Analysis of landmark HC decision for ITC of construction ( Safari retreats)

Table of Contents

- Introduction:

- About the decision by Orrissa High court

- Facts of the case landmark HC decision for ITC of construction

- Cases taken in discussion for decision in case of Safari retreats

- How to interpret a taxation statute?

- Key Takeaways from the HC decision for ITC of construction in case of Safari retreats

- Download full judgment:

Introduction:

Here I would like to mention the case of Safari Retreats, by Odhisha high court. This very important judgement clarified the situation of input tax credit for the situation covered by Clause”d” of section 17(5). After this section it was a common practice to reject the input tax credit of any goods/services used for construction of immovable property. There was no distinction in residential building or commercial building. Also there was no segregation in a building constructed for the self use or constructed for letting it out to others.

GST was implemented to remove the cascading effect. But by virtue of this provision it was creating the biggest cascading effect. Let us discuss how?

When we construct a building for self use. The chain of taxability breaks. Because there is no GSt on sale of an immovable property. But when we construct a building for letting it out to others and not for self use. The chain of taxability is still there. But this provision was denying ITC in every case. Once this we need to remember is GST is on supply and not on sales of Goods only. Sale of a building is out of the definition of Goods but its letting out is covered by services. When a property is constructed the purpose is only to let it out. Input tax credit shall be allowed in that case.

| 1. | Construction of residential property | Sale: No GST

Letting out: No GST |

No ITC |

| 2. | Construction of a commercial property | Sale : No GST

Letting out: Taxable in GST |

In the second case of letting out of a commercial property input tax credit shall be available. |

About the decision by Orrissa High court

A landmark decision for input tax credit in GST. Safari retreats Private Limited is a company registered under the companies Act 1956.They have their registered office in Khurda, Odisha .

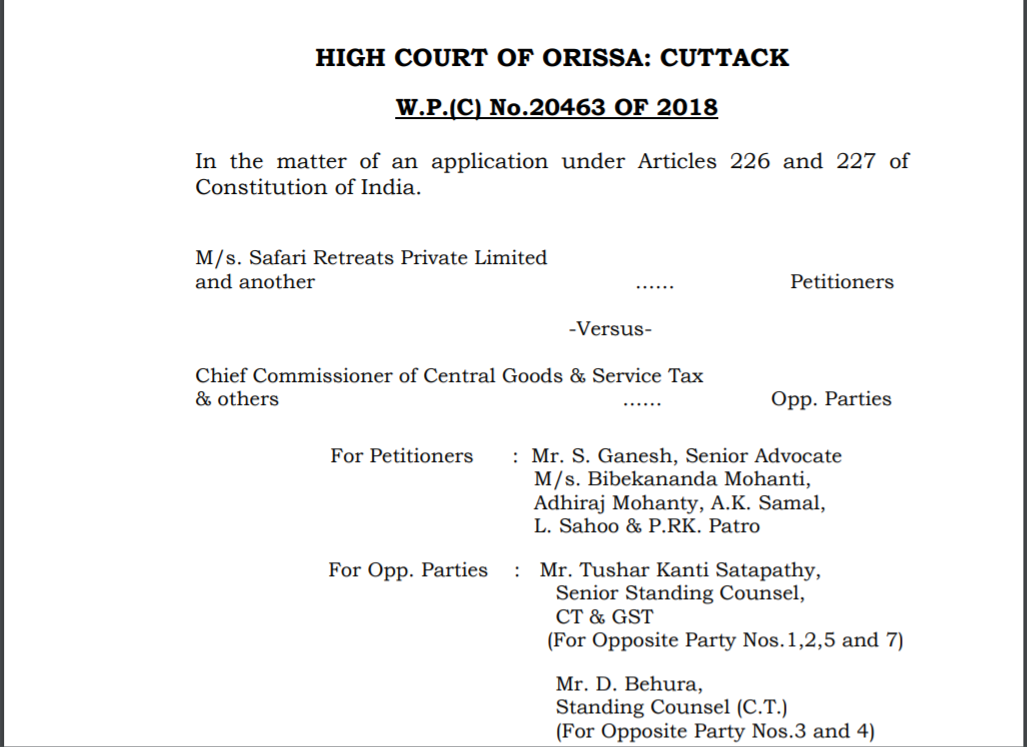

It is represented for the applicant by Mr. S. Ganesh , Senior Advocate, M/s Bibekananda Mohanti,Adhiraj Mohanti, A.K. Samal, L. Sahoo & P.RK. Patro

This case has raised an important issue related to disallowance of input tax credit in GST. Article 14 and 16 of constitution of India were referred to.

What is article 14 and 16 of constitution of India?

Article 16 embodies the fundamental guarantee that there shall be equality of opportunity for all citizens in the matters relating to employment or appointment to any office under the state. Article 14 & 16 hits on the arbitrariness and ensure the equality.

