How to file a reply in form GST ASMT-11?

1.How can I file reply in Form GST ASMT-11 to the notice issued against Scrutiny of Returns?

Ans: To file reply in Form GST ASMT-11 to the notice issued against Scrutiny of Returns, perform following steps:

- Navigate to view additional notices / orders page to view Notices and Orders issued against you by Tax Official,

- Take action using Notices tax of Case Details screen: View issued Notices.

- Take action using Replies tax of Case Details screen: View/Add your reply to the issued Notice,

- Take action using Orders tab of Case Details screen: View issued Orders.

Related Topic:

SOP for Taxpayers-How to furnish a reply in ASMT-11 against a Notice in ASMT-10

Click each hyperlink above to know more.

B.Take action using Notices tax of Case Details screen: View issued Notices.

To view issued Notices, perform following steps after logging into the GST Portal:

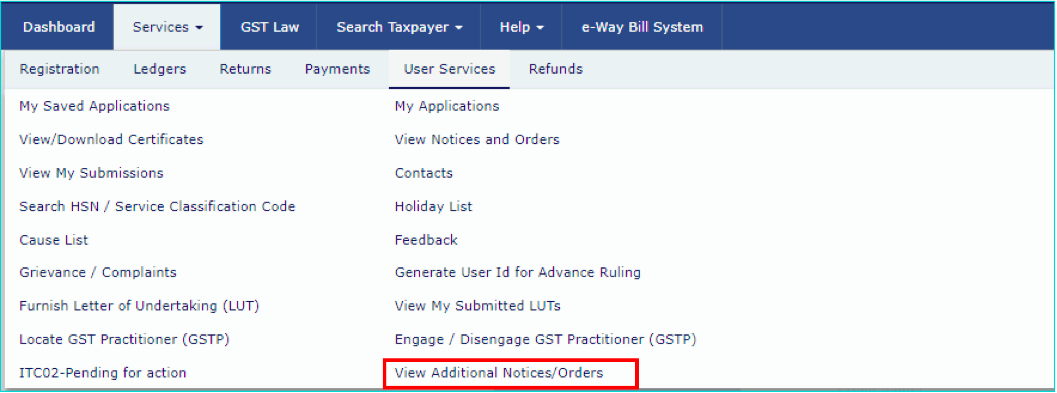

- Navigate to Services > User Services > View Additional Notices/Orders

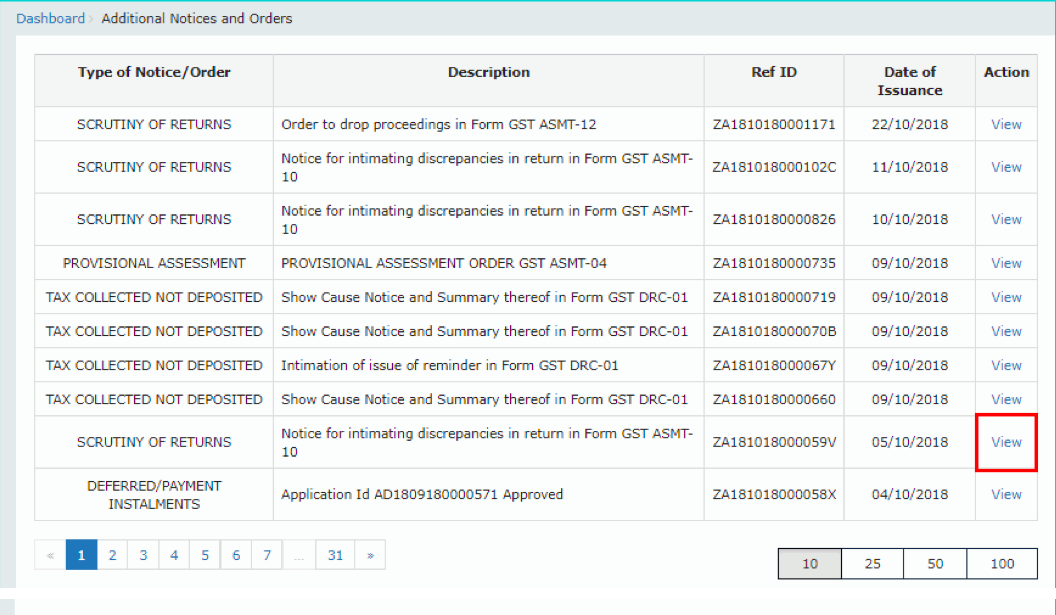

- Click View of the relevant case you want to view notice.

