(Read Order) Tran 1 is barred by limitation Act ,Reliance Elektrik Works Vs. UOI

Quick Synopsis of Reliance Elektrik Works Vs. UOI

Delhi high court in a historical decision allowed Tran 1 form till June 30. In the case of

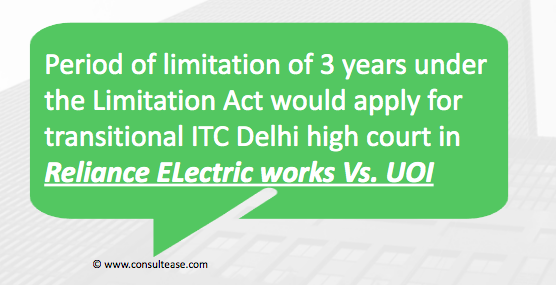

Reliance Elektrik Works Vs. UOI, This decision was made. The court observed that the period provided by the CGST Act is a directory. It is also observed that the period of Limitation Act will be applicable in this case. The period of limitation is 3 years. So the taxpayer can file it up to three years from the enactment of the GST Act. It was enacted on 1st July 2017. Three years of limitation will complete on 30th June.

In the Act, the time limit was 90 days. Then the form to take up transitional credit Tran 1 was made life even later. This form was closed when 90 days of the enactment of GST completed. Earlier judgments were on technical glitches. In many of those judgements court allowed to file trans one even if no technical glitch was there.

There are many case laws that allowed transitional credit later on. But this one is a landmark because it also decided that the time limit of limitation Act will apply. The full judgment will be uploaded soon. We will come up with a detailed discussion over this judgment. But please communicate to all your clients, whose transitional credit was pending, that now they can claim it.

Download a copy of judgment:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.