Bhutan GST things you must know – May 2019

Following is the book about Bhutan GST. It covers all major portions related to Bhutan GST.

1. Basics of indirect taxation

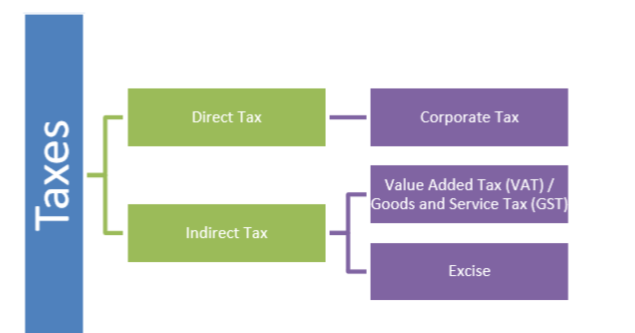

Taxes are typically a key source of revenues for Governments across the world. Taxes can be ‘direct’ taxes or ‘indirect’ taxes.

1.1 Direct Tax

Direct taxes are taxes which are levied and collected directly from the person, company, firm, etc. Taxes such as Corporate Tax is an example of Direct Tax.

1.2 Indirect Tax

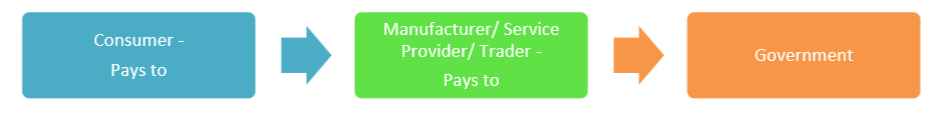

Indirect taxes are levied and collected from consumers through manufacturers, traders or service providers. Herein, the Government collects the taxes through manufacturers, service providers, traders than the person who bears it ultimately (i.e. consumer), and thus it is called as ‘Indirect Tax’.

In a legal sense, the responsibility to pay an indirect tax rests with the manufacturer/ seller/ service providers though, finally, the tax is collected from the consumer.

The following picture depicts how money is collected by the Government indirectly:

Pictorial depiction of Direct Tax and Indirect Tax:

2. Primer on GST

2.1 How GST derives its name?

GST is an abbreviation for Goods and Services Tax. In a few countries, GST is

also known as Value Added Tax (VAT).

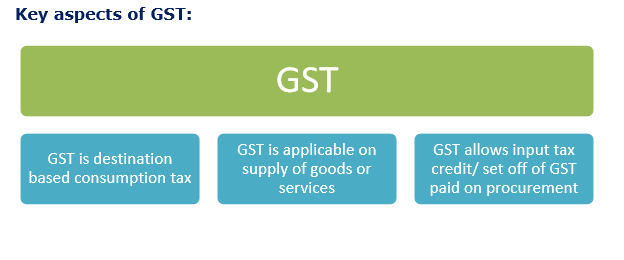

2.2 GST is consumption-based tax

GST is a consumption-based tax wherein the basic principle is to tax the value addition at each business stage. To achieve this, tax paid on purchases is allowed as a set off/ credit against liability on output/income.

Goods and Services Tax is levied on activities such as ‘supply’ of goods and services. Each time goods/ services exchange hands, typically, they are subjected to GST. GST is levied on all transaction of goods and services.

Thus, in principle, GST should not differentiate between ‘goods’ and ‘services’ (though GST law may prescribe separate place of supply/ time of supply provisions for goods and services).

Internationally, GST was first introduced in France and now more than 162 countries have introduced GST.

Related Topic:

