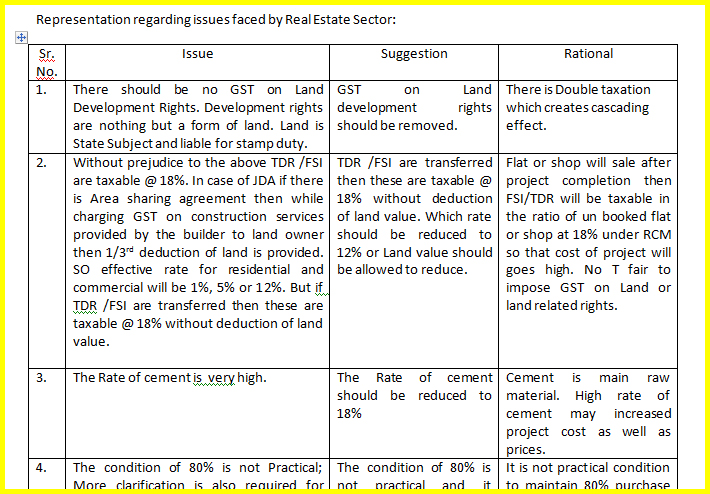

Representation regarding GST issues faced by Real Estate Sector

Download the full representation regarding GST issues faced by Real Estate sector by clicking the below image:-

A full representation regarding GST Issues faced by Real Estate Sector is as below.

|

Sr.No. |

Issue |

Suggestion |

Rational |

|

1. |

There should be no GST on Land Development Rights. Development rights are nothing but a form of land. The land is State Subject and liable for stamp duty. |

GST on Land development rights should be removed. |

There is Double taxation which creates a cascading effect. |

|

2. |

Without prejudice to the above TDR /FSI are taxable @ 18%. In case of JDA if there is Area sharing agreement then while charging GST on construction services provided by the builder to landowner then 1/3rd deduction of land is provided. SO effective rate for residential and commercial will be 1%, 5% or 12%. But if TDR /FSI are transferred then these are taxable @ 18% without deduction of land value. |

TDR /FSI are transferred then these are taxable @ 18% without deduction of land value. Which rate should be reduced to 12% or Land value should be allowed to reduce. |

Flat or shop will sale after project completion then FSI/TDR will be taxable in the ratio of unbooked flat or shop at 18% under RCM so that cost of the project will go high. No T fair to impose GST on Land or land related rights.

|

|

3. |

The Rate of cement is very high. |

The Rate of cement should be reduced to 18% |

Cement is the main raw material. The high rate of cement may increase project cost as well as prices. |

|

4. |

The condition of 80% is not Practical; More clarification is also required for Interest Cost, Water Charges and other charges by Municipal Corporation, etc. Further if in a Fin.year purchase in excess of prescribed limit (Presently 80%) Then it is not allowed to set off in next year |

The condition of 80% is not practical and it should be removed or should be capped at 50% and if in a year purchase in excess of prescribed limit (Presently 80%) should be given set off in next year |

It is not practical condition to maintain 80% purchase from registered supplier in every financial year because, in the starting of year, main raw material (cement, still, sand, etc) is purchased from registered supplier but at the end of the project, miscellaneous raw material is required to finish the project so that at the end of the project, this condition may not be fulfilled which attract RCM and increased the project cost. |

|

5. |

FSI charges paid to Municipal Corporation/ Government should be liable for GST under RCM or not? |

It should be clarified that FSI charges paid to Municipal Corporation/ Government should not be liable for GST under RCM. |

As per Article 234W of the constitution, This should be treated as Covered under Statutory work and charges paid to municipality should not be covered under the tax. |

|

6. |

In Surat and other textile hubs of the country, there are many integrated Textile Park, As per Integrated Textile Park Scheme of Ministry of Textiles, the building is constructed by the Developer from the contribution of the members. There should be no GST on such construction activity as it is as per within framework of Textile Park Scheme but due to unclarity entrepreneurs are discouraged for new investment. |

A clarification should be issued urgently so that the development of such parks can gain momentum as this is need of the hour and not required to go into litigation. |

Each park is having world-class infrastructure and consists of Hundreds of SME units and providing employment to thousands of people so that this type of park developer required motivation from the government to fight competition with China. |

|

7. |

The rate of 5% on Non-Affordable Housing will increase the burden of effective GST (As ITC Not Allowed) and will defeat the purpose of Housing for all. |

The rate of Non-Affordable Housing should be capped at 3%. |

The cost of Non-affordable housing will go high due to non-availability of ITC on inward supplies. |

|

8. |

Deduction of land cost is deemed deduction of 1/3rd |

Deduction of land should be of actual value and should not be deemed deduction of 1/3rd |

Only deemed deduction of 1/3rd of land cost is not giving more benefit to customers. If the actual value of land will deduct then more benefit will get by customers. |

|

9. |

A builder should not be burdened with Matching concept with GST 2A. |

It should be sufficient that it is purchased from a Registered dealer. |

There is a number of agencies involved in the construction of the building. So it is not possible to track each and every one. Once the payment is made it is difficult to force them for GST compliance. SO builder has to again deposit the GST and this burden is very high. |

|

10. |

For level playing field to Ongoing projects which are launched before few months and has opted to continue for old rates, the rate of GST on works contract is 18%. |

The Rate should be 12% for those projects also for which option to continue with old rates has been opted. |

It will ensure level playing field otherwise the cost of housing will be increased. |

|

11. |

The rate on Commercial projects is 12%. |

The concept of affordable housing should be extended to affordable commercial also. The Carpet area up to 340 Sq. ft. (Value of 45 Lacs) should be treated as affordable commercial. |

Affordable commercial space will generate more employment due to less cost of investment. Which was the increased GDP of the country. |

|

12. |

Looking at the rising cost of land and construction cost. the Value for affordable housing should be increased to 75 lacs. |

The Definition of affordable housing should be revised and the price of the affordable house should increase. |

It will meet the aspirations of the lower middle class and working self-employed youth and small businessmen. |

|

13. |

Notification should clearly provide for adjustment of GST refunded on account of cancellation by the buyer against Output Tax liability. |

If adjustment not allowed then it will be an additional burden on buyers. There should be no time limit for such adjustment as time limit up to September of Next Financial Year is not practical for Real Estate Sector like any other Manufacturing or trading units. Construction period is 3 to 5 years so it is canceled anytime. |

In the Real Estate Industry, customers may cancel booking any time and they get back their money with GST. For keep maintain the goodwill of the firm, the firm should give back full money of customers. |

|

14. |

Due to Mudra Loan, Startup India, Standup India schemes many young and women are becoming an entrepreneur but are not having enough resources to purchase Commercial space, they prefer to take on lease. The rate of GST on lease is 18%. |

So for the period of two years, the rate of GST on Rent should be 6% if given by the builder to the entrepreneurs. |

This decision will give relief to new entrepreneurs in the cost of investment which may give them motivation. |