Liquor license fee is out of GST

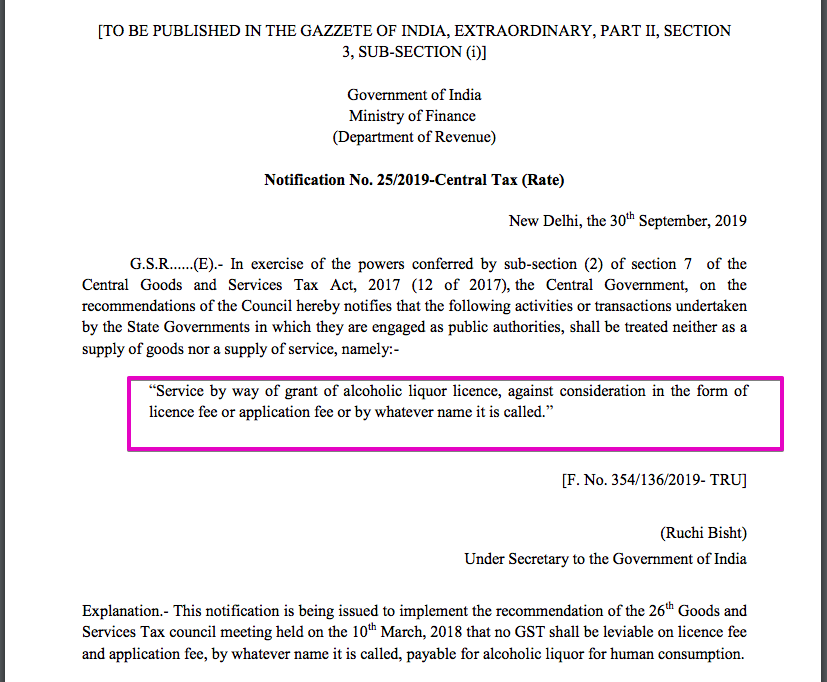

The liquor license fee is out of GST via notification no. 25/2019 CTR dated 30th September 2019

The license fees for a liquor license will be treated as a “No supply”. This issue was creating a lot of mess in alcohol license holders. The supply of alcohol is already out of the preview of GST. It is notified u/s 7(2) of the CGST Act. This section empowers the government to notify any supply as neither a supply of goods, not services.

Impact on Industry:

The impact of this confusion was high on Industry. E.g a liquid shop owner purchased a license in Say, Rs. 2,00,00,000. Now he is required to pay GST on this amount which amounts to Rs. 36,00,000. But their outward supply is not covered in GST. They will not be able to adjust this ITC ever. Neither they will be able to claim it’s refunded. Under GST provisions refund of ITC is allowed only in two cases.

- Zero-rated supply

- Inverted rated supply

This case is not covered in any of them. But you can vouch that its a hardship. Liquor is out of the GST preview. Local taxes on the sale of liquor are already high. Then the burn of ITC was hitting the industry.

How it is resolved?

Inclusion of licensing of liquor in neither a supply of goods nor services will exclude it from the preview of GST. But this inclusion has not included these services in schedule III of the CGST Act. Section 17(3) exclude any item in schedule III (except item no 5) to calculate the reversal of ITC. When we provide both exempted and taxable supplies, A reversal of ITC is required as per section 17 of the CGST Act. Here the confusion is there that the amount of liquor license collected by the licensor is to be included for reversal or not.

I hope some more clarification will be there on this issue.

You can post your queries in our QA section.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.