Comprehensive Charts for all due dates in direct tax and indirect tax

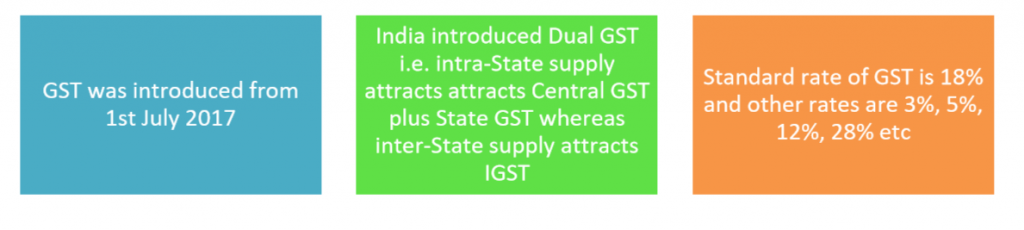

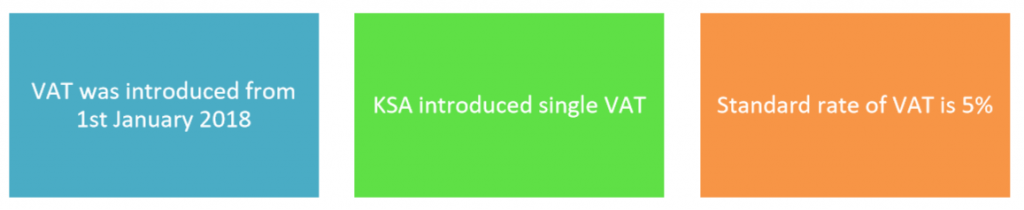

Most of the countries, depending on their own socio-economic formation, have introduced Single GST (like UAE or KSA) or Dual GST (like India).

Key Aspects of GST

3. GST in India and Gulf Countries

3.1 India

India introduced GST from 1st of July 2017. The key aspect of Indian GST are:

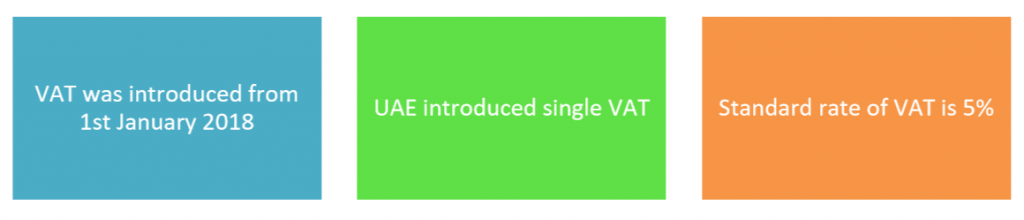

3.2 United Arab Emirates (UAE)

3.3 Kingdom of Saudi Arabia (KSA)

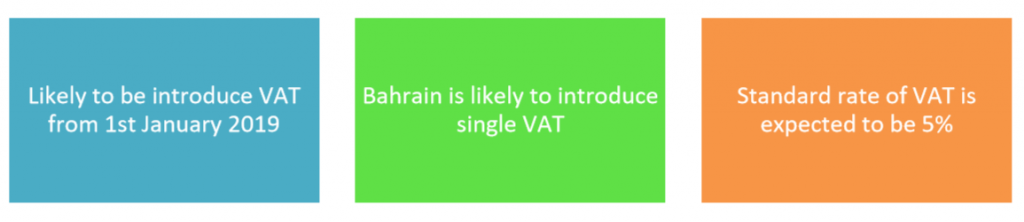

3.4 Kingdom of Bahrain

3.5 Recent Chronology of GST in Asia and Gulf Countries

4. About the Kingdom of Bhutan1

4.1 Constitution of Bhutan

The Constitution of Bhutan is the Supreme Law of the State and affirms the authority of legal precedent.

Adoption of Constitution of Bhutan, in 2008, marks the transition from a Monarchy to a Democratic Constitution Monarchy in the country.

4.2 Supreme Court

Supreme Court of Bhutan is the Kingdom of Bhutan’s highest court of review and interpreter of the Constitution2.

4.3 Religions

Major religions are Buddhism (official) and Hinduism.

4.4 Language

The major language is Dzongkha, while English is used as an official language in the business sector.

4.5 Currency

Bhutan’s currency is ngultrum and it is approx. equivalent to INR.

4.6 Other key aspects

Bhutan’s Capital is Thimphu. Bhutan has 20 districts.

Bhutan has one Airport, Paro.

Bhutan’s population is approx. 750,000.

Bhutan’s GDP is approx. USD 2,056 mn (2016).

Bhutan has Local Government and Municipalities.

Bhutan’s key sector are Agriculture, Minerals and Mining, Cement, Food products, Tourism, Livestock, Renewable Energy.

Bhutan has very close trade and business links with India.

4.7 Setting up of business in Bhutan

Typically, businesses are formed as:

- Company

- Partnership firm

- Proprietorship etc

Fiscal Year is from 1st January to 31st December.

