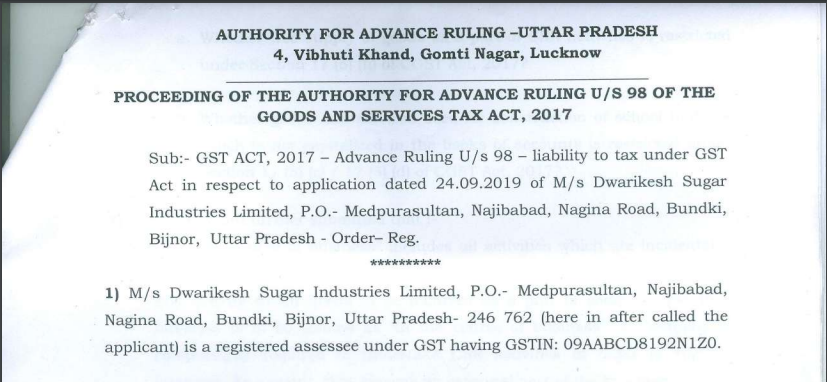

Uttar Pradesh AAR in the case of M/s. Dwarikesh Sugar Industries Limited

Introduction:

The UP AAR in the case of M/S. Dwarikesh Sugar Industries Limited held that expenses incurred towards Corporate Social Responsibility (CSR) by the Company in order to comply with requirements under the Companies Act, 2013 (Companies Act) qualify as being incurred in the course of business and therefore, eligible for Input Tax Credit (ITC) in terms of Section 16 of the Central Goods and Services Tax Act, 2017 (CGST Act).

Case Covered:

M/s. Dwarikesh Sugar Industries Limited

Facts of the case:

The applicant is a Company incorporated under the Companies Act 2013 and engaged in the business of manufacture and sale of sugar and allied products. In order to comply with the CSR norms in terms of Section 135 of the Companies Act, the Applicant undertakes certain activities and in order to undertake the Corporate Social Responsibilty (CSR) in terms of Section 135 of the Companies Act.

Issues:

i. Whether expenses incurred by the Company in order to comply with requirements of Corporate Social Responsibilty (CSR) under the Companies Act, 2013 (‘CSR Expenses’) qualify as being incurred in the course of business and eligible for Input Tax Credit (‘ITC’) in terms of the Section 16 of the Goods and Services Tax Act, 2017 (‘CGST Act’).?

Whether ITC in relation to CSR activities which have been obliged under a law are restricted under section 17(5)(h) of CGST Act, 2017? If yes,

a. Whether free supply of goods as a part of CSR activities is restricted under Section 17(5)(h) of CGST Act, 2017?

b. Whether goods and services used for construction of school building which is not capitalized in the books of accounts is restricted under Section 17(5)(c) / Section 17(5)(d) of CGST Act?

Ruling:

Question 1:- Whether expenses incurred by the Company in order to comply with requirements of Corporate Social Responsibilty (CSR) under the Companies Act, 2013 (‘CSR Expenses’) qualify as being incurred in the course of business and eligible for Input Tax Credit (‘ITC’) in terms of the Section 16 of the Goods and Services Tax Act, 2017 (‘CGST Act’).?

Answer:- Yes.

Question 2:- Whether free supply of goods as a part of CSR activities is restricted under Section 17(5)(h) of CGST Act, 2017?

Answer:- No.

Question 3:- Whether goods and services used for construction of school building which is not capitalized in the books of accounts is restricted under Section 17(5)(c) / Section 17(5)(d) of CGST Act?

Answer:- ITC is not available to the extent of capitalization.

Read & Download the full Ruling in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.