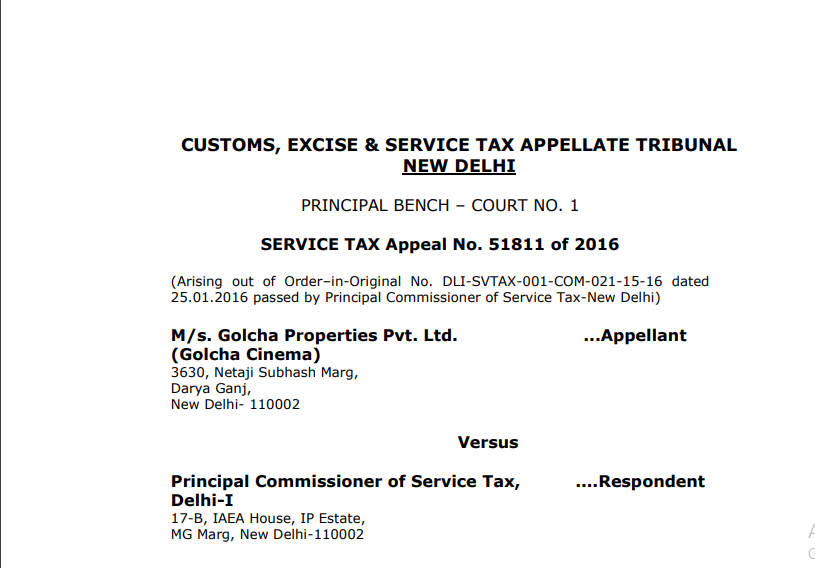

CESTAT in the case of M/s. Golcha Properties Pvt. Ltd. Versus Principal Commissioner of Service Tax

Case Covered:

M/s. Golcha Properties Pvt. Ltd.

Versus

Principal Commissioner of Service Tax

Facts of the Case:

The Appellant, an owner of a cinema hall called ‘Golcha Cinema’ and engaged in the business of exhibiting films in this theatre, has assailed the order dated January 25, 2016, passed by the Principal Commissioner of Service Tax, Delhi1 that confirms the demand of service tax under “renting of immovable property” service with penalty and interest proposed in the two show-cause notices dated April 17, 2014, and April 22, 2015, for the reason that the Appellant is providing service to the film Distributors by way of renting its theatre for screening the films.

The Appellant had entered into agreements with films Distributors under which the theatrical exhibition rights for the exhibition of the films were transferred to the Appellant, either for a specified number of shows and period or in perpetuity. It is in the exercise of such rights obtained from the Distributors that the Appellant exhibited movies in its theatre. In lieu of obtaining such rights, the Appellant agreed to share a specified percentage of Net Box Office Collection with the Distributors, subject to the conditions specified in the agreements. In one such agreement dated August 29, 2012, entered into between M/s. A.A. Films and the Appellant, the Appellant agreed to share 50%/40% of the Net Box Office Collection, with M/s. A.A. Films subject to a maximum theatre share of Rs.2,80,000/-.

Observations:

The Principal Commissioner found that the Appellant had provided ‘renting of immovable property’ services. For an activity to fall under ‘renting of immovable property’ services, the nature of the activity should be that of renting or letting or leasing or licensing or other similar arrangements of immovable property, for use in the course or furtherance of business or commerce. In other words, where the immovable property is given for use by the service recipient or where there is a transfer of the right to enjoy the property for a certain time for a consideration paid or promised or where there is granting of the right to use and occupy the immovable property by way of tenancy, lease, license, the transaction would be covered under the category of ‘renting of immovable property’ services. In the instant case, the immovable property i.e. the theatre is used and occupied by the Appellant in its own right to screen the films and at no point in time, the theatre is used by the Distributor.

Decision:

Thus, for all the reasons stated above, the confirmation of the demands in the impugned order cannot be sustained and are set aside.

The impugned order dated January 25, 2016, is, accordingly, set aside and the appeal is allowed.

Read & Download the full Decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.