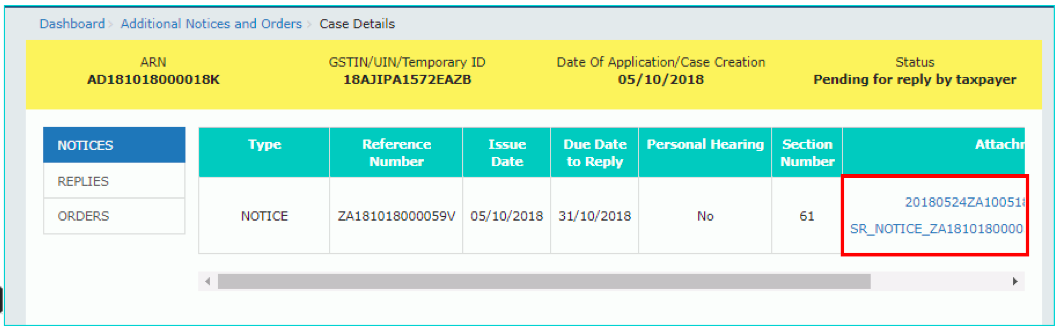

- On the Case Details page of that particular taxpayer, select the NOTICES tab, if it is not selected by default. This tab displays all the notices issued by the Tax Official to you in this particular case.

- Click the Viewlink in the Attachments column of the table to download notices issued into your machine and view them.

Go Back to the Main Menu.

- Take action using Replies tax of Case Details screen: View/Add your reply to the issued notice,

To view or add your reply in Form GST ASMT-11 to the notice issued in Form GST ASMT-10, perform following steps:

