Flavoured Milk is classified as Beverage and hence chargeable to GST @ 12%

Case Covered:

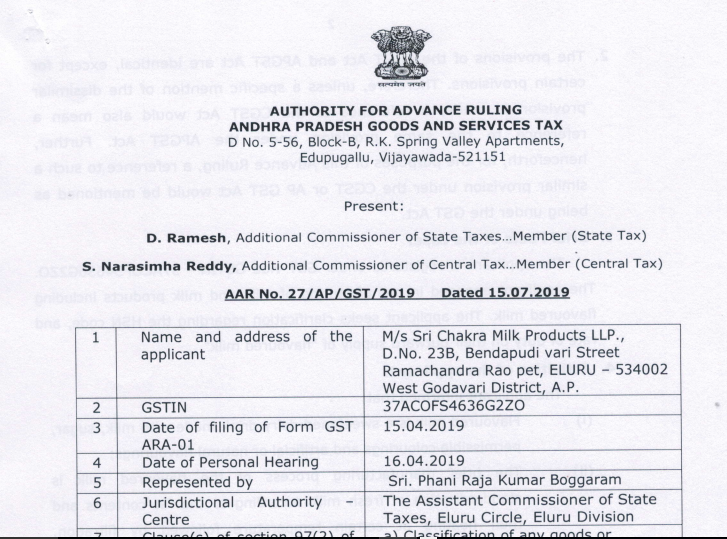

M/s Sri Chakra Milk Products LLP

Read the full text of the case here.

Facts of the case:

The present application has been filed u/s 97 of the Central Goods & Services Tax Act, 2017 and AP Goods & Services Tax Act, 2017, (hereinafter referred to CGST Act and APGST Act respectively) by M/s Sri Chakra Milk Products LLP., D.No. 238, Bendapudi vari Street Ramachandra Rao pet, ELURU – 534002 West Godavari District, A.P. (hereinafter referred to as the applicant), registered under the Goods & Services Tax.

The applicant is registered under GST vide GSTIN – 37ACOFS4636G2ZO. The applicant engaged in the manufacturing of milk and milk products including flavored milk. The applicant seeks clarification regarding the HSN code and rate of duty on their outward supply of “flavored mirk”.

Questions raised before the authority:

The applicant had filed an application in form GST ARA-01, dated 13.04.2019 by paying the required amount of fee for seeking Advance Ruling on the following issue:

(a) what is the rate of GST applicable to the outward supply of “Flavoured Milk”?

on Verification of basic information of the applicant, it is observed that the applicant falls under state jurisdiction, Assistant commissioner of state Taxes, Eluru Circle.

Accordingly, the application has been forwarded to the jurisdictional officer, Assistant Commissioner (State Tax), Eluru Circle, with a copy marked to the Central Tax authorities, to offer their remarks as per Section 98(1) of CGST/APGST Act 2017. The jurisdictional officers concerned responded that there are no proceedings passed or pending relating to the issue on which Advance Ruling is sought by the applicant.

Observations:

We have carefully considered the submissions, it is an undisputed fact that the appellants were adding flavors to the milk and the Commissioner (A) after seeing the ingredients has considered the item to containing milk falling under Chapter 22 as against classification under chapter 4 – ‘Milk and Milk Products’. The item cannot be used as milk per se in view of the addition of flavor added to it and it has to be considered as a beverage. This is our prima facie finding.

We have carefully considered the submissions, it is an undisputed fact that the appellants were adding flavours to the milk and the Commissioner (A) after seeing the ingredients has considered the item to containing milk falling under Chapter 22 as against classification under chapter 4 – ‘Milk and Milk Products’. The item cannot be used as milk per se in view of the addition of flavour added to it and it has to be considered as a beverage.

This is our prima facie finding.

Ruling:

(Under section 98 of Central Goods and Services Tax Act, 2017 and the Andhra Pradesh Goods and Services Tax Act,2017)

The HS Code for flavoured milk is 2202 9930 and the GST rate is 12% ( 6% CGST and 6% SGST) under entry no. 50 of the Schedule II of Notification No.1/2017 – central (Rate) dated 28.06.2017 as amended.

Download the copy:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.