5. Taxes in the Kingdom of Bhutan3

5.1 Key Taxes in the Kingdom of Bhutan

| Taxes | Particulars |

| Sales Tax | In 2000, Bhutan enacted its Sales Tax and Customs Excise Act.

The Act sets forth the duty to pay sales tax and excises on goods and services within Bhutan as well as customs on imports according to rates and schedules published by the Ministry of Finance.

|

| Corporate

Income Tax (CIT) |

CIT is a corporation tax.

It is levied @ of 30% on net profit. CIT is payable by those entities registered under the Company’s Act of the Kingdom of Bhutan, 2000. |

| Business

Income Tax5 (BIT) |

BIT is a non-corporate business tax.

It is levied @ of 30% on net profit. BIT is payable by all unincorporated business entities holding a trade license or registration certificate issued by the Ministry of Economic Affairs (MoEA) or any other competent authority. |

| Personal

Income Tax6 (PIT) |

PIT is a tax levied on the personal income of an individual on an accrual basis from any or more of the following six sources:

(a) Employment Income (b) Rental income (c) Dividend income (d) Income from interest (e) Income from the sale of Cash Crop (f) Income from other sources Rate varies from Nil to 25%. Further, specific exemptions/ deduction needs to be considered for computing aforesaid income. |

| TDS | A preliminary estimate of tax liability payable on a Pay As You Earn (PAYE) basis.

Its deducted at source from the payments made to a taxpayer by a withholding agent and deposited with Government. TDS is adjusted against the final tax liability. |

| Customs Duty | Customs duty is a tariff or an indirect tax levied on the import and export of goods entering or leaving the country.

In other words, Customs Duty is duties laid down in the Customs tariff schedule of the Bhutan Trade Classification 2017 to which goods are liable on entering or leaving the Customs territory. In the case of Bhutan, as to encourage export, there is no Customs Duty or any type of duties or indirect taxes levied on export. Duties may be ad valorem or specific. No customs or duties are levied on goods imported into Bhutan from India, as per the nations’ Agreement on Trade and Commerce. |

5.2 Constitution of Bhutan

Key Articles from a Tax Perspective

Article 8

Fundamental Duties

…

- A person shall have the responsibility to pay taxes in accordance with

the law

Article 14

Finance, Trade, and Commerce

- Taxes, fees and other forms of levies shall not be imposed or

altered except by law

5.3 IMF and ADB report

IMF report states that “While currently not in the baseline projections, the authorities have begun planning for GST implementation scheduled for July 2020, supported by Fund technical assistance (TA).”

Similarly, ADB report states that “The Fiscal Policy Framework projects a sharp increase in budget revenue in FY2020 on Bhutan introducing its own GST to replace most indirect taxes…”

6. IMF Report 2018 – Bhutan – Article IV Consultation9

Relevant extracts

Under Article IV of the IMF’s Articles of Agreement, the IMF holds bilateral discussions with members, usually every year.

A staff team visits the country, collects economic and financial information, and discusses with officials the country’s economic developments and policies. On return to headquarters, the staff prepares a report, which forms the basis for discussion by the Executive Board.

IMF Executive Board Concludes 2018 Article IV Consultation with Bhutan

On October 26, 2018, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Bhutan.

…

Nevertheless, risks are skewed to the downside. Domestic risks include delays in implementing the goods and services tax (GST) and completing hydropower projects and lower electricity exports. …

6.1 Executive Board Assessment10

Executive Directors welcomed the significant improvements in per capita income and poverty indicators, with strong economic growth and low inflation…

Given Bhutan’s infrastructure needs, Directors called for higher capital expenditure supported by additional domestic revenue and a modest increase in domestic financing. They welcomed the authorities’ commitment to implement a broad-based GST by July 2020 and called for rationalization and gradual curtailment of tax exemptions.

6.2 Key Policy Recommendations:

Fiscal consolidation is appropriate to reduce vulnerabilities. However, a more gradual pace than envisaged in the draft 12th Five-Year Plan would help lessen the planned sharp fall in capital spending and better support growth. Resources should be secured for the timely implementation of the GST project.

