PIL filled in Supreme Court – Rule 36(4)

Introduction:

Nuances of Rule 36(4) are hitting hard. It is inserted into CGST Rules 2017. It provides for 110% of ITC. There are many practical issues in this rule. Its implementation is facing a lot of hardship.

Case Covered:

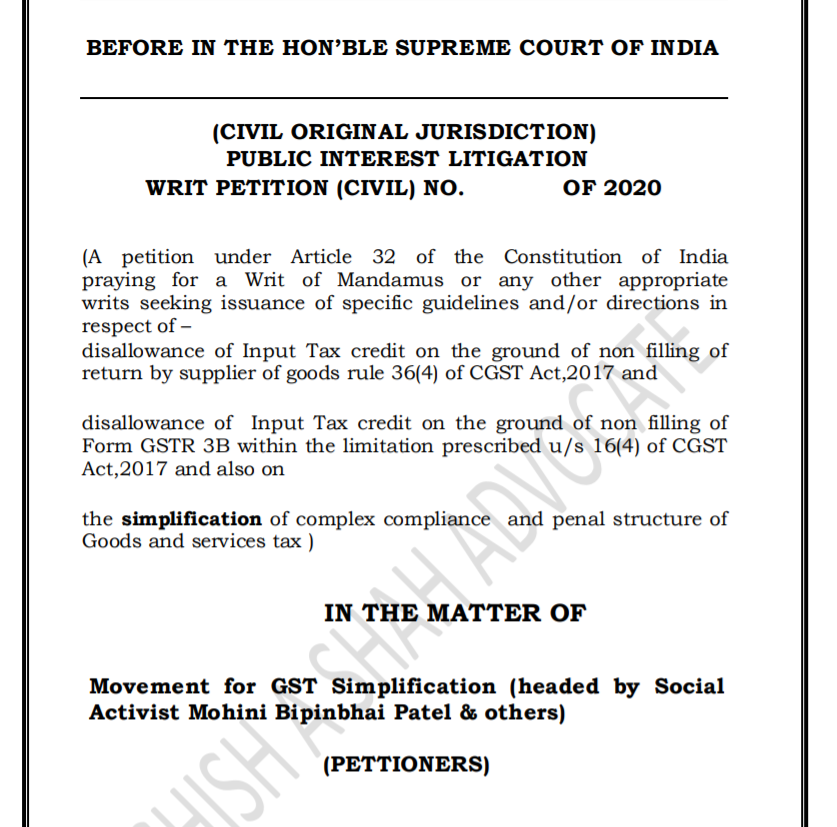

Movement for GST Simplification (headed by Social Activist Mohini Bipinbhai Patel & others) (PETTIONERS)

V.

Union of India, through the chairperson and members of Goods & Services Tax Council, Office of the GST Council Secretariat, 5th Floor, Tower II, Jeevan Bharti Building, Janpath Road, Connaught Place, New Delhi-110 001 & Central Board of Indirect Taxes and Customs (erstwhile Central Board of Excise & Customs) part of the Department of Revenue under the Ministry of Finance (RESPONDENTS)

PIL filled in Supreme Court – Rule 36(4)

(A petition under Article 32 of the Constitution of India praying for a Writ of Mandamus or any other appropriate writs seeking issuance of specific guidelines and/or directions in respect of – disallowance of Input Tax credit on the ground of non filling of return by supplier of goods rule 36(4) of CGST Act,2017 and disallowance of Input Tax credit on the ground of non filling of Form GSTR 3B within the limitation prescribed u/s 16(4) of CGST Act,2017 and also on the simplification of complex compliance and penal structure of Goods and services tax )

Related Topic:

A petitioner who seeks equity must do equity

FACTS OF THE CASE

- The Petitioner firmly believes that the Indian constitution guarantees justice and equality for all persons. Therefore, he has moved this Writ Petition under Article 32 of the Constitution of India, which seeks to invoke the most salient fundamental right, the right to equality guaranteed under Article 14.

- It is humbly submitted that Central Board of Indirect Taxes and Customs (erstwhile Central Board of Excise & Customs) has issued Rule 36(4) of the CGST Rules, 2017, stating that provisional credit can be claimed in the GSTR-3B only to the extent of 10%* of eligible ITC reflected in the GSTR-2A. *With effect from 1 Jan 2020; Was earlier restricted to 20% for the period from 9 Oct 2019 to 31 Dec 2019

- To make the simple interpretation of the above rule, it says that only 10% of Input Tax credit can be claimed which is showing on the portal of GST. It means the Tax credit of such purchases which were not updated or filled by the supplier shall not be considered while computation of the GST liability.

- It has been clarified through the Circular No. 123/42/2019- Central Tax dated 11-11-2019 by the CBIC, that the taxpayer needs to ascertain the ITC from the auto-populated Form GSTR 2A as available on the due date of filing of Form GSTR-1, i.e., 11th of the succeeding month for monthly return filers and for quarterly return filers last day of the month succeeding the end of the quarter. It means if any supplier is late in filling the GSTR 1, the buyer is going to suffer the same and shall pay the amount of GST again which already paid or accrued to the supplier. This creates the unnecessary burden on the genuine businesses to arrange extra working capital for payment of additional GST

- For better analysis, we would like to draw attention of your good honor on the historical principles of Goods and services tax previously known as Valued added tax. (the source of information is Wikipedia)

“A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. VAT essentially compensates for the shared service and infrastructure provided in a certain locality by a state and funded by its taxpayers that were used in the elaboration of that product or service.”

- In the recent publication from CBIC, Govt of India named “GOODS AND SERVICE TAX (GST) CONCEPT & STATUS”, The government itself pronounced the avoidance of cascading effect through successful implementation of GST. The relevant portion of text is reproduced here:

NEED FOR GST IN INDIA :

5.1 The introduction of CENVAT removed to a great extent cascading burden by expanding the coverage of credit for all inputs, including capital goods. CENVAT scheme later also allowed credit of services and the basket of inputs, capital goods and input services could be used for payment of both central excise duty and service tax. Similarly, the introduction of VAT in the States has removed the cascading effect by giving set-off for tax paid on inputs as well as tax paid on previous purchases and has again been an improvement over the previous sales tax regime………continue

Download copy to read more from following heading.

Related Topic:

Draft reply on 36(4) notices: Download PDF

Download the copy of PIL:

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.