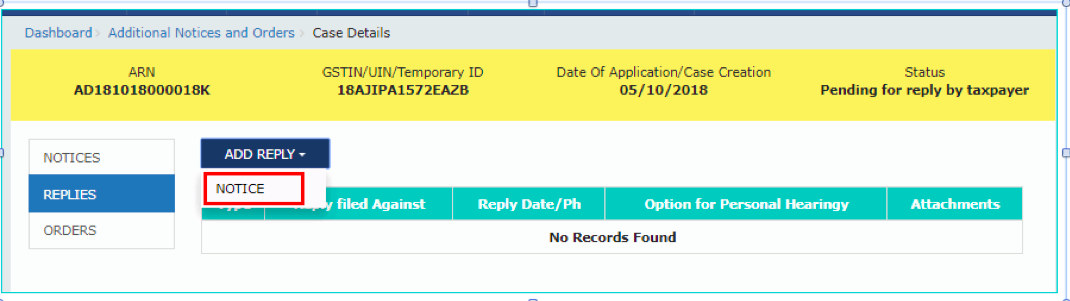

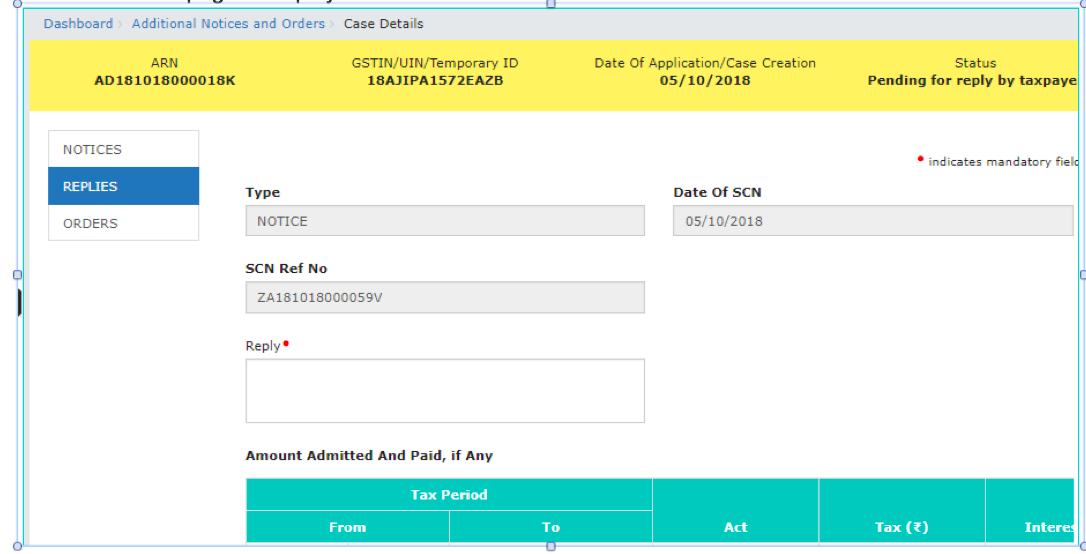

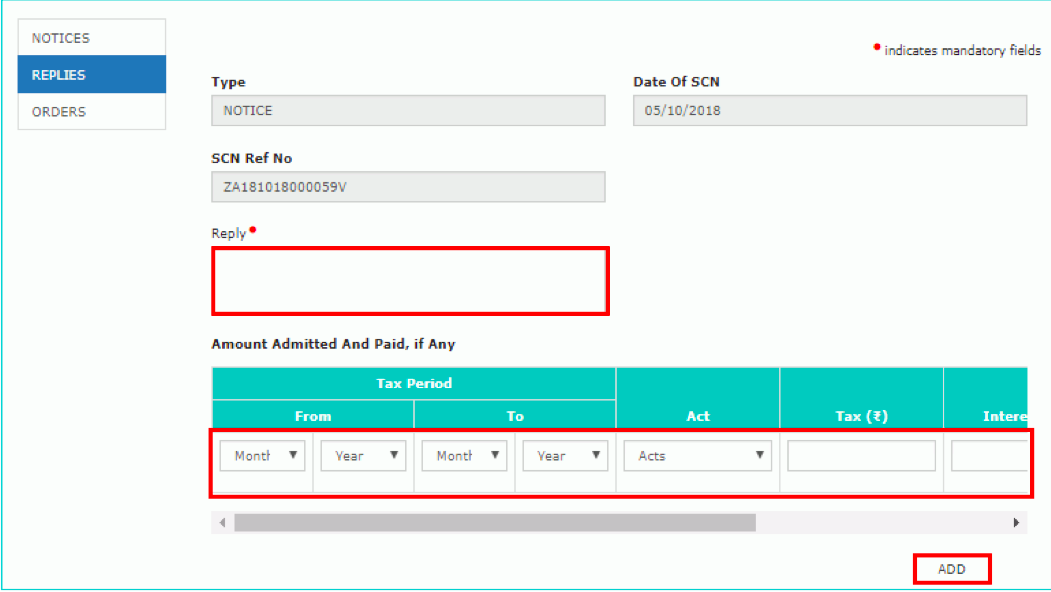

- On the Case Details page of that particular taxpayer, select the REPLIES tab. This tab will display the replies you will file against the Notices issued by the Tax Official. To add a reply, click NOTICE.

2. The REPLYpage is displayed.

- Enter your response in the reply field.