- To boost the domestic revenue base, the authorities should implement their plans for a broad-based GST without delay (Box 2). While currently not in the baseline projections, the authorities have begun planning for GST implementation scheduled for July 2020, supported by Fund technical assistance (TA). Early endorsement of the project by the incoming government and passage of the associated legislation will be critical to meet the implementation timeline. In terms of design, the GST should be broad-based (to include services) and have a simple rate structure (preferably a single tax rate). Some additional domestic revenue could be collected in the short term by updating the bases of user charges and land/property taxes, which have been eroded by inflation.

With India’s implementation of the GST in July 2017, the adoption of a GST in Bhutan has become a high priority. This box outlines some of the key considerations in adopting a GST in Bhutan, including the benefits and important milestones to be accomplished to meet the July 2020 deadline for its implementation.

At present, Bhutan raises around 5½ percent of GDP in indirect tax revenues. Sales taxes account for 2½ percent of GDP, while around 2 percent of GDP is raised from the excise duty refund (EDR), which reflects excises levied by India on exports to Bhutan. The remainder is raised from domestic excises, a green tax, and customs duties.

With India’s adoption of the GST (and removal of excises on exports), the EDR will effectively cease in FY2020, leaving a large revenue gap to be filled. While the authorities have identified a set of primary sales tax-related measures that could potentially make up for the loss of EDR revenue, a broad-based GST will help to cover the revenue gap in a sustainable and more efficient manner. Moreover, a GST is likely to be buoyant; in a sample of nearly 70 countries compiled by the staff, the average increase in VAT revenue as a percent of GDP was about ½ percent of GDP over a five-year period.

Furthermore, the potential to increase indirect tax revenues from other sources, such as raising customs duties, is severely limited by Bhutan’s free trade agreement with India (which covers 90 percent of imports), as well as South Asian Association for Regional Cooperation preferences and the preferential trade agreement with Bangladesh. Thus, indirect tax revenues will rely heavily on GST implementation.

While the benefits of a broad-based GST are well understood, the key challenge from a tax policy perspective will be to design and implement a GST that does not “resemble” the existing sales tax. This requires:

(i) a broad base,

(ii) effective input tax credit/refund management, and

(iii) administrative simplicity (e.g., few rates), in particular given capacity constraints.

The GST under consideration presently in Bhutan resembles a standard VAT with the input tax credit, a mandatory turnover-based registration threshold, and adherence to the destination principle (with zero-rated exports and taxed imports, including service imports).

Bhutan is receiving extensive IMF support for implementing the GST. Bhutan created a project office and prepared a GST implementation plan, consisting of a detailed timeline, in line with IMF recommendations. IMF TA has provided further recommendations in key areas including:

(i) legislation and rules including to draft the GST law;

(ii) establishing and guiding business processes related to the GST;

(iii) selection of the appropriate information technology (IT) system;

(iv) taxpayer outreach; and

(v) capacity building.

TA on the GST law is currently on-going. The draft law is being reviewed by the GST Working Group at the Department of Revenues and Customs. In terms of challenges, the ability of the revenue authority to develop and implement an IT system that can underpin GST processing is considered one of the potential stumbling blocks that could delay the adoption of the GST.”

7. Things you must know about GST

As GST has a pervasive impact on businesses, it’s critical for businesses to understand a broad framework of GST.

Thus, let’s discuss things one must know about GST.

7.1 GST is payable on the supply

GST is imposable on every taxable supply and deemed supply made by a taxable person. Thus, in GST regime, all ‘supplies’ be it sale, transfer, barter, lease, import of services, etc. of goods or services are subject to GST.

Typically, GST is leviable on a supply made for consideration, however, the GST law may levy GST on specific supplies made without consideration, such as the use of business assets for purposes other than business.

7.2 GST payable as per the time of supply

The liability to pay GST will arise at the time of supply as determined for goods and services. In this regard, separate provisions, typically, prescribe what will be the time of supply for goods and services.

Further, the GST typically contemplates payment of GST at the earliest of date of issuance of invoice or receipt of consideration. Additionally, there could be special provisions for supplies of a repetitive nature or continuous supplies.

Given that there could be multiple parameters in determining ‘time’ of supply, maintaining reconciliation between revenue as per financials and as per GST could be a major challenge to address for businesses.