Related Topic:

No interest for availed ITC: Patna HC

Facts of the case landmark HC decision for ITC of construction

– The applicant is engaged in letting out of commercial building. They have constructed the commercial complex. In construction of complex they incurred huge expenses. The inward supplies used for this purpose includes:

- The construction material

- The architect services

- The construction services

They have paid GST on all these supplies. Then they are making the outward supplies. This is the plea of applicant that they should be eligible for the input tax credit for all these inward supplies. The deterrent is the provision of CGST Act for blockage of input tax credit. Section 17(5)(d) of CGST Act restrict the credit in case of immovable property. The section provides that no input tax credit will be available if it is used for construction of immovable property.

- The petitioner also discussed about the basic reasons for implementation of GST in India. Curbing the cascading effects was one of them. But now GST provisions are creating a cascading effect. The building constructed by the taxpayer is meant for letting out. There is no break in the chain of supply. But GST provisions are restricting its input tax credit.

Related Topic:

How to do Export to Nepal & Bhutan in GST

Cases taken in discussion for decision in case of Safari retreats

Following important case were cited in this discussion. Main emphasis was on article 14,16 and 19 of constitution of India. Also the discussion related to the interpretation of a statute was made.

Eicher motors Ltd. V. Union of India reported in (1999) 2 SCC 361,

Collector of Central Excise, Pune v. Dai Ichi Karkaria Ltd. Reported in (1999) 7 SSC 448

Circular dated 8/12/2018

Spentex industries limited V. Commissioner of central excise and others reported in (2016) 1 SSC 780

Indian metals & ferro Alloys ltd. V. Collector of central excise , Bhubneswar, reported in 1991 Supp (1) SCC 125.

Shayara Bano V. Union of India and others, reported in (2009) SSC 1.

Oxford university press v. commissioner of income tax reported in (2001) 3 SCC 359

K.P. Varghese V. Income tax officer Ernakulam and another 1981(reported in volume 131 ,ITR 597.

Delhi Transport corporation V. D.T.C. Majdoor Congress and others reported in 1991Supp(1) SCC 600

In the interpretation of the provisions of an Act two constructions are possible. On of which leads towards the constitutionality of the legislation

Indian oil corporation ltd. V. State of Bihar (TS-347-SC-2017-VAT): “No assesse can claim set off as a matter of right and levy of entry tax can not be assailed as unconstitutional only because set off is not given.”

Cellular operators association of India and others Vrs. UoI(2018-TIOL-310-HC-DEL-ST):

In this case the hon’ble Delhi High court rejected the claim of the taxpayer to allow credit of unutilized education and higher education cess and upheld the power of government to restrict the utilization of balance Cess.

Mohit minerals pvt. Ltd. Vrs. Union of India: Held that petitioner is not eligible for any credit of clean energy cess.

JCB India Ltd Vs. Union of India 2018 –TIL -23-HC –Mum- GST:

Held that CENVAT credit is merely a concession and it cant be claimed as a matter of right.

Observation of honorable Odhisha High court in case of Safari retreats privately limited:

How to interpret a taxation statute?

The principal of contemporanea expositio: The court in Deshbandhu Gupta & Co. V Delhi stock exchange (1979) 4 SCC 565 explained this principal. The meaning of this maxim is interpreting a statute or other document by reference to the exposition it has received from the contemporary authority. It is a well-settled principle of interpretation that courts in construing a statute would give much weight to the interpretation put upon it, at the time of its enactment.

While dealing with the constitutional validity of a taxation law enacted by parliament or state legislature, the court must have regard to the followed principles:

- There is always a presumption in favor of the constitutionality of a law made by Parliament or a State legislature.

- No enactment can be struck down by just saying that it is arbitrary or unreasonable. Or irrational but some constitutional infirmity has to be found.

- The court is not concerned with the wisdom or unwisdom, the justice or injustice of the law as Parliament and state legislatures are supposed to be alive to the needs of the people whom they represent and they are the best judge of the community by whose suffrage they come into existence,

- Hardship is not relevant in pronouncing on the constitutional validity of a fiscal statute or economic law, and

- In the field of taxation, the legislature enjoys greater latitude for classification.

Key Takeaways from the HC decision for ITC of construction in case of Safari retreats

- The very purpose of the Act is to make the uniform provision for levy and collection of tax, intra state supply of goods and services both central and state and to prevent multi taxation.

- In case the taxpayer is using the property for let out he will be eligible for the input tax credit of tax paid on its construction.

- Provisions of Law to be read strictly and no adding of words in between shall be allowed.

- The principal of contemporanea exposition shall be taken into consideration where the reading of a provision of law is defeating the purpose of its enactment.

This is a historical decision where the Court has allowed to defer from the literal interpretation of a statue. Almost 15 cases were discussed and articles 14,15,19(1)(g) of the constitution of India were discussed. It is one of the most beautifully crafted and represented cases.

Download full judgment:

You can also read another write up on the same case by CA Rachit Aggarwal.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.