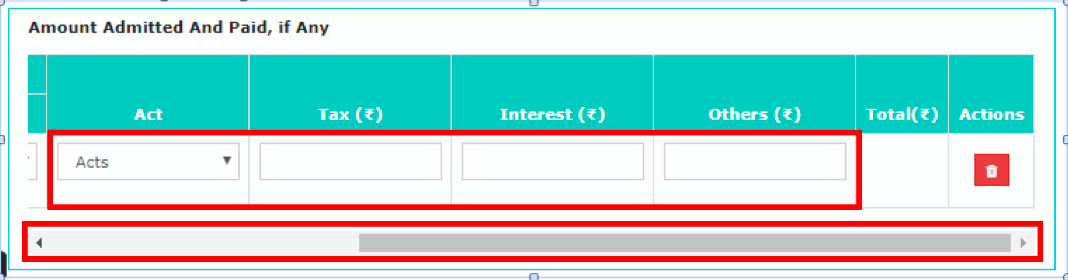

- Enter the Amount admitted and paid details, if any.

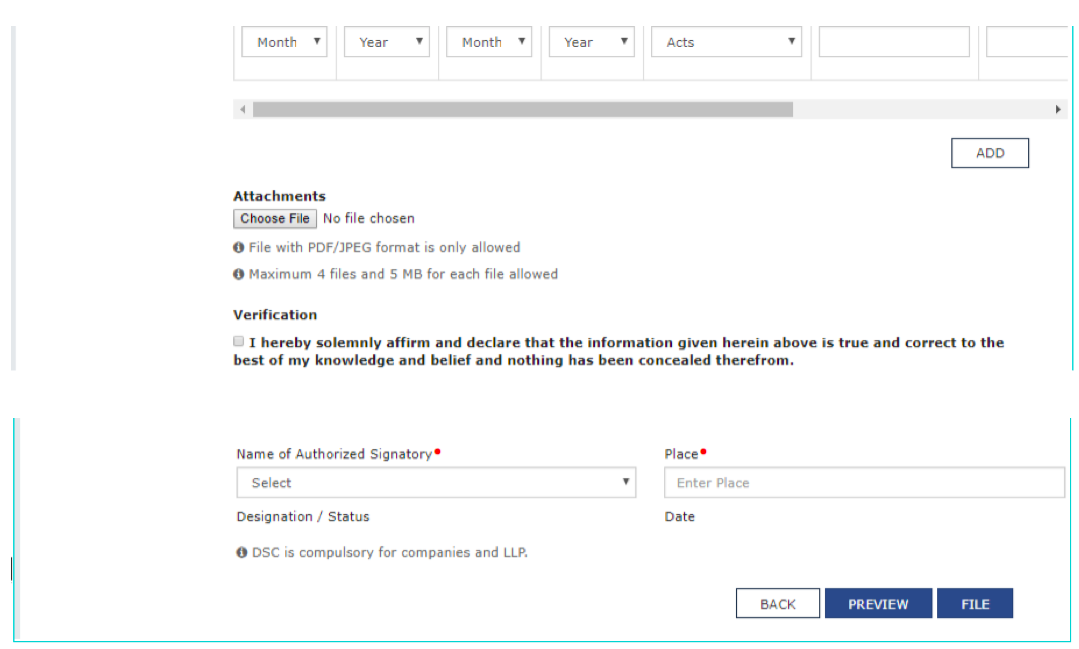

- Scroll to the right using the scroll bar to enter more details.

- Click ADDbutton to add more details.

Note: The notice issued by the tax official may indicate some discrepancies which were observed during scrutiny of return by him. If due to any of the indicated discrepancy, taxpayer is liable to pay differential tax, and he agrees to the discrepancy and pays the tax due on this count, he may mention the said agreed amount paid and enter the payment particulars in its reply to notice in Form GST ASMT 11.

If he is yet to pay the admitted amount, he can pay it either by using Form DRC-03 or he may furnish the outward supply invoice/debit note/amended invoice/amended debit note, in Form GSTR-1 or by paying tax or do cenvat reversal, as the case may be, at the time of filing Form GSTR-3B, in reply to the notice.