7.3 Determining Place of Supply could be the key

In GST law, determining the place of supply is critical as if it is determined that supply is made within a country’s jurisdiction then in such case GST becomes applicable.

In this regard, GST typically provides separate provisions which help an assessee determine the place of supply for goods and services.

Typically, for ‘goods’ the place of supply would be shall be in the State if the supply was made in the State, and does not include Export from or Import into the State. Whereas for ‘services’ the place of supply could be either the Place of Residence of supplier or recipient.

Further, GST Law generally prescribes multiple scenarios wherein the aforesaid generic principles will not be applicable and specific provisions will determine the place of supply. Thus, in GST regimes, businesses are expected to scroll through all the place of supply provisions before determining the place of supply.

7.4 Valuation in GST

GST would be payable on the ‘value’ of supply.

Typically, the value of supply shall be the value of consideration less the tax and includes the value of the non-cash portion of the consideration determined according to the fair market value.

The value of the supply shall include all the expenses imposed by the taxable supplier on the customer, the fees due as a result of the Supply and all the Taxes including Excise Tax if any, but excluding GST.

Typically, discounts given are permissible as a deduction from the value of supply (subject to fulfillment of prescribed conditions).

7.5 Input tax credit in GST

Goods and Services Tax scheme derives its name as ‘value-added tax’ to the fact that it enshrines in its framework the concept of input tax.

Input tax is the recoverable GST paid on procurement of goods and services.

Let’s take an example, goods worth 105 (inclusive of 5 as GST), are sold for 210 (inclusive of 10 as GST). In this case, 5 is referred to as input GST whereas 10 is referred to as output GST. In the GST regime, the supplier is liable to deposit net GST with the Government. Thus, in the example supplier is liable to deposit GST of 5 (Output GST less input GST) with Government.

The aforesaid example is tabulated in below:

| Particulars

|

Goods sold by A to B | Goods sold by B to C |

| Sale Price | 100 | 200 |

| GST applicable @ 5% (I) | 5 | 10 |

| Input Tax Credit (II) | Nil | 5 |

| Net GST payable (III = I-II) | 5 | 5 |

Though at a prima-facie level, aforesaid appears simple, in GST regime, the complications crop up due to the fact that, typically, goods or services used for personal purposes or exempt supplies is denied.

Herein, in GST regime interpretation issues crop up such as business lunch with clients, is it a personal expense or official expense or both!

Similarly, GST laws restrict GST credit in respect of employees related expenses or motor vehicles, catering, etc. related expenses. Further, there could be a restriction on availment of goods disposed of by way of gift or free samples.

Thus, businesses need to factor in availability, non-availability of credit.

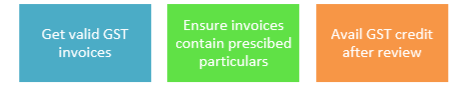

Further, businesses need to ensure that the conditions prescribed to availment of credit are fulfilled.

It is pertinent to note that incorrect GST credit leads to penal consequences whereas non-availability of credit leads to tax cascading. Thus, the business needs to finding the right balance between these two to sail successfully in the GST regime.

7.6 Rate of GST

Each country depending on its socio-economic needs decides the standard rate of GST.

Rate of GST varies across the world from 5% in UAE to 18% in India and 25% in Norway.

Typically, most of the goods attract a standard GST rate unless exemption or zero-rate is applicable.

The businesses need to be careful in determining whether the goods or services supplied by them are liable for standard rate, zero rates or exempted.

7.7 GST framework comprises of Law and Regulations

In GST regime, typically the substantive provisions (such as provisions governing levy of GST, registration, place of supply, time of supply etc) is contained in GST Law whereas procedures/ processes (such as process of registration, explanation for what qualifies as goods or services, etc) are typically contained in Rules/Executive Regulations.

Additionally, in the GST regime, the Government may issue Decrees or Decisions or Notifications for specific aspects of GST law.

Further, the Tax Authorities issue Guides, flyers, clarifications on social media (Twitter, etc).

