Nidhi Auto Pvt Ltd Vs. CCE Noida: CENVAT without goods receipt

Case Covered:

Nidhi Auto Pvt Ltd

Versus

C.C.E Noida-I

Matter:

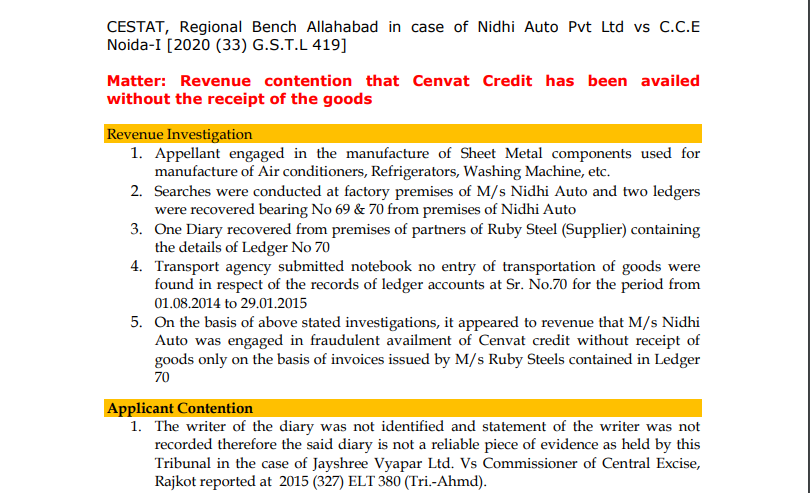

Revenue contention that Cenvat Credit has been availed without the receipt of the goods.

Revenue Investigation:

1. The appellant engaged in the manufacture of Sheet Metal components used for the manufacture of Air conditioners, Refrigerators, Washing machines, etc.

2. Searches were conducted at factory premises of M/s Nidhi Auto and two ledgers were recovered bearing No 69 & 70 from premises of Nidhi Auto

3. One Diary recovered from premises of partners of Ruby Steel (Supplier) containing the details of Ledger No 70

4. Transport agency submitted notebook no entry of transportation of goods was found in respect of the records of ledger accounts at Sr. No.70 for the period from 01.08.2014 to 29.01.2015

5. On the basis of above-stated investigations, it appeared to revenue that M/s Nidhi Auto was engaged in fraudulent availing of Cenvat credit without receipt of goods only on the basis of invoices issued by M/s Ruby Steels contained in Ledger 70

Applicant Contention:

1. The writer of the diary was not identified and the statement of the writer was not recorded therefore the said diary is not a reliable piece of evidence as held by this Tribunal in the case of Jayshree Vyapar Ltd. Vs Commissioner of Central Excise, Rajkot reported in 2015 (327) ELT 380 (Tri.-Ahmd).

2. The total quantity of inputs allegedly not received were 9112.5 MT and during the relevant period finished goods totally weighing 25781.88 MT were manufactured and cleared on payment of duty and revenue has not established from where the appellants have procured the required inputs if they have not received inputs but only he received invoices.

3. Shri Kuldeep Singh Parmar Director of the appellant retracted in his statement recorded on 29.09.2015 by filing an affidavit on 30.09.2015 duly notarized and therefore, the statement dated 29.09.2015 cannot be relied upon.

4. Diary was recorded for the period from 06.03.2014 to 27.01.2015 which is only for 11 months and the said evidence was relied upon for rising demand for the period of 5 years

5. On the basis of the statement of Transporter for 5 months allegations for 5 years cannot be levied

6. Cross-examination of evidence was not allowed

7. No cash was recovered from either end during searches and there was no evidence that any cash was received back by M/s Ruby Steels from M/s Nidhi Auto

Related Topic:

10 Major Changes in CARO, 2020 vs CARO, 2016 in Fastrack Summary Mode

Tribunal Order:

1. Cross-examination of none of the prosecution witnesses was allowed. Therefore we hold that none of the statements were admissible evidence in the present case.

2. Author of the diary recovered at the residence of the partner of M/s Ruby Steels was not identified and his statement was not recorded and therefore, the diary recovered was not admissible evidence.

3. Revenue has not investigated as to if 9112.500 MT of the number of inputs shown in the books of account of M/s Ruby Steels were not delivered to M/s Nidhi Auto

4. If 9112.500 MT of inputs were not received by M/s Nidhi Auto then from were M/s Nidhi Auto has procured inputs for the manufacture of goods which were cleared on payment of duty

5. We, therefore, set aside the entire impugned order and allow all the appeals.

Download the copy:

If you already have a premium membership, Sign In.

CA Rachit Agarwal

CA Rachit Agarwal