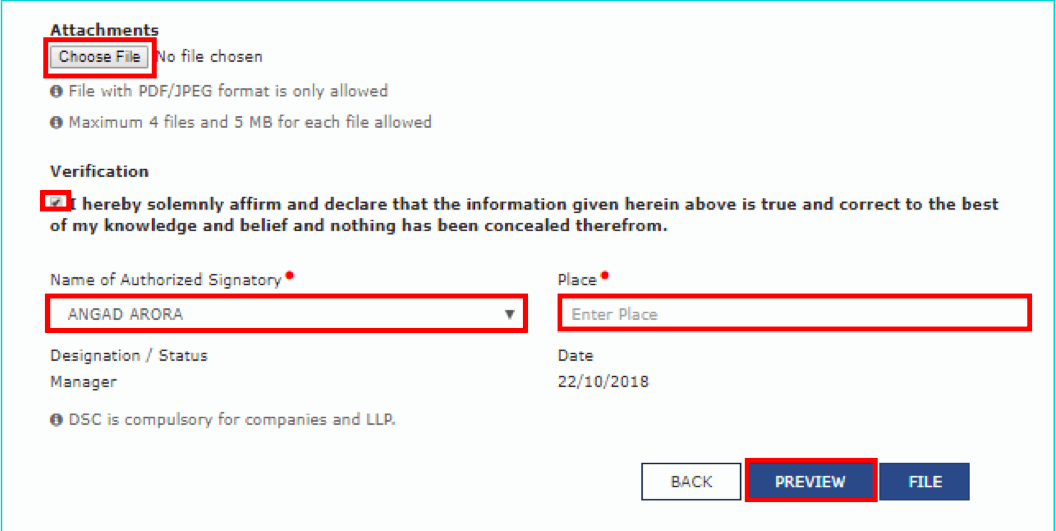

- Click Choose Fileto upload your reply and upload any supporting document(s) related to your reply, if any.

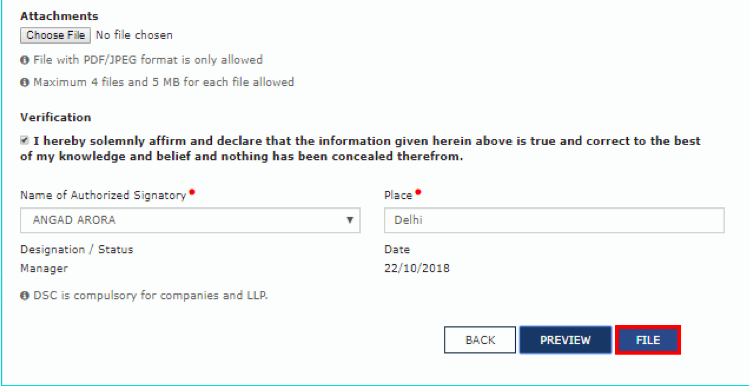

- Select the Verification check-box and select the name of the authorized signatory.

- Enter the Place where the form is filed.

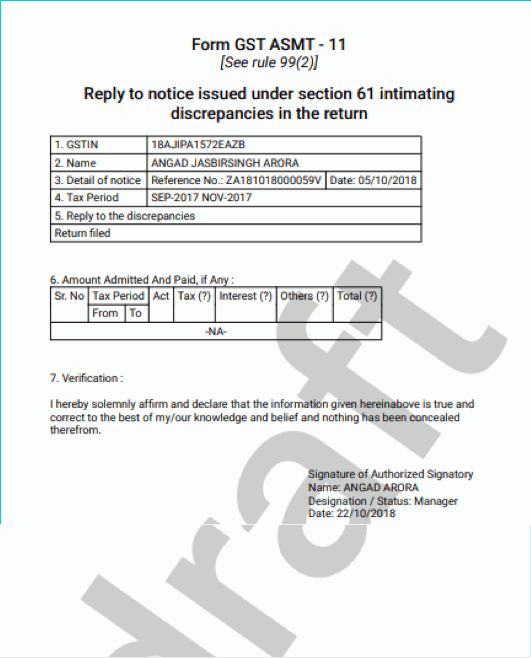

- Click PREVIEW to download and review your reply.