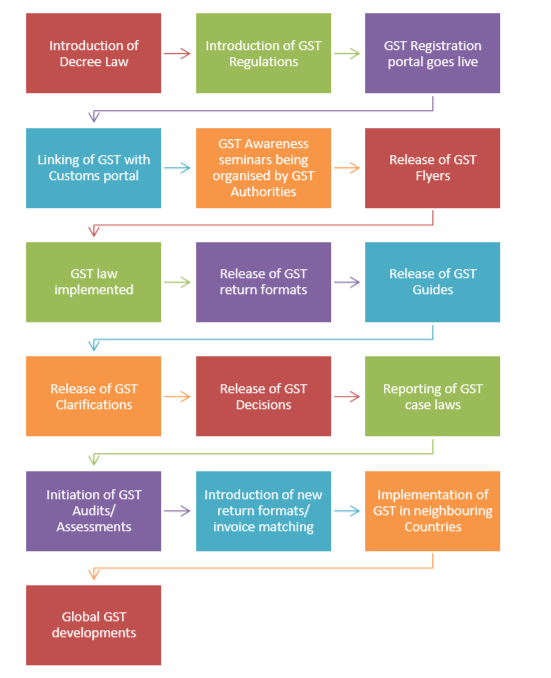

During the implementation of GST in a country, typically, these pieces of GST legislation are available at different points of time (such as Decree Law may be issued first followed by Regulations).

Also, over a period of time, based on feedback from taxpayers, the Authorities, clarify various aspects through seminars/ workshops.

Thus, it can be observed that in typically, the GST law is contained in different pieces of law and thus, taxpayers need to ensure that they join all these pieces of GST jigsaw puzzle to see the correct picture and take appropriate GST position on the business transactions.

- Commentary on GST

8.1 GST introduction also brings disruption!

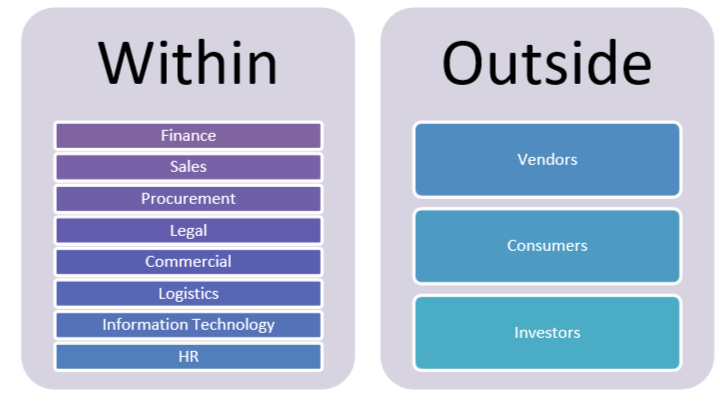

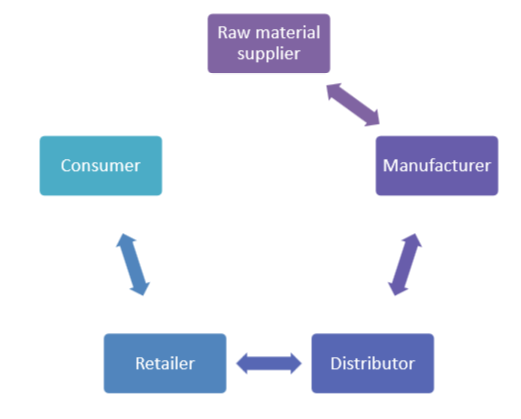

8.2 GST impacts businesses and their supply chain

Pictorial depiction: GST Impacts inside and outside entity

8.3 Prepare step plan for each team!

8.4 Top-down or bottom-up approach for GST!

8.5 Co-ordination amongst the team is critical for GST implementation!

8.6 GST shapes technology!

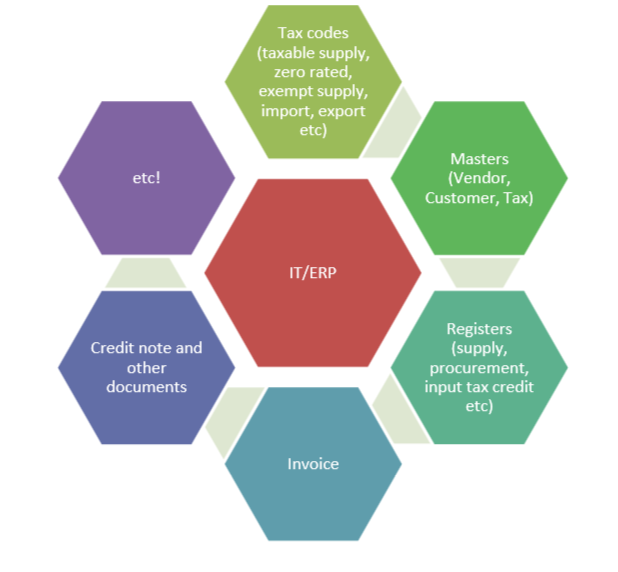

Pictorial depiction: GST shapes technology!

