Original copy of GST AAR of RITES Limited

Original copy of GST AAR of RITES Limited

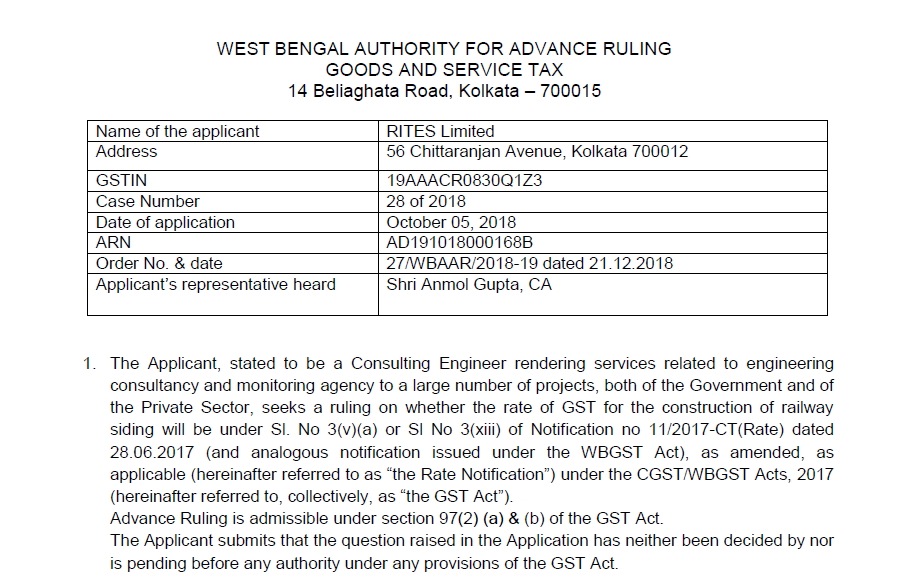

The GST AAR of RITES Limited, the applicant has raised the query regarding the nature of the supply. Whether the supply is “export” or not. Following is the original copy of GST AAR of RITES Limited:

Order:

The Applicant, stated to be a Consulting Engineer rendering services related to engineering consultancy and monitoring agency to a large number of projects, both of the Government and of the Private Sector, seeks a ruling on whether the rate of GST for the construction of railway siding will be under Sl. No 3(v)(a) or Sl No 3(xiii) of Notification no 11/2017-CT(Rate) dated 28.06.2017 (and analogous notification issued under the WBGST Act), as amended, as applicable (hereinafter referred to as “the Rate Notification”) under the CGST/WBGST Acts, 2017 (hereinafter referred to, collectively, as “the GST Act”).

Advance Ruling is admissible under section 97(2) (a) & (b) of the GST Act.

The Applicant submits that the question raised in the Application has neither been decided by nor is pending before any authority under any provisions of the GST Act.

The officer concerned raises no objection to the admission of the Application.

The Application is, therefore, admitted.

2. The Application states that Damodar Valley Corporation (hereinafter referred to as “DVC”) has appointed the Applicant as Project Management Consultant for construction of railway infrastructure, including commissioning of the railway system to handle coal and oil fuel traffic of Raghunathpur Thermal Power Station (hereinafter RTPS). The scope of work includes awarding contracts on behalf of DVC for construction of railway infrastructure. The work includes construction of a private siding between Joychandipahar and Bero stations in Adra division of SE Railway, enabling carriage of coal and oil fuel to RTPS.

The Applicant is responsible for passing the bills of the vendors and contractors after necessary scrutiny, and making the payments from a specially designated escrow account in which DVC deposits the requisite amount, and deduction of statutory taxes and deposit of the same, issuance of tax deduction certificates etc.

3. In support of his submissions, the Applicant has provided a copy of the agreement with DVC. It is an agreement to undertake Engineering and Construction Management Service for construction of Railway Infrastructure including commissioning of the railway system and advance procurement of railway section and P. way materials. The Construction Management includes procurement of Rails and PSC sleepers with fittings, points, and crossings, track fitting etc, construction of railway formation and bridges and procurement of stone ballast as per specifications of the Indian Railways, laying of new P. way with Points and Crossings, procurement and installation of electrical equipment etc. Apart from track laying the work includes the cost of all civil work, signaling and telecommunication, overhead electrification and allied

electrical work. The basic cost, including the Applicant’s fee, for the project, is estimated to be Rs

496.69 crore.

The Applicant also provides a copy of an agreement with M/s Bridge & Roof Co Ltd – a contractor employed for execution of earthwork in railway formation, construction of minor and major bridges, p. way track linking work, including the supply of truck ballast and p.way fittings and fixtures etc. The contract price is Rs 70.99 crore. Evidently, it covers only a portion of the total project but can be relied upon as a specimen of the nature of the work being executed.

