Stay on circular adding TCS for calculation of GST

Stay on circular adding TCS for calculation of GST:

Circular no. 76/50/2018 dated 31st December 2018 clarified the calculation of GST in case of TCS. In some cases TCS deduction is required under the provisions of income tax Act. The current provisions of TCS u/s 206C of the Income Tax Act cast an obligation on the seller of specified goods to deduct TCS at specified rates from the buyer of the goods. The above mentioned notification clarified to include the value of TCS for calculating GST. Now the industry was in dilemma, as TCS is also required to be collected on value including GST.

Relief for taxpayers:

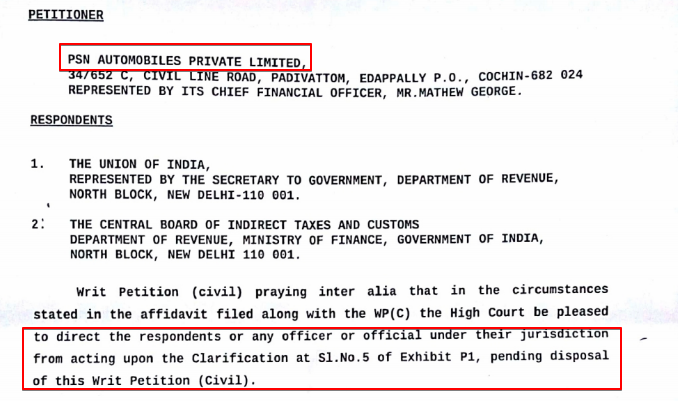

To the relief taxpayer the Kerala High Court in case of PSN Automobiles Pvt. Ltd. Stayed the application of this part of circular. The counsel for petitioner submitted that the 1% TCS is collected by the seller from the buyer of a car worth more than Rs. 10 Lac. This collection is under section 206C(1F) of Income tax Act. The counsel told that this 1% is collection on behalf of government and deposited to the credit of the buyer. That amount can’t be included in the value for the purpose of section 15(2a) of CGST Act. The entry 2 of section 15 provide that:

Stay on circular adding TCS for calculation of GST

(a) any taxes, duties, cesses, fees and charges levied under any law for the time being in force other than this Act, the State Goods and Services Tax Act, the Union Territory Goods and Services Tax Act and the Goods and Services Tax (Compensation to States) Act, if charged separately by the supplier;

Emphasis was also supplied on the phrase “if charged separately by the supplier;” in above entry. The supplier does not charge TCS under income tax.

High court accepted that this matter needs a deeper analysis and stayed the application of the aforementioned circular.

Thus we need to keep looking at this progress and wait for final decision. It can be a huge relief for taxpayers.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.