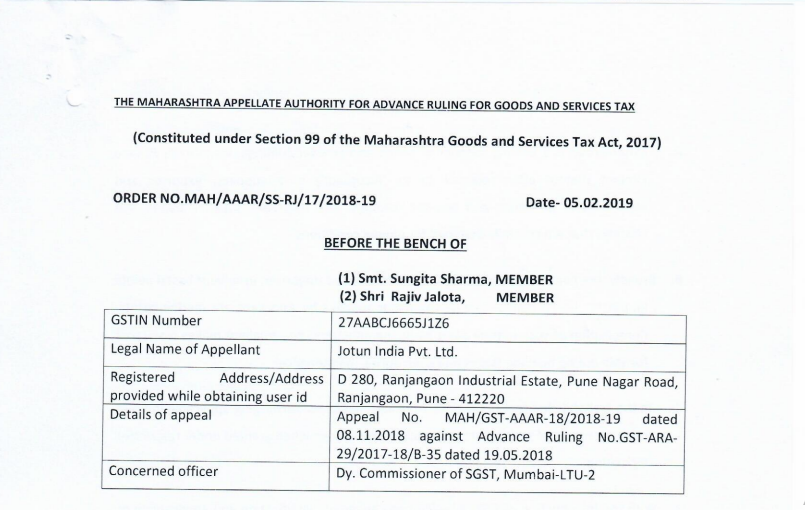

Maharashtra AAAR in the case of Jotun India Pvt. Ltd.

Case Covered:

Jotun India Pvt. Ltd.

facts of the case:

Jotun Group is a leading supplier of paints and powder coatings, Jotun India Private Limited (hereinafter referred to as ‘Appellant’) is a supplier, exporter, and manufacturer of paints and powder coatings. The appellant supplies paints and coatings that are specially designed for unique conditions.

Broadly, the paints supplied by the appellant can be categorized in solvent-based paints and water-based paints. One of the major supplies by Appellant are marine paints. The composition of such marine paint being manufactured by the Appellant makes it suitable for the ship during building stages and even during maintenance.

In the erstwhile indirect tax regime, the Appellant has been discharging applicable indirect taxes on supply of such paints and availing exemptions when granted under the respective legislation.

With the introduction of GST, the Appellant has analyzed the classification and applicability of CGST, SGST, and IGST in light of new legislation. For classification, it has been clarified in the rate notification of respective legislation that rule of interpretation of the First Schedule to the Customs Tariff Act, 1975 including Section Notes and Chapter Notes and general explanatory notes of the said first schedule would be applicable for the purpose of the classification under GST.

Observations:

Thus, what we observe from the above is that the impugned product would not be a part of the ship because

- It is a standalone commodity having an independent existence

- it is also perceived as an independent product rather than as a part of something.

- It is not an integral part of the ship.

- The ship can sail without the application of the impugned product.

- It only adds to the comfort and durability of the ship but is not an indispensable part of it.

Order:

We do not find any reason to interfere with the ruling pronounced by the Advance Ruling Authority vide their Order no. GST-ARA-29/2017-18/B-35 dated 19.05.2018.

Read & Download the full Decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.