Download the Original copy of GST AAR of RITES Limited by clicking the below image:

4. According to Serial No. 3(v)(a) of Notification No. 11/2017 – CT (Rate) dated 28/06/2017, as amended from time to time, the composite supply of works contract as defined under section 2(119) of the GST Act, supplied by way of construction, erection, commissioning, or installation of original works pertaining to railways, including monorail and metro, is taxable @ 12%. Original work, as defined under para 2(zs) of Notification No. 12/2017-CT (Rate) dated 28/06/2017, means all new construction involving (i) all types of additions and alterations to abandoned or damaged structures on land that are required to make them workable, and (ii) erection, commissioning or installation of plant, machinery or equipment or structures, whether pre-fabricated or otherwise.

The term “railways” is not defined in the GST Act. It, however, is defined under section 2(31) of the Railways Act, 1989, meaning “a railway, or any portion of a railway, for the public carriage of passengers or goods, and includes

(a) All lands within the fences or other boundary marks indicating the limits of the land appurtenant to a railway;

(b) All lines of rails, sidings, or yards, or branches used for the purpose of, or in connection with, a railway;

(c) All electric traction equipment, power supply and distribution installations used for the purpose of, or in connection with, a railway;

(d) All rolling stock, stations, offices, warehouses, wharves, workshops, manufactories, fixed plant and machinery, roads and streets, running rooms, rest houses, institutes, hospitals, waterworks and water supply installations, staff dwellings and any other works constructed for purpose of, or in connection with, railway;

(e) All vehicles which are used and any road for the purpose of traffic of a railway and owned hired or worked by a railway;

(f) All ferries, ships, boats and rafts which are used on any canal, river, lake or other navigable inland waters for the purpose of the traffic of a railway and owned, hired or worked by a railway administration,

but does not include-

(i) A tramway wholly within a municipal area; and

(ii) Lines of rails built in any exhibition ground, fair, park, or any other place solely for the purpose of recreation.”

The Railways Act, 1989, distinguishes between, but covers, Government Railway under section 2(20) and Non-Government Railway under section 2(25) of the Act. It, therefore, includes scope for railways under both Government and private administrations.

5. It is evident from the above discussion that the scope of work, as outlined in the Applicant’s agreement with DVC, is that of works contract, as defined under section 2(119) of the GST Act, fit to be called an ‘original work’ within the meaning ascribed to the term in para 2(zs) of Notification No. 12/2017-CT (Rate) dated 28/06/2017, and pertains to ‘railways’, provided it is meant for public carriage of passengers or goods.

6. Whether the phrase “public carriage of passenger or goods” prevents a private siding from being included in the definition of ‘railways’ has repeatedly come up for judicial scrutiny. The courts generally held that the phrase ‘public carriage of passengers or goods’ cannot be construed in such manner as to exclude from the ambit of ‘railways’ the sidings built and owned by organizations other than the government.

[Cases relied upon: DMRC –vs- Municipal Corporation of Delhi, 2008 (103) DRJ 369 (Delhi High Court); Commissioner, Central Excise, Raipur –vs- Anand Construction, 2017 (51) STR 435 (CESTAT, Principal Bench, New Delhi); SMS Infrastructure Ltd –vs- Commissioner, Central Excise, Nagpur, 2017 (47) STR 17 (CESTAT, West Zonal Bench, Mumbai)]

7. Art 366(20) of the Constitution excludes from the ambit of ‘railway’ only (a) a tramway wholly within a municipal area and (b) any line of communication wholly situate in one State and declared by Parliament by law not to be a railway. The Parliament excludes by law, apart from the tramways, the lines of rails mentioned under section 2(31)(ii) of the Railways Act, 1989, being rails built solely for the purpose of recreation. The term ‘public carriage’, therefore, cannot be given any meaning that may add more exclusion than specifically provided under section 2(31)(ii) of the Railways Act, 1989.

DVC – a public sector undertaking – is the owner of the railway siding being built. It is meant for carriage of coal and oil fuel to RTPS. The purpose of the carriage of goods is, therefore, not recreation, but producing public goods like electricity. It is, therefore, not excluded under section 2(31)(ii) of the Railways Act, 1989.

The construction of the private siding that the Applicant refers to, therefore, pertains to ‘railways’.

Ruling:

In view of the foregoing, we rule as under

Construction of a private railway siding for carriage of coal and oil fuel to Raghunathpur TPS, as described in the agreement between the Applicant and DVC, is a composite supply of works contract taxable @ 12% under Serial No 3(v)(a) of Notification no 11/2017-CT(Rate) dated 28.06.2017.

This Ruling is valid subject to the provisions under Section 103(2) until and unless declared void

under Section 104(1) of the GST Act.

Source: http://www.wbcomtax.nic.in/GST/GST_Advance_Ruling/27WBAAR2018-19_20181221.pdf

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.