Original copy GST AAR OF M/s. Khedut Hat

Original copy GST AAR OF M/s. Khedut Hat

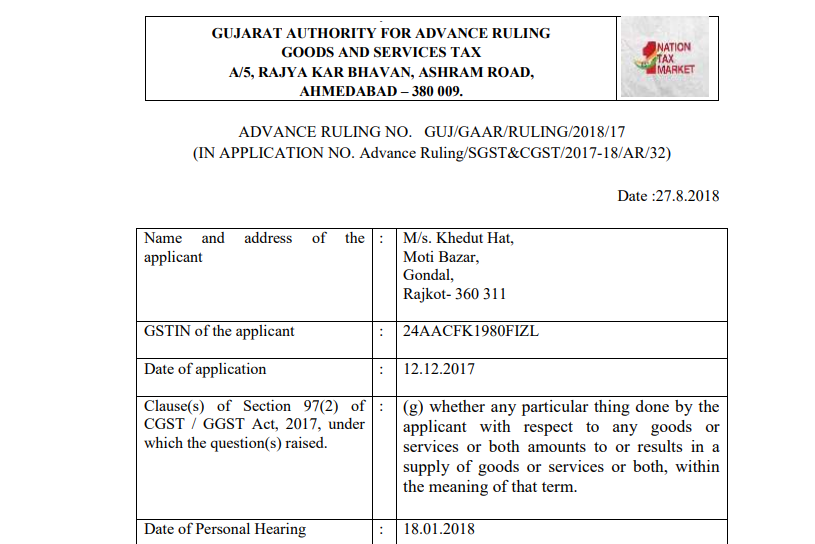

In the GST AAR of M/s. Khedut Hat, the applicant has raised the query regarding the classification of the services(Blasting Work) provided by him. Following is the GST AAR OF M/s. Khedut Hat:

Order:

The applicant, M/s. Khedut Hat has submitted that it is in the business of carrying out blasting work at various sites by means of use of explosives and other materials for which it has obtained licence from Petroleum and Explosives Safety Organization.

1.1. The applicant submitted that explosives procured by the applicant for blasting activity are stored only in licenced premises as stated in licence, termed as ‘magazine’; that prior to carrying out blasting activity, client inform the applicant number of holes to be charged at the site; that prior to initiating blasting activity, applicant with the help of shot firer determines the quantity of explosives to be filled in each hole and as per requirement, applicant fills every hole with approximately same quantity of explosives and thereafter each hole is connected to each other via detonators and/or detonating fuse and safety fuse; that each hole is connected to each other and network is created in such a manner that each hole is blasted in the manner and sequence as required.

1.2 The applicant further submitted that during the entire blasting activity, explosives are neither handed over to the client nor is it in possession of client; that any quantity of explosives or other material left after carrying out blasting activity is transferred back to the Magazine of the applicant.

1.3 The applicant has further stated that it is imperative to decide whether applicant is carrying out supply of goods or supply of services. The applicant has stated that during the entire activity of blasting, applicant has been granted right to carry out only blasting at the site only; that client is not qualified person to possess explosives and thus it is clear that applicant has not transferred title to goods used in blasting activity to its client and therefore the applicant has the view that blasting activity carried out by it shall be treated as ‘supply of service’.

1.4 On the basis of above facts and submissions, the applicant has sought ruling on following question-

(i) Whether the blasting activity carried out by the applicant is to be considered as a ‘supply of goods’ or ‘supply of service’?

Download the GST AAR of M/s. Khedut Hat by clicking the below image:

2. We have heard Shri Brijen Mehta, Chartered Accountant, for the appellant on 18.01.2018. We have considered the submissions made by the applicant in their application for advance ruling and submissions made at the time of personal hearing. We have also considered the comments on the application offered by the department vide letter F.No. IV/16-64/Tech/2017-18 dated 18.01.2018.

3. In order to decide the present issue, the judgement dated 30.01.2018 of Hon’ble Supreme Court in the case of State of Gujarat Vs. Bharat Pest Control [Civil Appeal No. 1335 of 2018] is relevant, wherein it has been held as follows :-

“5. A Constitution Bench of this Court in Kone Elevator India Private Limited vs. State of Tamil Nadu, while considering the correctness of its earlier view with regard to dominant nature of the contract test, had, apart from holding that the dominant nature test would no longer be determinative, considered paragraph 56 of the report in Larsen & Toubro Limited 2 (2014) 7 SCC 1 (supra) and has accepted the same to be the correct position in law.

6. In view of the above position of law enunciated in Larsen & Toubro Limited (supra) and Kone Elevator India Private Limited (supra) the view taken by the High Court that there is no deemed sale of the goods used in the contract executed by the respondent – contractor cannot have our approval. We, therefore, set aside the order of the High Court and allow this appeal.”

3. Section 7 of the Central Goods and Services Tax Act, 2017 (herein after referred to as the ‘CGST Act, 2017) and the Gujarat Goods and Services Tax Act, 2017 (herein after referred to as the ‘GGST Act, 2017’) provides for scope of supply and the definition of supply is an inclusive definition. Therefore, Schedule II is not the exhaustive condition for the scope of supply as defined under Section 7.

4. In the present case applicant uses explosives in the blasting activity at their client’s site. Thus it would be evident that blasting activity is carried out by the applicant for their client for which the applicant uses explosives. The applicant carries out blasting work with the aid of explosives. Thus, there is deemed supply of explosives in this case in view of the judgement of Hon’ble Supreme Court in the case of Bharat Pest Control (supra) as well as the supply of service in the form of the blasting work. Therefore, the situation as narrated by the applicant is a composite supply of goods and services and shall be covered by Section 2(30) and Section 8(a) of the CGST Act, 2017 and the GGST Act, 2017.

Ruling:

5. In view of the foregoing, we rule as under :-

The blasting activity carried out by M/s. Khedut Hat, Moti Bazar, Gondal, Rajkot360 311(GSTN No. 24AACFK1980FIZL) is a ‘composite supply’ of goods and services and shall be covered by Section 2(30) and Section 8(a) of the Central Goods and Services Tax Act, 2017 and the Gujarat Goods and Services Tax Act, 2017.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.