8.7 Review ERP systems

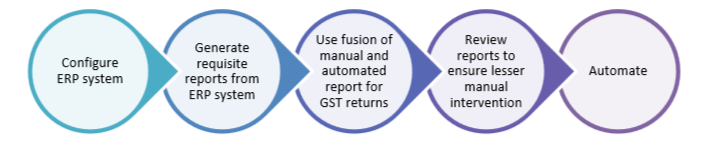

Pictorial depiction: Review ERP reports

8.8 Its about who blinks first!

Pictorial depiction: Who blinks first!

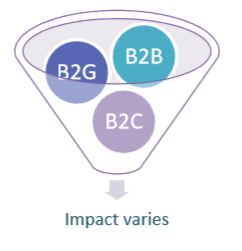

8.9 GST Impact varies based on who the buyer is!

Pictorial depiction: Impact depends on who the buyer is!

8.10 Everything is bi-lateral in GST!

Pictorial depiction: Everything is bi-lateral in GST!

8.11 Out of GST means out of business!

8.12 GST evolution is a continuous process!

Pictorial depiction: GST evolution!

8.13 GST impacts working capital!

8.14 Optimise GST credits!

Pictorial depiction: Optimise GST Credits!

8.15 Input Tax credit – Online matching

8.16 Reverse Charge mechanism

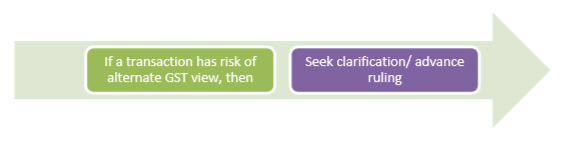

Pictorial depiction: Seek Clarifications!

8.18 Periodic GST Returns!

8.19 Periodic GST Returns in GST may become redundant!

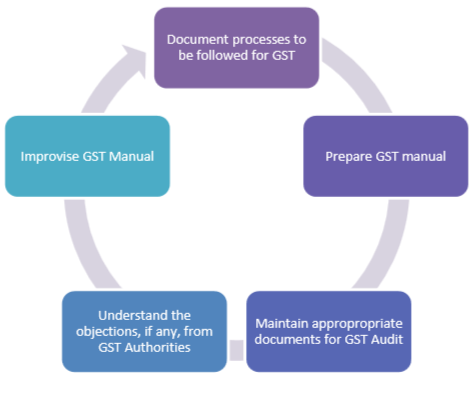

8.20 Gear up for GST Audit!

Pictorial depiction: Gear up for GST Audit!

8.21 Enabling GST administrators are key!

8.22 Empowering consumers are important!

8.23 Educate GST payers!

8.24 Enable fintech!

8.25 GST is a ‘rarest of rare’ policy of Government

8.26 Government needs to find the right ‘balance’ between protecting the buyer and seller interest!

Pictorial depiction: Finding balance is critical!

8.27 Government Authorities need to extensively co-ordinate during GST implementation!

8.28 Simpler user interface of GST portal is helpful!

8.29 Make the law and portal multi-lingual!

- Five steps to be GST ready

9.1. Decode GST

9.2. Understand GST impact

9.3. Gear up for transition of IT systems

9.4. Design Alternate Business Strategies

9.5. Make Representation

- The VAT in the United Arab Emirates (UAE)

10.1 Single rate!.

10.2 Reverse Charge Mechanism (RCM) is only a disclosure!

10.3 One-page return!

10.4 Staggered GST return filing!

10.5 Prices inclusive of GST!

10.6 Substantive FTA initiatives!

10.7 Few challenges!

10.8 GCC countries yet to become one common market!

- GST – International Scenario

You can download the full pdf of Bhutan GST by clicking here

If you already have a premium membership, Sign In.