Undervaluation of goods in invoice can not be ground for detention – Chhattisgarh High Court

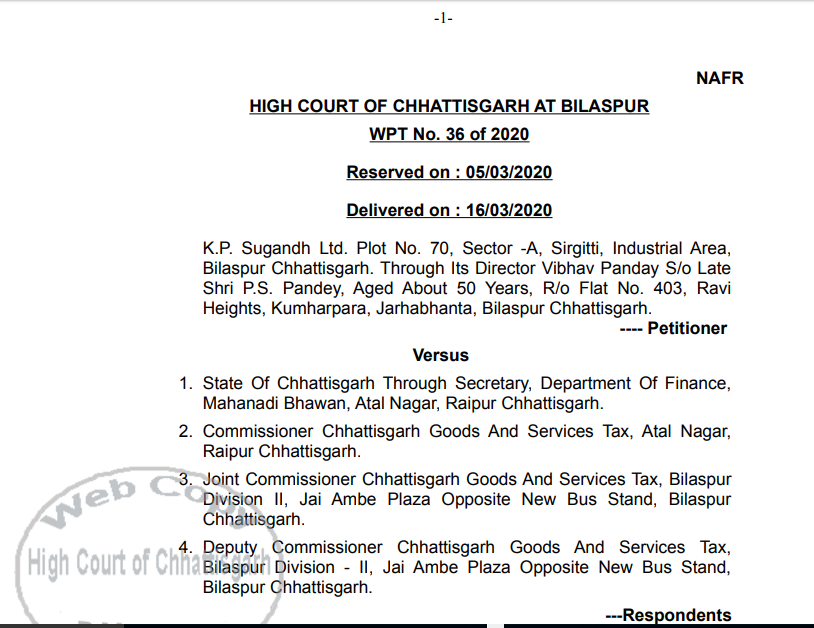

Case Covered:

K.P. Sugandh Ltd.

Versus

State Of Chhattisgarh

Read the full text of the case here.

Facts of the case:

Since the facts and grounds raised in both these writ petitions and the dates also being identical and the impugned orders also being same, both these writ petitions are being decided by this common judgment.

The challenge in the present writ petition is to the order dated 17.01.2020 (Annexure P/1) passed by the respondents for the purpose of the release of the vehicle carrying goods belonging to the petitioners from the manufacturing centers to the dealer.

The relevant facts, which are relevant for the adjudication of the present dispute is that the petitioners are the limited companies under the provisions of the Companies Act. The petitioners herein are the manufacturers of ‘Pan Masala and Tobacco Products’. On 14.01.2020, the petitioners dispatched goods both Pan Masala and Tobacco Products to its customer vide Maxi Truck Plus 1.2 TPS No. CG 04 ME 3494 belonging to the transporter Shyam Transport Company. The vehicle was being driven by one Shanker Yadav, resident of Ward No.3, Tilda, District Raipur. The customer to which the goods were being dispatched was M/s. Ravi Agency at Jhulelal Market, Raipur. While the goods were being transported, the petitioners/ establishment had issued with a tax invoice as well as an e-way bill generated and handed the same to the Incharge of the conveyance i.e. the driver namely Shanker Yadav. When the said vehicle/conveyance left for Raipur on 14.01.2020, the vehicle was intercepted by the officials of the respondents/ Department and asked for the details of the consignment. The driver of the vehicle i.e. the person, who was in Incharge of the conveyance at the time of interception produced before the authorities the relevant invoice bill and also produced the e-way bill as was required under the Act to the authorities concerned.

Observations of the court:

So far as the ground of an alternative remedy available to the petitioner as pleaded by the State Government is concerned, this Court is of the opinion that since the case of the petitioners at the outset itself was that the entire proceedings for the detention of the vehicle and the seizure of the goods being in total contravention to the GST law, relegating the petitioners to avail the alternative remedy of appeal under Section 107 would not be proper, legal and justified. More particularly when this Court also finds that the proceedings of detention and seizure of the goods and the vehicle by the respondents are without any authority of law.

Given the said facts and circumstances of the case, this Court is of the opinion that undervaluation of good in the invoice cannot be a ground for the detention of the goods and vehicle for a proceeding to be drawn under Section 129 of the Central Goods and Service Tax Act, 2017 read with Rule 138 of the Central Goods and Service Tax Rules, 2017. In view of the aforesaid the impugned order Annexure P/1 i.e. the order passed under Section 129 and the order of demand of tax and penalty both being unsustainable deserves to be and is accordingly set-aside/quashed. The respondents are forthwith directed to release the goods belonging to the petitioners based on the invoice bill as well as the e-way bill.

Quashing of the impugned order by itself would not preclude the State Authorities from initiating appropriate proceedings against the petitioners for the alleged act of undervaluation of the goods as compared to the MRP on the product in accordance with the law.

With the aforesaid observations, the present writ petitions stand allowed.

Download the copy:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.