as per the Table mentioned herein above at para 2C, of the Petitioners, maintained with the Respondent No.4 to 6 Banks, in the interest of justice;

(C) Pending admission hearing and till final disposal of the present petition, Your Lordship may be pleased to suspend operation, execution, and implementation of the order of provisional attachment said to have been issued by Respondent No.2 for attachment of above mentioned Bank Accounts of the Petitioners maintained with Respondent No.4 to 6 to permit the Petitioners to operate the said Accounts, in the interest of justice:

(D) Your Lordship may be pleased to pass such other and/or further orders as may be deemed fit, just and proper in the interest of justice.”

It is the case of the petitioners that the bank accounts of the petitioners have been provisionally attached under section 83 of the Gujarat Goods and Service Tax Act, 2017 (for short “GGST Act”) without considering the provisions of section 83 of the GGST Act, as in the case of the petitioners no proceedings are pending under any of the sections mentioned therein.

Related Topic:

Gujarat HC in the case of Material Recycling Association of India

Observations of the Court:

On a bare perusal of the aforesaid provision, it is clear that once an opinion is formed by the competent authority as stipulated in section 83 that there is a reasonable apprehension that the petitioners may default in the ultimate collection of demand that is likely to be raised on completion of the assessment, then it was incumbent upon the respondent authorities to exercise powers under section 83 of the GGST Act.

The Decision of the Court:

In view of the foregoing reasons, no interference is required to be made in the exercise of powers under section 83 of the GGST Act by the respondent authorities while exercising extraordinary powers under Articles 226 and 227 of the Constitution of India.

The petition, therefore, being devoid of any merit, is summarily dismissed. Notice is discharged with no order as to costs.

Read & Download the full Decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.