- Reply to the show cause notice is downloaded in PDF format.

- Click FILE.

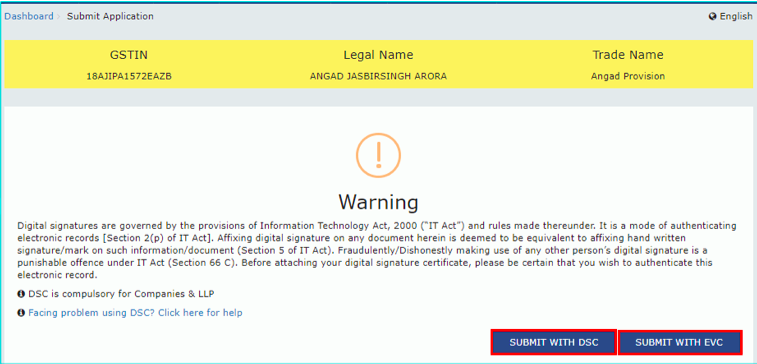

13. Submit Application page is displayed. Click ISSUE WITH DSC or ISSUE WITH EVC.

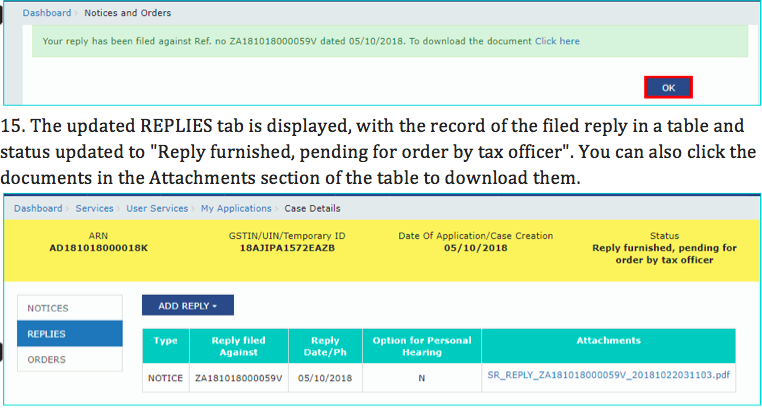

- A success message is displayed with the generated Reference number. Click OK.

Note: Once you file your reply successfully, following actions take place on the GST Portal:

- You will receive an acknowledgement intimation via your registered email and SMS, along with the generated RFN.

- Your reply will be available on Tax Official’s dashboard.

Go Back to the Main Menu

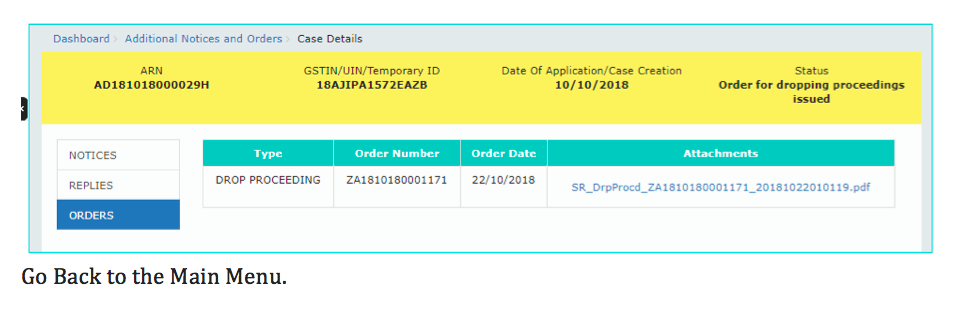

D.Take action using Orders tab of Case Details screen: View issued Orders.

To download order issued against your case, perform following steps:

- On the Case Details page of that particular taxpayer, click the ORDERStab. This tab provides you an option to view the issued order, with all its attached documents, in PDF mode.

2.Click the View link in the Action column of the table to download and view them.

B S Seethapathi Rao

B S Seethapathi Rao

East Godavari, India